- Algorithmic Trading and AI trading systems are two popular ways of trading.

- Quantitative and systematic investing have been affected negatively recently because of market changes.

- RegalX allows fully automated trading and is powered by AI Autotrade.

Not a human touch but yet it is

Traders all over the globe have had their experiences using all different ways of trading. AI-driven trading systems and the popular algorithmic trading method are something to talk about. Apart from tons of differences, the most significant ones you will notice are the way how both of these systems work.

Algorithmic trading is a method of executing orders using pre-programmed trading instructions. While machine learning systems work independently by thinking and behaving just like any other trader and advising itself to be more efficient over time, by also allowing a trader to understand what made the AI enter and exit the trade.

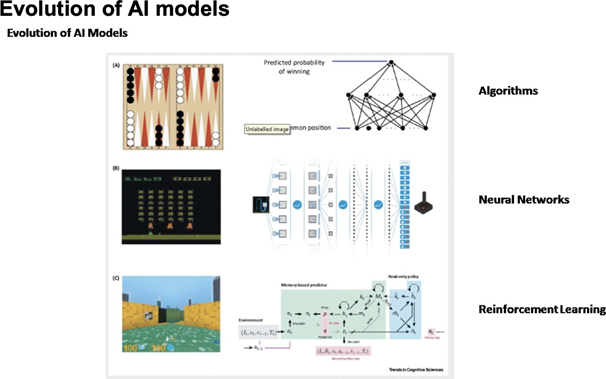

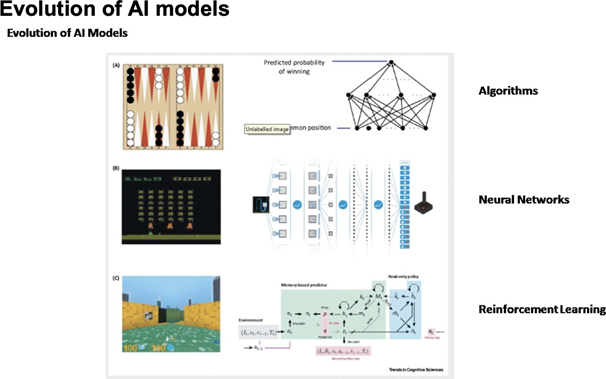

AI Autotrade systems are built using Thinking Fast and Slow, designed by Laureate Daniel Kahneman, an Israeli psychologist, and economist. He is endorsed by a foremost Reinforcement Learning Fast and Slow paper from Deepmind and OpenAI teams.

Reinforcement Learning is an important part of machine learning. It is a marvelous technology that learns itself from its mistakes. Reinforcement Learning is an award-driven behavior used in Autotrade systems. The AI-driven trading system works by Inheriting snapshots from historical data and applying slow learning on Causal AI graph models.

Here in the above image, you can see how the trading system recalls price action and analyses the current indicators to calculate the risk and probability.

Furthermost, the AI uses this whole intelligence and maps it on the trading grounds for real and takes actions like changing strategies to Martingale, switching the trading asset from commodities to index, Bitcoin to ETH, or any it thinks will work best for higher profitability.

Discovering the Hurdle

The Market behavior of any form of trading is dynamic and keeps changing continuously. Due to this market behaviors change, quantitatively and systematic investing has been affected negatively. Wherein earlier these two forms of investing were seen giving an astonishing performance.

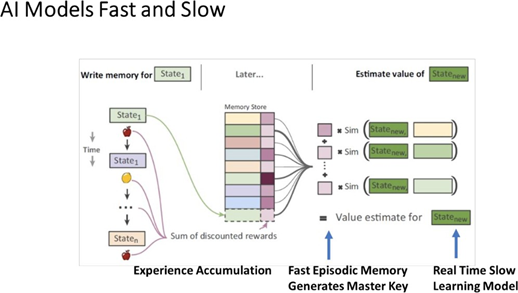

Autonomous trading is very similar to autonomous driving; both here make use of their intelligence and take critical decisions with complex learning based on real-life scenarios.

The working of AI driving is based on two fundamental elements; one of them is the map for direction, and the second is its decision-making abilities for driving. On the other hand, AI trading uses both Fundamental and Technical analysis for trend analysis and analyzing market behavior.

AI Autotrade, the broader perspective

AI Autotrade is an established company in the field of auto trading and conducts re- search and development in the areas of human and quantitative trading. AI Autotrade has designed and built fully autonomous trading machines, much like the Waymo of financial markets. It uses the same analogy as in autonomous cars.

As you can see in the below graphs, inspired by Casual AI, which identifies underlying network behavior and generates insights that the predictive models fail to furnish. The four main components of the learning models are:

- Sensors (live price action).

- Perception (live environment).

- Planning (master key and graph AI)

- Control (calibration models).

The basis of the technology is a combination of well-researched price action signals combined with advanced reasoning AI models.

At the core of an AI, it’s supposed to buy and sell tradable assets without human

intervention. An AI has to collect historical market data, and its algorithm models the market’s behavior. This highly secretive model generates and executes trades. An AI has to make split-second decisions based on millions of data sets.

Due to the volatile nature of the markets, the AI has to undergo extensive testing to determine its capabilities in different market conditions. An excellent AI has the ability to trade across various assets like currency pairs and major stock indices to the susceptible cryptocurrencies market. It should also be able to execute trades at different time frames.

A platform to accommodate AI trading

A trading platform created by RegalX, which allows fully automated trading, can help you with your trading needs. Powered by AI Autotrade, it’s a combination of price action, learning real-time, made possible with new AI models, and the power of cloud.

Who are Regal Assets?

Regal Assets is listed 20th on the 500 fastest growing US companies. They are the company behind RegalX. Regal Assets has been awarded numerous accolades and has been voted by the Consumers Choice Awards as the #1 Gold IRA provider for 2012, 2013, and 2014.

Other awards that they have won are the International Bullion Dealer of the Year award from 2018 to 2020. Regal Assets clients have invested over $1 Billion of gold in stockpiles.

Coinbase partnered with Regal Assets for retirement accounts, and they are the first company to obtain a crypto trading license in the Middle East. Last but not the least, their CEO and CMO are Forbes Council Members, as well as regular writers for Forbes.

Source: https://coinquora.com/ai-takes-trading-to-the-next-level/

- 2020

- Action

- AI

- algorithm

- algorithmic trading

- All

- Allowing

- analysis

- asset

- Assets

- auto

- Automated

- autonomous

- BEST

- Billion

- Bitcoin

- Bloomberg

- buy

- cars

- ceo

- change

- Cloud

- Commodities

- Companies

- company

- Consumers

- Council

- crypto

- crypto trading

- Currency

- Current

- data

- Development

- driving

- Environment

- ETH

- Exit

- Experiences

- FAST

- financial

- First

- Forbes

- form

- Giving

- Gold

- Growing

- here

- How

- HTTPS

- image

- index

- insights

- Intelligence

- International

- investing

- IT

- JavaScript

- Key

- learning

- Level

- License

- machine learning

- Machines

- major

- map

- Maps

- Market

- Markets

- Members

- model

- network

- orders

- Other

- Paper

- performance

- platform

- plugin

- Popular

- power

- price

- profitability

- quantitative

- real-time

- Risk

- Search

- sell

- Social

- stock

- system

- Systems

- Technical

- Technical Analysis

- Technology

- Testing

- Thinking

- time

- tons

- touch

- trade

- trader

- trades

- Trading

- us

- Work

- works

- year