The Bitcoin price, which had been striving to break the $28k threshold over the past three days, ultimately yielded to the prevailing sell pressure within the last 24 hours. As per the latest crypto price oracles, Bitcoin experienced a decline of approximately 2.4 percent during this period, now hovering around $27,159 during the early London market hours on Wednesday. If this downward trend continues, Bitcoin is likely to conclude the month of May on a bearish note, marking a shift from the bullish sentiments observed in the initial four months of the year.

Bitcoin Market Analysis

In a recent YouTube video, an analyst from InvestAnswers shed light on a noteworthy development: the odds are favoring a Bitcoin gold cross on the weekly time frame, potentially occurring in August this year. This forecast comes despite Bitcoin’s first weekly death cross, witnessed between the 50 and 200 Moving Averages. The analyst pointed out that Bitcoin responded to this occurrence with a bullish outlook, showcasing its resilience.

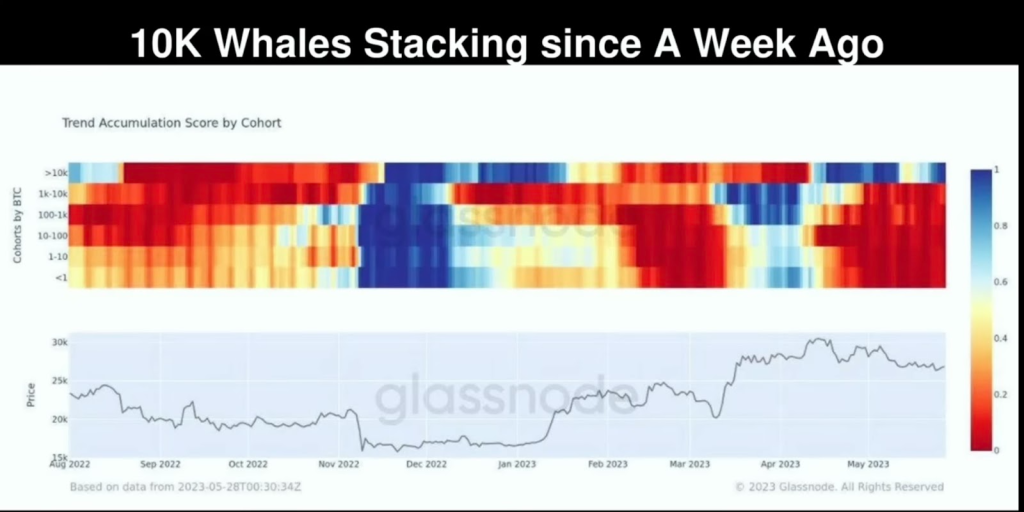

According to the analyst, Bitcoin whales with more than 10k units have been stacking in the past week, despite the increased volatility.

Nevertheless, the analyst warned traders of an incoming recession according to data from the conference board leading index if global monetary regulators do not put measures to ensure a soft landing.

Investor Concerns Rise

Bitcoin’s dominance over the entire crypto market retraced from 48 percent following today’s dip. A further decline in Bitcoin dominance is likely to trigger rising dominos in the altcoin market. From another perspective, Bitcoin’s capitulation could send fear and shock waves in the entire crypto industry and cause more sell-offs in the near term.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://coinpedia.org/bitcoin/bitcoin-golden-cross-in-august-heres-what-next-for-btc-price/

- :is

- :not

- 10K

- 200

- 24

- 50

- 7

- a

- According

- Altcoin

- an

- analysis

- analyst

- and

- Another

- approximately

- ARE

- around

- AS

- AUGUST

- bearish

- been

- between

- Bitcoin

- Bitcoin Gold

- bitcoin whales

- board

- Break

- BTC

- btc price

- Bullish

- capitulation

- Cause

- Coinpedia

- comes

- Concerns

- conclude

- Conference

- conference board

- continues

- could

- Cross

- crypto

- Crypto Industry

- Crypto Market

- Crypto Price

- data

- Days

- Death

- Decline

- Despite

- Development

- Dip

- do

- Dominance

- downward

- during

- Early

- ensure

- Entire

- experienced

- fear

- fintech

- First

- following

- For

- Forecast

- four

- FRAME

- from

- further

- Global

- Gold

- Golden

- had

- Have

- here

- High

- HOURS

- HTTPS

- if

- in

- Incoming

- increased

- index

- industry

- initial

- InvestAnswers

- ITS

- june

- landing

- Last

- latest

- leading

- levels

- light

- likely

- London

- Low

- low levels

- Market

- Market Analysis

- marking

- max-width

- May..

- measures

- Monetary

- Month

- months

- more

- moving

- moving averages

- Near

- next

- noteworthy

- now

- occurring

- Odds

- of

- on

- Oracles

- out

- Outlook

- over

- past

- percent

- period

- perspective

- plato

- Plato Data Intelligence

- PlatoData

- points

- potential

- potentially

- prediction

- pressure

- price

- Price Prediction

- put

- Read

- recent

- recession

- Regulators

- resilience

- rising

- s

- sell

- send

- shed

- shift

- showcasing

- Soft

- stacking

- term

- than

- that

- The

- The Weekly

- this

- this year

- three

- threshold

- time

- to

- today’s

- Traders

- Trend

- trigger

- Ultimately

- units

- Video

- Volatility

- waves

- Wednesday

- week

- weekly

- whales

- What

- which

- with

- within

- witnessed

- year

- yielded

- youtube

- zephyrnet