Bitcoin (BTC) has fallen to never seen before oversold levels on several weekly metrics. The short-term readings suggest that a bounce is expected.

BTC has been falling since reaching an all-time high of $68,958 in Nov. The downward movement so far led to a low of $17,605 on June 18.

An important development is that the price has reached a weekly close below its 200-week moving average (MA). While this has previously occurred in March 2020 (green circle), the price has never stayed below the MA for a considerable period of time.

Historically, BTC bounced at this MA before beginning a sharp upward movement. Therefore, touches of this MA have usually coincided with market bottoms. The MA is currently at $22,700 and could act as resistance.

Has BTC bottomed?

The daily RSI provides a more bullish outlook. Firstly, the RSI reached a low of 20, which is the lowest value since March 2020. So, this is in line with the relationship of the price to the 200-week MA, which suggests that a bottom is close or has been reached.

Secondly, from June 18 to 19, BTC created a bullish engulfing candlestick that had a long lower wick. When combined with the oversold RSI, it is a sign of a potential bottom.

The six-hour chart supports this possibility, since it shows a very pronounced bullish divergence. Also, since the RSI has moved above the high between the divergences (red icon), it has effectively created a failed swing bottom.

If the upward movement continues, the closest resistance would be at $23,000. This is the 0.382 Fib retracement resistance level and a horizontal resistance area.

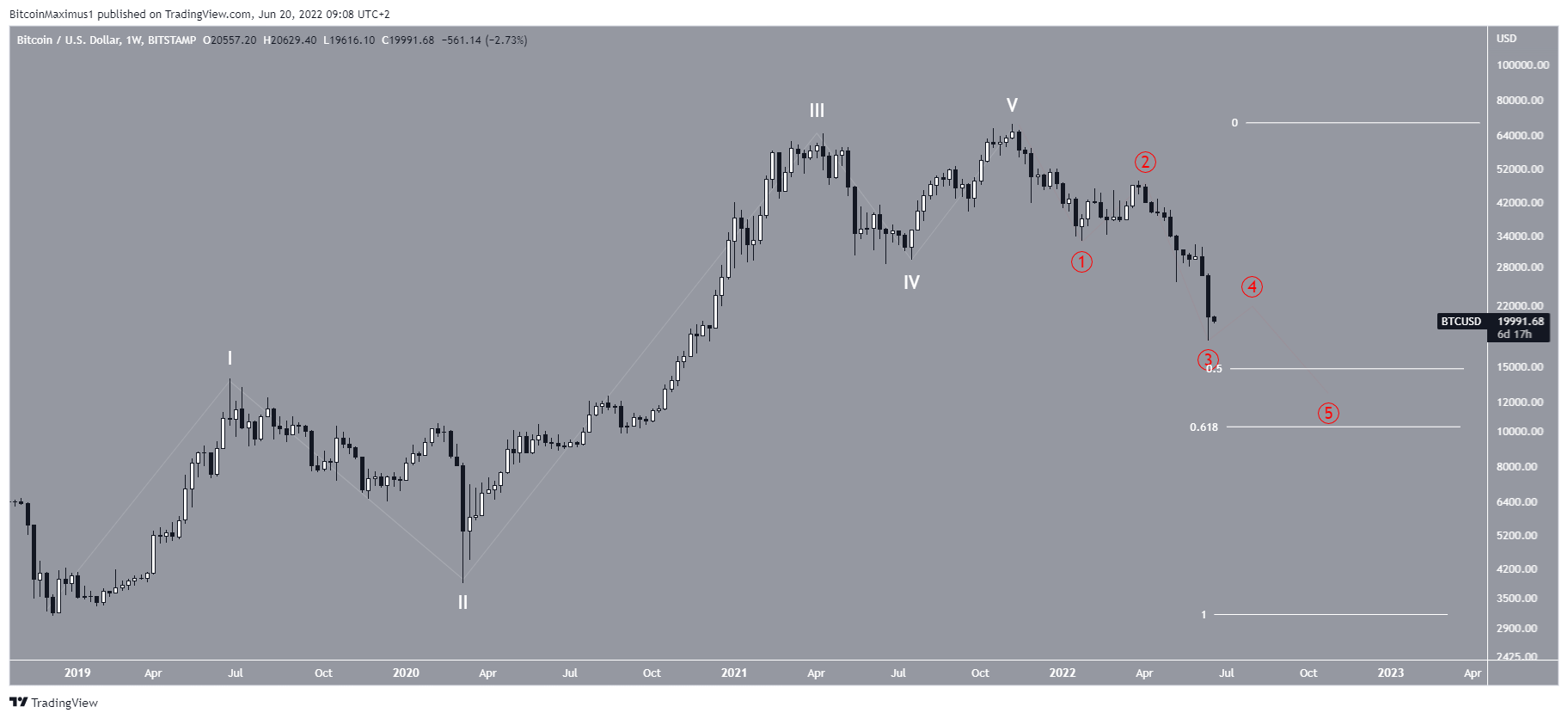

Wave count analysis

There are several possibilities for the wave count.

The most bullish one suggests that BTC is nearing the bottom of wave four (white), of a five wave upward movement that began in March 2020.

A drop below the wave one high at $13,880 (red line) would invalidate this particular count.

The neutral count suggests that the price is still in wave four of the same five-wave upward movement. The difference between this and the bullish count is the top of wave three, which is later in the neutral count.

As a result of this difference, another downward movement would be expected prior to a significant bounce.

Similar to the previous count, a decrease below $13,888 would invalidate this count.

The bearish count indicates that the entire five-wave formation has already come to an end. In this possibility, the price has begun a new five-wave downward movement (red), which will take it between $10,500 and $14,500, the 0.5-0.618 Fib retracement support levels.

The irregularity in this BTC count is the massive difference in time and magnitude between waves two and four.

Unlike the long-term counts, the short-term ones are similar in each possibility.

The price is in wave five of a short-term five-wave downward movement (black). The sub-wave count is given in yellow, also indicating that the price is in sub-wave five.

The only potential difference is if there is another small drop prior to the bottom or if the bottom has already been reached.

For Be[in]Crypto’s previous bitcoin (BTC) analysis, click here

The post Bitcoin (BTC) Reaches Weekly Close Below 200-Week Moving Average (MA) appeared first on BeInCrypto.

- 000

- 2020

- a

- Act

- already

- Another

- AREA

- average

- bearish

- before

- began

- Beginning

- below

- between

- Bitcoin

- Black

- BTC

- Bullish

- Circle

- combined

- come

- continues

- could

- created

- Currently

- daily

- Development

- difference

- Drop

- each

- effectively

- expected

- First

- from

- Green

- High

- Horizontal

- HTTPS

- ICON

- important

- IT

- Led

- Level

- levels

- Line

- Long

- long-term

- March

- march 2020

- Market

- massive

- Metrics

- more

- most

- movement

- moving

- Outlook

- particular

- period

- possibilities

- possibility

- potential

- previous

- price

- provides

- reached

- relationship

- same

- several

- short-term

- sign

- significant

- similar

- since

- small

- So

- stayed

- Still

- support

- Supports

- The

- therefore

- three

- time

- top

- usually

- value

- Wave

- waves

- weekly

- while

- would

- youtube