Bloomberg’s senior macro strategist, Mike McGlone, has cautioned that Bitcoin may slide further, despite BlackRock’s recent application for a Bitcoin exchange-traded fund (ETF) boosting BTC’s price.

In the latest monthly report shared on Friday, McGlone highlighted the potential challenges Bitcoin could encounter, including a possible equity bear market and the watchful eye of central banks.

He emphasized that the launch of US Bitcoin ETFs will not shield the cryptocurrency from the aforementioned risks. According to him, although the advent of physical Bitcoin ETFs in the United States is deemed inevitable, he cautioned that BlackRock’s application, which has expedited the process, may not lead to an actual launch in 2023.

“Physical Bitcoin ETFs in the US are a matter of time, we believe. BlackRock’s application to start such a fund appears to have expedited this process, but a launch may not come in 2023,” said McGlone, echoing the sentiments of Eric Balchunas, a senior ETF analyst at Bloomberg.

Additionally, McGlone predicted that the US economy might lean towards recession in the coming months, further complicating the outlook for Bitcoin. Drawing attention to the relationship between risk-asset performance, negative liquidity, and economic contraction, the pundit suggested that Bitcoin will likely gravitate towards the $20,000 support level rather than the $40,000 resistance level.

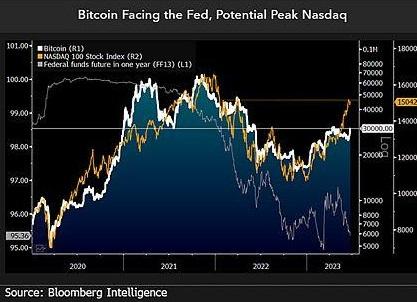

“Our graphic shows Bitcoin trailing the recent Nasdaq 100 Stock Index gains, which may have peaked. Federal funds futures in one year (FF13) show little potential for additional liquidity fuel,” he said.

McGlone’s analysis comes days after the Fed declared a pause in interest rate increases, ending a streak of 10 successive hikes within a compressed timeframe of 15 months. The Fed responded to a decrease in inflation, providing investors with relief. As a result, markets experienced a significant upswing, leading Bitcoin to reclaim the $30,000 threshold once more.

Nevertheless, despite the decision, Fed chair Jeremy Powell signalled that they could resume their aggressive anti-inflation policies stating, “Inflation pressure continues to run high, and the process of getting inflation back down to 2% has a long way to go.”

According to McGlone, despite Fed’s decision to halt rate hikes, the “liquidity rug-pull” is likely to continue, with most central banks continuing to tighten in June, creating more headwinds for risk assets. Despite McGlone’s warnings, some experts are convinced that the bottom is already in for Bitcoin, and the bull market is on course.

Popular crypto analyst Ali Martinez suggested on Friday that the price would likely push towards $35,000, citing the lack of significant barriers ahead.

“Bitcoin is set for a clear run, with major supply barriers only appearing close to the $35,000 mark! Conversely, he tweeted that critical support levels for BTC are within the $29,260-$30,200 and $26,500-$27,400 range,” he tweeted.

Bitcoin traded at $30,385 at press time, down 2.74% in the past 24 hours. Over the past week, the top cryptocurrency grew by an impressive 15.23%

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://zycrypto.com/bitcoin-risks-crashing-to-20000-amid-blackrock-spot-btc-etf-filing-warns-bloomberg-analyst/

- :has

- :is

- :not

- 000

- 10

- 100

- 15%

- 2%

- 200

- 2023

- 23

- 24

- 385

- 7

- 8

- a

- According

- actual

- Additional

- advent

- After

- aggressive

- ahead

- already

- Although

- Amid

- an

- analysis

- analyst

- and

- appearing

- appears

- Application

- ARE

- AS

- Assets

- At

- attention

- back

- Banks

- banner

- barriers

- Bear

- Bear Market

- believe

- between

- Bitcoin

- BlackRock

- Bloomberg

- Bloomberg Analyst

- boosting

- Bottom

- BTC

- BTC ETF

- bull

- Bull Market

- but

- by

- central

- Central Banks

- Chair

- challenges

- chief

- clear

- Close

- come

- comes

- coming

- content

- continue

- continues

- continuing

- contraction

- convinced

- could

- Course

- Crashing

- Creating

- critical

- crypto

- crypto analyst

- cryptocurrency

- Days

- decision

- decrease

- deemed

- Despite

- down

- drawing

- Economic

- economy

- emphasized

- equity

- Eric Balchunas

- ETF

- ETFs

- exchange-traded

- exchange-traded fund (ETF)

- experienced

- experts

- eye

- facing

- Fed

- Fed Chair

- Federal

- Filing

- First

- For

- Friday

- from

- fund

- funds

- further

- Futures

- Gains

- getting

- Go

- Graphic

- Have

- he

- headwinds

- High

- Highlighted

- Hikes

- him

- HOURS

- HTTPS

- image

- impressive

- in

- Including

- Increases

- index

- inevitable

- inflation

- interest

- INTEREST RATE

- Investors

- ITS

- jpg

- june

- Lack

- latest

- launch

- lead

- leading

- Lessons

- Level

- levels

- likely

- Liquidity

- little

- Long

- Macro

- major

- Market

- Markets

- Matter

- max-width

- May..

- might

- mike

- mike mcglone

- monthly

- MONTHLY REPORT

- months

- more

- most

- Nasdaq

- Nasdaq 100

- negative

- negative liquidity

- of

- on

- once

- ONE

- only

- or

- Outlook

- over

- past

- pause

- performance

- physical

- plato

- Plato Data Intelligence

- PlatoData

- policies

- possible

- potential

- Powell

- predicted

- press

- pressure

- price

- process

- providing

- providing investors

- Push

- range

- Rate

- rather

- recent

- recession

- relationship

- relief

- report

- Resistance

- result

- resume

- Risk

- risk assets

- risks

- Run

- Said

- senior

- set

- shared

- Shield

- show

- Shows

- significant

- Slide

- some

- Spot

- standard

- start

- States

- stating

- stock

- Strategist

- streak

- such

- supply

- support

- support level

- support levels

- than

- that

- The

- the Fed

- their

- they

- this

- threshold

- time

- timeframe

- to

- top

- towards

- traded

- Trailing

- true

- United

- United States

- us

- US economy

- vs

- Warns

- Way..

- we

- week

- which

- will

- with

- within

- Won

- would

- year

- zephyrnet