The amount of money generated in network fees is often considered an important indication of the usage of that network — and Bitcoin appears to be falling behind other blockchains.

Network fees may be used as a measure of usage and demand on a system, and Bitcoin is dropping down the charts in terms of this metric.

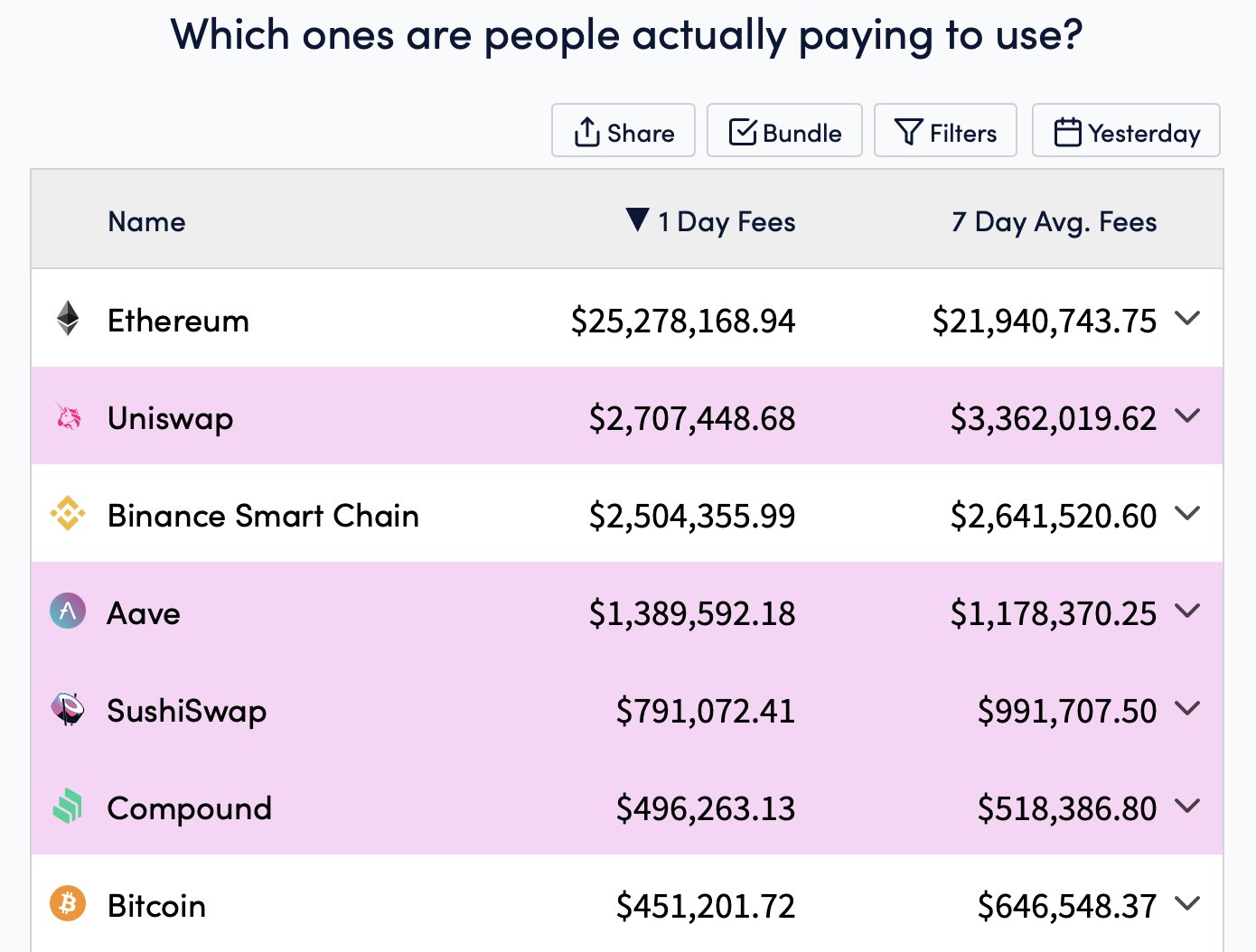

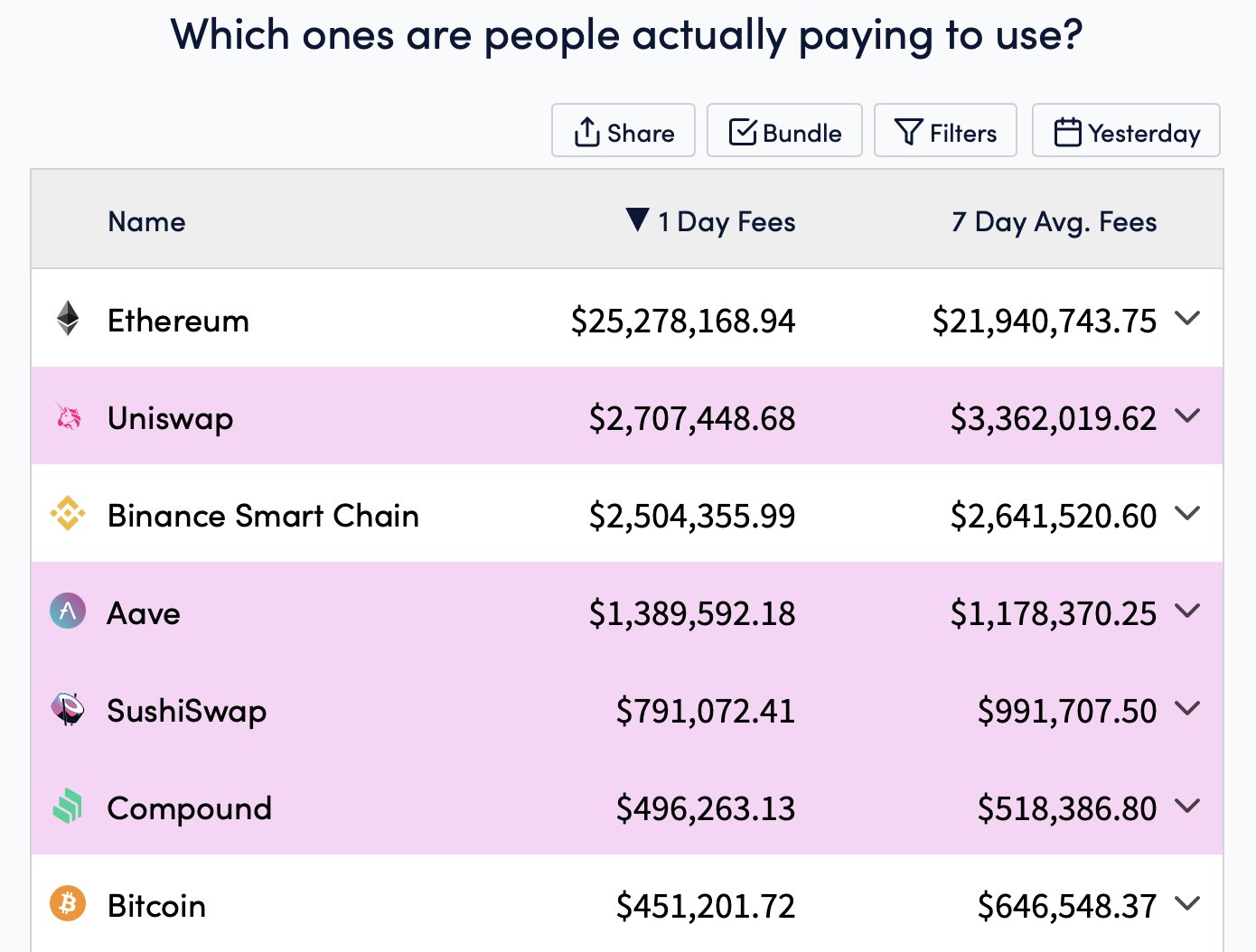

As observed on Aug 16 by Yearn Finance developer ‘banteg,’ BTC had fallen to seventh in terms of daily fees generated from network usage. The coder tweeted a screenshot from CryptoFees showing the list of blockchains and networks for the previous day, stating,

“Orange coin in disbelief as it falls behind 56x in terms of actual usage,”

Ethereum way ahead

Bitcoin was ranked sixth in terms of daily fees for Aug 15 with $515,789 generated according to CryptoFees. Leading the way was Ethereum with $19.85 million generated in fees for the period. BTC fees were just 2.5% of what Ethereum generated for that day.

The Uniswap DeFi exchange came in the second spot for that day with $2.49 million in daily fees with Binance Smart Chain taking the third spot, generating $2.18 million. Also ranking above Bitcoin was flash loan platform Aave and the SushiSwap decentralized exchange with $1.4 million and $836,000 respectively.

Even DeFi lending protocol Compound surpassed Bitcoin in terms of daily fees generated.

When asked if fees were a good measure of network success, the developer replied:

“People willing to pay insane fees sounds like the best free market comparison. Means they find immense value in Ethereum.”

Other metrics for Ethereum have also surpassed those for Bitcoin such as on-chain value settlement, active addresses, and daily transactions. According to BitInfoCharts, Ethereum processed 1.25 million transactions yesterday whereas Bitcoin processed almost 80% fewer with 263,000.

Gas surges 160% in August

All of these extra fees generated on Ethereum and Ethereum-based protocols are of little consolation to the average user who has to suck up the increased cost of using the network.

Average gas prices have increased more than 160% so far this month from around $8 at the beginning of August to a three-month high of $21 on Aug 16.

Etherscan’s gas tracker is currently reporting an average fee of $25 to carry out a simple Uniswap token swap, and around $9 for a simple ERC-20 token transfer.

Recent NFT launches and minting incentives have driven gas prices higher as the NFT marketplace OpenSea has become its largest consumer.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Source: https://beincrypto.com/bitcoin-falls-behind-network-fees-usage/

- 000

- Action

- active

- All

- around

- AUGUST

- BEST

- binance

- Bitcoin

- blockchain

- BTC

- Charts

- Coin

- Compound

- consumer

- crypto

- Crypto Industry

- cyber

- cyber security

- data

- day

- decentralized

- Decentralized Exchange

- Demand

- Developer

- driven

- ERC-20

- ethereum

- exchange

- experience

- Fees

- finance

- Free

- GAS

- General

- good

- High

- HTTPS

- industry

- information

- IT

- latest

- launches

- leading

- lending

- List

- Market

- marketplace

- measure

- Metrics

- million

- money

- network

- networks

- NFT

- Other

- Pay

- platform

- Reader

- Risk

- security

- Simple

- smart

- So

- Spot

- success

- system

- token

- Trading

- Transactions

- Uniswap

- value

- Website

- WHO