A race to the bottom in the fee war among prospective spot Bitcoin ETFs could make investing in crypto a lot cheaper through Wall Street than crypto exchanges.

Spot Bitcoin ETFs are engaged in a fee war that price them lower than crypto exchanges on an annual basis.

(Shutterstock)

Posted January 9, 2024 at 3:33 pm EST.

With price competition raging among prospective spot Bitcoin ETF issuers, investing in Bitcoin may soon become cheaper on an annual basis than directly buying BTC on most cryptocurrency exchanges.

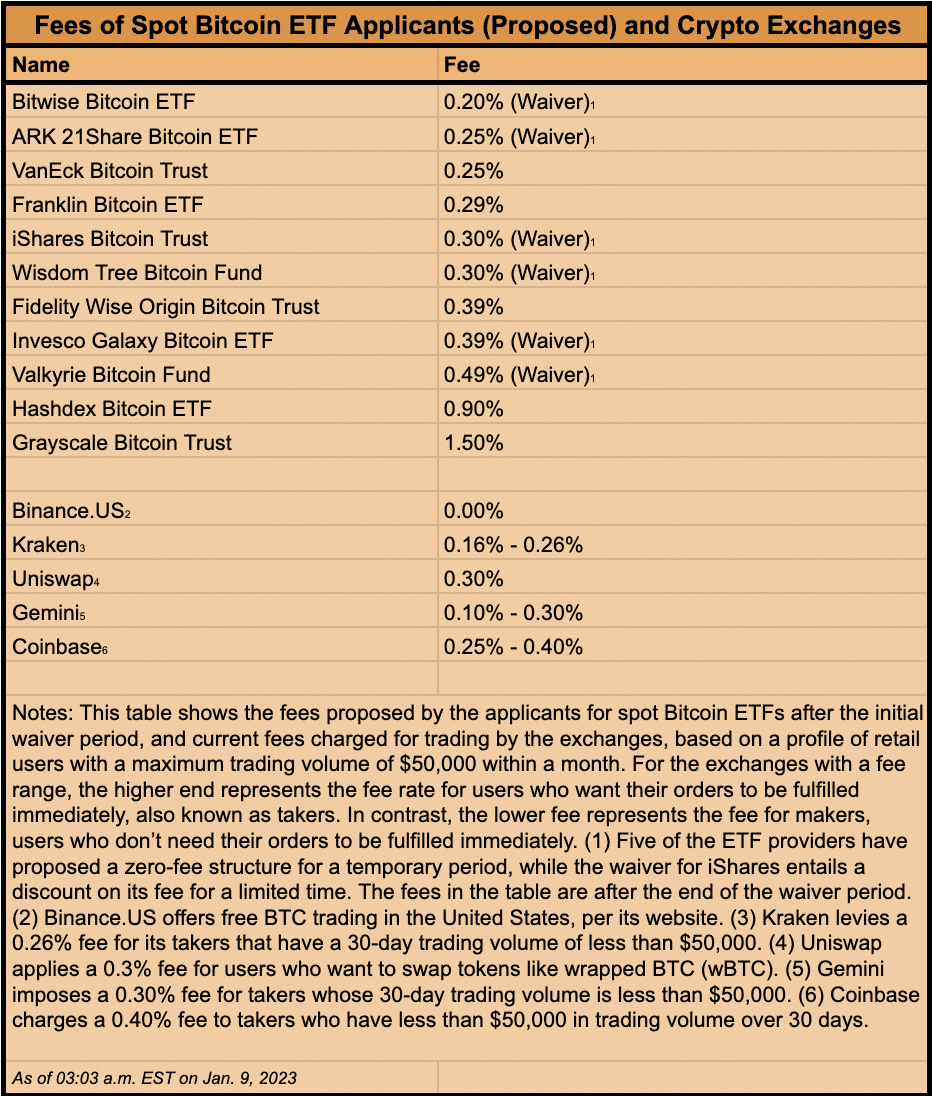

Days before heavily anticipated approval of spot Bitcoin ETFs by the U.S. Securities and Exchange Commission, Wall Street heavyweights have set their proposed annual fees at bargain-basement levels, signaling an expectation of huge inflows.

Some prospective ETF providers are offering a fee waiver for an introductory period of the first six months or until the fund reaches a certain threshold in assets. The ETF applicants began to disclose their proposed fee structures on Jan. 7, starting a fee war that continues today. On Tuesday morning, Bitwise, Valkyrie and Wisdom Tree announced they cut their fees by several basis points to as low as 0.20%. Yesterday, the lowest announced fee was 0.24%, by Bitwise.

In the midst of the stream of disclosures of strikingly low fees that now range between 0.20% to 1.50% from Wall Street titans including BlackRock (iShares), Fidelity and Franklin Templeton, VanEck’s digital asset strategy director Gabor Gurbacs noted on X that the fees were lower than those on Coinbase, the largest cryptocurrency exchange in the U.S. by trading volume.

It costs less to hold a Bitcoin ETF for a year than a single trade on Coinbase. (~40-60bps vs ~25bps for a retail size trade)

The “ETF terrordome” has arrived, as @EricBalchunas would say.

— Gabor Gurbacs (@gaborgurbacs) January 8, 2024

Crypto exchanges set their fees for spot trading based on several factors, such as a user’s trading volume, whether a user wants their order to be fulfilled immediately and how much a user holds of an exchange’s native token. “Fees are calculated at the time you place your order and can be influenced by factors such as your chosen payment method, order size, market conditions, jurisdictional location and other costs we incur to facilitate your transaction,” according to the Coinbase website.

As of today, Coinbase, Gemini, Uniswap and Kraken — all of which are available to U.S. residents — have fees that are between 0.10% and 0.40% for retail investors who have less than $50,000 in trading volume over the prior 30 days. Binance.US, which has a 24-hour spot trading volume of over $29 million, is an outlier, charging no fee for retail trades of Bitcoin. It introduced this fee structure on Aug. 1, 2022.

obvious point but ETF issuers lowering their fees to absolute bargain basement levels implies massive expectations on their part around AUM

the biggest financial instits in the world are telling u something … will u listen?

— nic 🌠 carter (@nic__carter) January 8, 2024

Financial heavyweights aggressively slashing their ETF fees to rock bottom signals their anticipation of monumental growth in their assets under management (AUM), according to Nic Carter, a Bitcoin commentator and venture capitalist. “ETF issuers lowering their fees to absolute bargain basement levels implies massive expectations on their part around AUM…,” he wrote on X.

“The world is not anymore the way it used to be,” he added.

Read More: Fee Competition Heats Up Among BlackRock and Other Spot Bitcoin ETF Applicants

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://unchainedcrypto.com/bitcoin-etf-fee-war-could-make-investing-in-bitcoin-cheaper-than-using-an-exchange/

- :has

- :is

- :not

- $UP

- 000

- 1

- 10

- 2024

- 30

- 31

- 33

- 500

- 7

- 8

- 9

- 98

- a

- Absolute

- According

- added

- All

- among

- an

- and

- announced

- annual

- Anticipated

- anticipation

- anymore

- applicants

- approval

- ARE

- around

- arrived

- AS

- asset

- Assets

- At

- available

- based

- basis

- BE

- become

- before

- began

- between

- Biggest

- binance

- BINANCE.US

- Bitcoin

- Bitcoin ETF

- Bitwise

- BlackRock

- Bloomberg

- Bloomberg Intelligence

- Bottom

- BTC

- but

- Buying

- by

- calculated

- CAN

- certain

- charging

- cheaper

- chosen

- CNBC

- coinbase

- commentator

- commission

- competition

- conditions

- continues

- Costs

- could

- crypto

- Crypto Exchanges

- cryptocurrency

- Cryptocurrency Exchange

- Cryptocurrency Exchanges

- Cut

- data

- Days

- digital

- Digital Asset

- directly

- Director

- Disclose

- engaged

- ETF

- ETFs

- exchange

- Exchanges

- expectation

- expectations

- facilitate

- factors

- fee

- Fees

- fidelity

- financial

- First

- For

- franklin

- from

- fund

- Gemini

- Growth

- Gurbacs

- Have

- he

- heavily

- heavyweights

- High

- hold

- holds

- How

- HTML

- HTTPS

- huge

- immediately

- in

- Including

- inflows

- influenced

- Intelligence

- introduced

- introductory

- investing

- Investors

- iShares

- issuers

- IT

- Jan

- January

- jpg

- Kraken

- largest

- less

- levels

- listen

- location

- Lot

- Low

- low fees

- lower

- Lowering

- lowest

- make

- make investing

- management

- Market

- market conditions

- massive

- max-width

- May..

- method

- million

- months

- monumental

- more

- Morning

- most

- much

- native

- Native Token

- Nic Carter

- no

- noted

- now

- of

- offering

- on

- or

- order

- Other

- outlier

- over

- part

- payment

- payment method

- period

- Place

- plato

- Plato Data Intelligence

- PlatoData

- pm

- Point

- points

- posted

- price

- Prior

- proposed

- prospective

- providers

- Race

- raging

- range

- Reaches

- residents

- retail

- Retail Investors

- s

- say

- SEC

- Securities

- Securities and Exchange Commission

- set

- several

- shutterstock

- single

- SIX

- Six months

- Size

- slashing

- something

- soon

- Spot

- Spot Bitcoin Etf

- Spot Trading

- Starting

- Strategy

- stream

- street

- structure

- structures

- such

- telling

- templeton

- than

- that

- The

- The Coinbase

- the world

- their

- Them

- they

- this

- those

- threshold

- Through

- time

- titans

- to

- today

- token

- trade

- trades

- Trading

- trading volume

- transaction

- tree

- true

- Tuesday

- u.s.

- U.S. Securities

- U.S. Securities and Exchange Commission

- Unchained

- under

- Uniswap

- until

- us

- used

- User

- using

- VALKYRIE

- venture

- venture capitalist

- volume

- vs

- Wall

- Wall Street

- wants

- war

- was

- Way..

- we

- were

- whether

- which

- WHO

- will

- wisdom

- world

- would

- X

- year

- yesterday

- You

- Your

- zephyrnet