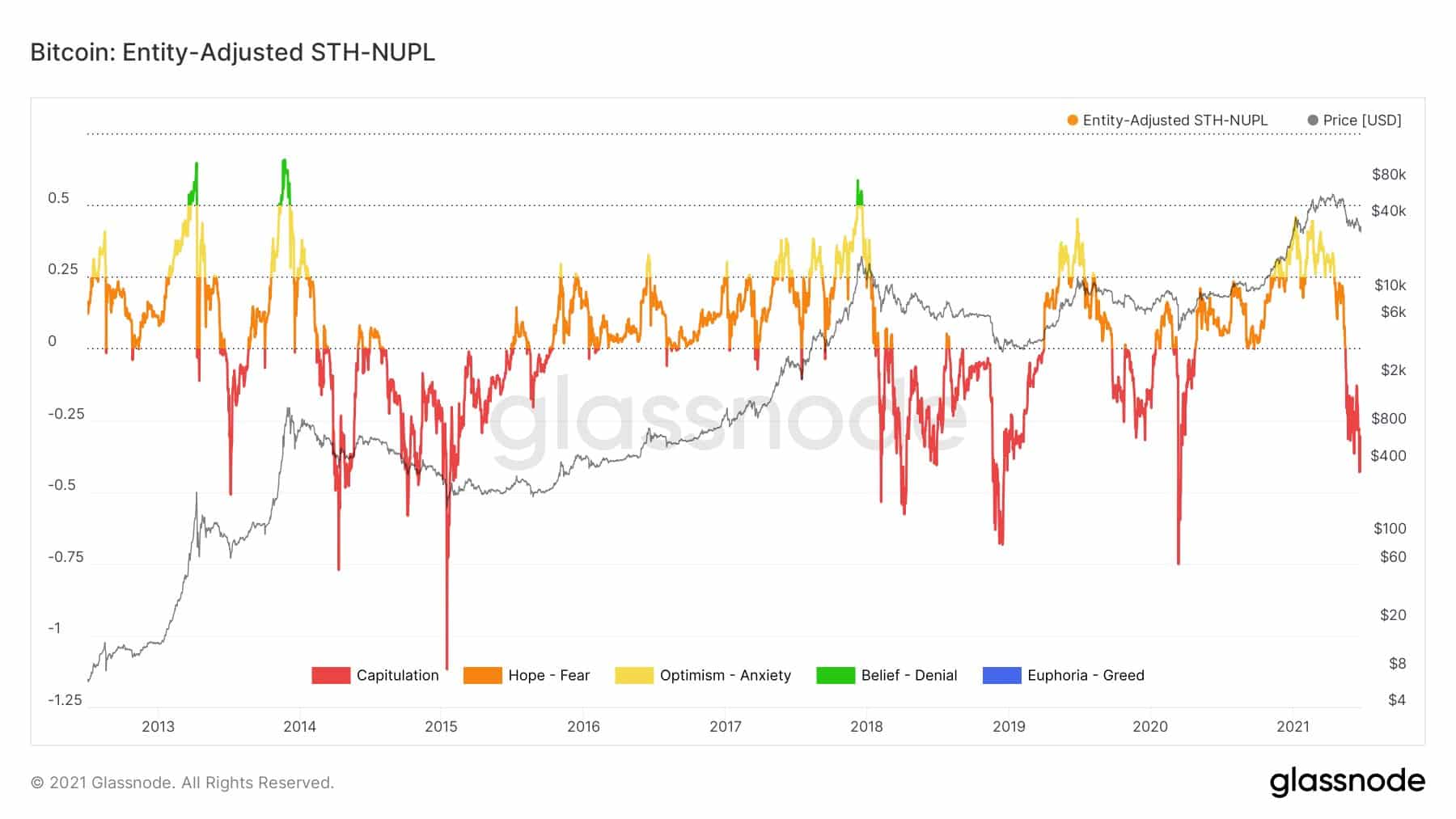

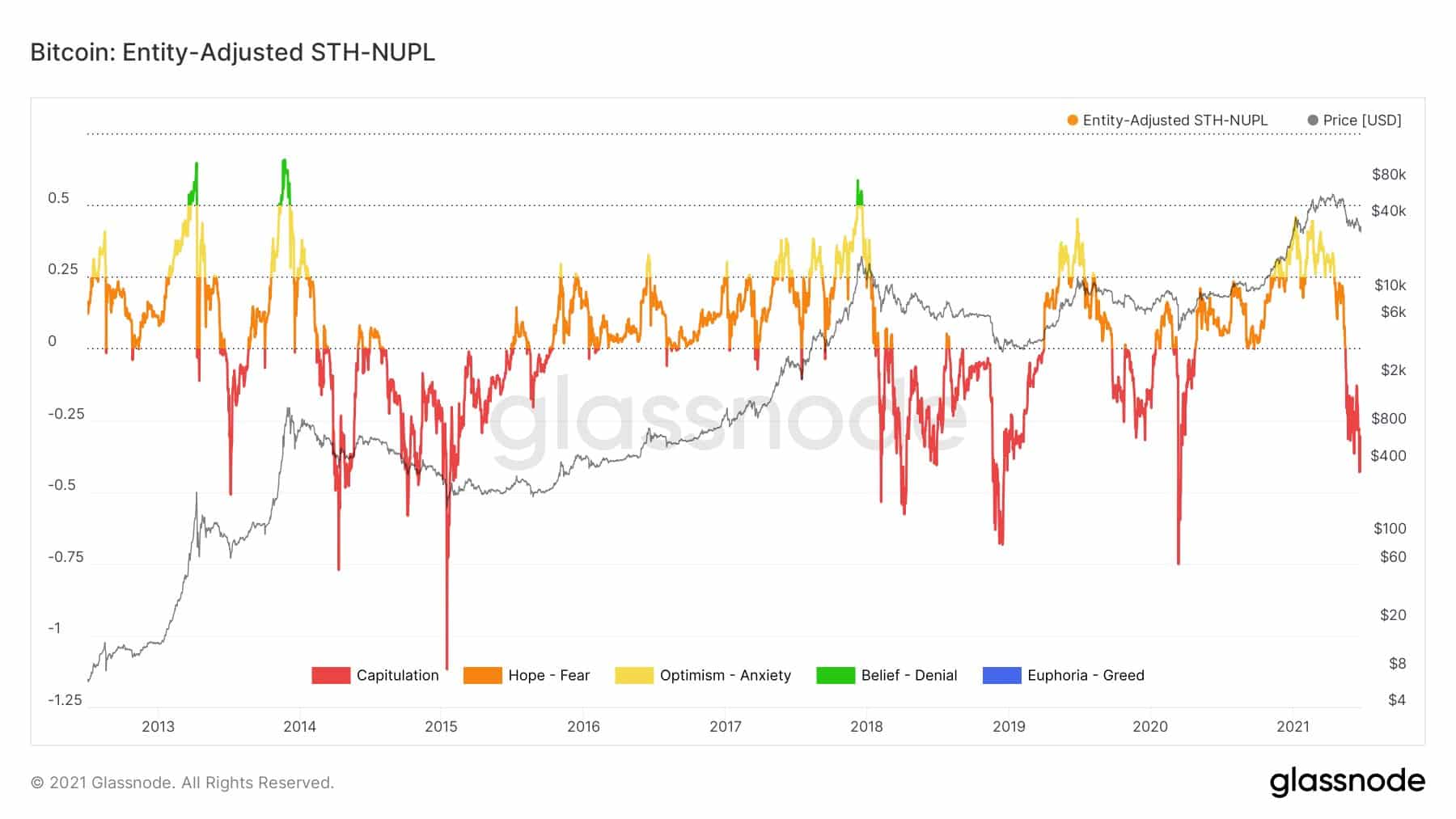

The number of Bitcoin (BTC) investors or traders selling off the digital currency on a short-term basis is declining, albeit, the trend is not impacting the price of the premier cryptocurrency. According to Glassnode’s on-chain data, the beginning of this year saw a lot of buying actions as prices soared from a base of about $29,000 to a peak of over $64,000 by April. This period coincided with the period of extreme Optimism and Anxiety amongst investors.

The growth seen in the price of Bitcoin in the first quarter and the beginning of the second quarter was largely driven by the influx of institutional investors. While MicroStrategy leads the charge in this regard, new investors including electric car manufacturer, Tesla Inc also pumped enough liquidity into the digital asset, sending the price to a new all-time high.

As volatility is prevalent in the digital currency ecosystem, the price of Bitcoin witnessed a number of retracements along the line as the short bag holders resort to profit-taking. The Bitcoin ecosystem has seen a number of negative news surrounding its fundamentals in the past months, with the duo of Tesla CEO Elon Musk, and Chinese authorities compounded the talk on Bitcoin mining’s energy usage.

The latter has taken more proactive steps to stifle Bitcoin mining operations, as it has issued a quit notice that has pushed miners out on a one-of-a-kind migration. Beyond this, China is particularly determined to put an end to every form of digital currency-related activities through enforcement of its age-long ban on trading.

All these events have weakened the resolve of many investors. This has informed an aggressive sell-off that has pushed prices lower by 52.38% from Bitcoin’s ATH price above $64,863.10. The rate of sell-off is growing, leaving determined, long-term holders in the bid to resuscitate the price.

Capitulation Not Reflecting in Price

As shown in the Glassnode charts, the sell-off capitulation is not affecting price resurgence, either because the market bulls have not factored in the long-term impact, or the current Fear, Uncertainty, and Doubt (FUD) is pitching buyers to take a more cautious approach at this time.

While the broader market awaits the settlement of native Chinese miners in their respective new locations to return mining hashrates to their growth tracks, expectations that easy sellers are sifted off can help the long-term recovery and growth prospects of the premier digital asset.

Subscribe to our newsletter for free

- 000

- activities

- agriculture

- Anxiety

- applications

- April

- asset

- avatar

- Ban

- Bitcoin

- Bitcoin mining

- Bitcoin mining operations

- Bitcoin Price

- blockchain

- blockchain technology

- BTC

- Bulls

- Buying

- car

- ceo

- charge

- Charts

- China

- chinese

- content

- cryptocurrencies

- cryptocurrency

- Currency

- Current

- data

- digital

- Digital Asset

- digital currency

- driven

- ecosystem

- Electric

- Elon Musk

- energy

- events

- financial

- First

- follow

- form

- Fundamentals

- General

- Glassnode

- Growing

- Growth

- High

- hold

- HTTPS

- Impact

- Including

- Institutional

- institutional investors

- integration

- investing

- Investors

- IT

- Journalists

- Line

- Liquidity

- Manufacturer

- Market

- market research

- Media

- Miners

- Mining

- months

- news

- Newsletter

- Operations

- Opinion

- People

- price

- recovery

- research

- Sellers

- settlement

- Share

- Short

- Sites

- Sports

- Technology

- Tesla

- time

- Traders

- Trading

- Volatility

- WHO

- worldwide

- writing

- year