- During the Bitcoin Spot ETF announcement, Bitcoin’s price experienced a significant rise, approaching $49,000, marking a substantial high since 2021.

- According to CoinPedia, Bitcoin’s price may experience a bearish period, as seen recently.

- On Jan 12, Arkham intelligence data showed that the Grayscale Bitcoin Trust sent over 894 BTC to Coinbase in a single transaction and another 2,605 BTC to other wallets.

The 2024 crypto market has kickstarted with a buzz and promise of great value. In the past few weeks, the crypto market has witnessed the approval of the world’s first Bitcoin Depositary Receipts and Bitcoin Spot ETFs. These milestones have expanded the reach of the crypto market to other investors with lower risks. Since then, the entire industry went into a frenzy with investors streaming in.

The approval came at a pivotal point after the storm of 2023. The hurdles of the 2023 crypto market almost shut down the franchise, with regulatory bodies tightening their grip on anything converting cryptocurrency. The market faced complete oblivion, with top crypto exchanges like Binance, Kraken, and Coinbase facing numerous legal battles with the US SEC.

With the approval of the Bitcoin Sot ETFs, many have pegged their hope in Bitcoin, surpassing its initial high of $69k to reach $ 100k. The promise of glory has lured many potential buyers, but not many hold the same notion.

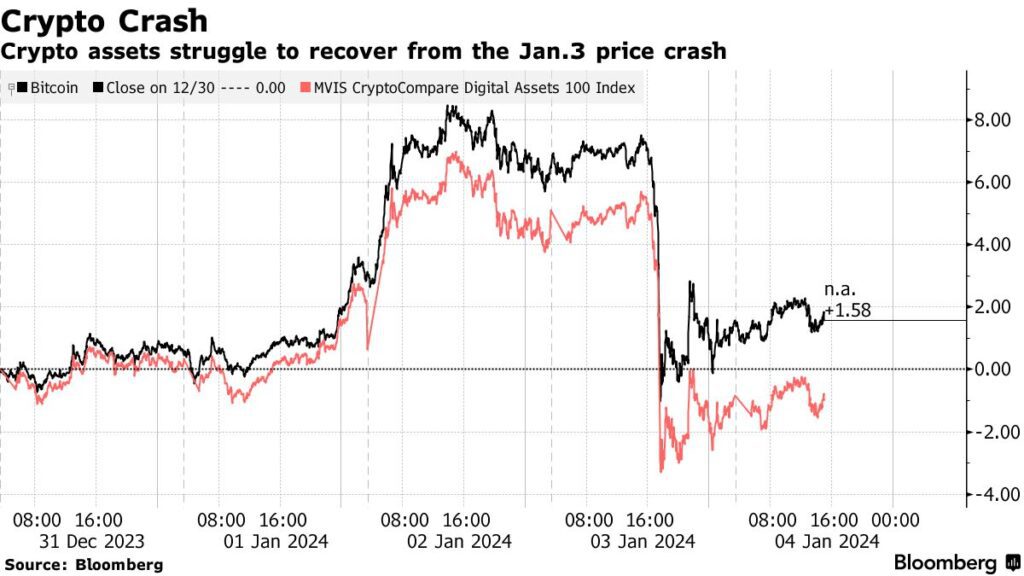

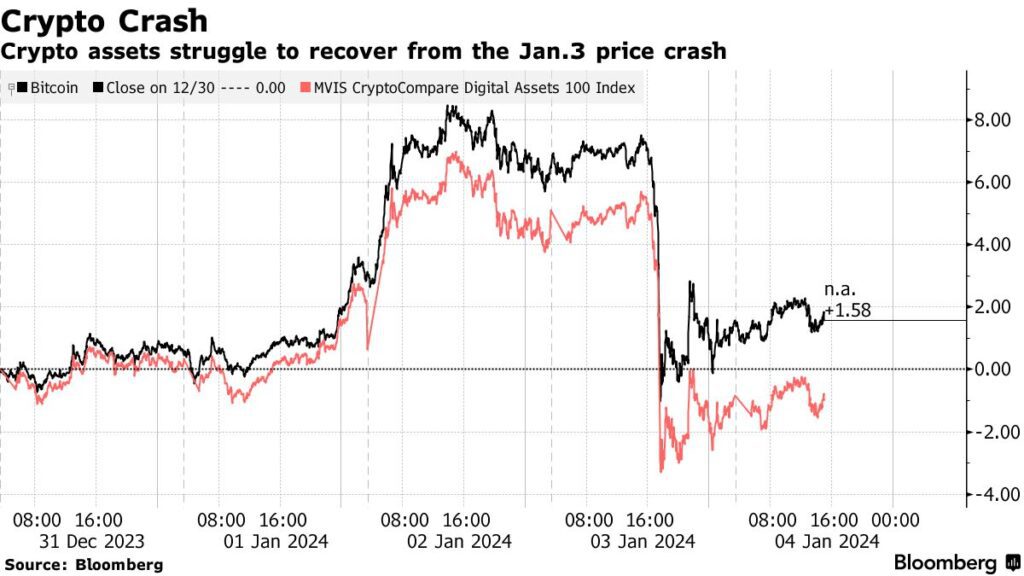

According to several experts, the Bitcoin ETFs will eventually cause a crypto price crash for the first few months before the industry picks up. In addition, since then, Bitcin’s price has effectively shot down.

Looming Danger of Crypto Price Crash

The 2024 crypto market kicked off with a surprisingly positive turn, with Bitcoin surpassing and surpassing its $40,000 mark. The anticipated Bitcoin Halving caused significant rage within the market. This, as expected, influenced the altcoin, causing the market valuation to increase exponentially.

The news of the BTC DRs also spared new opportunities for investors to participate in the market with little risk. Although the anticipated Bitcoin Spot ETFs were among the key players. It would allow advertisers to expose clients to Bitcoin in a wrapper they are most comfortable with.

The Bitcoin Spot EFTs allow products to directly own Bitcoin with minimal risk and experience the benefits of other ETF structures. Top heads such as Paul Cappelli of Galaxy Asset Management and Dave LaValle from Grayscale Investments have positively spoken about the potential effects of the ETFs on the market, hinting at a possible rise in Bitcoin Price.

Also, Read Bitcoin Spot ETF Proposals Get Green Signal from US SEC after X Hacking Drama.

Unfortunately, the expectations and analysts haven’t aligned with reality. During the Bitcoin Spot ETFs, Bitcoin’s price experienced a significant rise, approaching $49,000, marking a substantial high since 2021. This feat coincided with the kickstart of the sports ETF trading, but soon after, Bitcoin’s Price dipped. Many within the community merely saw this as an ordinary occasion given to the market, but concern has been raised since its value has yet to show any positive outcomes. By Friday evening, Bitcoin’s price had dropped from $43,413 to $42,632.

Bitcoin Price has showcased an unexpected downward trend causing worry within the community.[Photo/Medium]

At the time of writing, Bitcoin’s price stands at $42,660. Currently, over $90 million worth of Bitcoin positions are liquidated, according to CoinGlass. This included $76 million in long positions and over $14 million in shorts. It also became a concern since almost $30 million of long liquidations occurred on Friday.

Fortunately, the reduction in Bitcoin’s price has yet to affect other altcoins. For instance, Ethereum has experienced a noticeable issue as investors appreciate the potential introduction of EThreum Spot ETFs. BlackRock CEO Larry Fink expressed optimism about a likely Ether ETF, stating that it would be possible with Ethereum’s increased value.

The possibility of a crypto price crash with the ETFs

The Bitcoin Spot ETF approval introduced many investors into the 2024 crypto market. Top corporates such as VanEck, Bitwise, Fidelity, Franklin, Valkyrie, Hashdex, Ark Invest, Grayscale, Blackrock, Wisdom Tree, and Invesco Galaxy could eventually redefine the market.

Unfortunately, according to experts, the consistent rise of Bitcoin’s price may be a long way ahead. Instead, the community should brace for a brief crypto price crash during the first few weeks of the Spot ETF offering. According to CoinPedia, Bitcoin’s price may experience a bearish period, as seen recently. The primary cause of this brief crypto price crash could be a strong pump into the news.

This triggers a phenomenon well known by the stock market as buying the rumour & selling the news rally. This rally will incline many new traders to enter the market, while expert traders who initially invested in Bitcoin previously will now opt to sell them.

A prime example occurred on Jan 12, when Arkham intelligence data showed that the Grayscale Bitcoin Trust sent over 894 BTC to Coinbase in a single transaction and another 2,605 BTC to other wallets in three other separate transactions in three other wallets in individual transactions. According to Coinbase, the amount represented $41 million in outflows, while the raining outfits presented an additional $119 million.

Unfortunately, Bitcoin’s price broke through the $48,000 resistance; hence, it will showcase a downward trend for some time. According to Hayes, the chief investment officer of family office Maelstrom and the former chief executive of the bitcoin derivatives pioneer exchange BitMex predicted a substantial drop in prices. Hayes stated that the Bitcoin price could crash between 20% and 30% due to “a dollar liquidity rug pull.”

Also, Read Bitcoin Surge Ignites Remarkable Rebound in NFT Sales for December 2023.

He said, “Bitcoin initially will decline sharply with the broader financial markets but will rebound before the Fed meeting. That is because bitcoin is the only neutral reserve hard currency not a liability of the banking system and is traded globally.“

Experts have claimed that the crypto price crash will be temporary but still hold hope for long-term expectations. The Bitcoin Halving is still an anticipated event, so the price may recover then.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://web3africa.news/2024/01/16/news/crypto-price-crash-bitcoin-etfs/

- :has

- :is

- :not

- $UP

- 000

- 100k

- 12

- 2021

- 2023

- 2024

- 33

- 7

- a

- About

- According

- addition

- Additional

- advertisers

- affect

- After

- ahead

- aligned

- allow

- almost

- also

- Altcoin

- Altcoins

- Although

- among

- amount

- an

- Analysts

- and

- Announcement

- Another

- Anticipated

- any

- anything

- appreciate

- approaching

- approval

- ARE

- Ark

- ark invest

- AS

- asset

- asset management

- At

- Banking

- banking system

- battles

- BE

- bearish

- became

- because

- been

- before

- benefits

- between

- binance

- Bitcoin

- bitcoin derivatives

- Bitcoin halving

- Bitcoin Price

- Bitcoin spot etf

- Bitcoin Trust

- BitMEX

- Bitwise

- BlackRock

- bodies

- broader

- Broke

- BTC

- but

- buyers

- Buying

- by

- came

- Cause

- caused

- causing

- ceo

- chief

- Chief Executive

- claimed

- clients

- coinbase

- coincided

- Coinpedia

- comfortable

- community

- complete

- Concern

- consistent

- converting

- corporates

- could

- Crash

- crypto

- Crypto Exchanges

- Crypto Market

- Crypto Price

- cryptocurrency

- Currency

- Currently

- DANGER

- data

- Dave

- December

- Decline

- Depositary

- Derivatives

- directly

- Dollar

- dollar liquidity

- down

- downward

- Drop

- dropped

- due

- during

- effectively

- effects

- Enter

- Entire

- ETF

- etf offering

- ETFs

- Ether

- ethereum

- Ethereum's

- evening

- Event

- eventually

- example

- exchange

- Exchanges

- executive

- expanded

- expectations

- expected

- experience

- experienced

- expert

- experts

- exponentially

- expressed

- faced

- facing

- family

- family office

- feat

- Fed

- few

- fidelity

- financial

- First

- For

- For Investors

- Former

- Fortunately

- franchise

- franklin

- frenzy

- Friday

- from

- Galaxy

- get

- given

- Globally

- glory

- Grayscale

- Grayscale Bitcoin Trust

- Grayscale investments

- great

- Green

- hacking

- had

- Halving

- Hard

- HASHDEX

- Have

- he

- heads

- hence

- High

- hold

- hope

- HTML

- HTTPS

- Hurdles

- ignites

- in

- included

- Increase

- increased

- individual

- industry

- influenced

- initial

- initially

- instance

- instead

- Intelligence

- into

- introduced

- Introduction

- Invesco

- Invest

- invested

- investment

- Investments

- Investors

- issue

- IT

- ITS

- Jan

- jpg

- Key

- kickstarted

- known

- Kraken

- Larry Fink

- launch

- Legal

- liability

- like

- likely

- LIQUIDATED

- liquidations

- Liquidity

- little

- Long

- long-term

- looms

- lower

- management

- many

- mark

- Market

- Markets

- marking

- max-width

- May..

- merely

- Milestones

- million

- minimal

- months

- most

- Neutral

- New

- news

- NFT

- nft sales

- Notion

- now

- numerous

- occasion

- occurred

- of

- off

- offering

- Office

- Officer

- on

- only

- opportunities

- Optimism

- ordinary

- Other

- outcomes

- outflows

- over

- own

- participate

- past

- Paul

- pegged

- period

- phenomenon

- Picks

- pioneer

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- players

- Point

- positions

- positive

- positively

- possibility

- possible

- potential

- predicted

- presented

- previously

- price

- Price Crash

- Prices

- primary

- Prime

- Products

- promise

- Proposals

- pump

- Rage

- raised

- rally

- reach

- Reality

- rebound

- receipts

- recently

- Recover

- redefine

- reduction

- regulatory

- remarkable

- represented

- Reserve

- Resistance

- Rise

- Risk

- risks

- rug pull

- Said

- sales

- same

- saw

- SEC

- seen

- sell

- Selling

- sent

- separate

- several

- shorts

- shot

- should

- show

- showcase

- showcased

- showed

- shut

- Shut down

- Signal

- significant

- since

- single

- So

- some

- soon

- spoken

- Sports

- Spot

- spot etf

- stands

- stated

- stating

- Still

- stock

- stock market

- Storm

- streaming

- strong

- structures

- substantial

- such

- surge

- surpassing

- system

- temporary

- that

- The

- the Fed

- their

- Them

- then

- These

- they

- this

- three

- Through

- tightening

- time

- to

- top

- traded

- Traders

- Trading

- transaction

- Transactions

- tree

- Trend

- true

- Trust

- TURN

- Unexpected

- us

- US Sec

- VALKYRIE

- Valuation

- value

- VanEck

- Volatility

- Wallets

- Way..

- Weeks

- WELL

- went

- were

- when

- while

- WHO

- will

- wisdom

- with

- within

- witnessed

- world’s

- worry

- worth

- would

- writing

- X

- Yahoo

- yet

- zephyrnet