Executive Summary

- Bitcoin prices are attacking the ATH once again, taking the market by surprise, and rallying with strength even prior to the widely anticipated halving event.

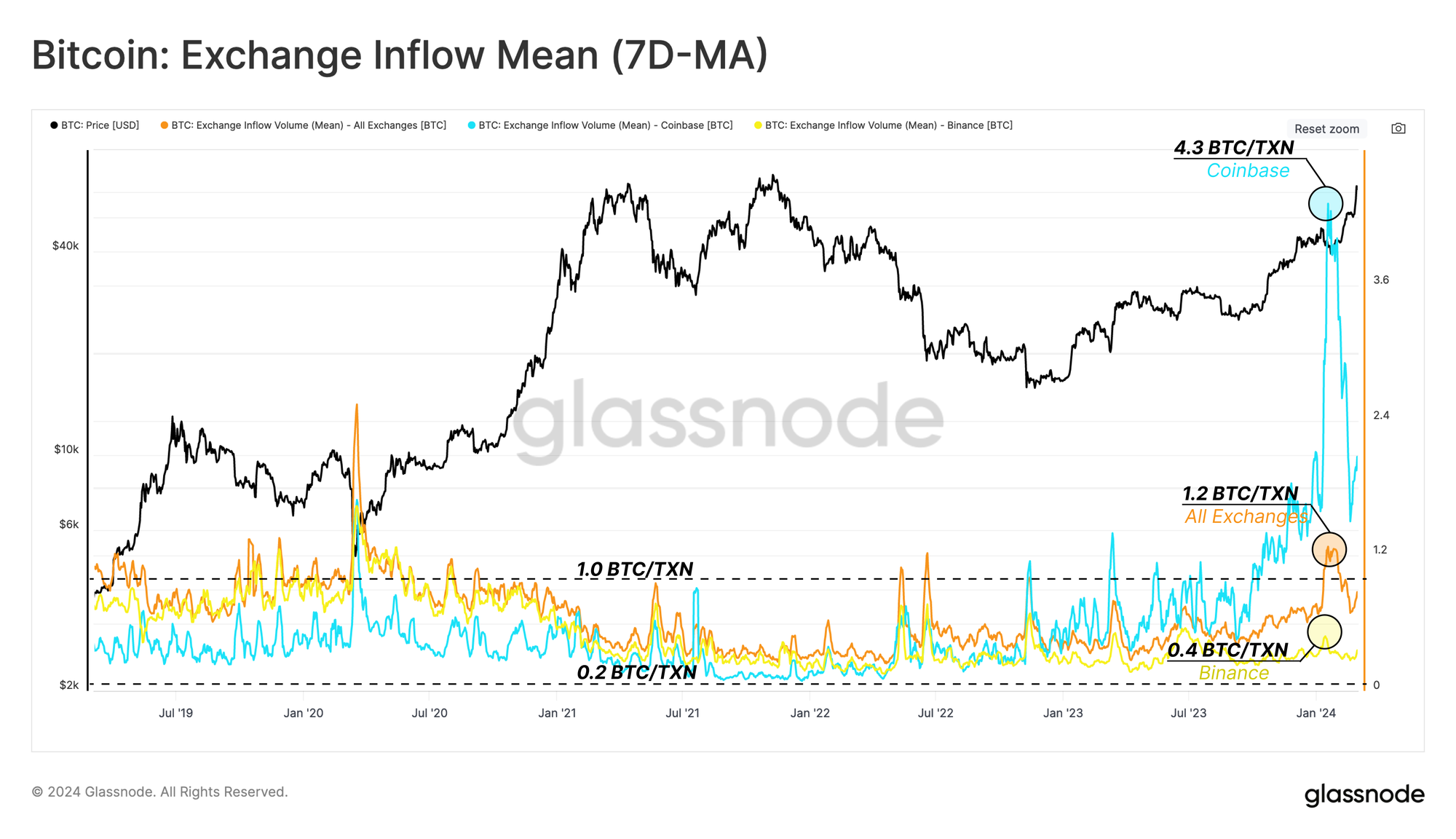

- We have seen a sudden spike in the average transaction size interacting with Coinbase, which highlights the size and scale of new institutional capital entering Bitcoin.

- Long-Term Holders have started to ramp up their distribution pressure, hitting spending rates of 257k BTC/month, with GBTC accounting for 57% of these volumes.

The opening of 2024 has become one for the Bitcoin history books, with the Bitcoin market rallying towards ATHs, even before the halving event coming in April.

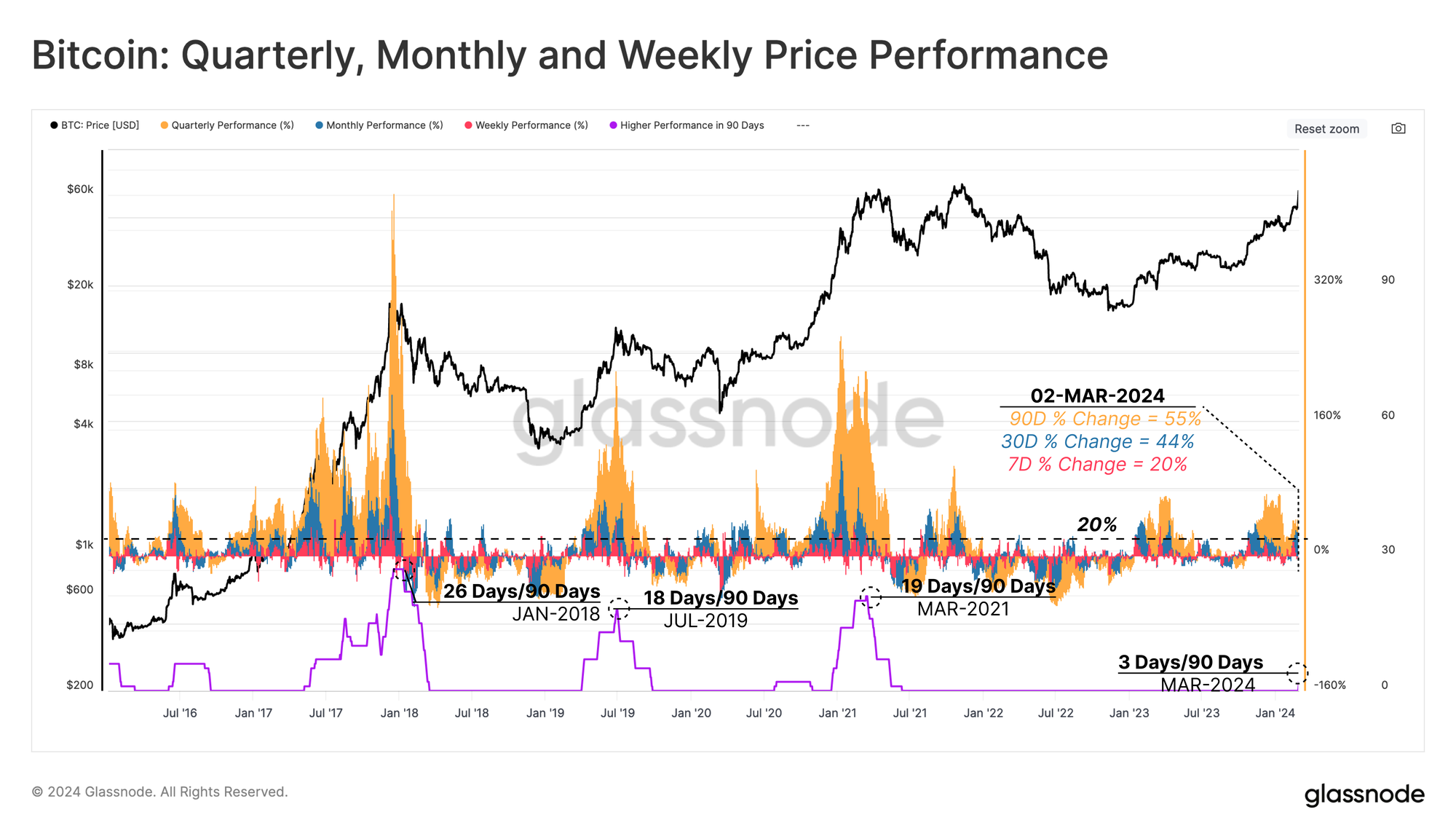

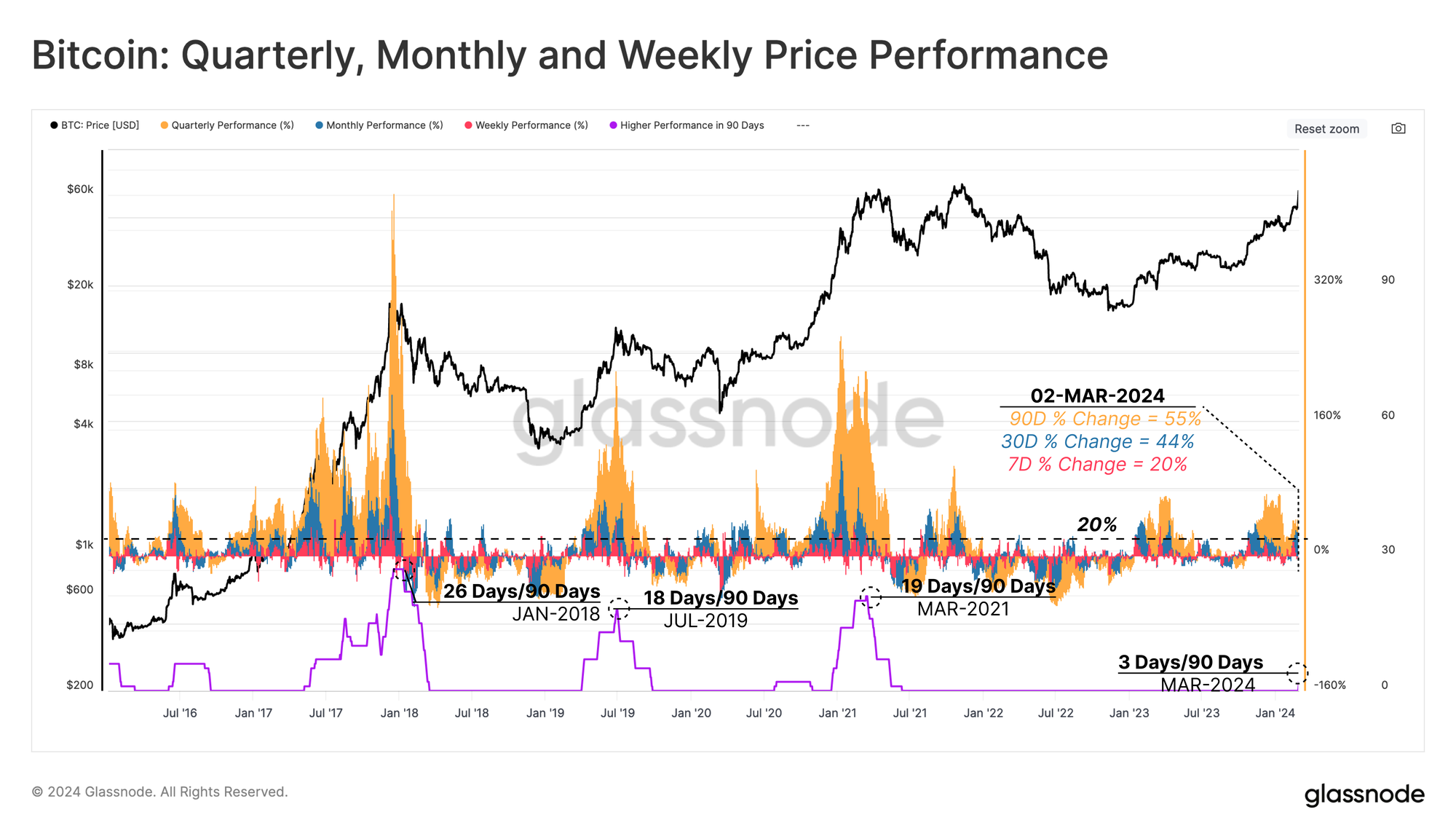

The chart below shows the rolling performance over Weekly 🟥, Monthly 🟦 and Quarterly 🟧 timeframes, and have hit +20%, +44%, and +55% at the time of writing. If we count the number of trading days over the last quarter where all three performance indicators exceed +20%, we can see that the rally late last week has been the most powerful since the 2021 bull market.

Spot ETFs Demand

Many observers anticipated strong demand after the SEC approved Spot ETFs for US markets. At the same time, many were sceptical, and believed that the ETF news was already priced in, and thus expected a sell-the-news correction. With Bitcoin now trading at $68.0k, 58% higher than $42.8k at the time of ETF approvals, the sell-the-news camp have found themselves offside.

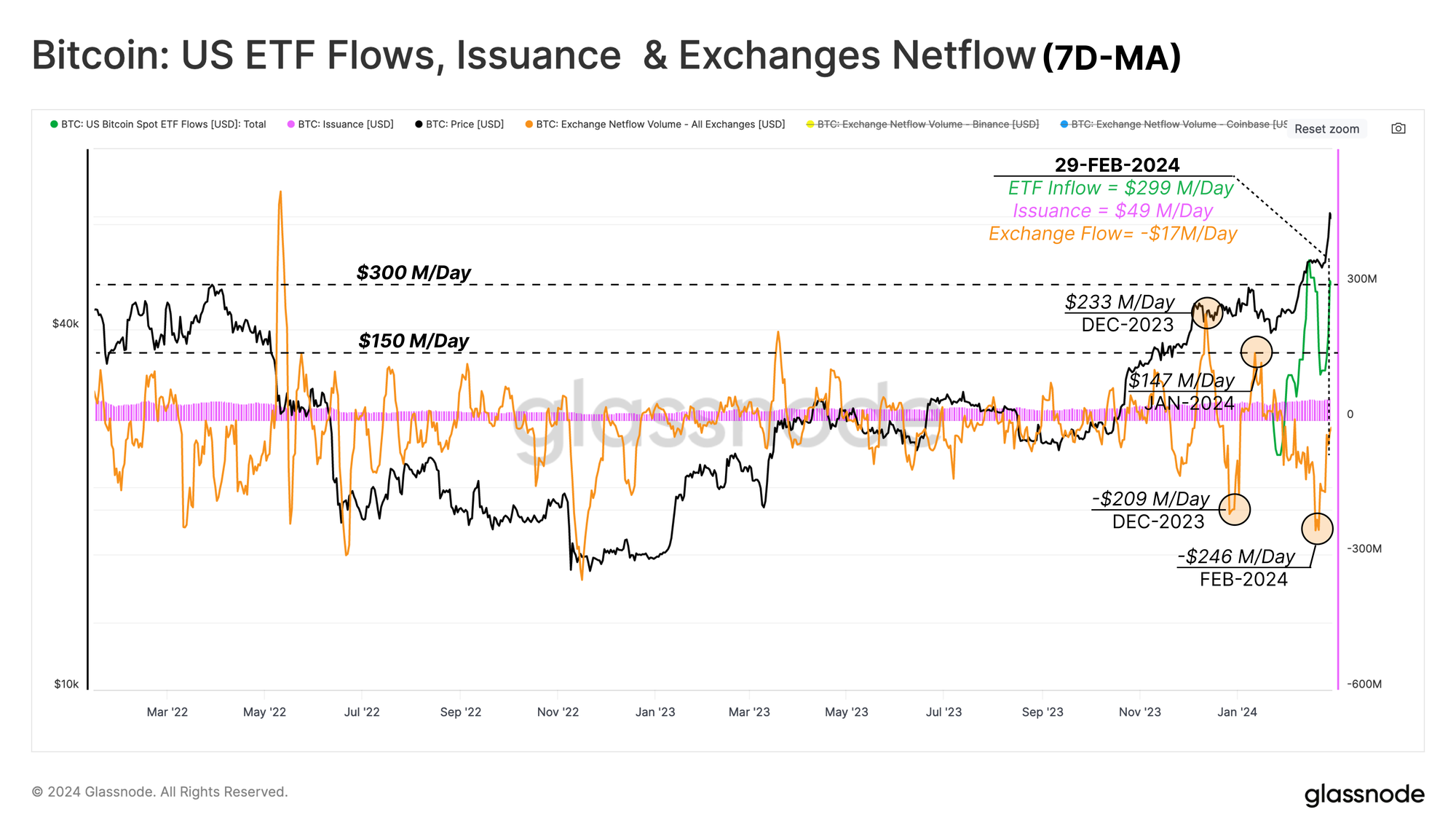

To better gauge the aggregate demand inflows, the chart below presents the weekly average of the USD flows via the following areas:

- Network Issuance 🟪: The daily network reward to miners (assumed sell side), which has increased from $22M/day in September 2023, to $49M/day today.

- All Exchanges Netflow 🟧: Focusing on the months leading up to the ETF approval date, centralized exchanges witnessed significant swings between positive (sell-side) and negative (buy-side) waves of capital flows. Since the ETFs started trading, this metric has shown a consistent outflow or buying pressure of up to $246M/day. At the end of last week, the aggregate exchange netflow was experiencing a $17M/day outflow.

- US Spot ETFs Netflow 🟩: Despite an initial and significant sell-side pressure exerted by existing GBTC holders, the aggregate net flow into US Spot ETFs averaged $299M/day.

Overall, this represents an on-balance, and back of the envelope net capital inflow into Bitcoin of around $267M/day (−49+17+299). This represents a meaningful phase shift in market dynamics and a valid explanation for the market’s rebound towards new ATHs.

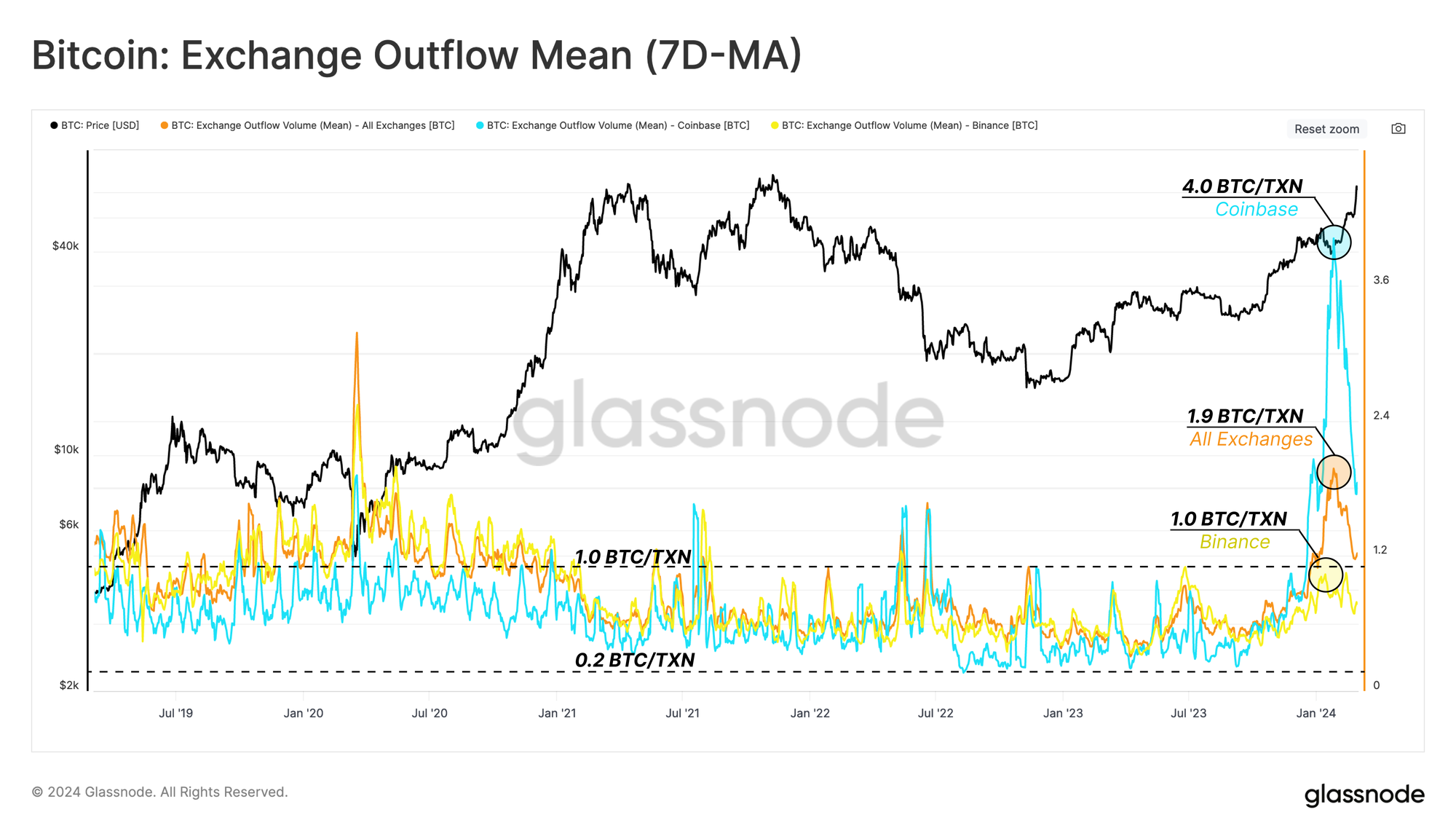

We can also isolate fund flows related to specific exchanges, such as Coinbase, to identify any changes in overall market dynamics. The charts below show the average deposit volume [BTC] flowing into and out of:

- All Exchanges 🟠

- Coinbase 🔵

- Binance 🟡

The result shows that the average inflow and outflow transactions have reached considerably higher values with respect to Coinbase in particular. The average transaction size peaked at 4.3 BTC/Tx at the time of the ETF approval.

These values are noteworthy when compared with their historical range, which has been between 0.2 BTC/Tx and 1.0 BTC/Tx since 2019.

Diamond Hands in Profit

With the market getting near ATHs, both the unrealized profit held by long-term investors and the magnitude of their distribution pressure have increased accordingly.

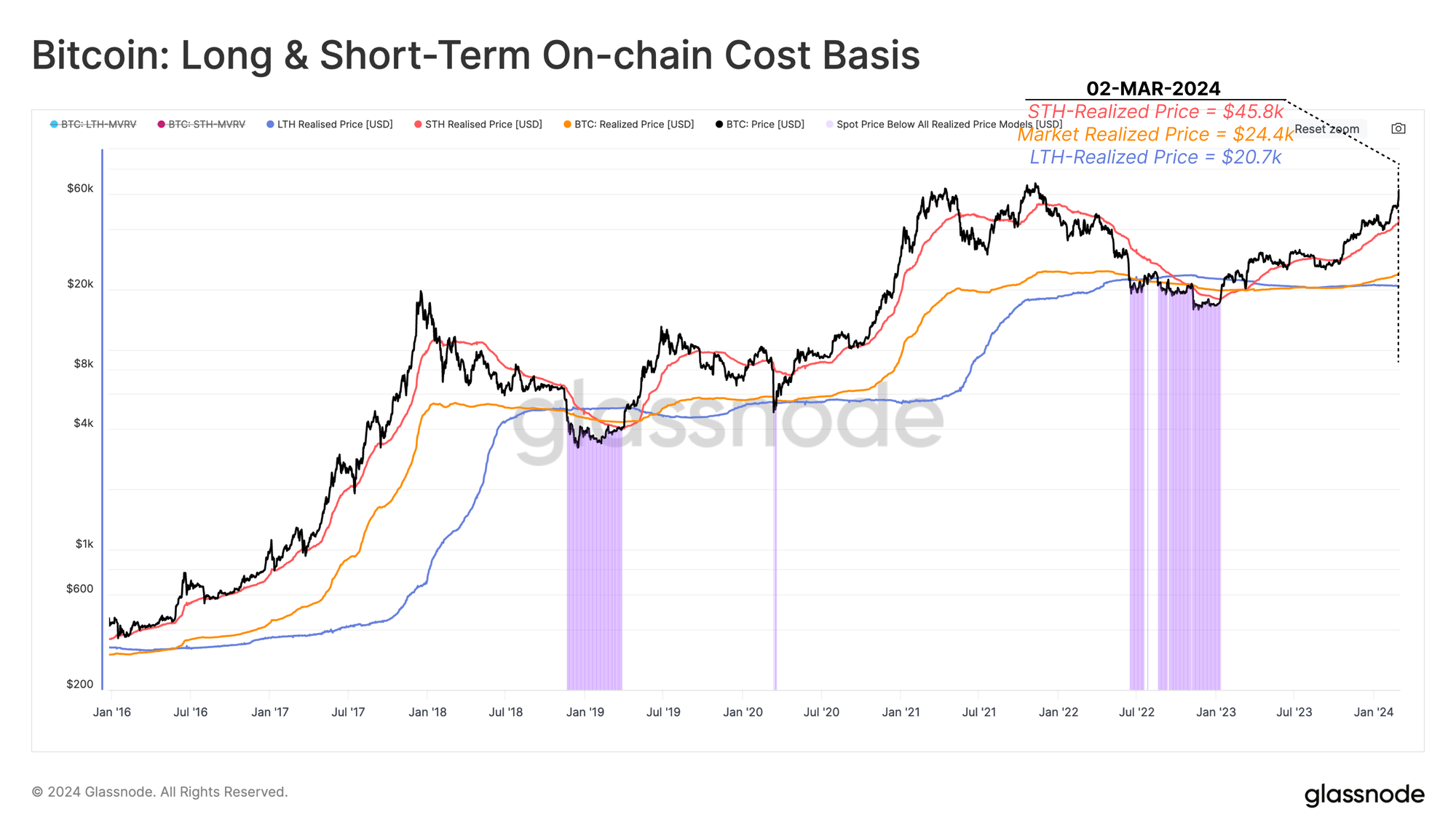

One way to gauge the profitability of the market for any specific cohorts of investors is to leverage their on-chain cost basis (or the average price at which each cohort acquired their coins) and compare it with the spot price.

- Long-Term Holders 🔵 = $20.7K

- Short-Term Holders 🔴 = $45.8K

- Market Realized Price 🟠 = $24.4K

With price trading at $68k, the long-term holders are, on average, sitting on an unrealized profit of ~228%.

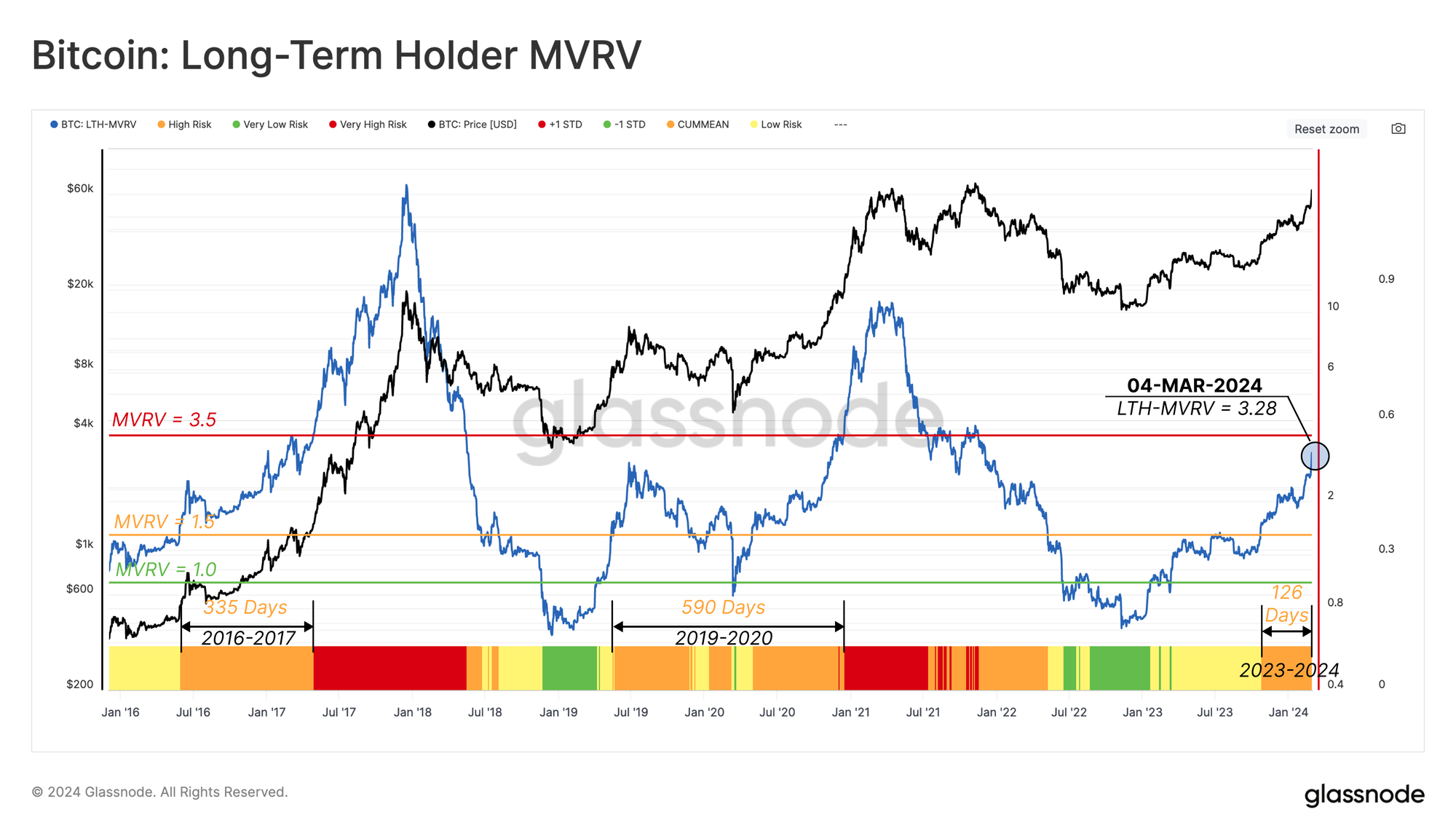

We can plot the unrealized profit multiple held by long-term holders using the LTH-MVRV metric, which is a ratio between price and their cost basis. This ratio currently trades at 3.28, which falls between two historically significant threshold levels separating the following phases of a typical cycle.

- Bottom Discovery 🟩 (LTH-MVRV < 1): means, on average, these investors are at a loss.

- Bear-Bull Transition 🟨 (1 < LTH-MVRV < 1.5): means long-term holder profitability is between break-even, and +50% profit.

- Equilibrium 🟧 (1.5 < LTH-MVRV < 3.5): means long-term holders have an average unrealized profit of +50% to +250%.

- Euphoria 🟥 (3.5 < LTH-MVRV): means, on average, long-term investors are in more than +250% profit.

Based on the current value, these investors are approaching their Euphoria state with an elevated incentive to spend and take profits. Historically, this cohort ramps up their spending as new market ATHs are reached, with distribution accelerating until they help form the cycle macro top.

Long-Term Players in Action

Now that we have established the magnitude of unrealized profit attributed to long-term holders, we must evaluate how these entities are reacting this shift in profitability.

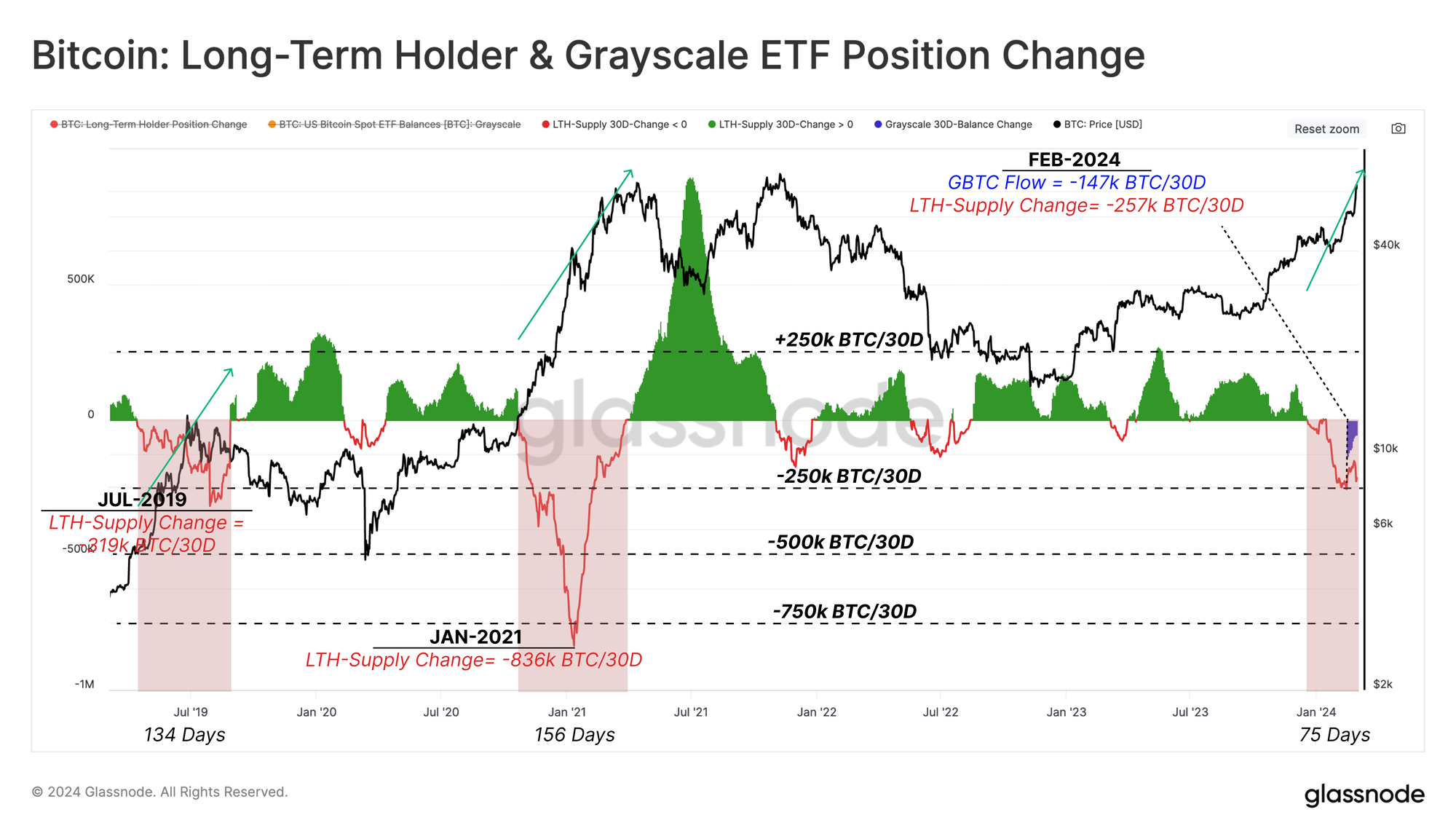

A quick and straightforward method is to look at the Long-Term Holder Supply. As shown below, long-term investors have distributed approximately 480k BTC since December 2023, when LTH-MVRV was still in the Equilibrium phase. This means some of these investors began to spend at +50% to +200% profit on average, even before the ETF launch date.

To assess distribution regimes by long-term holders, we consider two pillars: the distribution rate, and the continuation time.

The following chart displays the monthly change in the long-term holder supply. Zooming in on the last two major market expansions in mid-2019 and early 2021, we can see the distribution rate for LTHs reached peaks of 319k BTC/month and 836k BTC/month, respectively.

The distribution rate of this cycle has thus far peaked at 257 BTC/month, with outflows from GBTC accounting for approximately 57% of this.

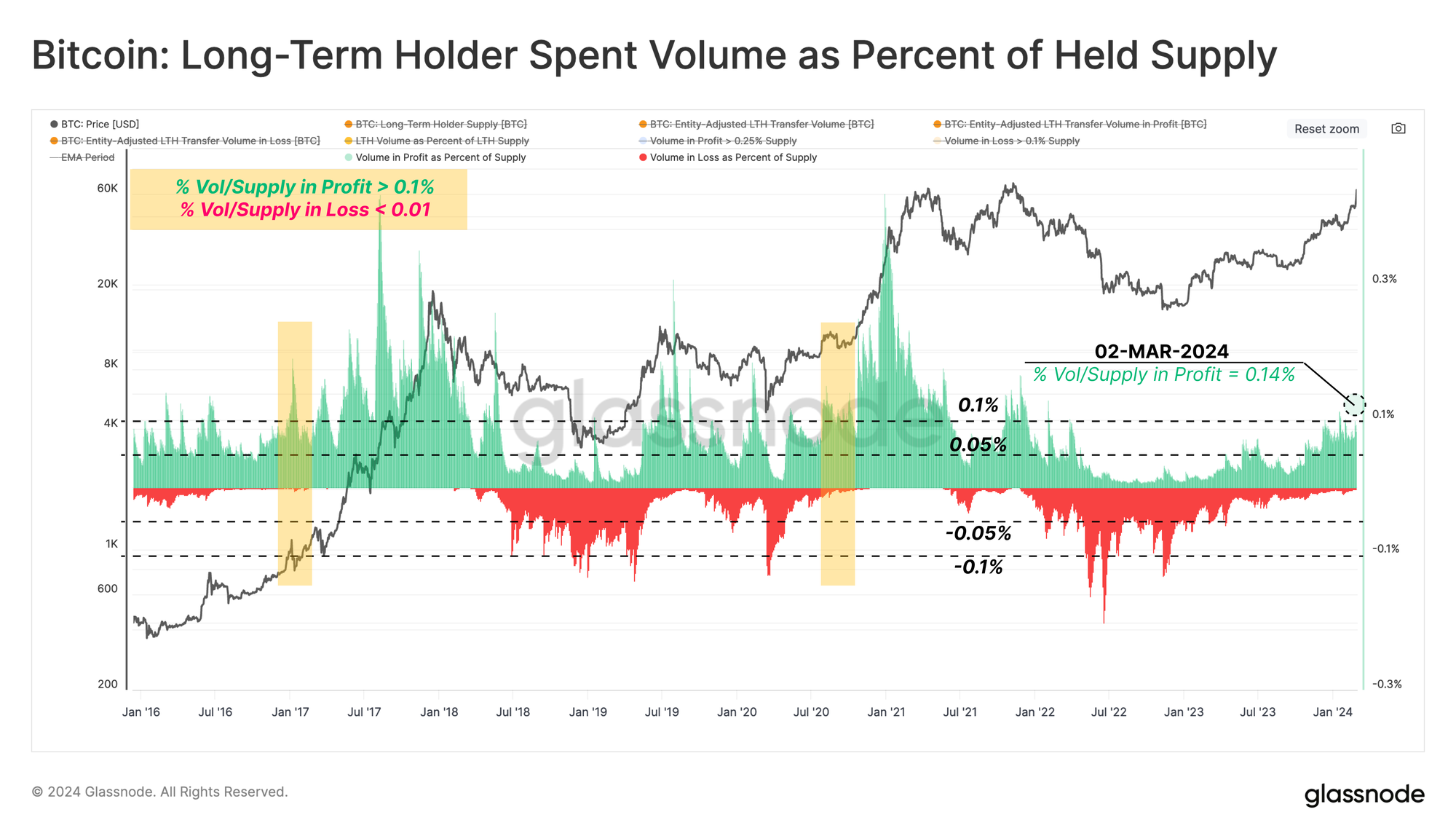

As LTH distribution increases, so too does the magnitude of realized profit locked in. To monitor this dynamic, we have measured the proportion of LTH transfer volume in profit/loss relative to their overall balance.

At the time of writing, this indicator shows that LTHs are realizing profit at rates equal to 0.14% of their aggregate supply daily. This metric is approaching levels coincident with the early Euphoria phase and prior breaks of the market ATH.

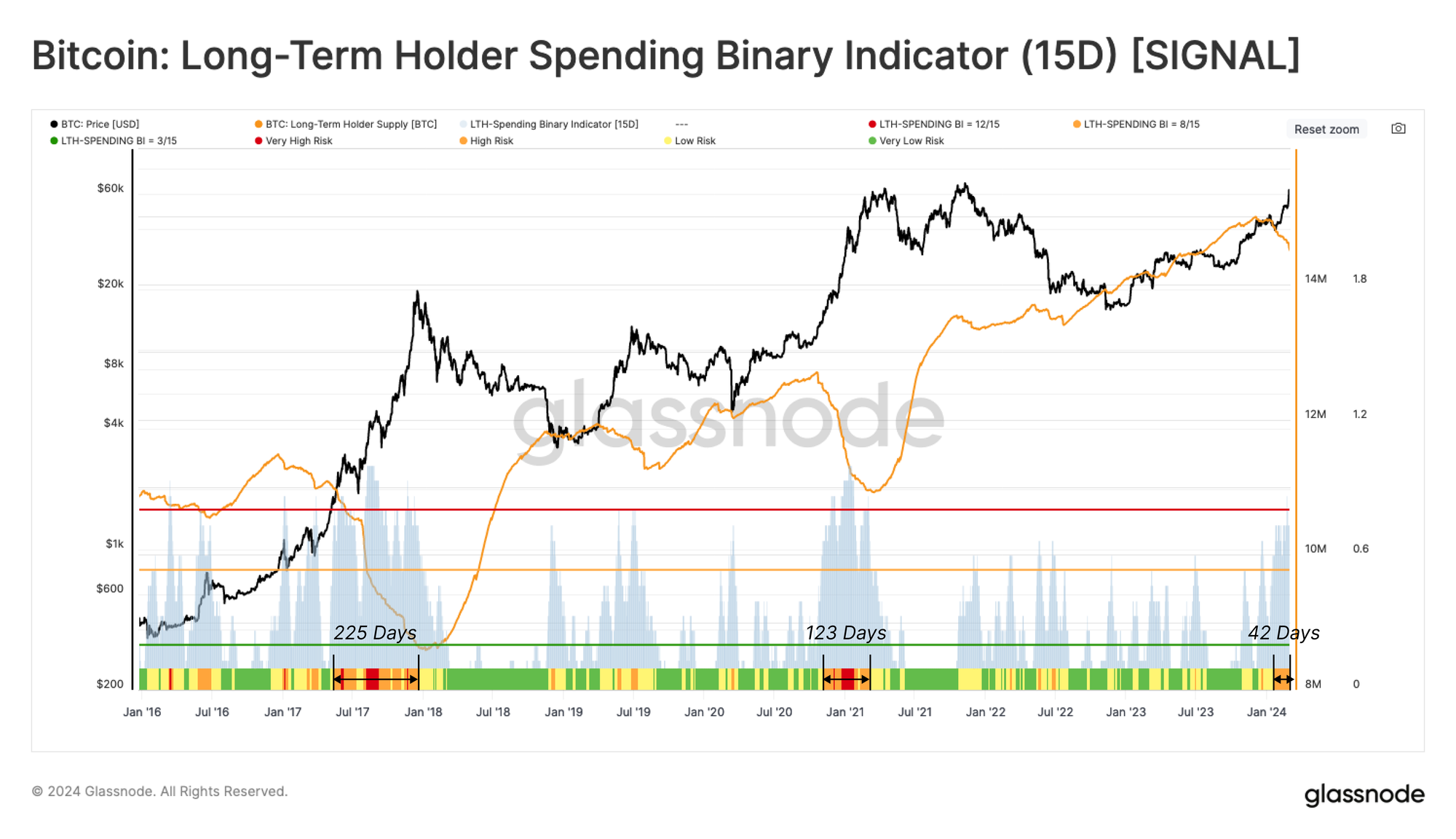

In the last part of this investigation, we have created a binary indicator which identifies periods when LTH spending is of a magnitude sufficient to deplete their aggregate balance over a sustained 15-day period. This spending represents a release of long-dormant supply back into liquid circulation, which acts as a counterweight, offsetting new demand.

In the chart below, we have used several threshold values to categorize the spending regimes. Since late January 2024, the market has entered a phase where the binary indicator has flagged long-term holder supply decline for at least 8 of the last 15-days.

If we study the 2017 and 2021 cycle tops, A similar structure was sustained for between 123, and 225 days. With the current phase having been in this state for 42 days thus far, it may suggest that demand inflows could offset LTH spending for several months ahead, should history be any guide.

Conclusion

Once again, Bitcoin has surprised investors by rallying to the last ATH before the halving event, being the first such time this has occurred. The new US Spot ETFs have introduced a significant new source of demand into the market, offsetting the daily issuance and recent sell-side pressure deposited to exchanges by some margin.

Long-Term Holders are spinning up their distribution cycle, which is a trend we have seen in all prior cycles as the ATH is challenged. This allows us to compare these new demand vectors via the ETFs, with the distribution pressure from existing holders and explains Bitcoin’s meteoric rise back to all-time highs.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://insights.glassnode.com/the-week-onchain-week-10-2024/

- :has

- :is

- :where

- $UP

- 1

- 2000

- 2017

- 2019

- 2021

- 2023

- 2024

- 225

- 28

- 8

- 8k

- a

- accelerating

- accordingly

- Accounting

- acquired

- acts

- advanced

- After

- again

- aggregate

- ahead

- All

- all-time highs

- allows

- already

- also

- an

- and

- Anticipated

- any

- approaching

- approval

- approvals

- approved

- approximately

- April

- ARE

- areas

- around

- AS

- assess

- assumed

- At

- ATH

- Attacking

- Attacks

- average

- back

- Balance

- basis

- BE

- become

- been

- before

- began

- being

- believed

- below

- Better

- between

- Bitcoin

- Bitcoin market

- Books

- both

- breaks

- BTC

- bull

- Bull Market

- Buy-Side

- Buying

- by

- Camp

- CAN

- capital

- categorize

- centralized

- Centralized Exchanges

- challenged

- change

- Changes

- Chart

- Charts

- Circulation

- Cohort

- coinbase

- Coins

- coming

- compare

- compared

- conclusion

- Consider

- consistent

- continuation

- Cost

- cost basis

- could

- count

- created

- Current

- Currently

- cycle

- cycles

- daily

- Date

- Days

- December

- Decline

- Demand

- deposit

- deposited

- Despite

- displays

- distributed

- distribution

- does

- dynamic

- dynamics

- each

- Early

- elevated

- end

- entered

- entering

- entities

- envelope

- equal

- Equilibrium

- established

- ETF

- ETFs

- evaluate

- Even

- Event

- exceed

- exchange

- Exchanges

- existing

- expected

- experiencing

- Explains

- explanation

- Falls

- far

- First

- flagged

- flow

- Flowing

- Flows

- focusing

- following

- For

- form

- found

- from

- fund

- gauge

- GBTC

- getting

- Glassnode

- guide

- Halving

- Hands

- Have

- having

- Held

- help

- higher

- highlights

- Highs

- historical

- historically

- history

- Hit

- hitting

- holder

- holders

- How

- HTTPS

- identifies

- identify

- if

- in

- Incentive

- increased

- Increases

- Indicator

- Indicators

- inflows

- initial

- Institutional

- interacting

- into

- introduced

- investigation

- Investors

- issuance

- IT

- January

- Last

- Late

- launch

- leading

- least

- levels

- Leverage

- Liquid

- locked

- long-term

- Long-term Holder

- long-term holders

- Look

- loss

- Macro

- major

- many

- Margin

- Market

- Markets

- May..

- meaningful

- means

- meteoric

- method

- metric

- Miners

- Monitor

- monthly

- months

- more

- most

- multiple

- must

- Near

- negative

- net

- network

- New

- New Market

- news

- noteworthy

- now

- number

- observers

- occurred

- of

- offset

- offsetting

- on

- On-Chain

- once

- ONE

- opening

- or

- out

- outflows

- over

- overall

- part

- particular

- performance

- period

- periods

- phase

- phases

- pillars

- plato

- Plato Data Intelligence

- PlatoData

- players

- plot

- positive

- powerful

- presents

- pressure

- price

- Prices

- Prior

- professional

- Profit

- profitability

- profits

- proportion

- Quarter

- quarterly

- Quick

- rally

- Ramp

- Ramps

- range

- Rate

- Rates

- ratio

- reached

- realized

- realized price

- realizing

- rebound

- recent

- regimes

- related

- relative

- release

- represents

- respect

- respectively

- result

- Reward

- Rise

- Rolling

- s

- same

- Scale

- SEC

- see

- seen

- sell

- separating

- September

- several

- shift

- should

- show

- shown

- Shows

- side

- significant

- similar

- since

- Sitting

- Size

- So

- some

- Source

- specific

- spend

- Spending

- spike

- Spot

- standard

- started

- State

- Still

- straightforward

- strength

- strong

- structure

- Study

- such

- sudden

- sufficient

- suggest

- supply

- surprise

- surprised

- Swings

- Take

- taking

- than

- that

- The

- The Weekly

- their

- themselves

- These

- they

- this

- three

- threshold

- Thus

- time

- to

- today

- too

- top

- Tops

- towards

- trades

- Trading

- transaction

- Transactions

- transfer

- transition

- Trend

- two

- typical

- until

- us

- USD

- used

- using

- valid

- value

- Values

- via

- volume

- volumes

- was

- waves

- Way..

- we

- week

- weekly

- were

- when

- which

- widely

- with

- witnessed

- writing

- zephyrnet

- zooming