Over the last week, the world’s largest cryptocurrency has been consolidating in the $62K-$63K range. We have been also hearing a lot of institutional and regulatory talk around Bitcoin post the launch of the first Bitcoin futures ETF in the United States.

As per data from Glassnode, Bitcoin HODLers have been strong holding their BTC supplies. The illiquid supply for Bitcoin has touched a record high of 14.52 million.

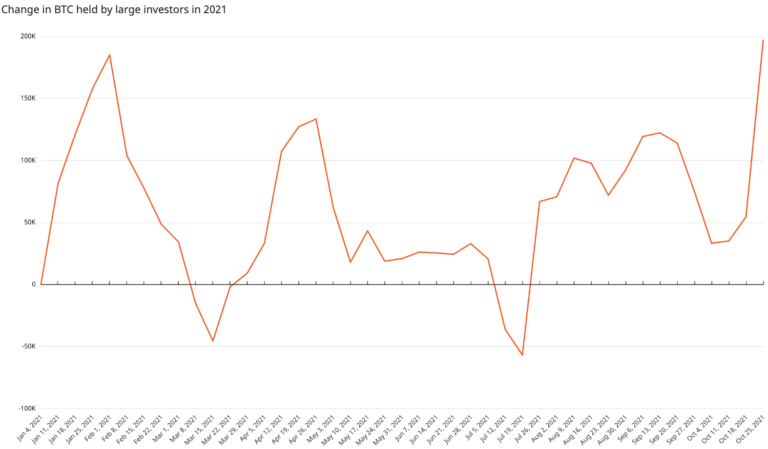

This happens as the Bitcoin whales have been gobbling up major supplies. As per the recent Chainlaysis report, Bitcoin whales have bought 142,000 BTC over the last week. The report further notes that whale addresses with over 1,000 BTC are holding the highest supply in the entire 2021.

As we can see in the above chart, whales were holdings 185,000 BTC earlier in February but sold during the May period when BTC was around its all-time high levels. But during the last week of October, the BTC whales added a staggering 142,000 BTC taking the total holdings to above 200,000.

Furthermore, the Bitcoin address activity has also skyrocketed over the last week. Over the last five days, over 1 million active addresses have been interacting on the Bitcoin blockchain network.

#Bitcoin has had 5 straight days (excluding historically slow weekends) of over 1M active addresses interacting on the $BTC network. This rise is an encouraging sign that another #AllTimeHigh can inevitably be tested. https://t.co/UMESL7Iy72 pic.twitter.com/yyVNXa1yf6

— Santiment (@santimentfeed) November 4, 2021

U.S. Congressman Advocates for Spot Bitcoin ETF

Just as the U.S. Securities and Exchange Commission (SEC) has become somewhat comfortable with the Bitcoin Futures ETF, the demand for spot Bitcoin ETF is growing. Interestingly, this time it’s coming from two U.S. Congressmen, Tom Emmer (MN-06) and Darren Soto (FL-09). The two Congressmen sent letters to SEC chairman Gary Gensler requesting the same.

Today I sent a letter to @GaryGensler with my @blockcaucus co-chair @RepDarrenSoto about Bitcoin ETFs. It doesn’t make sense that Bitcoin futures ETFs are allowed to trade but Bitcoin spot ETFs are not. pic.twitter.com/k1WTF0HA0U

— Tom Emmer (@RepTomEmmer) November 3, 2021

In the letter to the SEC, the congressmen wrote:

“We question why, if you are comfortable allowing trading in an ETF based on derivatives contracts, you are not equally or more comfortable allowing trading to commence in ETFs based on spot Bitcoin. Bitcoin spot ETFs are based directly on the asset, which inherently provides more protection for investors.”

The recent demand for spot Bitcoin ETF coming from lawmakers might accelerate the process of approval. Just like Bitcoin, the demand for Ethereum Futures ETF is also growing.

- 000

- active

- All

- Allowing

- around

- asset

- Bitcoin

- Bitcoin ETF

- Bitcoin Futures

- bitcoin whales

- blockchain

- BTC

- Bull Run

- chainalysis

- chairman

- coming

- commission

- content

- contracts

- cryptocurrencies

- cryptocurrency

- data

- Demand

- Derivatives

- Emmer

- ETF

- ETFs

- ethereum

- exchange

- financial

- First

- For Investors

- Futures

- Glassnode

- Growing

- High

- Hodlers

- hold

- HTTPS

- Institutional

- investing

- Investors

- IT

- launch

- lawmakers

- major

- Market

- market research

- million

- network

- Opinion

- protection

- range

- regulatory

- report

- research

- Run

- SEC

- Securities

- Securities and Exchange Commission

- sense

- Share

- sold

- Spot

- States

- supply

- time

- trade

- Trading

- u.s.

- U.S. Securities and Exchange Commission

- United

- United States

- week