Despite soaring to an all-time high of $73,700 on March 14th, Bitcoin encountered a week of consolidation, sparking concerns among investors that a potential dip may be on the horizon. Notably, the leading cryptocurrency slipped to $65,700 on Friday, leading to a broader slump in the cryptocurrency market.

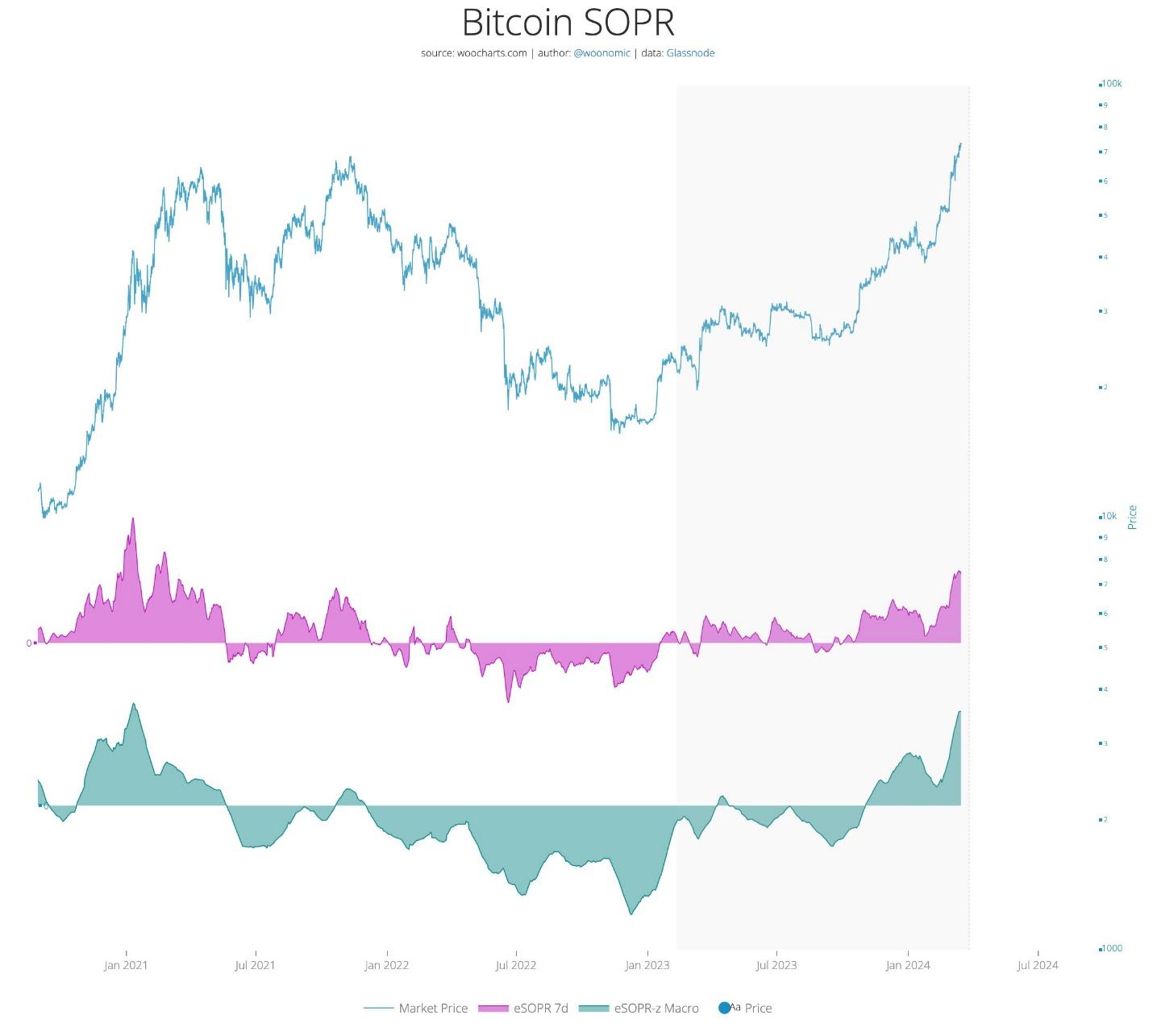

That said, amid this drop, renowned analyst Willy Woo took to X today to share his insights, stating, “Bitcoin SOPR peaking suggests the rest of March will be about consolidation around the last all-time-high.” Woo pointed out historical data, indicating that during similar SOPR peaks in the past, Bitcoin experienced significant downturns, presenting buy-the-dip opportunities.

“Last time this happened in Q4 2020, the buy the dip opportunity was -17%, and before that, during Q1 2017, when BTC was much more volatile, it was -31%.” He noted, adding he projects BTC to trade below $80,000 in March.

SOPR, or the Spent Output Profit Ratio, is a metric used to analyze Bitcoin transactions and market behaviour. It measures the profit ratio of Bitcoin transactions by comparing the price at which Bitcoins were sold to the price at which they were originally acquired.

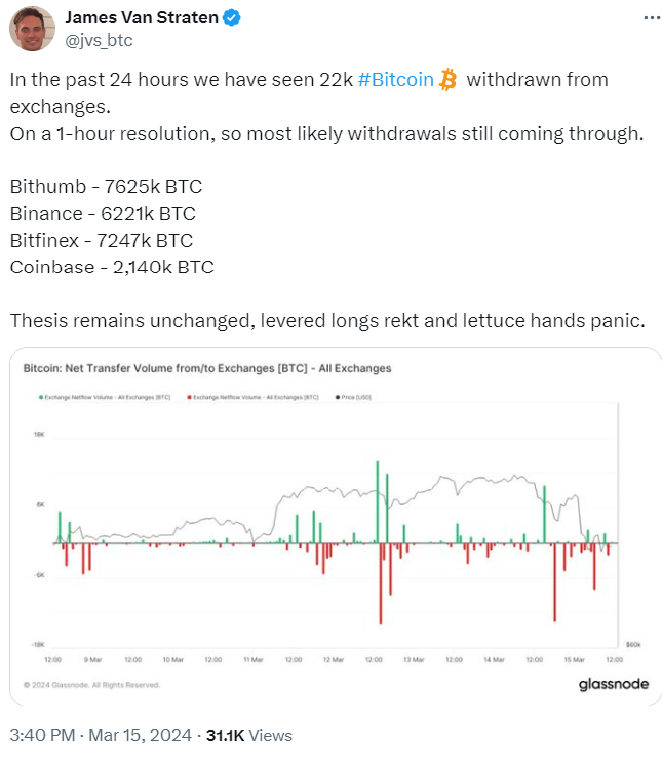

Nevertheless, despite this expectation of a deeper plunge, balances on accumulation addresses have reached an all-time high, and Bitcoin exchange-traded funds (ETFs) are increasing their holdings. As per Glassnode data, in the past 48 or so hours, approximately 22,000 Bitcoins have been withdrawn from exchanges, indicating a shift towards holding rather than selling. This withdrawal trend could further tighten Bitcoin’s supply, potentially leading to a supply shock and higher prices.

In a Saturday tweet, analyst Ash Crypto highlighted crucial support and resistance levels for Bitcoin, emphasizing the significance of Fibonacci ratios in determining price movements. According to the pundit, Bitcoin’s first support level, based on the Fib ratio of 0.236, was at $65,461, where a bounce occurred.

He suggested, telling his 1 million followers on X that Bitcoin may continue to range around this level until the Federal Open Market Committee (FOMC) meeting on March 20th. The analyst further identified the next support level at the Fib ratio of 0.382, standing at $60,318, while highlighting the golden ratio at 0.618, which sits at $52,000.

However, analyst “Castillo Trading” emphasized the importance of Bitcoin holding previous all-time highs as support, allowing other cryptocurrencies like Ethereum (ETH) and altcoins to catch up.

That said, Bitcoin’s recent decline, approaching the support line of its upward channel, poses a significant challenge. There’s a possibility of a breakout leading to a correction towards $59,000 or potentially even lower. Conversely, optimistic investors anticipate a resurgence, speculating that the price may rebound from its November 2021 all-time highs.

Bitcoin was trading at $67,033 at press time, reflecting a 1.94% loss over the past 24 hours.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://zycrypto.com/bitcoin-expected-to-dip-harshly-in-march-following-sopr-peaks-asserts-analyst-willy-woo/

- :is

- :not

- :where

- $UP

- 000

- 1

- 14th

- 2017

- 2020

- 2021

- 20th

- 22

- 24

- 700

- a

- About

- According

- acquired

- adding

- addresses

- all-time highs

- Allowing

- Altcoins

- Amid

- among

- an

- analyst

- analyze

- and

- anticipate

- approaching

- approximately

- ARE

- around

- AS

- At

- balances

- based

- BE

- been

- before

- begun

- behaviour

- below

- Bitcoin

- bitcoin transactions

- Bitcoins

- Bounce

- breakout

- broader

- BTC

- buy

- buy the dip

- by

- Catch

- challenge

- Channel

- committee

- comparing

- Concerns

- consolidation

- content

- continue

- conversely

- could

- crucial

- crypto

- cryptocurrencies

- cryptocurrency

- cryptocurrency market

- data

- Decline

- deeper

- Despite

- determining

- Dip

- downturns

- Drop

- during

- emphasized

- emphasizing

- ETFs

- ETH

- ethereum

- ethereum (ETH)

- Even

- exchange-traded

- exchange-traded funds

- Exchanges

- expectation

- expected

- experienced

- Federal

- Federal Open Market Committee

- Fibonacci

- First

- followers

- following

- FOMC

- For

- Friday

- from

- funds

- further

- Glassnode

- Goes

- Golden

- happened

- Have

- he

- High

- higher

- Highlighted

- highlighting

- Highs

- his

- historical

- holding

- Holdings

- horizon

- HOURS

- HTTPS

- image

- importance

- in

- increasing

- indicating

- insights

- Investors

- IT

- ITS

- jpg

- JPMorgan

- JPMorgan analyst

- just

- Last

- leading

- Level

- levels

- like

- Line

- loss

- lower

- March

- Market

- max-width

- May..

- measures

- meeting

- metric

- million

- more

- movements

- much

- next

- notably

- noted

- November

- November 2021

- occurred

- of

- on

- only

- open

- opportunities

- Opportunity

- Optimistic

- or

- originally

- Other

- out

- output

- over

- past

- per

- plato

- Plato Data Intelligence

- PlatoData

- plunge

- poses

- possibility

- potential

- potentially

- presenting

- press

- previous

- price

- Prices

- Profit

- projects

- Q1

- range

- rather

- ratio

- ratios

- reached

- rebound

- recent

- reflecting

- Renowned

- Resistance

- REST

- Said

- saturday

- Selling

- Share

- shift

- significance

- significant

- similar

- sits

- Slump

- So

- soaring

- sold

- SOPR

- spent

- standing

- stating

- Suggests

- supply

- support

- support level

- telling

- than

- that

- The

- their

- they

- this

- tighten

- time

- to

- today

- took

- towards

- trade

- Trading

- Transactions

- Trend

- tweet

- until

- upward

- used

- volatile

- was

- week

- were

- when

- which

- while

- will

- Willy Woo

- withdrawal

- Woo

- X

- zephyrnet