Several metrics indicate Bitcoin (BTC) could be establishing a bear market floor, according to leading crypto analytics firm Glassnode.

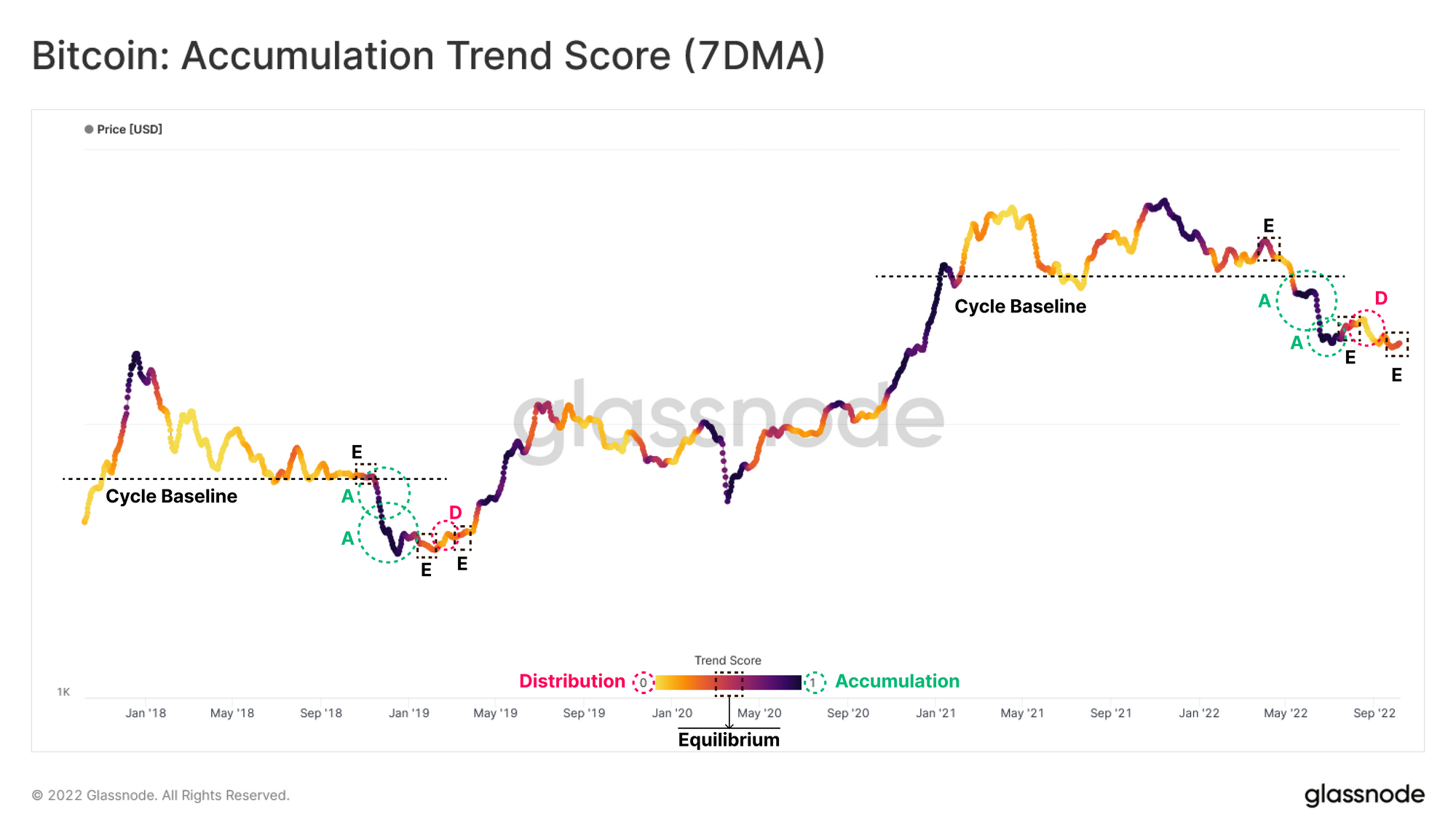

Glassnode notes in a new analysis that Bitcoin’s accumulation trend score has displayed “a series of consecutive events” similar to the 2018/2019 bear market.

The accumulation trend score shows the aggregated balance change intensity of active investors in the past month.

Says the analytics firm,

“Throughout the capitulation in early 2022, the accumulation trend score indicates significant accumulation by large entities has taken place, as well as the seizure of the recent bear market rally to $24,500 for exit liquidity. At present, this metric suggests an equilibrium (neutral) structure in the market, which remains similar to early 2019.”

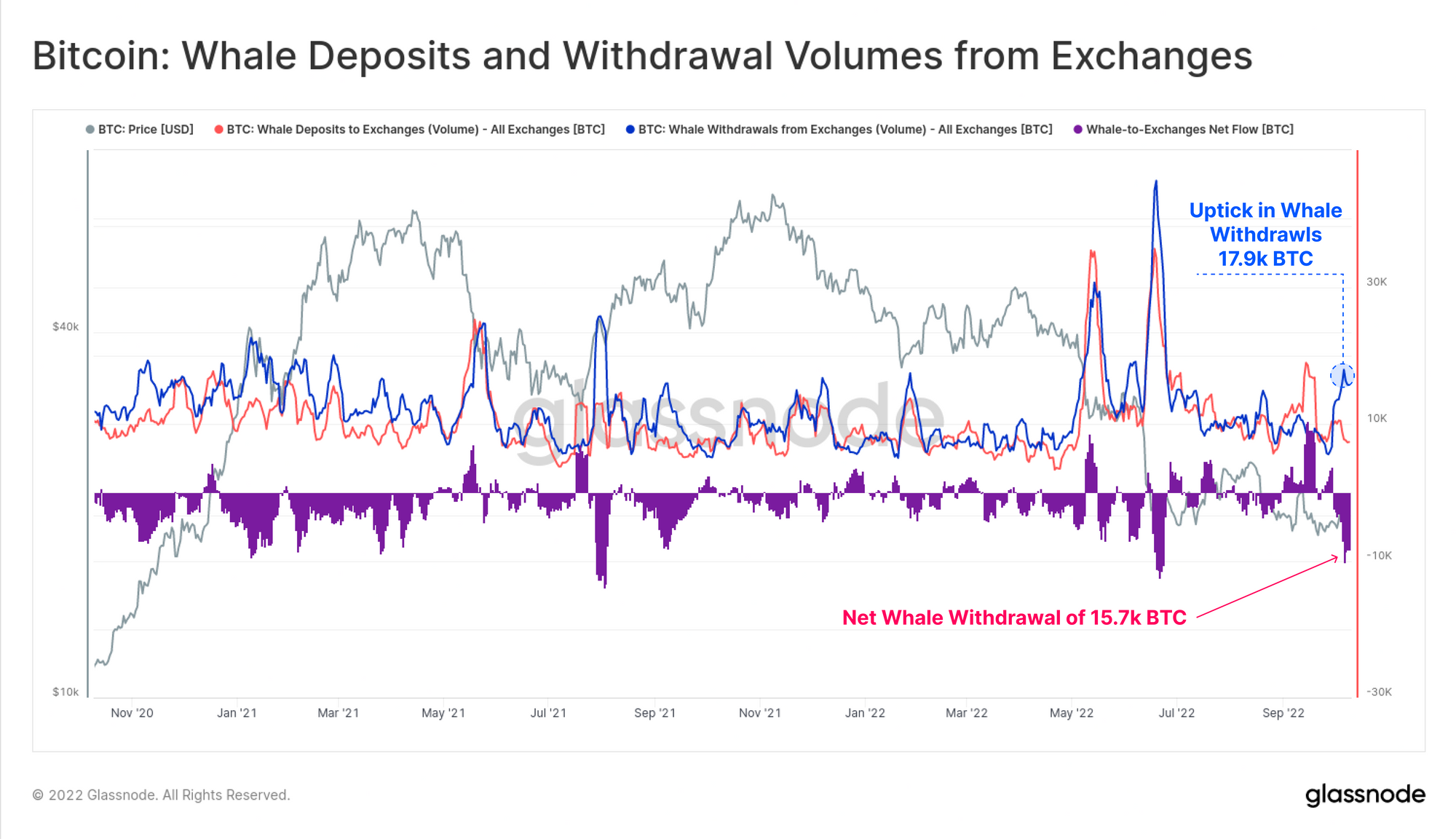

Glassnode also notes there has been an uptick in net Bitcoin whale withdrawal in the past few weeks. Exchanges have recently registered outflows of 15,700 BTC, worth over $300 million – the largest net whale withdrawal since June.

The analytics firm also calculated the cost basis for active whales, which it says is a psychologically important level to large investors.

‘By price stamping the deposits and withdrawal volumes of the whale cohort (1k+ BTC) to/from exchanges, we can estimate the average price of Whale Deposits/Withdrawals since Jan-2017. This Whale cost basis is currently around $15,800.”

The analytics firm concludes its report by saying that Bitcoin appears to be in the process of printing a bear market bottom.

“In many ways, many on-chain metrics, market structure, and investor behavior patterns are dotting of the Is, and crossing the Ts for a textbook bear market floor. A principle piece which is missing is duration, of which history would suggest there may be several months still ahead before a full recovery.”

Bitcoin is trading at $18,990 at time of writing. The top-ranked crypto asset by market cap is down more than 2% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Design Projects/Sensvector

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- BTC

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- news

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- The Daily Hodl

- Trading

- W3

- zephyrnet