The cryptocurrency industry has experienced a number of turmoils in the past few months with the resultant effect being shown by the plunging in the price and valuation of assets in the ecosystem. Bitcoin (BTC) has been at the forefront of each of these fundamental turmoils, and the latest, involving China’s revival of its clampdown on all crypto-related activities notably pushed the price of the cryptocurrency to a 30-day low of $39,787.61.

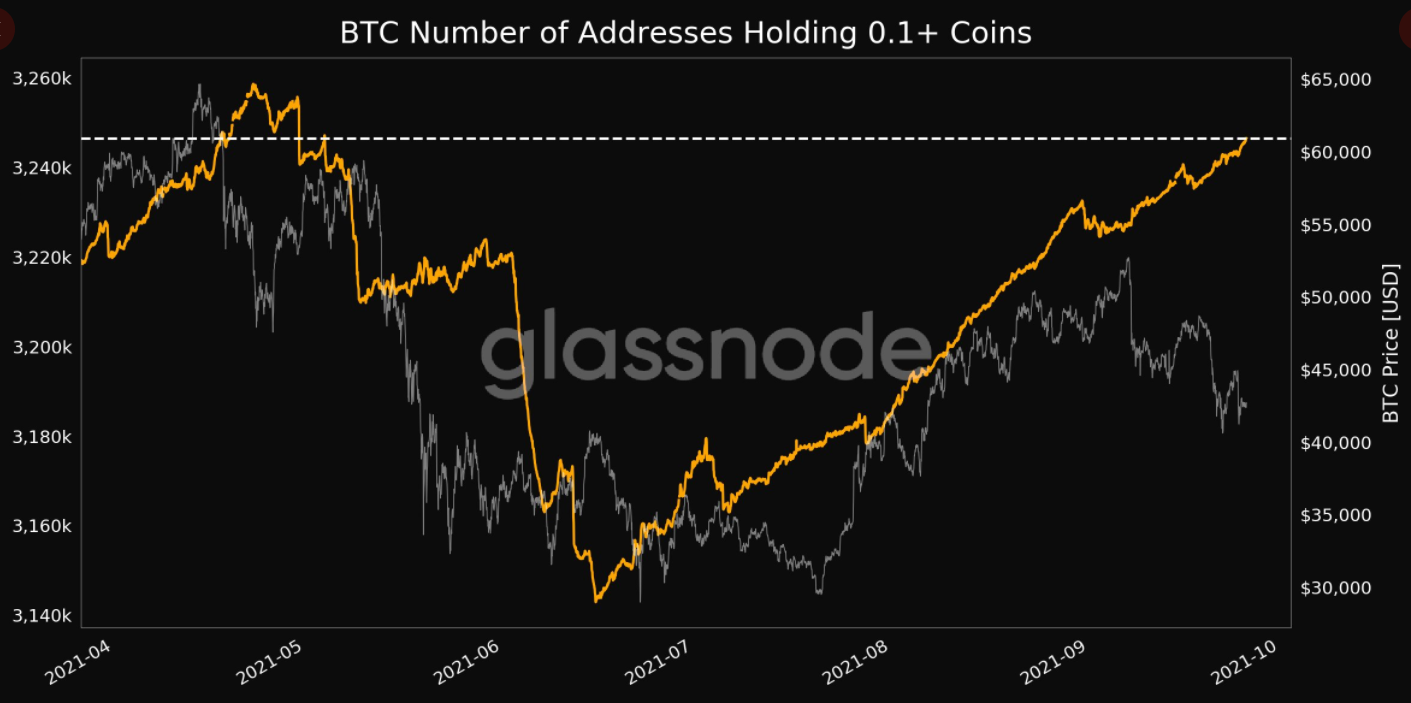

Many retail investors have notably taken advantage of the price slump to “buy the dip.” This claim is further substantiated by data from Glassnode, a crypto markets analytics platform. Per the shared insight, the number of Bitcoin addresses holding at least 0.1 coins (about $4,261.43) has soared to a 4-month high of 3,246,533. In other words, the latest dip pushed more people to stack up on their assets, some for the first time, and others increased their portfolios.

BTC Addresses Holding 0.1+ Coins. Source: Glassnode

Many who are bullish on Bitcoin are often anticipating periods of price slumps to take up new positions in Bitcoin. While many are beginning to embrace altcoins with unique fundamentals, periods of corrections often serve as an opportunity to buy in and take profits all within a short time frame.

Is the retail buyup the basis for price rebound?

The price of Bitcoin has started seeing some mild recoveries as it is trading midway from the $40,936.56, lowest point to the highest price of $42,839.75 printed in the past 24 hours. For a stable or sustainable uptrend, Bitcoin will need an aggressive buying momentum beyond the capacity the retail holders are currently doing.

While currently changing hands at a price of $42,718.90, Bitcoin will need to consistently trade above the $45,000 resistance point, before it can regain its 7-day high of $48,328.37. From the sloppy movements seen by the 24-hour rate of gain of 0.31%, the chances that the needed recovery will be spearheaded by the current retail buyup.

However, Bitcoin and the broader digital currency industry is known to withstand and recover from the impact of all forms of Fear, Uncertainty, and Doubt (FUD) being spread by the threats of Chinese clampdown year after year in the past decade. This current clampdown will be no exception in the medium to long term.

- 000

- activities

- ADvantage

- All

- Altcoins

- analytics

- Assets

- Bitcoin

- BTC

- btc price

- Bullish

- buy

- Buying

- Capacity

- chances

- chinese

- Coins

- content

- Corrections

- crypto

- Crypto Markets

- cryptocurrencies

- cryptocurrency

- Currency

- Current

- data

- digital

- digital currency

- ecosystem

- financial

- First

- first time

- Fundamentals

- Glassnode

- High

- hold

- HTTPS

- Impact

- industry

- investing

- Investors

- IT

- latest

- Long

- Market

- market research

- Markets

- medium

- Momentum

- months

- Opinion

- Opportunity

- Other

- People

- platform

- price

- recovery

- research

- retail

- Retail Investors

- Share

- shared

- Short

- spread

- started

- sustainable

- threats

- time

- trade

- Trading

- Valuation

- WHO

- within

- words

- year