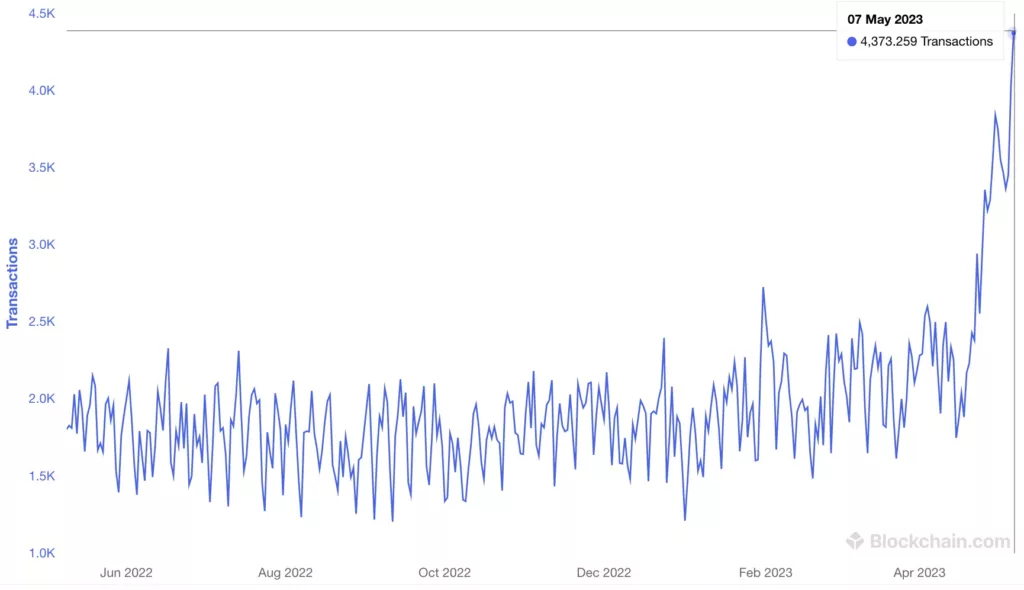

Users of the bitcoin network have paid 403 BTC in fees in an otherwise quiet Sunday with May seeing a significant spike.

For much of April bitcoin miners earned about 20 BTC and at most 40 bitcoins a day, but starting earlier this month that has increased with speed.

The reason is because the 2017 bitcoin network update through segregated witnesses (segwit) is only now being utilized, albeit not quiet for what it was meant for.

The upgrade intended to facilitate the adoption of second layers like the Lightning Network (LN), or semi-proprietary products from Blockstream, like their Liquid sidechain.

Both can rely heavily on signatures, mainly to ‘bridge’ the coin ownership between the base blockchain and the second layer or sidechain, hence these signatures were given a 75% discount on fees, but neither LN nor Liquid have found much use.

For LN, the lack of adoption is probably primarily due to the very complex nature of the network that requires bitcoin collaterals – with almost no returns – to facilitate transfers.

While for Liquid, its significant tradeoffs on security and permissionlessness can not easily compete with other alternative base layers or second layers.

But the, at the time, somewhat controversial segwit upgrade is finally finding use in… yes, frog pictures.

Crypto outlets are tracking almost by the second what’s happening to Pepe, with one headline saying some whale lost $500,000, in a crypto market of $1 trillion.

Another one tells us Pepecoin has entered 110th in crypto market cap. This is while banks collapse, the Bitcoin Magazine has a nice expose on NY Times, and quite a lot more is happening.

But Changpeng Zhao of Binance decided to temporarily pause withdrawals because of on-chain fees.

For this one, it wasn’t just crypto outlets tracking it by the second, but entities like Reuters giving us headlines about the pause and then the restart and the second pause.

Bitcoin’s price dipped to $27,80 after nearing $30,000 on Friday, making the Binance move a bit controversial as some bitcoiners vent.

2017 Again?

Some frog matter seems to keep appearing around this part of the cycle with it being the Chainlink frogs last time, and now we have jpeg frogs.

To make matters less confusing, we have two of them. Crypto media is obsessed with the ERC20 Pepecoin running on ethereum, but there’s a Pepe on BRC20 running on bitcoin.

BRC20 is the new name for what early bitcoiners might remember as colored coins. It’s a bit different, because this too has Jason Parser, json, and that’s basically what it is: a bit of json on a satoshi to make it distinct from other toshis.

For non-coders, json is a bit like the colored tabs in a well organized paper folder. It’s a way to neatly specify information like names or dependencies or data.

BRC20 uses the data bit that was meant for LN, and just like that you have NFTs of sorts running on bitcoin, or tokens without jpegs.

In combination they are worth about $1 billion in market cap, up 5x in just days. And so the bitcoin blocksize is now up to 1.7MB from usually 1.1MB, with the amount of transactions per block doubling too.

Due to the way segwit is designed, these frogs can sort of take priority over normal transactions because there is more space available to them in a block and for 75% less in fees than for normal transactions.

A block with only normal transactions can only be about 1MB. A block with only signatures, which in theory is possible, can be 4MB.

In five years since segwit was implemented, bitcoin blocks remained at 1MB despite in theory having the capacity for 4MB, because almost no one used the signature part with LN stagnating to about $100 million in capitalization.

The utilization of the signatures through the token changes that, and so what was meant to be a second class user onchain to in effect force LN adoption, is now a second class user to frogs.

There was a whole ‘civil war’ in bitcoin due to this matter, so some are laughing now, but is there a reason for concern?

No DDoS, Just Segwit

The bitcoin network is being used as it has been coded, and the consequences of those uses are due to the tradeoffs made in 2017, so the network is operating as it is meant to, in a way.

BRC20 “is only driving up transaction fees and filling up blocks, it isn’t preventing full nodes from operating or knocking them offline. Hence I personally wouldn’t call it a DDOS attack,” says Michael Folkson, a bitcoin protocol developer, adding:

“I don’t think anything will or should be done. It was expected that transaction fees would rise eventually through normal onchain transactions and Lightning channel opens and closes. This kind of usage is just driving transaction fees higher prematurely.”

Nor is it the first time fees reach these levels. They hit 700 BTC a day at the peak of the 2017 bull, and in USD they were significantly higher in April 2021 following another peak of bitcoin’s price.

Binance wasn’t around in 2017 and didn’t pause withdrawals in 2021, so the decision to do so on a quiet Sunday is due to boredom, crypto-politics, or they’re manually setting the network fee they deduct from withdrawals and needed some time to adjust it, in which case it would be due to stretchy communication.

Because fundamentally the on-chain fees are none of Binance’s business – save for what they need to deduct from withdrawing customers – but that of their customers.

The bitcoin network is working. Blocks are being processed, transactions are moving, and therefore an exchange has no good reason to pause withdrawals because of the network.

They may have their own reason in not automating network fee measurements and charges, but Binance has been around for some time and fees have been volatile throughout that time. Hence some have accused the exchange of playing crypto politics.

Good For Corn Though?

Binance’s opinions aside, these frog developments are more nuanced for holders, though with their own costs and benefits.

On the costs part, a significant concentration of value on NFTs can put downwards pressure on the base coin when that base coin is converted to fiat.

Beeple kind of ‘crashed’ eth as he cashed out back in 2021, and these frogs may ‘crash’ bitcoin when they’re done with their party.

On the other hand, NFTs brought significant demand for eth and they may do for bitcoin as well.

As bitcoin remains Proof of Work, these frogs may even pay for network security, and if they do then the 21 million limit might stay.

Otherwise some devs have suggested it should be lifted, but with frogs on board that won’t be necessary as miners are currently receiving in fees as much as in block rewards.

For network users however, an expensive network becomes a lot less appealing. Fees at these levels therefore have not been sustainable, with the market unlikely to tolerate in a sustainable way fees of more than about $10 per transaction.

But for now there’s clearly a bull going on in BRCs, and as long as that lasts, the bull participants are willing to pay a lot more than usual.

The normal transactions during this period are collateral damage, and irrelevant from an investment perspective while the bulls are around.

Especially because those bull frogs will eventually rub off the base coin, making the base coin potentially bullish too.

BRC however is fundamentally a copy of actual NFTs, which as a new invention at least in acronym attracted much attention.

The BRC bull therefore may be more a bear market bull, rather than bull bull, but still it is a sign of excitement and some frothiness which should add some confidence for investors that are paying attention.

Because the fee politics are over as solutions to that are hard and take time. Complaining about those fees therefore, instead of coding up solutions that have acceptable tradeoffs, is a bit futile in front of these frogs.

And so enjoy it all. The quiet family party before the many guests arrive and quite a lot before it gets so noisy we get bored of it.

The bit where the actual doers are in stealth, and the rest retell the good stories of NFT days or Jason Parser or the blocksize wars.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://www.trustnodes.com/2023/05/08/bitcoin-transaction-fees-spike-10x-no-ddos-says-dev

- :has

- :is

- :not

- :where

- $100 million

- $UP

- 000

- 1

- 20

- 2017

- 2021

- 2023

- 40

- a

- About

- acceptable

- accused

- add

- adding

- Adoption

- After

- again

- All

- alternative

- amount

- an

- and

- Another

- anything

- appealing

- appearing

- April

- ARE

- around

- AS

- At

- attack

- attention

- attracted

- automating

- available

- back

- Banks

- base

- Basically

- BE

- Bear

- Bear Market

- because

- becomes

- been

- before

- being

- benefits

- between

- Billion

- binance

- Bit

- Bitcoin

- Bitcoin Magazine

- Bitcoin Miners

- Bitcoin Network

- bitcoiners

- Bitcoins

- Block

- block rewards

- blockchain

- Blocks

- Blockstream

- board

- Bored

- brought

- BTC

- bull

- Bullish

- Bulls

- business

- but

- by

- call

- CAN

- cap

- Capacity

- capitalization

- case

- Chainlink

- Changes

- Changpeng

- Changpeng Zhao

- Channel

- charges

- class

- clearly

- Closes

- coded

- Coding

- Coin

- Coins

- Collapse

- Collateral

- combination

- Communication

- compete

- complex

- concentration

- Concern

- confidence

- confusing

- Consequences

- controversial

- converted

- Costs

- crypto

- Crypto Market

- crypto market cap

- Crypto Media

- Currently

- Customers

- cycle

- data

- day

- Days

- DDoS

- DDoS attack

- decided

- decision

- Demand

- designed

- Despite

- Dev

- Developer

- developments

- Devs

- different

- Discount

- distinct

- do

- done

- Dont

- doubling

- driving

- due

- during

- Earlier

- Early

- earned

- easily

- effect

- enjoy

- entered

- entities

- ERC20

- ETH

- ethereum

- Even

- eventually

- exchange

- Excitement

- expected

- expensive

- facilitate

- family

- fee

- Fees

- Fiat

- Finally

- finding

- First

- first time

- following

- For

- For Investors

- Force

- found

- Friday

- frogs

- from

- front

- full

- fundamentally

- get

- given

- Giving

- going

- good

- guests

- hand

- Happening

- Hard

- Have

- having

- he

- headline

- Headlines

- heavily

- hence

- High

- higher

- Hit

- holders

- However

- HTTPS

- i

- if

- implemented

- in

- increased

- information

- instead

- Invention

- investment

- Investors

- IT

- ITS

- JPEGs

- json

- just

- Keep

- Kind

- Knocking

- Lack

- Last

- layer

- layers

- least

- less

- levels

- Lifted

- lightning

- Lightning Network

- Lightning Network (LN)

- like

- LIMIT

- Liquid

- ln

- Long

- lost

- Lot

- made

- magazine

- mainly

- make

- Making

- manually

- many

- Market

- Market Cap

- Matter

- Matters

- max-width

- May..

- measurements

- Media

- Michael

- might

- million

- Miners

- Month

- more

- most

- move

- moving

- much

- name

- names

- Nature

- nearing

- necessary

- Need

- needed

- Neither

- network

- Network Security

- New

- NFT

- NFTs

- no

- nodes

- normal

- now

- number

- NY

- of

- off

- offline

- on

- On-Chain

- Onchain

- ONE

- only

- opens

- operating

- Opinions

- or

- Organized

- Other

- otherwise

- out

- Outlets

- over

- own

- ownership

- paid

- Paper

- part

- participants

- party

- Pay

- paying

- Peak

- period

- Personally

- perspective

- Pictures

- plato

- Plato Data Intelligence

- PlatoData

- playing

- politics

- possible

- potentially

- pressure

- preventing

- price

- primarily

- priority

- probably

- Processed

- Products

- proof

- protocol

- put

- rather

- reach

- reason

- receiving

- rely

- remained

- remains

- remember

- requires

- REST

- Reuters

- Rewards

- Rise

- running

- Satoshi

- Save

- saying

- says

- Second

- Second Layers

- security

- seeing

- seems

- segregated

- SegWit

- setting

- should

- sidechain

- sign

- Signatures

- significant

- significantly

- since

- So

- Solutions

- some

- somewhat

- Space

- speed

- spike

- stagnating

- Starting

- stay

- Stealth

- Still

- Stories

- sustainable

- Take

- tells

- than

- that

- The

- The Lightning Network

- their

- Them

- then

- There.

- therefore

- These

- they

- think

- this

- those

- though?

- Through

- throughout

- time

- times

- to

- token

- Tokens

- too

- Tracking

- transaction

- Transaction Fees

- Transactions

- transfers

- Trillion

- Trustnodes

- two

- Update

- upgrade

- us

- Usage

- USD

- use

- used

- User

- users

- usually

- utilized

- value

- very

- volatile

- was

- Way..

- we

- webp

- WELL

- were

- Whale

- What

- when

- which

- while

- whole

- will

- willing

- with

- Withdrawals

- withdrawing

- without

- Work

- working

- worth

- would

- years

- You

- zephyrnet

- Zhao