June 25, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

What Do You Meme?

What’s Poppin’?

Investing in cryptocurrency companies is poppin’.

Yesterday, Andreessen Horowitz launched a new $2.2B crypto fund. The VC plans to invest in a slew of companies across the blockchain and digital asset space. a16z also announced former Securities and Exchange Director Bill Hinman will join the firm as an advisory partner.

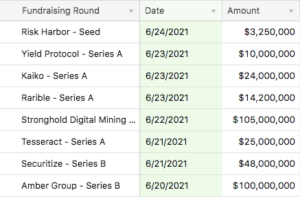

A new $2.2B fund should only accelerate the pace of crypto investments. According to Dove Mountain Data, crypto companies received an influx of $329,450,000 across a series of eight fundraising rounds announced over the past week.

Source: Dove Mountain Data

With that in mind, let’s test your knowledge:

Recommended Reads

- WallStreetBets Dapp is creating a macro hedge exchange-traded product with the help of Balancer labs:

- Everything you need to know about DAOs:

- Nassim Taleb, the author of several well-regarded books on finance, published a paper critiquing Bitcoin, saying “[I]n spite of the hype, bitcoin failed to satisfy the notion of ‘currency without government (it proved to not even be a currency at all).”

You can find the full criticism here.

Nic Carter, co-founder of Castle Island Ventures, gathered a thread of threads, rebutting Taleb’s paper:

On The Pod…

Strong Hands Aren’t Selling Bitcoin. So Who Is?

Will Clemente, author of the BTC by WC3 newsletter, breaks down the current state of Bitcoin’s on-chain activity and explains why he believes the market is in a mid-cycle lull rather than turning bearish. Show highlights:

-

why Will is not worried about a bear market

-

what indicators make Will believe BTC is in a mid-cycle consolidation

-

who is selling and driving the recent market downturn

-

why Will thinks the unwinding of derivatives is a significant factor in Bitcoin’s move below $30K

-

what Will believe institutions are waiting on before entering the market again

-

how Bitcoin cycles can be broken down into mini hype-cycles

-

how long-term holders are acting on-chain

-

the difference between long-term holders versus short-term holders during bear and bull markets

-

why Will is interested in finding data on Latin American Bitcoin users

-

how long the consolidation process might take

-

what metrics Will has his eyes on for the latter half of 2021

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians

Source: https://unchainedpodcast.com/ark-invest-bought-the-dip/

- 000

- 11

- advisory

- All

- American

- announced

- Ark

- asset

- bearish

- Bill

- Bitcoin

- blockchain

- Books

- BTC

- CNBC

- Co-founder

- Coindesk

- Companies

- consolidation

- Creating

- crypto

- cryptocurrency

- Currency

- Current

- Current state

- dapp

- data

- Derivatives

- digital

- Digital Asset

- Director

- driving

- ethereum

- exchange

- finance

- Firm

- First

- full

- fund

- Fundraising

- Government

- here

- HTTPS

- ICO

- institutions

- Investments

- IT

- join

- knowledge

- Labs

- Latin American

- Long

- Macro

- Making

- Market

- medium

- meme

- Metrics

- move

- Newsletter

- Notion

- Paper

- partner

- Product

- purchase

- rounds

- Securities

- Series

- So

- Space

- State

- test

- VC

- Ventures

- Versus

- week

- WHO