AAVE/USDT and BZRX/USDT technical analysis indicate strength. AAVE prices may bounce back to $585, while BZRX could soar to $0.55.

bZx Protocol (BZRX)

Powering the multi-purpose lending and trading platform is the BZRX token. It launched in July 2020.

Past Performance of BZRX

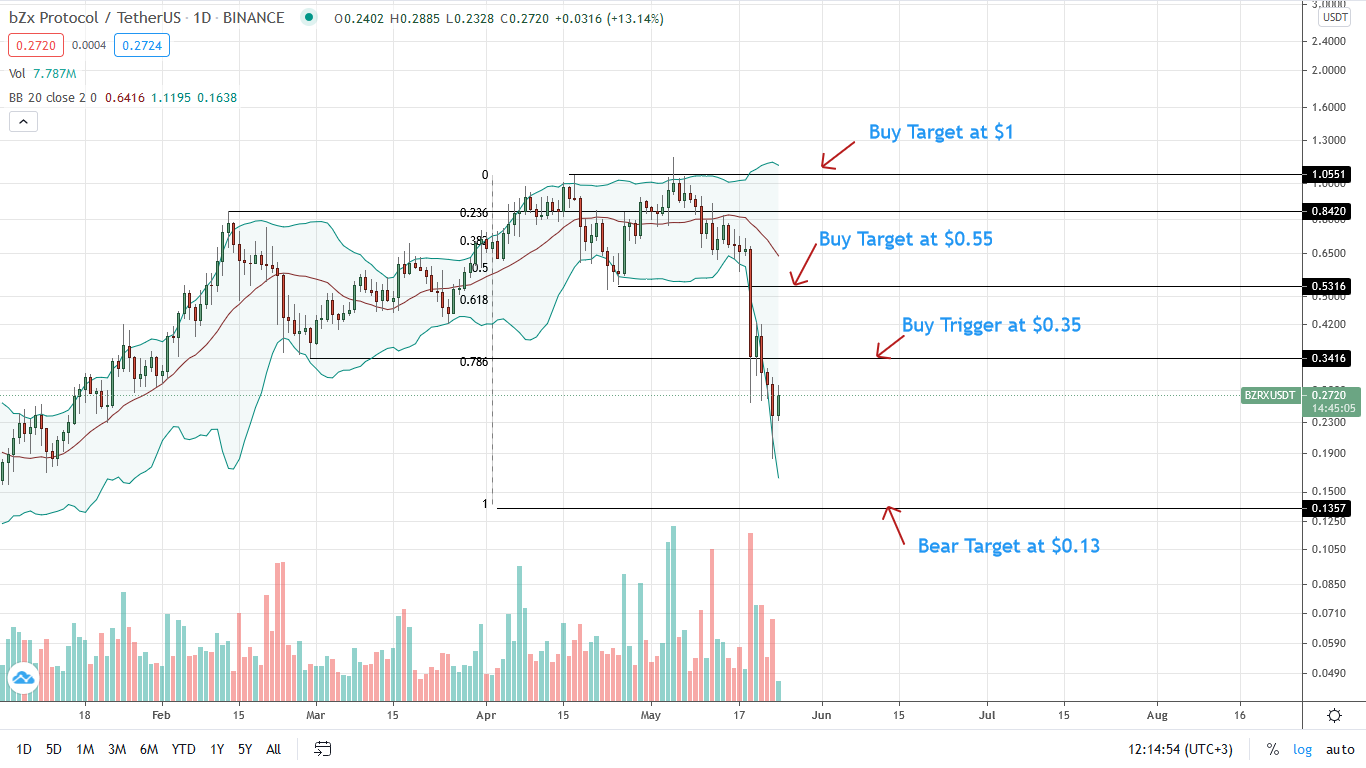

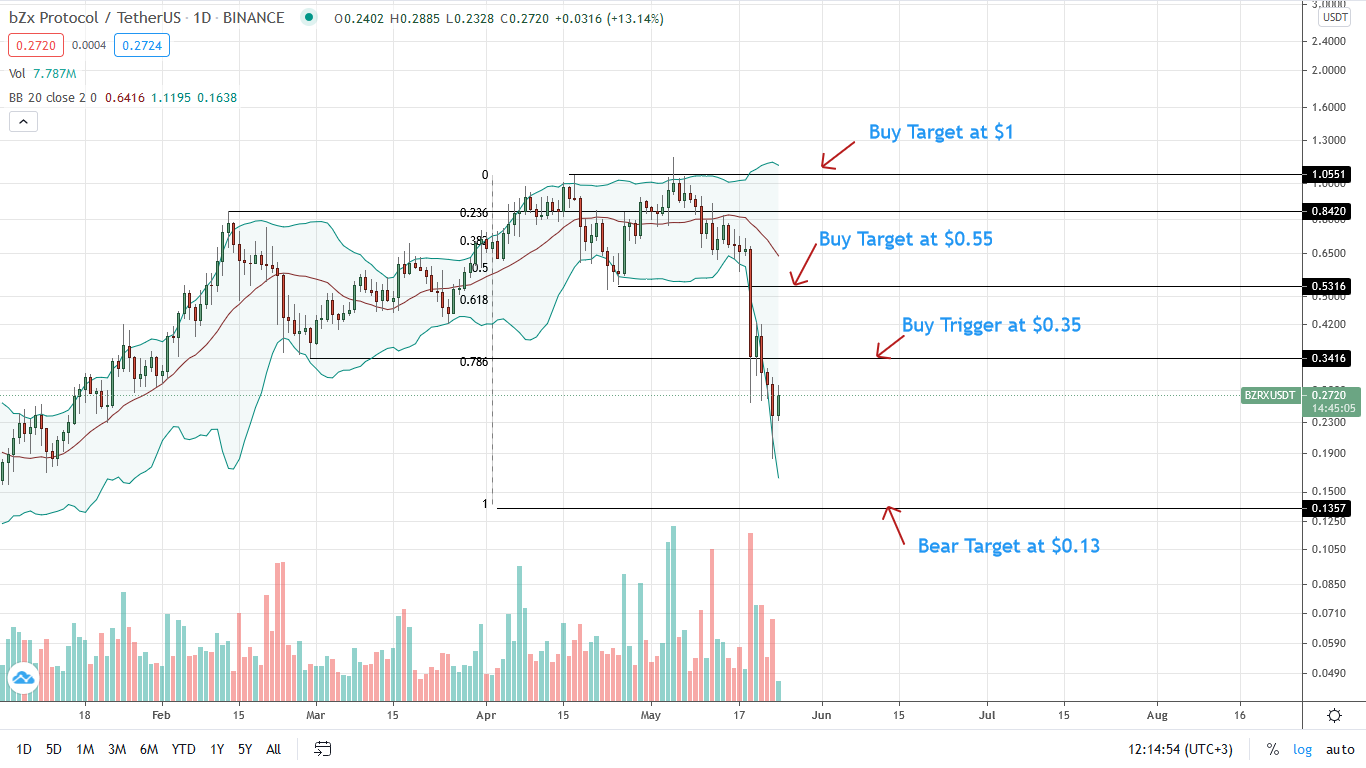

Trading at around $0.27, the BZRX token is recovering, adding 16 percent in 24 hours against the USD.

At the same time, gains versus ETH and BTC are decent.

Backing the uptrend is an uptick in trading volumes–up 97 percent to around $17.8 million.

Days-Ahead and What to Expect: bZx Protocol

Compared to other DeFi tokens, BZRX losses were steep and protracted.

For perspective, the BZRX token lost over 80 percent of Q1 2021 gains following the correction from March 2021 peaks.

Meanwhile, bars now align along the lower BB while BZRX/USDT prices are below the middle BB, pointing to bear pressure.

BZRX/USDT Technical Analysis

Although BZRX prices are recovering, BZRX/USDT technical analysis is bearish.

All indicators suggest a possible bear trend continuation that may wipe gains of Q1 2021 as sellers force prices back to $0.13.

At the same time, concerted efforts by bulls to drive BZRX prices above $0.35 may trigger demand, pushing BZRX/USDT back to April 2021 lows of $0.55.

AAVE

The protocol that popularized “flash loans” is also one of the world’s leading lending and borrowing protocols.

Past Performance of AAVE

The AAVE token is firm, finding support at a critical reaction point as AAVE/USDT prices remain at a broader consolidation point.

Overly, buyers stand a chance, especially after gains of the last 24 hours. The price is up 24 percent against the greenback, reflecting the market-wide recovery by DeFi tokens.

Day-Ahead and What to Expect

AAVE/USDT technical analysis indicates consolidation.

Depending on the breakout direction, the current oscillation may either become a distribution or an accumulation.

A follow-through on May 23 losses may see a price dump towards $150.

AAVE/USDT Technical Analysis

The crypto market remains fragile.

Although the AAVE uptrend is valid, a close below $320 may easily see sellers flow back, forcing the token to $150.

On the flip side, buyers have a chance. However, this depends on if there is a confirmation of today’s gains.

In that case, AAVE buyers can aim at $585.

- "

- 2020

- active

- analysis

- Application

- April

- around

- Ban

- bars

- bearish

- border

- Borrowing

- breakout

- BTC

- Bulls

- bZX

- capital

- consolidation

- crypto

- Crypto Market

- Current

- DeFi

- Demand

- ETH

- Figure

- flow

- HTTPS

- Investments

- IT

- July

- leading

- lending

- March

- Market

- million

- Other

- payment

- performance

- perspective

- pilot

- platform

- Posts

- pressure

- price

- Q1

- reaction

- recovery

- Sellers

- support

- Technical

- Technical Analysis

- time

- token

- Tokens

- Trading

- USD

- Versus