The bearish charts hint SOL could hit $70 after another oversold bounce sparks a new movement as we can see more in today’s latest altcoin news.

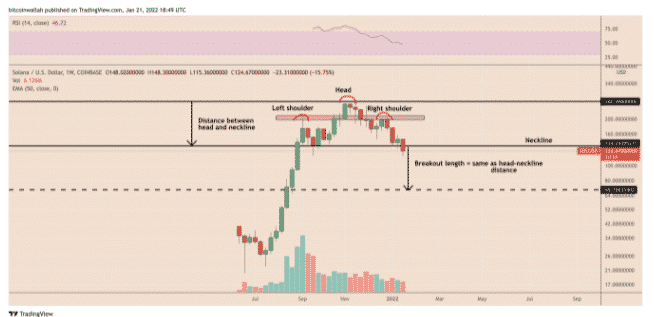

Solana could fall to $70 per token in the upcoming weeks as the head and shoulders pattern emerged on the daily timeframe and could point towards a 45% decline. The bearish charts hint that the SOL price rallied to $217 initially but then dropped to a support level near $134. SOL then tried to establish a new high of $260 and earlier this week the price dropped back to test the same $134 support level before breaking the 2022 low at an $87.73 price range.

The phase of price action seems to have formed a head and shoulders setup and a bearish reversal pattern that contained three consecutive peaks with the middle one set at $257 coming out to be higher than the two set at $200 and $210. In the meantime, SOL’s three peaks stood atop a common support level at $134, and a fall below only signals an extended downtrend to the level at a length equal to the maximum distance between the head and the neckline. In SOL’s case, the distance is near $137 which puts the head and shoulders price target at $170.

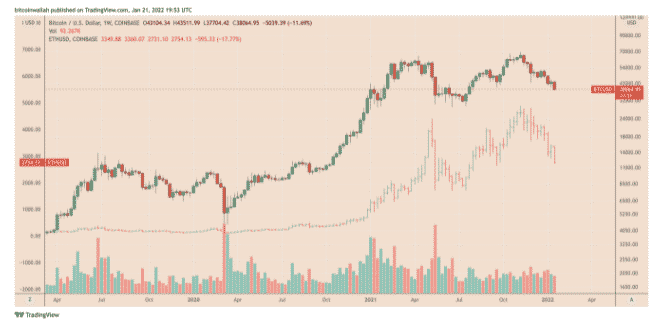

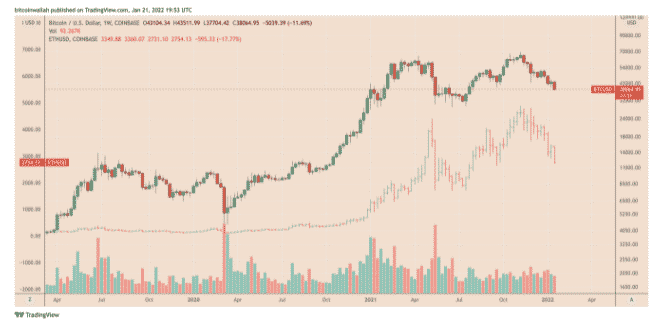

The bearish outlook came as the SOL price dropped by 22% this week and now the altcoin is around 55% from its high, in line with other larger-cap digital assets like BTC and Ether. At the center of the ongoing crypto market drop in the US after the FED decision to unwind a $120 billion per month asset purchasing program followed by three or more interest rates hikes in 2022. The central bank’s monetary policies assisted in pumping the market’s valuation from $128 billion since 2020 as high as $3 trillion in 2021. The evidence of tapering was influencing the investors to limit their exposure in the markets including Solana which gained $12,500 since March 2020.

As a result, if the market continues declining in the sessions ahead, SOL can be at risk of validating the head and shoulders setup. While SOL’s timeframe charts lean on a prolonged bearish setup, its short-term outlook looks quite bullish. This is mainly due to two factors. First, SOL’s price dropped to a critical support level at $116 which was instrumental in limiting the attempts for the downside and its daily relative index also dropped to below 30 which is a classic buy signal.

- 2020

- 2022

- Action

- Altcoin

- around

- asset

- Assets

- bearish

- Billion

- BTC

- BTCUSD

- Bullish

- buy

- Charts

- classic

- CoinGecko

- coming

- Common

- continues

- could

- crypto

- Crypto Market

- digital

- Digital Assets

- distance

- Drop

- dropped

- Ether

- ETHUSD

- factors

- Fed

- First

- head

- High

- HTTPS

- Including

- index

- influencing

- interest

- Interest Rates

- Investors

- Level

- Line

- March

- march 2020

- Market

- Markets

- Near

- news

- Other

- Outlook

- Pattern

- phase

- policies

- price

- Program

- range

- Rates

- Risk

- set

- Solana

- support

- support level

- Target

- test

- today’s

- token

- us

- Valuation

- week

- weekly