In another major price crash, Bitcoin (BTC) has corrected another 12% dropping under its crucial support levels of $40,000. Bears are clearly in charge of the market at this point. The recent price crash comes as The People’s Bank of China (PBoC) warns local businesses and institutions of dabbling into Bitcoin and crypto.

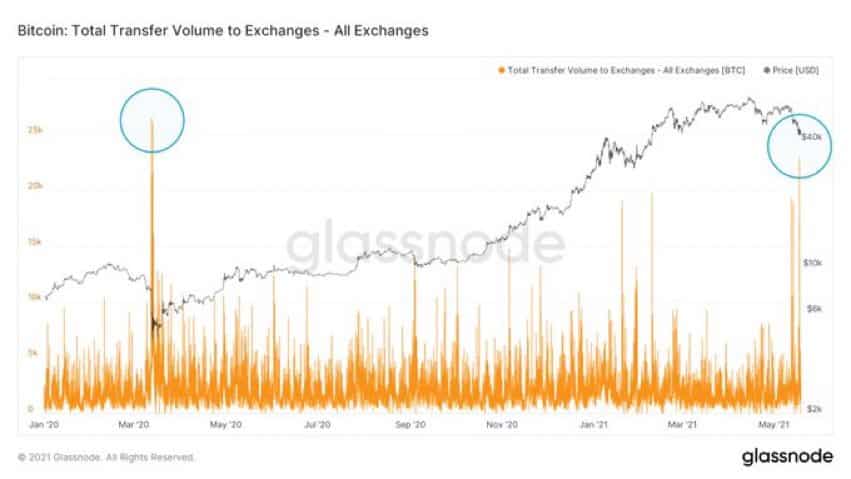

This is for the second time in the last three that the BTC price has corrected over 12%. It happens as the exchange deposits spike to new highs. As per the Glassnode data, over 30,000 Bitcoins were transferred to exchanges in a single day during Monday’s price crash. This has been the largest single-day deposit at exchanges after the March 2020 crash.

It looks like there’s clear fear at this point among investors and traders who are not willing to buy the dips. At press time, Bitcoin is trading at levels last seen in February 2021. Also, its market cap has taken a dive under $750 billion. The BTC price crash over the last week has been more than digestible.

The BTC price has corrected by more than 30% with its price crashing from over $57,000 to now under $40,000. Moreover, over $300 billion have been eroded along from the Bitcoin (BTC) valuations. The Bitcoin (BTC) price dominance has also reached a three-year-low to under 40%.

Institutions and Long Term Holders Continue Buying

As the Bitcoin (BTC) price continues to correct further, institutional players and long-term holders have been buying the dips. As per the Glassnode data, the number of accumulation addresses has surged 1.1% over the last week.

In almost perfect opposition to new entrants panic selling, long term holders appear to be buying the dip and accumulating cheaper coinshttps://t.co/Swkzt7JmNN pic.twitter.com/jqR7V9RsgL

— unfolded. (@cryptounfolded) May 18, 2021

On Tuesday, May 18, business intelligence firm MicroStrategy announced another $10 million worth of Bitcoin purchase taking its total Bitcoin holdings to now above 92,000. However, the fear among investors has peaked to new levels who are now on a “wait and watch” mode rather than “buy the dips”. Speaking to Business Insider, Pankaj Balani, chief executive of crypto derivatives exchange Delta, said:

“Yesterday we saw a lot of volume in the $40,000 puts. In the previous dips, we had seen that the sentiment had not changed as much. This time around, we are seeing change of sentiment. We’re not seeing any signs of bottom-fishing. Consensus seems to be that it’s fallen quite sharply and it can fall a little more. So $35,000 to $38,000 is the zone where most traders are looking at.”

- '

- &

- 000

- 2020

- Absolute

- among

- around

- auto

- avatar

- Bank

- Bank of China

- Bears

- Billion

- Bitcoin

- blockchain

- blockchain technology

- border

- BTC

- btc price

- business

- business intelligence

- businesses

- buy

- Buying

- change

- charge

- chief

- China

- Consensus

- content

- continue

- continues

- Crash

- crypto

- cryptocurrencies

- cryptocurrency

- data

- day

- Delta

- Derivatives

- Economics

- exchange

- Exchanges

- executive

- finance

- financial

- fintech

- Firm

- follow

- Free

- Georgia

- Glassnode

- good

- hold

- HTTPS

- Insider

- Institutional

- institutions

- Intelligence

- interest

- investing

- Investors

- IT

- knowledge

- learning

- local

- Long

- major

- March

- march 2020

- Market

- Market Cap

- market research

- Markets

- million

- Opinion

- opposition

- Panic

- PBOC

- People’s Bank Of China

- press

- price

- Price Crash

- purchase

- research

- Screen

- sentiment

- Share

- Signs

- skills

- So

- Sponsored

- support

- Technology

- time

- top

- track

- Traders

- Trading

- Updates

- us

- Valuations

- volume

- week

- WHO

- worth