Coinbase’s IPO marked the top for Bitcoin at nearly $65,000 on April 14th, 2021 and then the cryptocurrency markets went into a three month correction – some speculate even a bear market, although BTC is showing signs of recovery, trading back over $40k this week.

That IPO followed the ‘buy the rumor, sell the news’ pattern – excitement and marketing hype over Coinbase listing on the Nasdaq and what it could mean for investor confidence in cryptocurrency drove the Bitcoin price higher in anticipation, which then corrected as swing traders took profit on the day.

Robinhood IPO July 29th

US broker Robinhood Markets Inc are known for their easy-to-use trading app that allows retails investors to buy stocks, ETFs, Gold, options and cryptocurrencies, commission-free and without requiring a large amount of capital. Their mission statement is to ‘democratize finance’ away from Wall street and open it up to beginning traders.

The California based financial services company has seen several hundred percent growth in revenue despite controversy, facing fines and lawsuits and angering some retail traders over halting trading during the Gamestop short squeeze popularized on Reddit.

Robinhood CEO Vlad Tenev and co-founder Baiju Bhatt are also under investigation for not being licensed by the Financial Industry Regulatory Authority (FINRA). Forbes analyst Peter Cohan cites this as one reason not to buy Robinhood stock.

Robinhood’s IPO – initial public offering – is expected tomorrow on July 29th and the company will allocate a larger than average amount of its shares – up to 35% – for investors to buy. Volatility is expected.

Buy or Sell HOOD Stocks?

If we review the Coinbase IPO, the price had a blow-off top on opening day pumping to over $400 a share, before retracing but closing the day green.

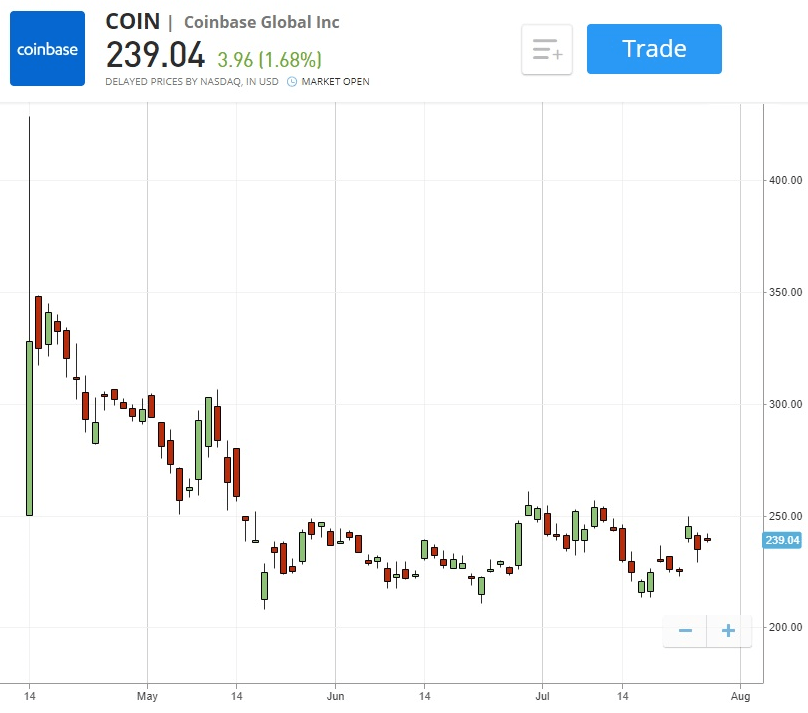

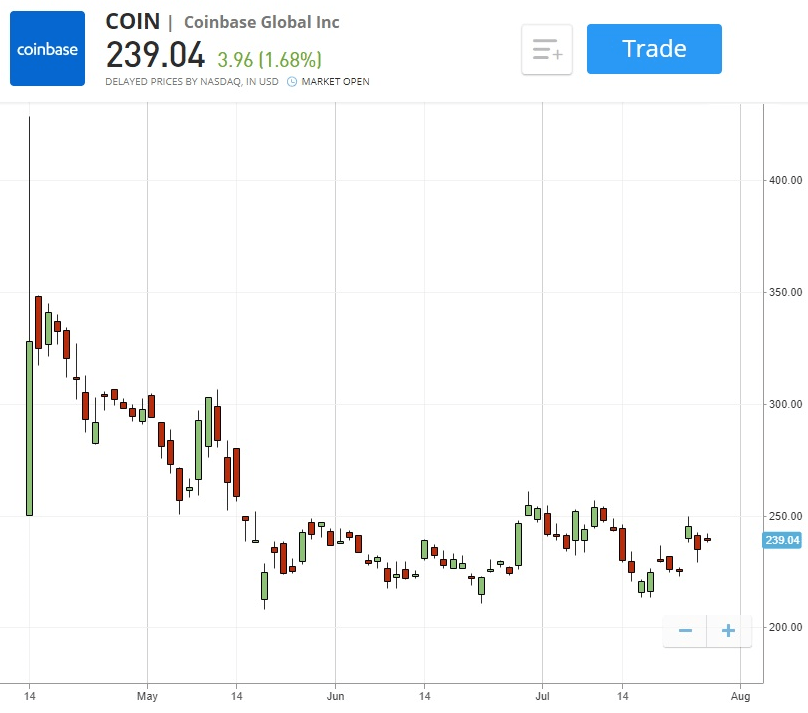

COIN share price on eToro

Then the share price sold off over the following weeks. Its ticker COIN is now trading at below the reference price of $250 set during the IPO – where at first it found support to bounce 20% but later became resistance.

Cryptocurrency traders will recognise this chart pattern as similar to many new altcoin listings on Binance. As a long-term investment the Coinbase stock price will likely recover but it shows the risks of FOMOing into an IPO on listing day without a stoploss or not taking profit when already up 60%.

Whether or not we’ll see a similar price spike and then downtrend for HOOD stock is yet to be seen but the volatility could present good scalp opportunities to both long and short for experienced traders. The HOOD price is set to open at around $38 – $42 per share.

How to Buy HOOD Shares

You can buy shares in HOOD stock on exchanges like eToro or speculate on the price of HOOD shares using contracts for difference (CFD) on platforms such as Plus500 and Capital.com. CFD trading allows you to speculate on the price action without having to own the underlying asset.

eToro is the easiest platform to deposit funds onto and use for beginner traders and includes an education section explaining how to short stocks at up to 5x leverage. You can also copytrade profitable traders who will be watching the Robinhood IPO tomorrow.

67% of retail investor accounts lose money. Invest responsibly.

Source: https://insidebitcoins.com/news/robinhood-ipo-buy-or-short

- 000

- Action

- Altcoin

- app

- April

- around

- asset

- Bear Market

- Bitcoin

- Bitcoin Price

- broker

- BTC

- buy

- california

- capital

- ceo

- Co-founder

- Coin

- coinbase

- company

- confidence

- contracts

- controversy

- cryptocurrencies

- cryptocurrency

- day

- Education

- ETFs

- etoro

- Exchanges

- facing

- financial

- financial services

- First

- For Investors

- Forbes

- funds

- Gold

- good

- Green

- Growth

- How

- How To

- HTTPS

- industry

- investigation

- investment

- investor

- Investors

- IPO

- IT

- July

- large

- learning

- Leverage

- listing

- Listings

- Long

- Market

- Marketing

- Markets

- Mission

- money

- Nasdaq

- offering

- open

- Options

- Pattern

- platform

- Platforms

- present

- price

- Profit

- public

- Recover

- recovery

- retail

- revenue

- review

- Robinhood

- sell

- Services

- set

- Share

- Shares

- Short

- Signs

- sold

- Statement

- stock

- Stocks

- street

- support

- top

- Traders

- Trading

- Volatility

- Wall Street

- week

- WHO