Today, we are bringing you a fantastic profile from Brandon Aversano, the founder of Alloy Market. The origin story is one to pay close attention to!

Who are you and what’s your background?

I graduated as the Distinguished Scholar from the Columbia College of Arts & Sciences at the George Washington University. My career began at Deloitte Consulting, where I focused primarily on designing, testing, and launching new products and services at the US Department of Veterans Affairs for Veterans and other government services users. I then advanced to JetBlue Airways, serving as a founding member of the in-house Strategy & Business Development team, reporting to the Chief Strategy Officer and Chief Executive Officer.

I was deployed cross-functionally to help solve some of the airline’s toughest challenges and was ultimately responsible for carving out all of JetBlue’s non-air ancillary products into a wholly-owned standalone subsidiary incorporated as JetBlue Travel Products. Working collaboratively with Airways’ executive leadership, I facilitated the separation and migration of key corporate functions including finance and technology, crafted new travel product and service categories for the JetBlue Vacations brand, and drove major operational efficiencies across the subsidiary’s international travel network.

More recently, I served as the Vice President & Business Manager overseeing one of JP Morgan Chase & Co’s largest co-branded credit card portfolios. During my time with Chase, I was responsible for conducting financial analysis and reporting, influencing customer acquisition and retention strategies, assisting technology roadmap development and adherence, and establishing critical controls to mitigate financial and reputational risk across the portfolio. I also had an opportunity to sharpen my people-leadership skills in this role as I was responsible for balancing institutional partnership obligations, public-facing customer commitments, and resource constraints of the team.

What is your job title and what are your general responsibilities?

I am the founder and CEO of Alloy, overseeing the growth, scale, and operations of the organization as we revolutionise precious metals exchange!

Can you give us an overview of your business?

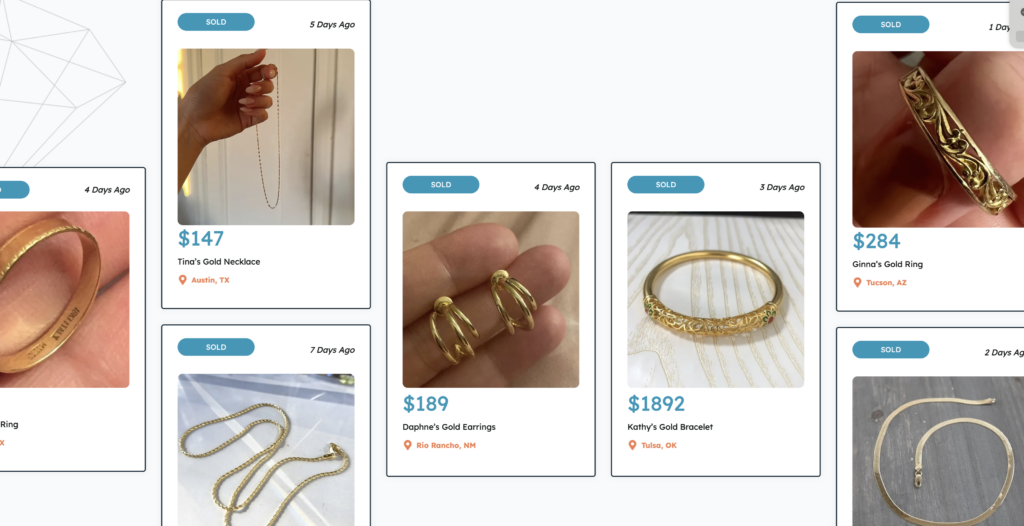

Alloy is your most trusted and transparent platform in the gold buying industry. With a loyal following of satisfied customers across the United States and unbeatable payouts, consumers can rest assured they are getting the best experience and largest payout possible. So whether they are trading in shimmering gold or sparkling silver, our expert team has their back.

“Gold Buyers” have popped up across the board with shockingly low buying prices and poor customer experiences. With their offers of “bonus coupons,” “gold parties,” and dubious guarantees, these companies convince customers to sell their gold for sometimes a mere 20-30% of their true worth. We’re proud to be different and we’re excited to be changing an industry that needs to be disrupted.

Tell us how you are funded?

Initially, Alloy was bootstrapped and self-funded but as we gained traction and achieved Product Market Fit, revenue became instrumental in fueling our growth. Recently, we’ve reached an exciting milestone by securing funding from strategic investors who believe in our mission and potential. This infusion of capital is propelling Alloy to new heights, enabling us to scale our operations, expand our product offerings, and cement our position as a leader in the industry.

What’s the origin story? Why did you start the company? To solve what problems?

In the Fall of 2022, I was diagnosed with testicular cancer which taught me two important lessons: The first is that time is not unlimited and the second is that cancer care is very expensive, even with good healthcare.

During my treatment journey, I sought to sell some of my jewellery to cover the cost of medical care but the experience was incredibly difficult. Realising the precious metal exchange market was ripe for disruption, I got to work founding Alloy, the first and only digital-based platform enabling users to exchange precious metals (gold, silver, platinum, and palladium) seamlessly and for industry-leading payouts.

Who are your target customers? What’s your revenue model?

Our target customers are anyone who wants to earn top dollar from gold. This could be individuals looking to declutter while earning quick cash by selling their gold items or someone who has inherited a number of gold items or jewelry.

Our platform offers a modern, transparent alternative to traditional pawn shops, catering to consumers who value convenience and transparency in the selling process. Our revenue model revolves around margin, where we take a small percentage of the margin as our fee for facilitating the sale. This approach ensures that our interests are aligned with those of our customers, as we only profit when they successfully sell their gold items through our platform.

If you had a magic wand, what one thing would you change in the banking and/or FinTech sector?

If I had a magic wand, the one thing I would change in the investment sector is the perception and accessibility of alternative assets like gold. For too long, gold has been viewed as a mysterious and inaccessible investment option, often overshadowed by more traditional avenues like stocks and bonds. By demystifying the process of investing in gold and making it more accessible to everyday investors, we can empower individuals to diversify their portfolios and hedge against economic uncertainty. Through education and innovation, we can unlock the potential of gold as a valuable asset class and provide investors with greater opportunities for long-term financial stability.

What is your message for the larger players in the Financial Services marketplace?

My message to the larger players in the Financial Services marketplace is one of encouragement to continue pushing the boundaries and driving innovation forward. Embracing change and leveraging technology to enhance transparency, accessibility, and efficiency is key to meeting the evolving needs of consumers in today’s digital age. By prioritizing customer-centric solutions and fostering collaboration within the industry, we can collectively advance towards a more inclusive and positive financial ecosystem. Let’s continue to challenge the status quo, innovate fearlessly, and work together to create a future where everyone can thrive.

Where do you get your Financial Services/FinTech industry news from?

As a FinTech and startup founder, I prioritise staying informed about the Financial Services and FinTech industry through regularly monitoring reputable financial news websites like Bloomberg and Financial Times. Social media platforms (especially LinkedIn) also help me follow thought leaders and key stakeholders, facilitating networking and providing valuable insights. Additionally, I rely on my professional network to receive first hand updates and industry insights. By combining these resources, I ensure that my startup remains agile, competitive, and well-positioned to navigate the dynamic landscape of the financial services sector.

Can you list 3 people you rate from the FinTech and/or Financial Services sector that we should be following on LinkedIn, and why?

- Gabbie Kelly is one person I must recommend you follow. She is a Money Coach & Profit Strategist helping businesses more profitable so they can pay themselves more and never stress about taxes again.

- Chiedo John is a wonderful investor and professional who shares a ton of excellent, informative insight with his audience. His posts are fun, his insight is very helpful, and we can all benefit from it!

- Tommy Nicholas is the CEO of a wonderful company that solves the identity risk problem for banks and fintech companies.

What FinTech services (and/or apps) do you personally use?

In terms of FinTech services and apps that I personally use, I rely on platforms like Robinhood for its user-friendly interface and accessibility to stock trading, TransferWise for its low-cost international money transfers, and Mint (now Credit Karma) for its comprehensive budgeting and financial tracking features. These tools have streamlined my personal finances and made managing money more convenient and efficient.

What’s the best new FinTech product or service you’ve seen recently?

Pulley is a platform that’s caught my attention. It’s aiding startups in managing equity ownership and strategic thinking. Pulley gives companies the tools and insights to make smarter, more informed decisions about their equity. While I haven’t tried it yet, I’ve been keeping my eye on what they are doing and it’s quite intriguing.

Finally, let’s talk predictions. What trends do you think are going to define the next few years in the FinTech sector?

In terms of trends that I believe will define the next few years in the FinTech sector, I foresee a continued emphasis on financial inclusion, with a focus on reaching underserved communities and providing them with access to essential banking services. I also anticipate a growing integration of artificial intelligence and machine learning into financial products and services, enabling more personalised and predictive experiences for consumers.

Here’s a great overview video featuring Brandon:

[embedded content]

Thank you for taking the time, Brandon.

Find out more about Alloy at https://thealloymarket.com/

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://fintechprofile.com/2024/04/24/brandon-aversano-founder-of-alloy-market-inc/

- :has

- :is

- :not

- :where

- $UP

- 20-30%

- 2022

- 33

- 39

- 500

- 7

- a

- About

- access

- accessibility

- accessible

- achieved

- acquisition

- across

- Additionally

- adherence

- advance

- advanced

- Affairs

- again

- against

- age

- agile

- airways

- aligned

- All

- Alloy

- also

- alternative

- alternative assets

- am

- an

- analysis

- and

- anticipate

- anyone

- approach

- apps

- ARE

- around

- artificial

- artificial intelligence

- Artificial Intelligence and Machine Learning

- Arts

- AS

- asset

- asset class

- Assets

- assisting

- assured

- At

- attention

- audience

- avenues

- back

- background

- balancing

- Banking

- Banks

- BE

- became

- been

- began

- believe

- benefit

- BEST

- Bloomberg

- board

- Bonds

- boundaries

- brand

- Brandon

- Bringing

- budgeting

- business

- business development

- businesses

- but

- Buying

- by

- CAN

- Cancer

- capital

- card

- care

- Career

- carving

- Cash

- categories

- catering

- caught

- cement

- ceo

- challenge

- challenges

- change

- changing

- chase

- chief

- Chief Executive

- chief executive officer

- class

- Close

- coach

- collaboration

- collectively

- College

- COLUMBIA

- combining

- commitments

- Communities

- Companies

- company

- competitive

- comprehensive

- conducting

- constraints

- consulting

- Consumers

- content

- continue

- continued

- controls

- convenience

- Convenient

- convince

- Corporate

- Cost

- could

- cover

- crafted

- create

- credit

- credit card

- critical

- customer

- Customers

- decisions

- define

- deloitte

- Department

- deployed

- designing

- Development

- development team

- DID

- different

- difficult

- digital

- digital age

- disrupted

- Disruption

- Distinguished

- diversify

- do

- doing

- Dollar

- driving

- during

- dynamic

- earn

- Earning

- Economic

- economic uncertainty

- ecosystem

- Education

- efficiencies

- efficiency

- efficient

- embedded

- embracing

- emphasis

- empower

- enabling

- enhance

- ensure

- ensures

- equity

- especially

- essential

- establishing

- Even

- everyday

- everyone

- evolving

- excellent

- exchange

- excited

- exciting

- executive

- Executive Officer

- Expand

- expensive

- experience

- Experiences

- expert

- eye

- facilitated

- facilitating

- Fall

- fantastic

- Features

- Featuring

- fee

- few

- finance

- Finances

- financial

- financial inclusion

- financial news

- financial products

- financial services

- financial stability

- fintech

- Fintech Companies

- First

- first hand

- fit

- Focus

- focused

- follow

- following

- For

- For Consumers

- foresee

- Forward

- fostering

- founder

- Founder and CEO

- founding

- from

- FT

- fueling

- fun

- functions

- funded

- funding

- future

- gained

- General

- George

- get

- getting

- Give

- gives

- going

- Gold

- good

- got

- Government

- great

- greater

- Growing

- Growth

- guarantees

- had

- hand

- Have

- healthcare

- hedge

- heights

- help

- helpful

- helping

- High

- his

- How

- http

- HTTPS

- i

- Identity

- important

- in

- inaccessible

- Including

- inclusion

- Inclusive

- Incorporated

- incredibly

- individuals

- industry

- industry insights

- Industry News

- industry-leading

- influencing

- informative

- informed

- infusion

- innovate

- Innovation

- insight

- insights

- Institutional

- instrumental

- integration

- Intelligence

- interests

- Interface

- International

- into

- intriguing

- investing

- investment

- investor

- Investors

- IT

- items

- ITS

- jewelry

- Job

- journey

- jp

- jp morgan

- JP Morgan Chase

- keeping

- Key

- landscape

- larger

- largest

- latest

- launching

- leader

- leaders

- Leadership

- learning

- Lessons

- leveraging

- like

- List

- Long

- long-term

- looking

- Low

- low-cost

- loyal

- machine

- machine learning

- made

- magic

- major

- make

- Making

- manager

- managing

- Margin

- Market

- marketplace

- max-width

- me

- Media

- medical

- medical care

- meeting

- member

- mere

- message

- metal

- Metals

- migration

- milestone

- mint

- Mission

- Mitigate

- model

- Modern

- money

- Money Transfers

- monitoring

- more

- Morgan

- most

- must

- my

- mysterious

- Navigate

- needs

- network

- networking

- never

- New

- new products

- news

- next

- now

- number

- obligations

- of

- Offerings

- Offers

- Officer

- often

- on

- ONE

- only

- operational

- Operations

- opportunities

- Opportunity

- Option

- or

- organization

- origin

- Other

- our

- out

- overseeing

- overview

- ownership

- palladium

- parties

- Partnership

- Pay

- payouts

- People

- percentage

- perception

- person

- personal

- Personalised

- Personally

- platform

- Platforms

- platinum

- plato

- Plato Data Intelligence

- PlatoData

- players

- poor

- portfolio

- portfolios

- position

- positive

- possible

- Posts

- potential

- Precious

- Precious Metals

- Predictions

- president

- Prices

- primarily

- prioritise

- prioritizing

- Problem

- problems

- process

- Product

- product market

- Products

- professional

- Profile

- Profit

- profitable

- propelling

- proud

- provide

- providing

- Pushing

- Quick

- quite

- Rate

- reached

- reaching

- realising

- receive

- recently

- recommend

- regularly

- rely

- remains

- Reporting

- reputable

- resource

- Resources

- responsibilities

- responsible

- REST

- retention

- revenue

- revolutionise

- revolves

- ripe

- Risk

- roadmap

- Role

- sale

- satisfied

- Scale

- Scholar

- SCIENCES

- seamlessly

- Second

- sector

- securing

- seen

- sell

- Selling

- served

- service

- Services

- serving

- Shares

- she

- shops

- should

- showing

- Silver

- skills

- small

- smarter

- So

- Social

- social media

- social media platforms

- Solutions

- SOLVE

- Solves

- some

- Someone

- sometimes

- sought

- Stability

- stakeholders

- standalone

- start

- startup

- Startups

- States

- Status

- staying

- stock

- stock trading

- Stocks

- Story

- Strategic

- strategies

- Strategist

- Strategy

- streamlined

- stress

- subsidiary

- Successfully

- Take

- taking

- Talk

- Target

- taught

- Taxes

- team

- Technology

- terms

- Testing

- that

- The

- their

- Them

- themselves

- then

- These

- they

- thing

- think

- Thinking

- this

- those

- thought

- thought leaders

- Thrive

- Through

- time

- Title

- to

- today’s

- together

- Ton

- too

- tools

- top

- towards

- Tracking

- traction

- Trading

- traditional

- transfers

- Transferwise

- Transparency

- transparent

- travel

- treatment

- Trends

- tried

- true

- trusted

- two

- Ultimately

- Uncertainty

- underserved

- United

- United States

- university

- unlimited

- unlock

- Updates

- us

- use

- user-friendly

- users

- Valuable

- value

- very

- Veterans

- vice

- Vice President

- Video

- wants

- was

- washington

- we

- Website

- websites

- What

- when

- whether

- which

- while

- WHO

- why

- will

- with

- within

- wonderful

- Work

- work together

- working

- worth

- would

- years

- yet

- You

- Your

- youtube

- zephyrnet