A new paper published by the Monetary Authority of Singapore (MAS) on June 21, 2023 introduces the concept of purpose bound money (PBM) and proposes a common protocol for digital money focusing on interoperability and versatility.

The proposed concept involves a common standard for digital money such as central bank digital currencies (CBDCs), tokenized bank liabilities and regulated stablecoins that’s designed to work with different ledger technology and forms of money, and which supports interoperability and accessibility through different wallet providers.

The PBM framework is outlined in a whitepaper produced in collaboration with the International Monetary Fund, Banca d’Italia, Bank of Korea, financial institutions and fintech firms including Grab, Amazon and DBS Bank, and is designed in a way that digital money could actually become a key component of the financial and payments landscape, the central bank said in a statement.

PBM and key considerations

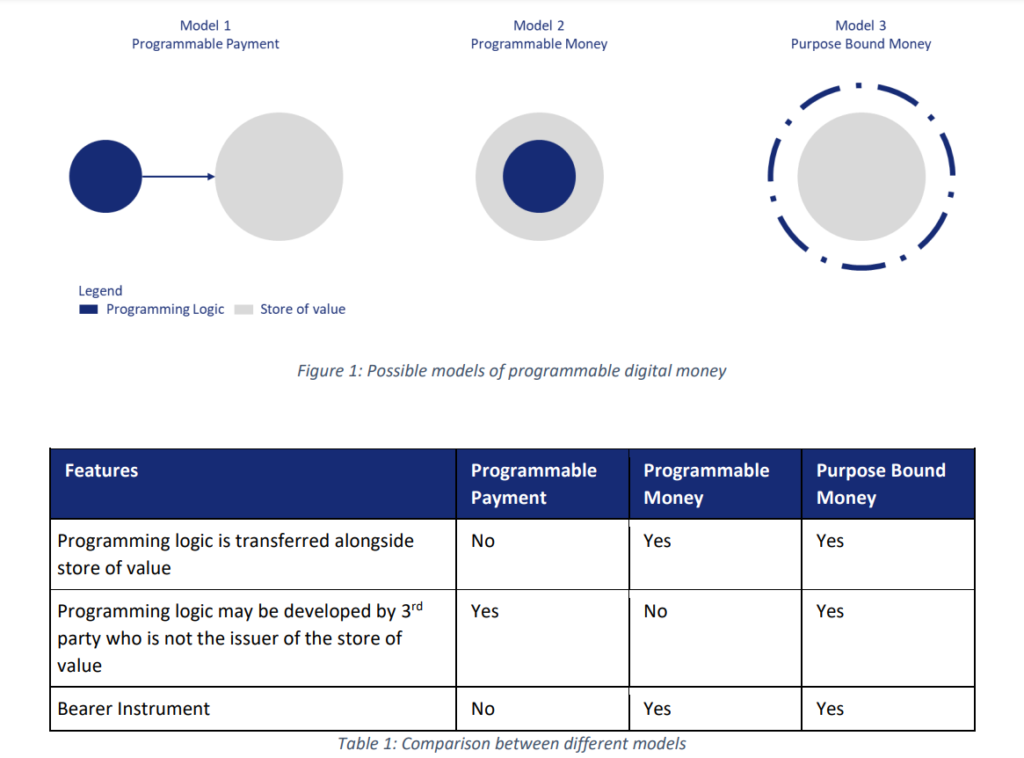

The paper provides a technical overview of the concept of PBM, defining it as “a protocol that specifies the conditions upon which an underlying digital money can be used.”

PBMs are bearer instruments and are transferrable on a peer-to-peer basis without intermediaries, the report says. They contain digital money as a store of value and programming logic denoting its use based on pre-defined conditions, such as a specific validity period and types of shops.

Before anything, the paper outlines several considerations that must be kept in mind when designing a PBM system. First, ensuring interoperability through a common standard is essential to avoid fragmentation and ensure compatibility across platforms and payment systems, the report says.

Second, the choice of digital money is important and should take into consideration factors like reserve assets, regulatory compliance, and guarantees provided by CBDCs, tokenized bank liabilities, and stablecoins.

Third, privacy is another critical element and should be addressed by separating the roles of the PBM creator and the digital money issuer, and by limiting data held by individual entities.

Next, the paper advises that digital readiness and user experience should be prioritized to ensure accessibility and adoption, particularly for vulnerable populations.

Finally, secure programming practices and independent audits are crucial to ensure the safety and reliability of smart contracts. This should be addressed by engaging trusted third-party organizations to provide reliable external data inputs in distributed ledger networks, the report says.

Proposed PBM system

MAS’ proposed PBM framework is comprised of two main elements: the PBM Wrapper and digital money.

The PBM Wrapper, implemented as smart contract code, sets the rules for how the money can be used. These rules can be a validity period, specific retailers or predetermined denominations.

The digital money, meanwhile, serves as collateral for the PBM system. Once the conditions of the PBM are met, the underlying digital money is released and transferred to the intended recipient.

The paper also outlines the lifecycle of a PBM, delving into its five stages. This lifecycle starts with the issuance stage, where PBM tokens are created and bound by a smart contract. The tokens represent digital money and are governed by specific conditions.

In the distribution stage, the tokens are transferred to intended holders who receive them in a wrapped form. The transfer stage allows for the exchange of tokens between entities according to predefined rules.

The redeem stage, meanwhile, occurs when all the specified conditions of the PBM are fulfilled. At this point, the tokens are unwrapped, and ownership of the underlying digital money is transferred to the recipient. The recipient can then freely utilize the digital money by adhering to any additional conditions set by the issuer.

If any conditions are violated or expire, the PBM tokens enter the expired stage where they become permanently unusable for the holder. They can then be aggregated and destroyed, returning the underlying digital money to the issuer.

Applications and use cases

The report outlines several examples of how PBM could be used. In pre-paid packages, PBM can be used to mitigate the risk of non-delivery by including conditions for payment. This would ensure that corporations fulfill their obligations before drawing down the pre-committed funds from consumers’ PBM e-wallets.

In e-commerce, PBM offers an alternative solution to protect both consumers and merchants, allowing for funds to be transferred only when service obligations are met and mitigating the risks of non-delivery or payment.

Similarly, in trade finance, PBMs can be programmed to make automatic payment upon fulfillment of service obligations, serving as transferable instruments in international trade transactions.

In contractual agreements, PBMs can be created based on terms stipulated in property sales. Funds would be released at different stages of property development or sales process when milestones are achieved.

PBMs can also be used for commercial leases, donations and cross-border payments, enabling more transparency, accountability and efficiency, the report says.

MAS’ PBM concept was first introduced as part of the central bank’s Project Orchid, an exploratory project examining the various design and technical aspects of a retail CBDC system for Singapore.

Phase 1 of Project Orchid involved research on PBM and featured four trials of the concept. These trials saw public agencies and industry stakeholders issue and distribute digital money through government and commercial vouchers and through government payouts, among other use cases.

Featured image credit: edited from freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://fintechnews.sg/75663/payments/behind-singapores-experiment-with-a-digital-version-of-sgd/

- :is

- :where

- 1

- 2023

- 7

- a

- accessibility

- According

- accountability

- achieved

- across

- actually

- Additional

- Adoption

- agencies

- agreements

- All

- Allowing

- allows

- also

- alternative

- Amazon

- among

- an

- and

- Another

- any

- anything

- ARE

- AS

- aspects

- Assets

- At

- audits

- authority

- Automatic

- avoid

- Bank

- bank of korea

- based

- basis

- BE

- Bearer

- become

- before

- behind

- between

- both

- Bound

- by

- CAN

- caps

- cases

- CBDC

- CBDCs

- central

- Central Bank

- central bank digital currencies

- CENTRAL BANK DIGITAL CURRENCIES (CBDCS)

- choice

- code

- collaboration

- Collateral

- commercial

- Common

- compatibility

- compliance

- component

- Comprised

- concept

- conditions

- consideration

- considerations

- Consumers

- contain

- contract

- contracts

- contractual

- Corporations

- could

- created

- creator

- credit

- critical

- cross-border

- cross-border payments

- crucial

- currencies

- data

- DBS

- DBS Bank

- defining

- Design

- designed

- designing

- destroyed

- Development

- different

- digital

- digital currencies

- Digital Money

- distribute

- distributed

- Distributed Ledger

- distribution

- donations

- down

- drawing

- e-commerce

- E-wallets

- efficiency

- element

- elements

- enabling

- engaging

- ensure

- ensuring

- Enter

- entities

- essential

- Examining

- examples

- exchange

- experience

- experiment

- external

- factors

- false

- featured

- finance

- financial

- Financial institutions

- fintech

- firms

- First

- focusing

- For

- form

- forms

- four

- fragmentation

- Framework

- friendly

- from

- Fulfill

- fund

- funds

- governed

- Government

- grab

- guarantees

- Held

- holder

- holders

- How

- HTTPS

- image

- implemented

- important

- in

- Including

- independent

- individual

- industry

- inputs

- institutions

- instruments

- intended

- intermediaries

- International

- international monetary fund

- International Trade

- Interoperability

- into

- introduced

- Introduces

- involved

- issuance

- issue

- Issuer

- IT

- ITS

- jpg

- june

- kept

- Key

- korea

- landscape

- Ledger

- liabilities

- lifecycle

- like

- logic

- Main

- make

- MAS

- max-width

- Meanwhile

- Merchants

- met

- Milestones

- mind

- Mitigate

- mitigating

- Monetary

- monetary authority

- Monetary Authority of Singapore

- Monetary Authority of Singapore (MAS)

- money

- more

- must

- networks

- New

- obligations

- of

- Offers

- on

- once

- only

- or

- Orchid

- organizations

- Other

- outlined

- outlines

- overview

- ownership

- packages

- Paper

- part

- particularly

- payment

- Payment Systems

- payments

- payouts

- peer to peer

- period

- permanently

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Point

- populations

- practices

- prioritized

- privacy

- process

- Produced

- programmed

- Programming

- project

- Project Orchid

- property

- proposed

- proposes

- protect

- protocol

- provide

- provided

- providers

- provides

- public

- purpose

- Readiness

- receive

- redeem

- regulated

- regulatory

- Regulatory Compliance

- released

- reliability

- reliable

- report

- represent

- research

- Reserve

- retail

- retail CBDC

- retailers

- return

- returning

- Risk

- risks

- roles

- rules

- s

- Safety

- Said

- sales

- saw

- says

- secure

- separating

- serves

- service

- serving

- set

- Sets

- several

- SGD

- shops

- should

- Singapore

- smart

- smart contract

- Smart Contracts

- solution

- specific

- specified

- Stablecoins

- Stage

- stages

- stakeholders

- standard

- starts

- Statement

- store

- store of value

- such

- Supports

- system

- Systems

- Take

- Technical

- Technology

- terms

- that

- The

- their

- Them

- then

- These

- they

- third-party

- this

- Through

- to

- tokenized

- Tokens

- trade

- Trade Finance

- Transactions

- transfer

- transferred

- Transparency

- trials

- trusted

- two

- types

- underlying

- upon

- use

- used

- User

- User Experience

- utilize

- value

- various

- version

- violated

- Vulnerable

- Wallet

- was

- Way..

- when

- which

- Whitepaper

- WHO

- window

- with

- without

- Work

- would

- Wrapped

- zephyrnet