On-chain knowledge exhibits Bitcoin long-term holders have simply ramped up their promoting because the binary CDD metric shoots up.

Bitcoin Binary Coin Days Destroyed Has Noticed A Surge

As identified by an analyst in a CryptoQuant post, long-term holders could also be utilizing the latest surge as a possibility to distribute their cash.

A “coin day” is claimed to be the quantity that 1 BTC accumulates whereas sitting nonetheless for 1 day. Thus, the full variety of coin days available in the market confer with the general time the Bitcoin provide has been dormant for.

At any time when any coin strikes on the chain, the coin days related to it flip again to zero. The “coin days destroyed” is an indicator that measures exactly this, for the complete market on any given day.

At any time when this metric’s worth spikes up, it means a considerable amount of dormant provide, doubtless belonging to the long-term holders or “hodlers,” has simply been offered or moved.

One method to interpret the information related to this indicator is thru the “binary CDD” metric. Here’s a chart that exhibits the pattern in it for the final one yr:

Seems to be like the worth of this metric has spiked up in latest days | Supply: CryptoQuant

What the binary CDD tells us is whether or not Bitcoin long-term holders are making extra strikes than common or not proper now.

When the indicator’s worth strikes in direction of 1, it means the LTHs are presumably placing promoting strain in the marketplace presently. Alternatively, values pointing in direction of 0 indicate LTHs aren’t shifting that many cash in the meanwhile.

Now, as you’ll be able to see within the above graph, at any time when the binary CDD metric has noticed rising values throughout the previous yr, the value of the crypto has typically noticed a pointy decline.

Lately, the indicator has as soon as once more seen an uplift in its worth whereas the value of Bitcoin has additionally trended up.

This might recommend that LTHs are utilizing this surge within the worth as a possibility to reap some revenue by promoting off a few of their cash.

If the previous pattern is something to go by, this spike within the binary CDD might show to be bearish for the worth of Bitcoin.

BTC Value

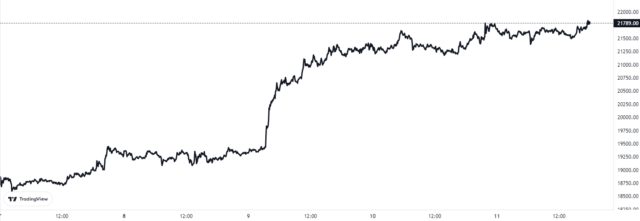

On the time of writing, Bitcoin’s worth floats round $21.7k, up 9% up to now week. Over the past month, the crypto has misplaced 9% in worth.

The under chart exhibits the pattern within the BTC worth during the last 5 days.

The worth of the crypto appears to have noticed upwards momentum throughout the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

#Bitcoin #Bearish #Signal #LongTerm #Holder #Selling #Ramps #Bitcoinist.com