Bitcoin is on the move again after only a slight pause at the resistance then support of $28,000, with it touching $28,800.

There’s no apparent news to directly explain this move, with it possibly being simply momentum on sentiment changes that have gained some steam after banks holding close to $1 trillion in deposits collapsed or got bought out.

$300 billion of it was in the Silicon Valley Bank and Signature Bank, while another circa $600 billion was on Credit Suisse.

Half a trillion dollars is ‘missing’ from the commercial banking system according to the Economist, which claims it has gone to reverse repos.

These are ‘bank’ accounts at the Federal Reserve Banks and usually can only be accessed by commercial banks, but the Economist suggests money-market funds can access them by directing commercial banks to send their funds to the repos.

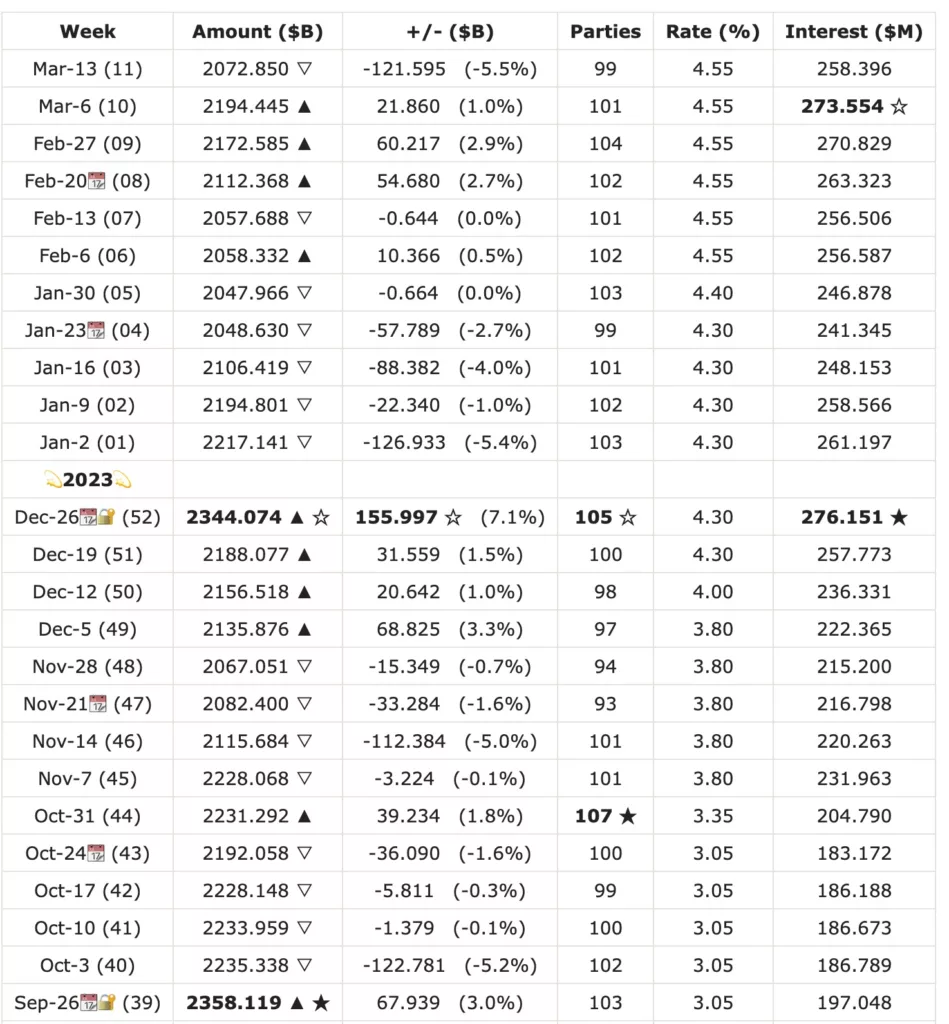

Holdings in reverse repos have increased to above $2 trillion, with Fed paying them 4.5% just for depositing.

Whether this is leading to some sort of deposits crunch is not too clear, just as Fed is to increase interest rates further by 0.25% in a few hours.

The market is green however overall, albeit just slightly with Nasdaq gaining 0.14%, making this bitcoin jump another decoupling.

Coincidentally the dollar strength index is down to 102 from 105 at the beginning of the month as the euro gains following the Fed slow down in rate hikes, rising to nearly $1.08 from $1.05 last week.

The macro financial situation therefore has changed, and so bitcoin now rises for no apparent reason, although it remains to be seen whether there has been any actual news.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.trustnodes.com/2023/03/22/bitcoin-jumps-to-near-29000

- :is

- 000

- a

- above

- access

- accessed

- According

- Accounts

- After

- Although

- and

- Another

- apparent

- ARE

- AS

- At

- Bank

- Banking

- banking system

- Banks

- BE

- Beginning

- being

- Billion

- Bitcoin

- bought

- by

- CAN

- Changes

- claims

- clear

- Close

- collapsed

- commercial

- Commercial Banking

- credit

- credit suisse

- crunch

- deposits

- directing

- directly

- Dollar

- dollars

- down

- Economist

- Euro

- Explain

- Fed

- Federal

- federal reserve

- few

- financial

- following

- For

- from

- funds

- further

- gaining

- Gains

- Green

- Have

- Hikes

- holding

- Holdings

- HOURS

- However

- HTTPS

- in

- Increase

- increased

- index

- interest

- Interest Rates

- IT

- jump

- jumps

- Last

- leading

- Macro

- Making

- March

- Market

- max-width

- Momentum

- Month

- move

- Nasdaq

- Near

- nearly

- news

- of

- on

- overall

- paying

- plato

- Plato Data Intelligence

- PlatoData

- Rate

- rate hikes

- Rates

- reason

- remains

- Reserve

- Resistance

- reverse

- Rises

- rising

- sentiment

- Silicon

- Silicon Valley

- simply

- situation

- slow

- So

- some

- Steam

- strength

- Suisse

- support

- system

- that

- The

- The Economist

- the Fed

- their

- Them

- therefore

- to

- too

- touching

- Trillion

- Trustnodes

- usually

- Valley

- webp

- week

- whether

- which

- while

- with

- zephyrnet