As a result of the negative coverage surrounding the crypto market quake triggered by Elon Musk, Bitcoin (BTC) saw its price drop by double-digit percentages.

In the last 10 days alone, the price fell continuously from 60,000 to currently 43,000 US dollars. The current events are reminiscent of the market collapse in March 2020 in the wake of the emerging Corona crisis. However, in this case, only individual tweets by a well-known personality were necessary, whereas a little more than a year ago, a global pandemic was responsible for “Black Thursday.”

But current figures from Glassnode nevertheless paint an interesting picture. Reason enough to take a closer look at the current market situation.

The headlines of the last few days were determined by the negative tweets of Tesla CEO Elon Musk regarding Bitcoin. First, he personally announced that Tesla would no longer accept payments in the form of the largest cryptocurrencies by market capitalization. He cited Bitcoin’s poor carbon footprint as the reason. Subsequently, he hinted in sometimes very cryptic tweets that Tesla could sell its Bitcoin holdings. After heavy criticism, however, he clarified that his electric car company has not sold a single BTC.

However, Musk was not shy about responding to the criticism and countering. Among others, podcaster Peter McCormick addressed Elon Musk directly. McCormick accused him of being a “troll” who wants to cause a furor with his poorly researched tweets. Musk responded that this kind of criticism would motivate him to go “all in” on Dogecoin in his own unique way. Musk already developed an idiosyncratic fondness for the Memecoin in the past, whose price he caused to skyrocket through an independently triggered hype.

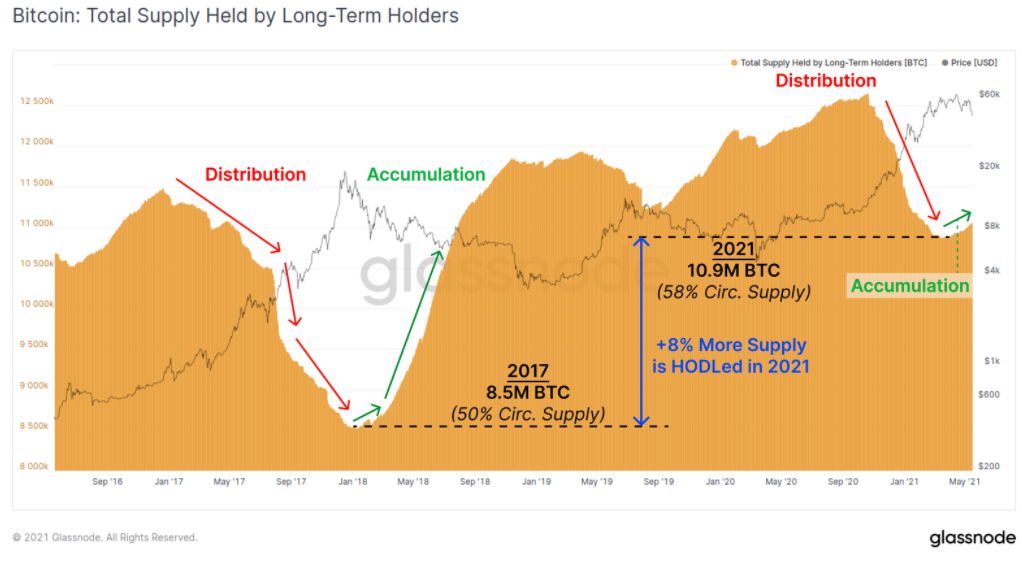

Currently, the Bitcoin price is hovering around 35% below the all-time high at around $65,000. Looking only at the price performance in the recent past, the current price slump was one of the deepest retracement moves in recent months. The plunge is reminiscent of “Black Thursday” in March 2020, when the price fell to just above $5,000. Metrics from analytics firm Glassnode show that newcomers to the market are now panicking and selling their recently acquired holdings. Long-term HODLers, on the other hand, show themselves unimpressed and kept their holdings.

Most of Glassnode’s metrics show similar readings as last seen during the burgeoning Corona crisis in March 2020. For example, the metric “Bitcoin: Net Transfer Volume from/to Exchanges” shows a similar increase in March 2020, suggesting that traders may be exchanging their holdings for other crypto or fiat currencies. An opposite trend in this metric suggests that traders are holding their BTC for a longer period of time. This effect could be observed especially in the last weeks while bitcoin was continuously rising and only a few traders were selling.

Further data from Glassnode also shows interesting data from retailers and institutional investors. The analysts compared data from Binance, a platform popular with retail traders, with Coinbase, an exchange used by institutions. Glassnode detected an inflow of BTC as a result of the negative coverage surrounding Elon Musk and Tesla. At the same time, the deposit and withdrawal rate on Binance increased, indicating that traders might be cashing out their BTC or exchanging it for other cryptocurrencies. Interestingly, institutional investors are behaving completely differently at the moment.

While private investors are selling their holdings mainly due to panic selling, institutional investors enter the market. Coinbase recently saw a higher inflow. The many large investors using the American exchange seem to see a suitable entry point at the moment and are stocking up their BTC holdings. Apparently, the institutions are not distracted by the news of individual, influential market participants and continue to see great potential in the long term.

Venture capitalist Anthony Pompliano even went a step further and expected that Musk and Tesla could also increase their holdings shortly. He assumes that Tesla could be somewhat dependent on Bitcoin in the future and thus eliminate inflation fears. Accordingly, Pompliano apparently does not expect a timely sale. He also received support from experienced investor Paul Santos, who wrote in an article that Elon Musk wants to make “money out of nothing” through his influence on the market.

After Elon Musk caused parts of the crypto market to crash through his negative tweets, the market situation is somewhat confusing. Many private investors reacted in panic to the news of the Tesla CEO and sold their BTC holdings. The interim market collapse was reminiscent of “Black Thursday” in March 2020.

However, current metrics from the experts at Glassnode show some interesting anomalies in the market. According to them, some large investors are taking advantage of the current panic and stocking up their Bitcoin holdings. This shows that most long-term institutions are not paying too much attention to current events. In general, the panic due to individual tweets fully reflects the risks of the crypto market.

However, investors should note that large investors, which are important for such a young market, are still holding and even adding to their holdings. Inexperienced retail investors, in particular, have been selling their newly acquired coins as a result of the news. Many long-term HODLers continue to hold their holdings or rather temporarily shift them into other cryptocurrencies.

I share more intimate thoughts in a monthly newsletter that you can check out here. Please let me know in a comment, and let’s build your crypto universe via Patreon. Join me on various social media platforms:

Twitter ● Instagram ● Patreon ●Facebook ● Snapchat ● LinkedIn.

- 000

- 2020

- ADvantage

- American

- among

- analytics

- announced

- Anthony Pompliano

- around

- article

- binance

- Bitcoin

- Bitcoin Price

- BTC

- build

- car

- carbon

- Cause

- caused

- ceo

- closer

- coinbase

- Coins

- company

- continue

- Corona

- Crash

- crisis

- crypto

- Crypto Market

- cryptocurrencies

- currencies

- Current

- data

- Dogecoin

- dollars

- Drop

- Electric

- Elon Musk

- EU

- EV

- events

- exchange

- experts

- fears

- Fiat

- Firm

- First

- form

- future

- General

- Glassnode

- Global

- global pandemic

- great

- Headlines

- High

- Hodlers

- hold

- hr

- HTTPS

- ia

- Increase

- inflation

- influence

- Institutional

- institutional investors

- institutions

- investor

- Investors

- IT

- join

- large

- Long

- March

- march 2020

- Market

- Market Capitalization

- Media

- medium

- Metrics

- months

- net

- news

- Other

- pandemic

- Panic

- payments

- performance

- Personality

- picture

- platform

- Platforms

- pompliano

- poor

- Popular

- price

- private

- retail

- Retail Investors

- retailers

- sale

- sell

- Share

- shift

- snapchat

- Social

- social media

- social media platforms

- sold

- support

- Tesla

- time

- Traders

- us

- volume

- WHO

- year