In the last 48 hours, the overall crypto market is down more than 10% and by 25% over the last week. Bitcoin (BTC) and Ethereum (ETH) have seen severe price corrections in this time period and this time it comes with sharply declining on-chain activity.

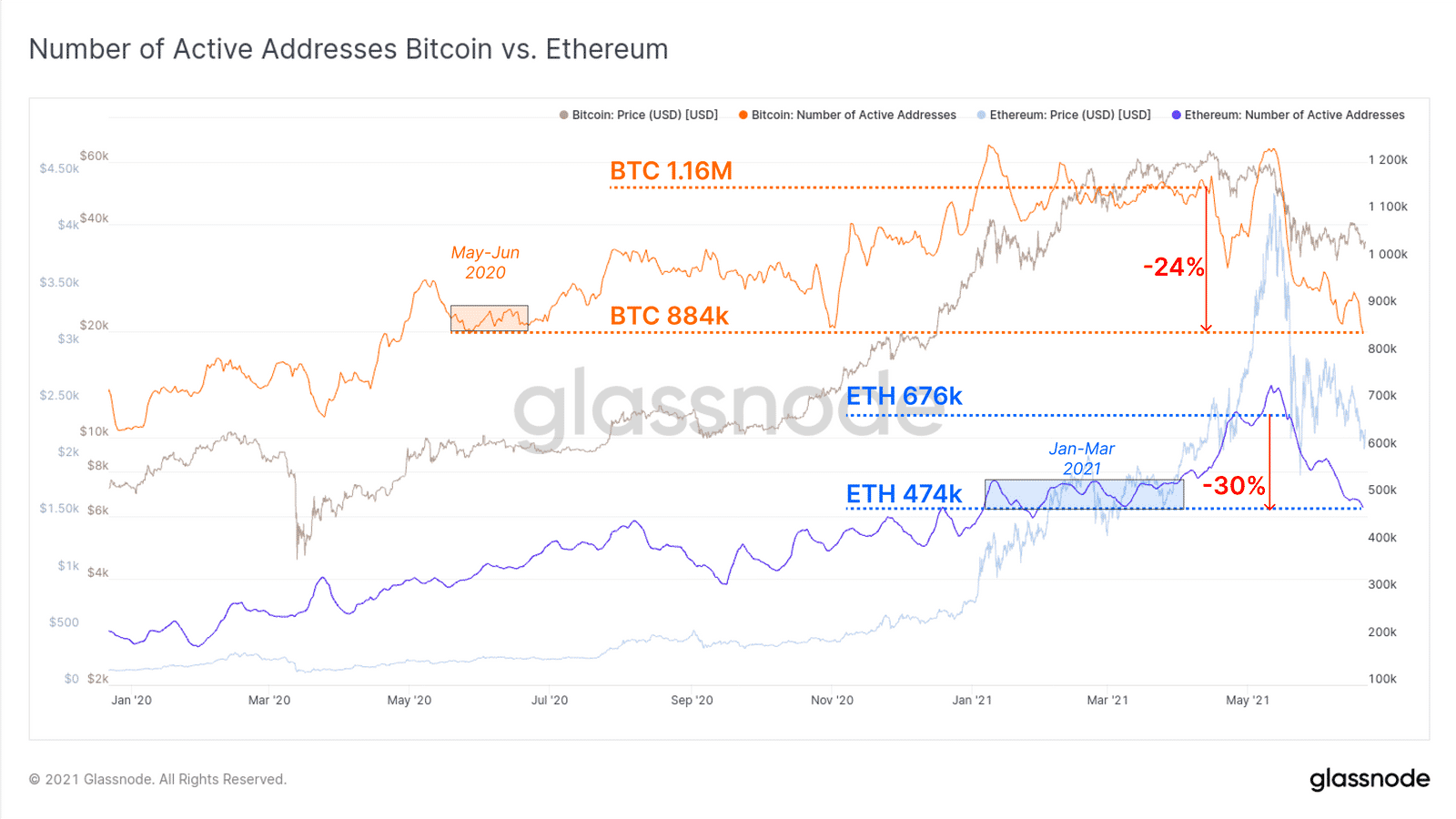

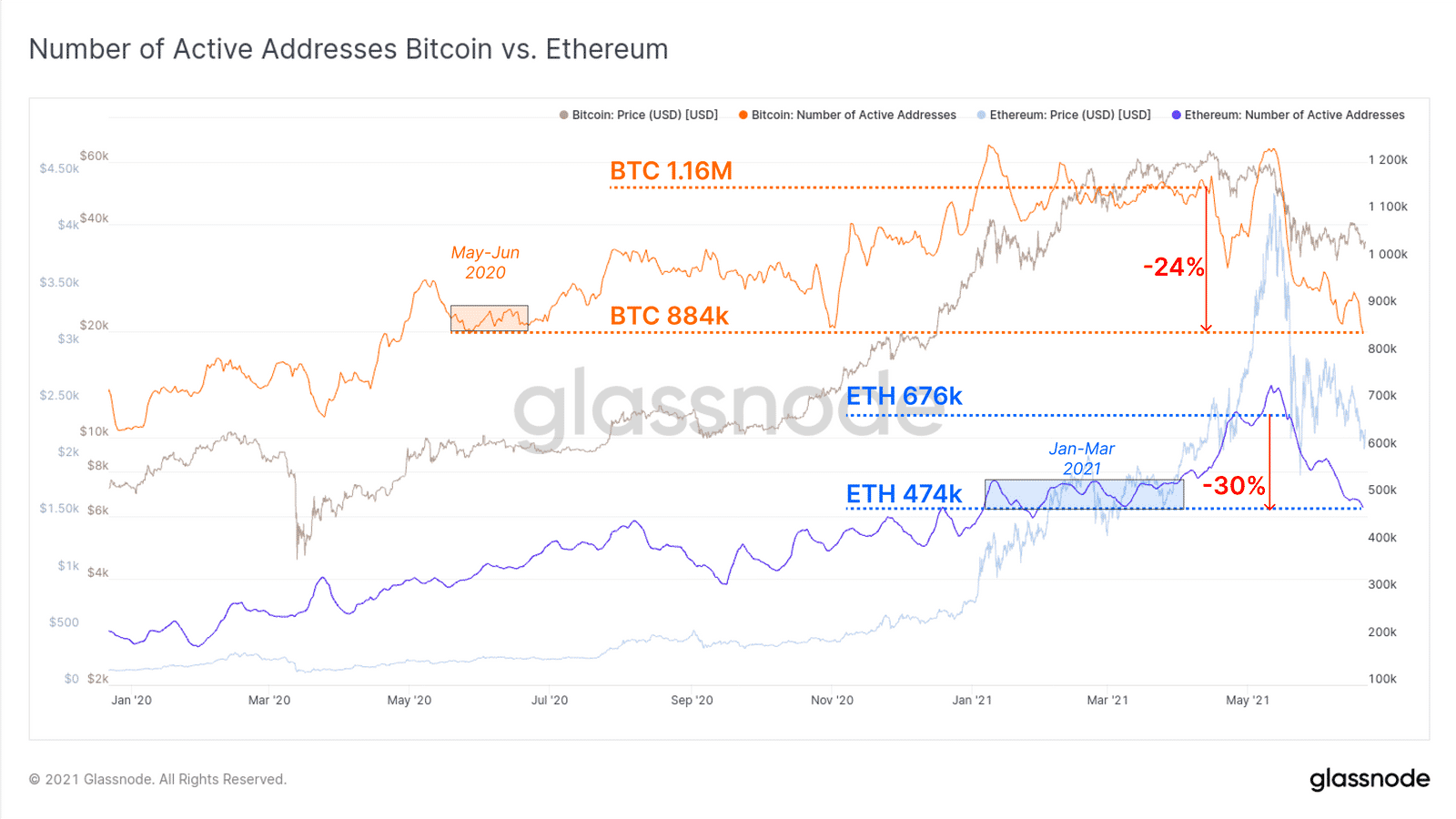

The on-chain active addresses for Bitcoin and Ethereum have fallen to levels seen one year back in June 2020. a majority of this fall comes during the rapid price corrections over the last month. During the period of March to early May 2021, Bitcoin address activity peaked at 1.16 million. Now it has dropped 24% from the top to 884K addresses recently.

On-chain data provider Glassnode notes that for Ethereum, the drop has been even more severe to 30%. From peak active addresses of 676K/day, the Ethereum active addresses have dropped to 474K per day.

Dramatic Drop In USD Network Settlements

While looking at the USD settlements on the Bitcoin and Ethereum blockchain, the decline in activity seems to be even more dramatic. Bitcoin network’s USD settlements have dropped 64% from their peak in May while the Ethereum network’s USD settlements have tanked 68%.

The Bitcoin network is currently settling $18.3 billion per day while the Ethereum network is settling $5 billion per day as of now.

We know that with the recent crackdown from Chinese authorities, the BTC network’s hashrate has also corrected 40% from its peak in May 2021. However, this has also resulted in lesser network congestion thereby reducing the block inclusion fee and transaction fee. The total fee paid to the network has dropped to levels last seen during late 2019 and early 2020.

Similarly, for Ethereum, the network’s fee revenue has dropped from 15K ETH/day last month to only 1.9k ETH. the fall also comes amid a sharp decline in the DeFi activity.

During the recent market movement, long-term holders have been accumulating major supply and even holding at unrealized losses. At the same time, the short-term holders have ended up booking major losses.

Subscribe to our newsletter for free

Source: https://coingape.com/bitcoin-btc-and-ethereum-eth-on-chain-activity-takes-massive-hit/

- 2019

- 2020

- active

- avatar

- Billion

- Bitcoin

- blockchain

- blockchain technology

- border

- BTC

- chinese

- content

- Corrections

- crypto

- Crypto Market

- cryptocurrencies

- cryptocurrency

- data

- day

- DeFi

- Drop

- dropped

- Early

- Economics

- ETH

- ethereum

- ethereum (ETH)

- ethereum network

- finance

- financial

- fintech

- Free

- Glassnode

- good

- Hashrate

- hold

- HTTPS

- inclusion

- interest

- investing

- IT

- knowledge

- learning

- major

- Majority

- March

- Market

- market research

- Markets

- million

- network

- Newsletter

- Opinion

- price

- research

- revenue

- Share

- skills

- supply

- Technology

- time

- top

- transaction

- USD

- week

- year