Bitcoin (BTC), the leading cryptocurrency, has experienced a surge of over 3.6% in the past 24 hours and an impressive 27% in the last month. These gains have propelled the Bitcoin price to reach a new 26-month high of $53,360 on Monday, signaling investors renewed optimism.

BTC Whales Make Waves

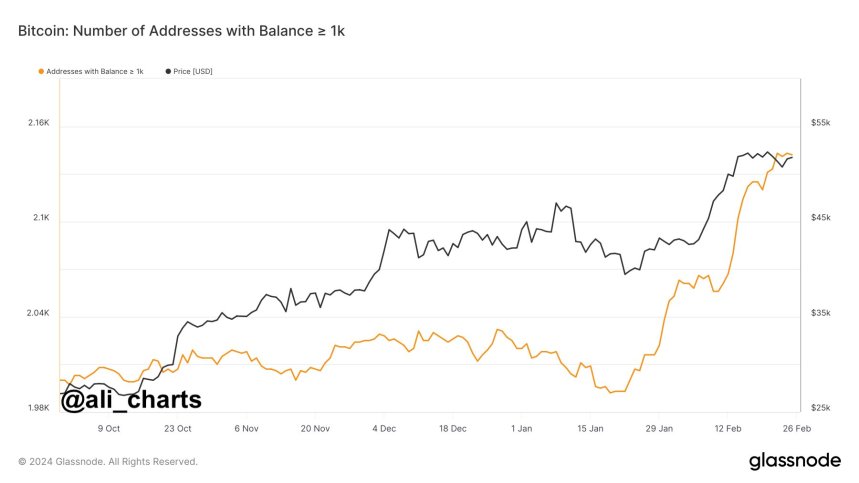

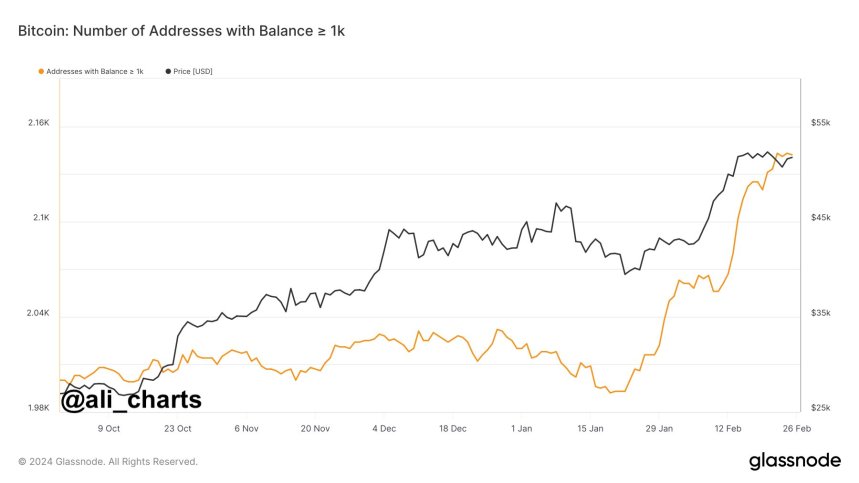

Adding to the bullish sentiment surrounding Bitcoin, crypto analyst Ali Martinez highlights the significant activity of the BTC whales, stating that “whales are going parabolic.”

Notably, In the past month alone, more than 150 new BTC addresses have appeared, each with more than 1,000 BTC. This surge in whale activity indicates a heightened confidence in Bitcoin’s long-term prospects and offers a positive outlook for its future price movements.

Martinez emphasizes a “megaphone pattern” observed on Bitcoin’s daily chart. According to the analyst, this pattern suggests that if BTC maintains its position above the $50,000 level, a sustained close above $53,000 could catalyze a substantial rally toward the $60,520 mark.

Bitcoin Rally Led By Leveraged Long Positions?

As detailed in a recent Bloomberg report, BTC’s rise has been driven in part by a surge in spot demand and momentum traders capitalizing on a breakout after a period of consolidation, according to Chris Newhouse, a decentralized finance (DeFi) analyst at Cumberland Labs.

Newhouse highlights that the current price action has seen a relatively balanced level of liquidations, indicating that excessive short liquidations do not drive the recent rally. Instead, leveraged long positions have quickly replaced the liquidated shorts, suggesting a shift in sentiment toward bullishness.

Moreover, the report highlights that open interest for perpetual Bitcoin futures has experienced a noticeable increase, indicating growing market participation and interest in BTC derivatives.

Simultaneously, Newhouse explains that short positions have been forced to close amid the latest rally, potentially a result of fresh long positions entering the market.

Nevertheless, the cryptocurrency’s ability to sustain its upward momentum and navigate key resistance levels will be crucial in determining its next growth phase.

In a further boost to Bitcoin’s optimism, MicroStrategy, the enterprise software firm known for its strategic Bitcoin purchases, announced that it has acquired an additional 3,000 cryptocurrency tokens this month for approximately $155.4 million.

With a total Bitcoin holding of about $10 billion, MicroStrategy continues to demonstrate its confidence in its long-term value and potential.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.newsbtc.com/bitcoin-news/bitcoin-surges-to-new-26-month-high-whales-go-parabolic-as-analyst-forecasts-rally-toward-60500/

- :has

- :is

- :not

- 000

- 1

- 150

- 24

- 360

- 500

- 7

- a

- ability

- About

- above

- According

- acquired

- Action

- activity

- Additional

- addresses

- advised

- After

- alone

- Amid

- amount

- an

- analyst

- and

- announced

- any

- appeared

- approximately

- ARE

- article

- AS

- At

- balanced

- BE

- been

- before

- Billion

- Bitcoin

- Bitcoin Futures

- Bitcoin Price

- bitcoin surges

- Bloomberg

- boost

- breakout

- BTC

- BTC Addresses

- BTC Whales

- BTCUSD

- Bullish

- buy

- by

- capitalizing

- catalyze

- Chart

- Chris

- Close

- Conduct

- confidence

- consolidation

- continues

- could

- created

- crucial

- crypto

- crypto analyst

- cryptocurrency

- Current

- daily

- decentralized

- Decentralized Finance

- decentralized finance (DeFi)

- decisions

- DeFi

- Demand

- demonstrate

- Derivatives

- detailed

- determining

- do

- does

- drive

- driven

- each

- educational

- entering

- Enterprise

- enterprise software

- entirely

- excessive

- experienced

- finance

- Firm

- following

- For

- forced

- forecasts

- fresh

- from

- further

- future

- Future Price

- Futures

- Gains

- Go

- going

- Growing

- Growth

- Have

- heightened

- High

- highlights

- hold

- holding

- HOURS

- HTTPS

- if

- image

- impressive

- in

- Increase

- increased

- indicates

- indicating

- information

- instead

- interest

- investing

- investment

- Investments

- Investors

- IT

- ITS

- Key

- key resistance

- known

- Labs

- Last

- latest

- leading

- Led

- Level

- levels

- leveraged

- LIQUIDATED

- liquidations

- Long

- long-term

- maintains

- make

- Making

- mark

- Market

- max-width

- MicroStrategy

- million

- Momentum

- Monday

- Month

- months

- more

- movements

- Navigate

- New

- NewsBTC

- next

- of

- Offers

- on

- only

- open

- open interest

- Opinions

- Optimism

- or

- Outlook

- over

- own

- parabolic

- part

- participation

- past

- Pattern

- period

- Perpetual

- phase

- plato

- Plato Data Intelligence

- PlatoData

- position

- positions

- positive

- potential

- potentially

- price

- PRICE ACTION

- propelled

- prospects

- provided

- purchases

- purposes

- quickly

- rally

- reach

- recent

- relatively

- renewed

- replaced

- report

- represent

- research

- Resistance

- result

- Rise

- Risk

- risks

- seen

- sell

- sentiment

- shift

- Short

- shorts

- Shows

- shutterstock

- significant

- small

- Software

- Source

- Spot

- stating

- Strategic

- substantial

- Suggests

- surge

- Surges

- Surrounding

- than

- that

- The

- These

- this

- to

- Tokens

- Total

- toward

- Traders

- TradingView

- uptrend

- upward

- upward momentum

- use

- value

- Website

- whales

- whether

- will

- with

- You

- Your

- zephyrnet