- Bitcoin dominance, a metric that measures the percentage of Bitcoin’s market capitalization to the total cryptocurrency market cap, has surpassed the 50% mark.

- The increase in Bitcoin’s dominance is attributed to investors using it as a safe haven asset.

- The combined value of Bitcoin and Ether now represents roughly 70% of the entire cryptocurrency market.

Bitcoin dominance, a metric that measures the percentage of Bitcoin’s market capitalization to the total cryptocurrency market cap, has surpassed the 50% mark. According to data from TradingView, Bitcoin dominance briefly exceeded 50% on June 19 at 6 pm UTC. This was before settling at 49.9% at the time of publication.

This milestone indicates that Bitcoin alone accounts for half of the total market capitalization of the cryptocurrency market. This is estimated to be around $1.1 trillion. Bitcoin’s market capitalization currently stands at approximately $519 billion, as reported by Coingecko.

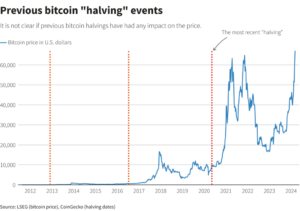

Notably, Bitcoin’s dominance has experienced a significant increase of over 10.5% since November 27, 2022. This surge can be attributed, in part, to investors flocking to Bitcoin. This is a safe haven asset amidst the aftermath of the FTX crisis. Furthermore, the growing regulatory scrutiny faced by various cryptocurrencies in the United States.

While Bitcoin’s dominance has risen over the past eight months, Ether’s market dominance has remained relatively stable. It is around the 20% mark for most of the year. As a result, the combined value of Bitcoin and Ether now represents roughly 70% of the entire cryptocurrency market.

READ: CAR bitcoin failure: Is Africa ready to legalize cryptocurrencies

Michael Saylor, the MicroStrategy co-founder and Bitcoin advocate, foresees BTC’s market dominance exceeding 80% soon. He believes rising regulatory scrutiny from the SEC will diminish stablecoins and most other crypto assets.

Saylor also attributes the limited institutional investment in the crypto space to the confusion and uncertainty surrounding more than 25,000 alternative cryptocurrencies positioning themselves as alternatives to Bitcoin. He emphasizes that Bitcoin is universally recognized as the digital commodity in the industry, particularly because SEC Chair Gary Gensler has classified it as such. Notably, the SEC has deemed 68 cryptocurrencies to be securities.

The latest data from the Cointelegraph Price Index shows that BTC is trading at $26,746, representing a 1.5% increase in the last 24 hours. Surprisingly, despite the prevailing market fears that have reached a three-month high, the value of Bitcoin has grown over 3% in the past week.

READ: Exploring paths to retrieve stolen BTC from cryptocurrency scams

Santiment, a crypto research firm, highlights BlackRock’s recent filing for a Bitcoin spot exchange-traded fund (ETF) as one of the significant drivers behind Bitcoin’s upward price movement in recent days. This development has likely generated positive market sentiment and contributed to the ongoing price surge.

In conclusion, Bitcoin’s dominance has surpassed the 50% mark. This indicates its significant share of the total cryptocurrency market capitalization. This growth can be attributed to several factors, including investors seeking Bitcoin as a safe haven asset and the increasing regulatory scrutiny the crypto industry faces. While Bitcoin’s dominance has increased, Ether’s market dominance has remained relatively stable. Michael Saylor predicts that Bitcoin’s dominance will continue to rise, reaching over 80%. Despite market concerns, Bitcoin has demonstrated strength and witnessed growth, buoyed by BlackRock’s BTC ETF prospects. Monitoring Bitcoin’s dominance will offer valuable insights into the evolving cryptocurrency market and digital asset landscape.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://web3africa.news/2023/06/21/news/bitcoin-reaches-50-market-dominance/

- :has

- :is

- 000

- 1

- 10

- 19

- 2022

- 24

- 25

- 27

- 49

- a

- According

- Accounts

- advocate

- africa

- After

- aftermath

- alone

- also

- alternative

- alternatives

- amidst

- and

- approximately

- around

- AS

- asset

- Assets

- At

- attributes

- BE

- because

- before

- behind

- believes

- Billion

- Bitcoin

- bitcoin dominance

- briefly

- BTC

- BTC ETF

- by

- CAN

- cap

- capitalization

- Chair

- classified

- Co-founder

- CoinGecko

- Cointelegraph

- combined

- commodity

- Concerns

- conclusion

- confusion

- continue

- contributed

- crisis

- crypto

- Crypto Industry

- crypto space

- crypto-assets

- cryptocurrencies

- cryptocurrency

- cryptocurrency market

- Currently

- data

- Days

- deemed

- demonstrated

- Despite

- Development

- digital

- Digital Asset

- Digital Commodity

- Dominance

- drivers

- emphasizes

- Entire

- estimated

- ETF

- Ether

- evolving

- exceeded

- exceeding

- exchange-traded

- exchange-traded fund (ETF)

- experienced

- faced

- faces

- factors

- Failure

- fears

- Filing

- Firm

- flocking

- For

- from

- FTX

- fund

- Furthermore

- Gary

- Gary Gensler

- generated

- Gensler

- Growing

- grown

- Growth

- Half

- Have

- he

- High

- highlights

- HOURS

- HTTPS

- in

- Including

- Increase

- increased

- increasing

- index

- indicates

- industry

- insights

- Institutional

- institutional investment

- into

- investment

- Investors

- IT

- ITS

- june

- landscape

- Last

- latest

- legalize

- likely

- Limited

- mark

- Market

- Market Cap

- Market Capitalization

- Market Dominance

- market sentiment

- measures

- metric

- Michael

- Michael Saylor

- MicroStrategy

- milestone

- monitoring

- months

- more

- most

- movement

- notably

- November

- now

- of

- offer

- on

- ONE

- ongoing

- Other

- over

- part

- particularly

- past

- percentage

- plato

- Plato Data Intelligence

- PlatoData

- positioning

- positive

- Predicts

- price

- price surge

- prospects

- Publication

- reached

- reaching

- ready

- recent

- recognized

- regulatory

- relatively

- remained

- Reported

- representing

- represents

- research

- result

- Rise

- Risen

- rising

- roughly

- safe

- Safe Haven

- Saylor

- SEC

- sec chair

- Securities

- seeking

- sentiment

- settling

- several

- Share

- Shows

- significant

- since

- soon

- Space

- Spot

- stable

- Stablecoins

- stands

- States

- stolen

- strength

- such

- surge

- surpassed

- Surrounding

- than

- that

- The

- themselves

- this

- time

- to

- Total

- total cryptocurrency market cap

- Trading

- TradingView

- Trillion

- two

- Uncertainty

- United

- United States

- upward

- using

- UTC

- Valuable

- value

- value of bitcoin

- various

- was

- week

- while

- will

- witnessed

- year

- years

- zephyrnet