In a tumultuous turn of events, Bitcoin faced an 8% price tumble on March 15, plummeting from its all-time high of $73,805 to a weekly low of $66,786.

This drastic dip wiped out over $120 billion of Bitcoin’s market capitalization, starkly contrasting the weeks of fervent bullish trading that had propelled the cryptocurrency to unprecedented heights.

Overheated Bull Trading and ETF Approval

The Bitcoin price downturn on March 15 was attributed to the overheated bull trading that had characterized the market over the last 60 days, particularly following the approval of Bitcoin exchange-traded funds (ETFs).

Bitcoin’s price surged by a remarkable 75% during this period, culminating in its all-time high on March 15.

One significant indicator of the overheated market was the average Bitcoin funding rates for perpetual futures contracts, which stood at 0.05% since the start of March, according to Santiment data. These rates represent fees paid by leveraged long traders to short position holders, indicating a high level of leverage in the market.

The prolonged elevation of Bitcoin funding rates led to an overheating of the BTC futures markets, leaving bullish traders vulnerable to margin calls and massive liquidations.

As a result, the market witnessed an 8% price downturn on March 15, the largest single-day loss since the beginning of 2024.

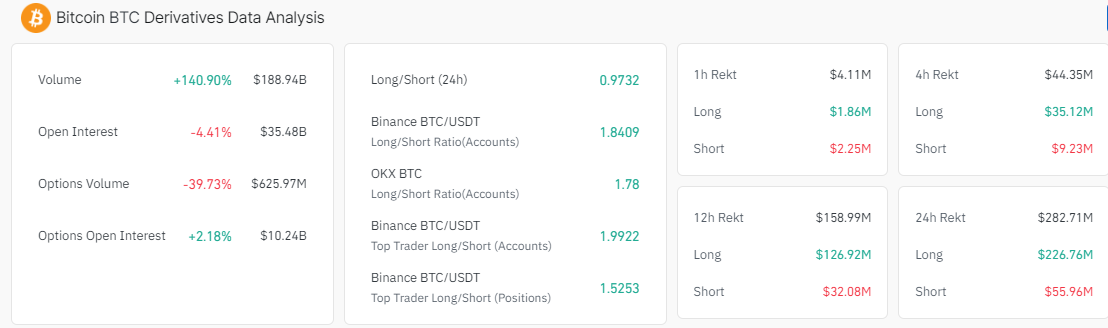

Aggregate derivatives market data compiled by Coinglass revealed that over $122 million worth of Bitcoin long contracts were liquidated within 24 hours of the price dip.

This triggered a cascade of forced sales of spot BTC assets deposited as collateral for leveraged positions, further exacerbating the price decline.

Bitcoin Whales Buy the Dip

Despite the market turmoil, large bag holders, often referred to as whales, seized the opportunity to accumulate Bitcoin at lower prices.

According to data from Santiment, whale wallets holding at least 10 BTC ($700,000) saw a significant increase in balances during this period.

Whales held a total of 16.08 million BTC at the start of March 2024, which increased to 16.12 million BTC by March 15, representing an acquisition of 40,000 BTC, worth approximately $2.7 billion at current prices.

This rapid accumulation by whales, particularly during price downturns, has historically been seen as a bullish signal for Bitcoin. If institutional investors continue accumulating BTC at this pace, it could signal a strong underlying confidence in Bitcoin’s prospects, potentially paving the way for an early price rebound.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://zycrypto.com/bitcoin-whales-snap-up-2-7-billion-in-btc-amid-8-dip-bullish-rebound-ahead/

- :has

- $3

- $UP

- 000

- 08

- 10

- 12

- 15%

- 16

- 2024

- 24

- 40

- 60

- 7

- 700

- a

- According

- Accumulate

- accumulation

- acquisition

- ahead

- Amid

- an

- and

- approval

- approximately

- AS

- Assets

- At

- average

- bag

- balances

- been

- Beginning

- Billion

- Bitcoin

- bitcoin funding rates

- Bitcoin Price

- bitcoin whales

- BTC

- BTC Whales

- bull

- Bullish

- buy

- by

- Calls

- capitalization

- cascade

- characterized

- Collateral

- compiled

- confidence

- content

- continue

- contracts

- could

- crypto

- Crypto Exchanges

- cryptocurrency

- culminating

- Current

- data

- Days

- Decline

- deposited

- Derivatives

- Dip

- DOWNTURN

- downturns

- during

- Early

- ETF

- ETFs

- events

- exchange-traded

- exchange-traded funds

- Exchanges

- faced

- Fees

- following

- For

- forced

- from

- funding

- funding rates

- funds

- further

- Futures

- futures markets

- going

- had

- heights

- Held

- High

- historically

- holders

- holding

- HOURS

- HTTPS

- if

- image

- in

- Increase

- increased

- indicating

- Indicator

- Institutional

- institutional investors

- Investors

- IT

- ITS

- jpg

- large

- largest

- Last

- least

- leaving

- Led

- Level

- Leverage

- leveraged

- Leveraged Positions

- LIQUIDATED

- liquidations

- Long

- loss

- Low

- lower

- March

- March 2024

- Margin

- Market

- Market Capitalization

- Market Data

- Markets

- massive

- max-width

- million

- more

- of

- often

- on

- Opportunity

- out

- over

- Pace

- paid

- parabolic

- particularly

- Paving

- period

- Perpetual

- plato

- Plato Data Intelligence

- PlatoData

- position

- positions

- potentially

- price

- Prices

- propelled

- prospects

- rapid

- Rates

- rebound

- referred

- remarkable

- represent

- representing

- result

- Revealed

- sales

- Santiment

- saw

- seen

- seized

- Short

- Signal

- significant

- since

- Snap

- Spot

- start

- stood

- strong

- Surged

- than

- that

- The

- These

- this

- to

- Total

- Traders

- Trading

- triggered

- tumble

- TURN

- underlying

- unprecedented

- Vulnerable

- Wallets

- was

- Way..

- weekly

- Weeks

- were

- Whale

- whales

- which

- within

- witnessed

- worth

- zephyrnet