Since the approval of a spot Bitcoin exchange-traded fund (ETF) was being awaited with bated breath, it got the greenlight last month, and so far, significant inflows have been ignited.

As a result, Bitcoin ETFs that are being issued by top asset management firms like Grayscale, BlackRock, and ARK Invest are scaling heights as they eye a piece of the Gold ETFs’ cake.

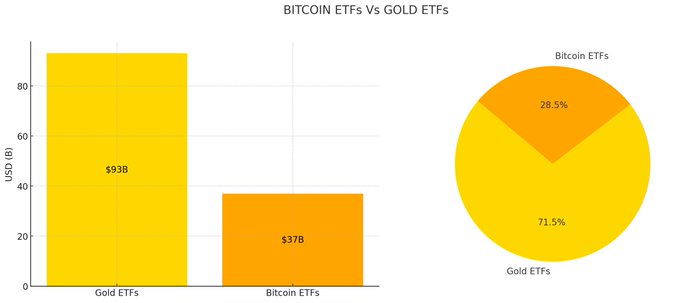

Taking on X, formerly Twitter, leading market insight provider Bitcoin Archive, highlighted, “Bitcoin ETFs are catching up to Gold ETFs for assets. $37b for BTC and $93b for Gold.”

Given that the fate of spot Bitcoin ETFs remained unknown till earlier this year, the United States Securities and Exchange Commission (SEC) okayed them on January 11, and ever since, they have been pumping significant capital inflows.

These ETF statistics show that the battle between Bitcoin and Gold for the safe haven status is not going away any time soon.

Bitcoin ETFs Shutter the $50 Billion Mark

The trading volume of spot Bitcoin ETFs recently surpassed the $50 billion mark as heightened investor interest continues to engulf the ecosystem.

Bitcoin ETFs have been enjoying remarkable growth this month since their volume has recently increased from $28.3 billion to $50.5 billion.

BlackRock’s IBIT has been leading the pack with $457.2. According to Yahoo Finance, the second position is Grayscale’s GBTC at $348.8 million, followed by Fidelity’s FBTC at $255.7 million.

Pundits have welcomed the Bitcoin ETF move since they see it as a stepping stone toward the apex cryptocurrency reaching unprecedented heights in the long term as institutional adoption continues to gain steam.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://zycrypto.com/bitcoin-etfs-scale-heights-as-they-continue-catching-up-with-gold-etfs/

- :has

- :is

- :not

- $UP

- 001

- 11

- 7

- 700

- 8

- a

- According

- accumulation

- Adoption

- and

- any

- Apex

- approval

- Archive

- ARE

- Ark

- ark invest

- AS

- asset

- asset management

- Assets

- At

- awaited

- away

- Battle

- beckons

- been

- being

- between

- Billion

- Bitcoin

- Bitcoin ETF

- BlackRock

- Breath

- BTC

- by

- CAKE

- capital

- coinbase

- commission

- content

- continue

- continues

- cryptocurrency

- Earlier

- ecosystem

- enjoying

- ETF

- ETFs

- EVER

- exchange

- exchange-traded

- exchange-traded fund (ETF)

- eye

- far

- fate

- finance

- firms

- followed

- For

- formerly

- from

- fund

- Gain

- GBTC

- going

- Gold

- got

- Grayscale

- Growth

- Have

- haven

- heightened

- heights

- HTTPS

- image

- in

- increased

- inflows

- insight

- Institutional

- Institutional Adoption

- interest

- Inu

- Invest

- investor

- Issued

- IT

- January

- jpg

- Last

- leading

- like

- Long

- management

- mark

- Market

- max-width

- million

- Month

- move

- mysterious

- of

- on

- Pack

- piece

- plato

- Plato Data Intelligence

- PlatoData

- position

- price

- provider

- pumping

- reaching

- recently

- remained

- remarkable

- result

- safe

- Safe Haven

- Scale

- scaling

- SEC

- Second

- Securities

- Securities and Exchange Commission

- see

- sees

- SHIB

- SHIB Price

- Shiba

- Shiba Inu

- show

- significant

- since

- So

- so Far

- soon

- Spot

- spree

- States

- statistics

- Status

- Steam

- stepping

- STONE

- surpassed

- term

- that

- The

- their

- Them

- they

- this

- this year

- till

- time

- to

- top

- toward

- Trading

- trading volume

- trillions

- United

- United States

- United States Securities and Exchange Commission

- unknown

- unprecedented

- volume

- was

- welcomed

- whales

- with

- X

- Yahoo

- yahoo finance

- year

- zephyrnet