Traditional lenders are losing market share in cross-border payments to non-banks, with digital challengers and fintech startups rapidly gaining ground by solving some of the most critical issues in the sector including its high fees, inefficiencies and slow transaction speeds, a new report by American banking group Citi says.

The report, titled “Future of Cross-Border Payments: Who Will Be Moving $250 Trillion in the Next Five Years?”, explores the challenges and opportunities faced by industry participants as they navigate the shift of the cross-border payment market, sharing results of a survey of more than 100 of the bank’s financial institution clients that sought to understand incumbents’ strategic priorities and struggles when it comes to cross-border payments.

Findings of the study show that traditional banking institutions are loosing ground to new market entrants, and are now viewing fintech companies as their biggest threats.

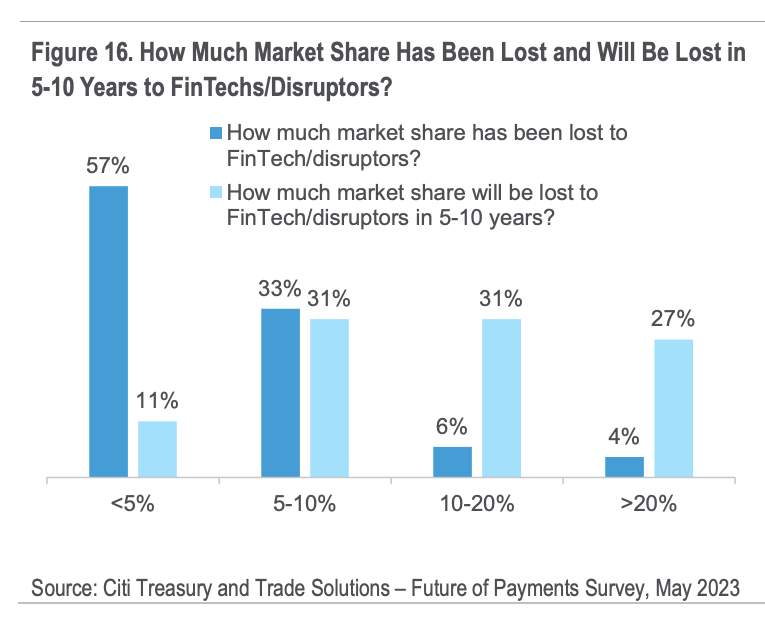

Of the 100+ financial institution clients surveyed, 43% shared that they had lost at least 5%-10% of market share in cross-border payments, and an even larger population (89%) predicted at least 5%-10% would be lost to fintech companies and disruptors within the next five to ten years, with 58% of respondents anticipating losing over 10%.

Market share lost to disruptors, Source: Future of Cross-Border Payments: Who Will Be Moving $250 Trillion in the Next Five Years?, Citi GPS, Sep 2023

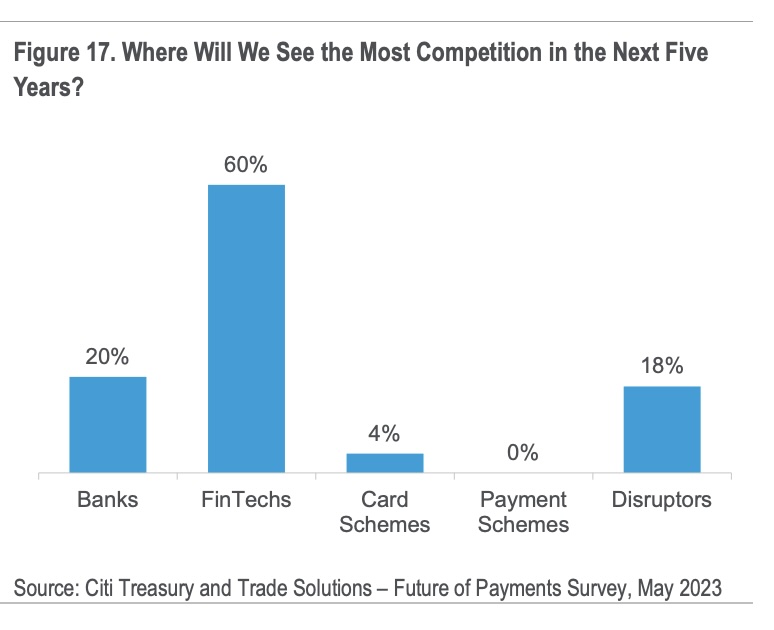

Financial institutions view fintech companies as the greatest threat to their market shares, with 60% of the respondents surveyed naming fintechs as their biggest competitors in the next five years, ahead of banks (20%), disruptors (18%) and card schemes (4%).

These new players are perceived as strong contenders as they make use of technology and data to provide superior user experiences, speed and personalized services.

Banks’ biggest competition in cross-border payments in the next five years, Source: Future of Cross-Border Payments: Who Will Be Moving $250 Trillion in the Next Five Years?, Citi GPS, Sep 2023

These findings echo those of other research which found that new market entrants are rapidly encroaching on banks’ market share. Between 2014 and 2021, non-bank market share in cross-border payments rose to 12% from 5%, a gain which Citi attributed to fintech companies’ better product offerings, greater convenience and lower pricing. By 2024, it’s projected that non-banks could hold up to 17% of the cross-border payment market, leaving banks with a 83% market share.

The transformation of the cross-border payment market

Intense competition, but also technological advancements and regulatory initiatives like open banking are combining to bring around a profound transformation in the cross-border payment landscape.

Application programming interface (API) connectivity is becoming increasingly prevalent, enabling seamless integration and communication between different financial systems. This move towards real-time data exchange enhances the speed and efficiency of cross-border transactions.

Regulation is also increasingly fostering innovation via initiatives such as open banking. These initiatives are prompting the entry of new players that are delivering technology nimbly and leveraging digital client experiences as a differentiating factor. This is contributing to a more competitive and dynamic cross-border payment environment.

At the same time, the emergence of blockchain technology and digital currencies is offering the potential of more secure and transparent cross-border transactions. In particular, blockchain-based payment networks can revolutionize the sector by delivering instant and more efficient transactions with and 24×7 operability.

Another technology outlined in the Citi report is artificial intelligence (AI), a technology that is increasingly becoming a catalyst for change in the payments market. Predictive analytics powered by AI can be used to enhance risk management, facilitate cross-selling, and provide a more personalized user experience, while AI-driven solutions can contribute to improved efficiency and accuracy in cross-border transactions.

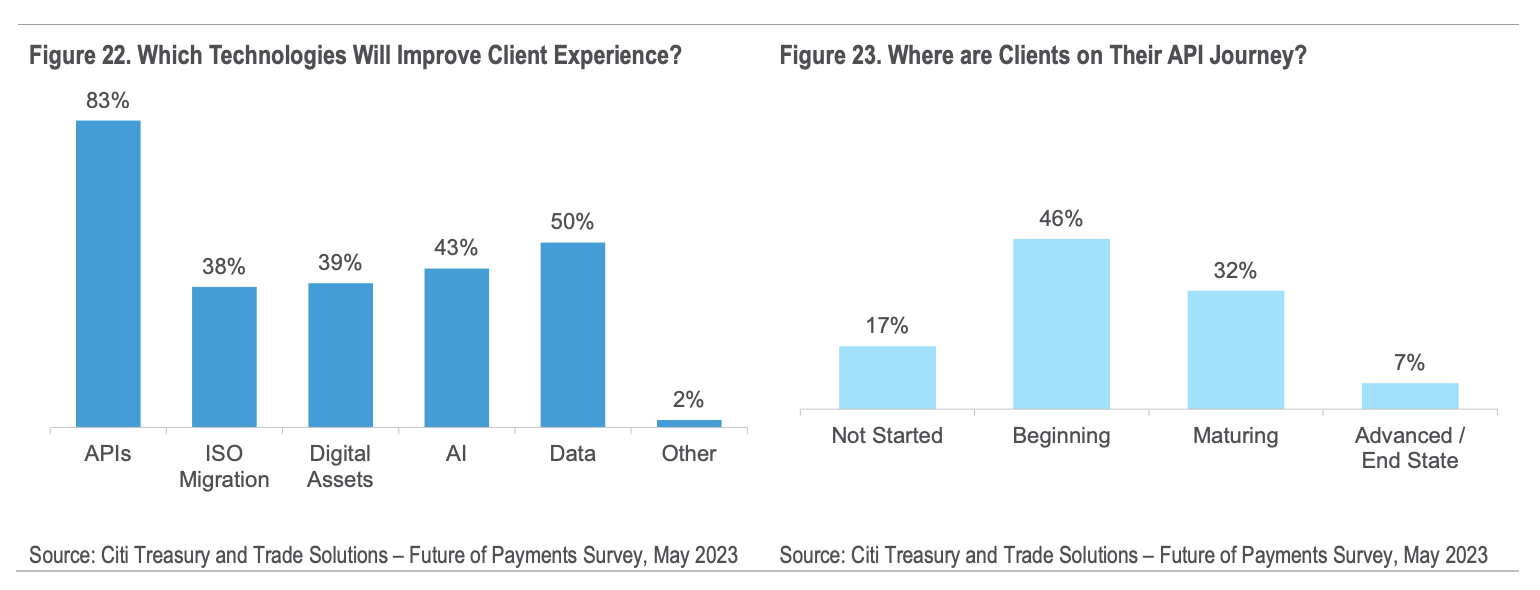

Findings of the Citi study reveal that financial institutions are recognizing the potential of these technologies, with more than 80% of those surveyed starting that they had started their API journey. APIs were identified as a critical technology for customer experience improvement (83%), followed by data (50%), AI (43%) and digital assets (39%).

Most impactful technologies for improving customer experience, Source: Future of Cross-Border Payments: Who Will Be Moving $250 Trillion in the Next Five Years?, Citi GPS, Sep 2023

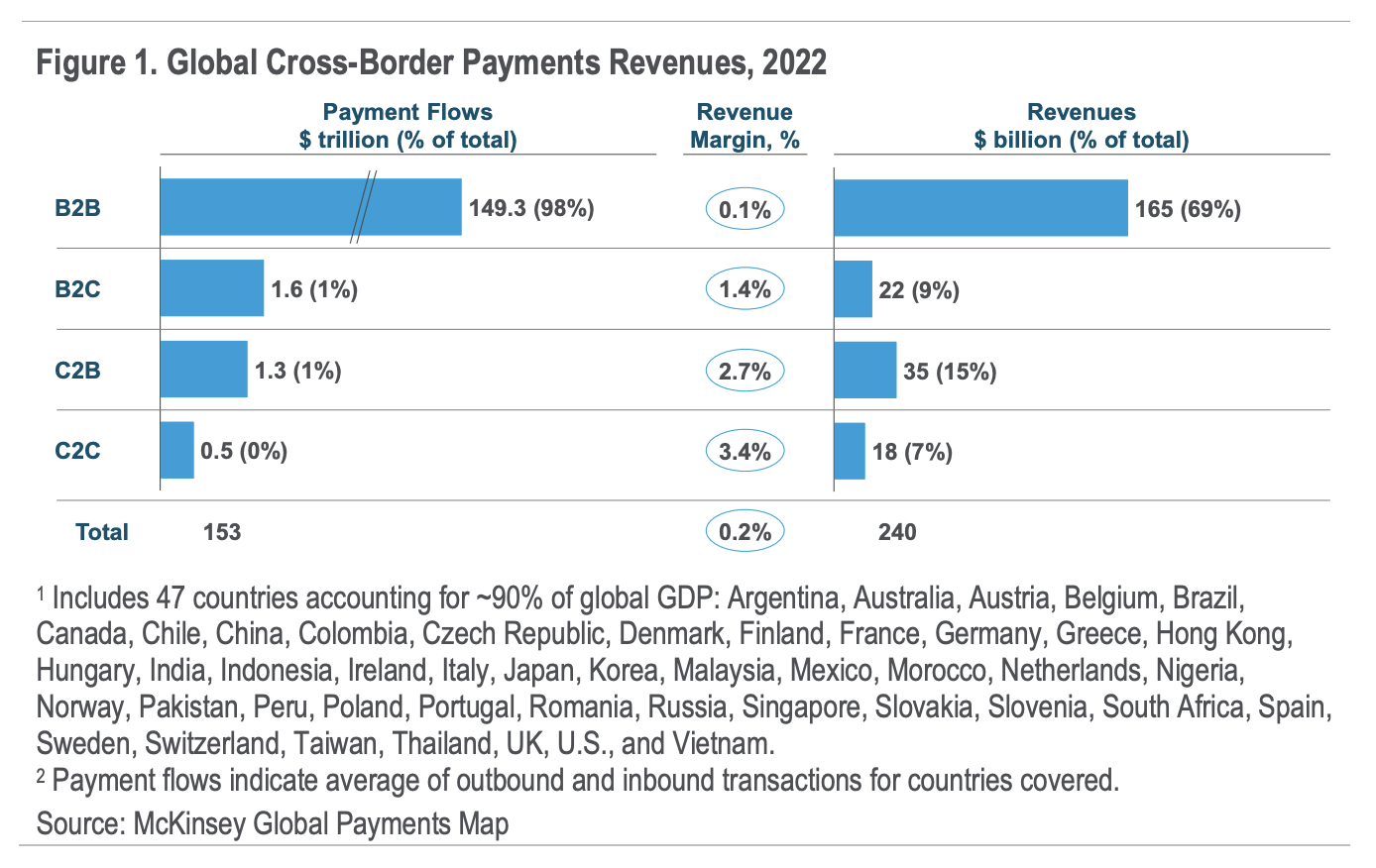

Cross-border payments is a large and growing business which totaled approximately US$240 billion globally in revenues in 2022, McKinsey and Company estimates. Citi expects the market to sustain mid- to high-single-digit growth over the next five years.

The Bank of England anticipates the value of cross-border payments to increase from almost US$150 trillion in 2017 to over US$250 trillion by 2027, equating to a rise of over US$100 trillion in just 10 years.

Global cross-border payments revenues, 2022, Source: Future of Cross-Border Payments: Who Will Be Moving $250 Trillion in the Next Five Years?, Citi GPS, Sep 2023

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/81095/payments/digital-challengers-are-gaining-ground-against-banks-in-cross-border-payments/

- :is

- $UP

- 1

- 10

- 100

- 2014

- 2017

- 2021

- 2022

- 2023

- 2024

- 27

- 36

- 7

- a

- accuracy

- advancements

- ahead

- AI

- almost

- also

- American

- an

- analytics

- and

- anticipates

- anticipating

- api

- APIs

- approximately

- ARE

- around

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- AS

- Assets

- At

- author

- Bank

- Bank of England

- Banking

- Banks

- BE

- becoming

- begin

- Better

- between

- Biggest

- Billion

- blockchain

- blockchain technology

- blockchain-based

- bring

- business

- but

- by

- CAN

- card

- Catalyst

- challenges

- change

- Citi

- Citigroup

- client

- clients

- combining

- comes

- Communication

- Companies

- company

- competition

- competitive

- competitors

- Connectivity

- content

- contribute

- contributing

- convenience

- could

- critical

- cross-border

- cross-border payments

- currencies

- customer

- customer experience

- data

- Data Exchange

- delivering

- different

- digital

- Digital Assets

- digital currencies

- Disruptors

- dynamic

- echo

- efficiency

- efficient

- emergence

- enabling

- end

- England

- enhance

- Enhances

- entrants

- entry

- Environment

- estimates

- Even

- exchange

- expects

- experience

- Experiences

- faced

- facilitate

- factor

- Fees

- financial

- financial institution

- Financial institutions

- financial systems

- findings

- fintech

- Fintech Companies

- Fintech News

- fintech startups

- fintechs

- five

- followed

- For

- form

- fostering

- found

- from

- future

- Gain

- gaining

- Global

- Globally

- gps

- greater

- greatest

- Ground

- Group

- Growing

- Growth

- had

- High

- hold

- hottest

- HTTPS

- identified

- impactful

- improved

- improvement

- improving

- in

- Including

- Increase

- increasingly

- industry

- inefficiencies

- initiatives

- Innovation

- instant

- Institution

- institutions

- integration

- Intelligence

- Interface

- issues

- IT

- ITS

- journey

- jpg

- just

- landscape

- large

- larger

- least

- leaving

- lenders

- leveraging

- like

- losing

- lost

- lower

- mailchimp

- make

- management

- Market

- market share

- max-width

- McKinsey

- Month

- more

- more efficient

- most

- move

- moving

- naming

- Navigate

- networks

- New

- New Market

- news

- next

- now

- of

- offering

- Offerings

- on

- once

- open

- open banking

- opportunities

- Other

- outlined

- over

- participants

- particular

- payment

- payment networks

- payments

- perceived

- Personalized

- plato

- Plato Data Intelligence

- PlatoData

- players

- population

- Posts

- potential

- powered

- predicted

- Predictive Analytics

- prevalent

- pricing

- Product

- profound

- Programming

- projected

- provide

- rapidly

- real-time

- real-time data

- recognizing

- regulatory

- report

- research

- respondents

- Results

- reveal

- revenues

- revolutionize

- Rise

- Risk

- risk management

- ROSE

- same

- says

- schemes

- seamless

- sector

- secure

- Services

- Share

- shared

- Shares

- sharing

- shift

- show

- Singapore

- slow

- Solutions

- Solving

- some

- sought

- Source

- speed

- speeds

- started

- Starting

- Startups

- Strategic

- strong

- Struggles

- Study

- such

- superior

- Survey

- surveyed

- Systems

- technological

- Technologies

- Technology

- ten

- than

- that

- The

- their

- These

- they

- this

- those

- threat

- threats

- time

- titled

- to

- towards

- traditional

- traditional banking

- transaction

- transaction speeds

- Transactions

- Transformation

- transparent

- Trillion

- understand

- use

- used

- User

- User Experience

- value

- via

- View

- viewing

- were

- when

- which

- while

- WHO

- will

- with

- within

- would

- years

- Your

- zephyrnet