The Bitcoin community celebrated the 13th year since Satoshi Nakamoto published the Whitepaper that will birth the first decentralized monetary network with its own native asset, BTC. In that time, the cryptocurrency has increased its value to trillions of dollars and it’s finally being embraced as a hedge against central banking and its consequences.

Related Reading | How A Coinbase User Lost $11.6 Million 10 Minutes After Bitcoin Purchase

Analyst John Street Capital explored the Bitcoin race to the top as one of the most profitable assets of the past decade with a $1.15 Trillion in market cap. Since the Whitepaper was launched, the network has processed $1.7 billion in transactions with a value estimated at $6.9 Trillion.

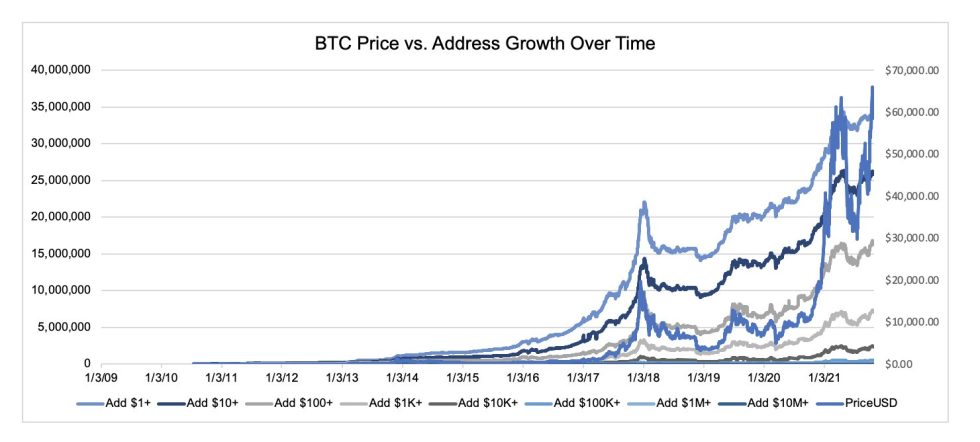

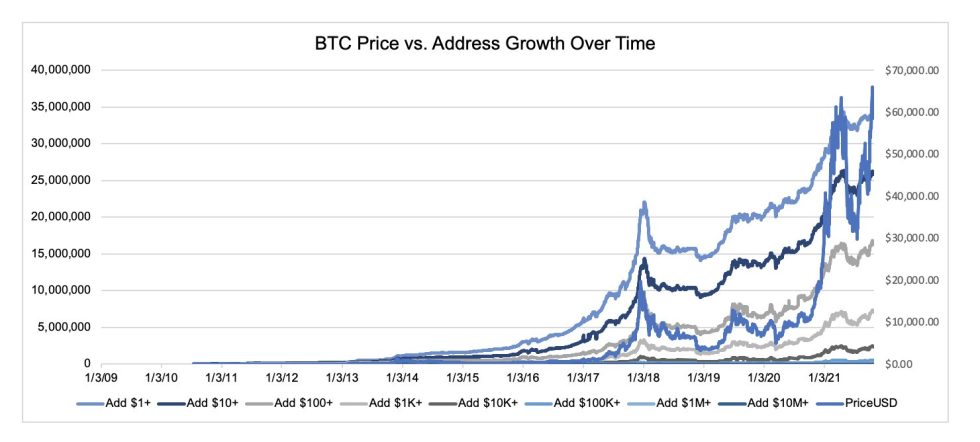

In total, the Bitcoin network has over 35 million addresses with a fund value of at least $1. The benchmark cryptocurrency has a 21 million total supply, one of its biggest lures to investors, with 18.86 million (89.8%) BTC already mine and in the market.

As seen below, the Bitcoin network started to grow in terms of active addresses in 2017. At the moment, the cryptocurrency went on a rally that took its price from $1,000 at the beginning of that year to $20,000 by the end.

Later, Bitcoin went into a multi-year bear market ranging around $10,000. In the meantime, the crypto industry benefited from Bitcoin and the surge of altcoins, companies, and platforms were created setting the ground for the coming wave of adoptions.

Related Reading | Regulated Bitcoin Futures In LatAm: Argentina Considers Proposal

Bitcoin And The Year Of The Black Swan

In 2020, with the COVID-19 pandemic and the central bank policies enforce to stop its consequences on the economy, Bitcoin rose to a new all-time high. From that year’s low at $4,000 to recently $67,000, the network has been embraced by the greatest minds in investment and finances.

Paul Tudor Jones, Ray Dalio, and Stan Druckenmiller have compared it to gold and called it a hedge against inflation. Tesla, MicroStrategy, and other companies around the world introduced BTC to their balance sheet in an effort to protect the value of their shares. The analyst added:

What will the next 13 years hold for $BTC? The white paper is 8 pages long + 8 references written by an anonymous contributor posted to a cypherpunk mailing list. There was $0 VC funding raised, $0 marketing dollars spent, 0 patents filed, & yet trillions of $ of value has been created.

Upon its return to price discovery, as Street Capital noted, Bitcoin closed its best month since Q4, 2020 with a 40.3% return. In that sense, the analyst expects Bitcoin to maintain its upwards momentum in November, a month that has historically yielded a median return of 8.8% for BTC’s price.

This prediction could extend into the unforeseeable future as the world enters a seemingly inflationary stage. During this period even central banks will need to consider owning Bitcoin in hopes of surviving and keeping their currencies afloat.

Related Reading | Regulated Bitcoin Futures In LatAm: Argentina Considers Proposal

At the time of writing, BTC’s price trades at $63,212 with a 2.1% profit in the daily chart.

- &

- 000

- 2020

- 7

- 9

- active

- Altcoins

- analyst

- Argentina

- around

- asset

- Assets

- Bank

- Banking

- Banks

- Bear Market

- Benchmark

- BEST

- Biggest

- Billion

- Bitcoin

- Bitcoin BTC

- Bitcoin Futures

- Black

- BTC

- BTCUSD

- capital

- Central Bank

- Central Banks

- closed

- coinbase

- coming

- community

- Companies

- considers

- COVID-19

- COVID-19 pandemic

- crypto

- Crypto Industry

- cryptocurrency

- currencies

- decentralized

- discovery

- dollars

- economy

- Enters

- expects

- Finally

- Finances

- First

- fund

- funding

- future

- Futures

- Gold

- Grow

- High

- hold

- How

- HTTPS

- industry

- inflation

- investment

- Investors

- IT

- keeping

- List

- Long

- Market

- Market Cap

- Marketing

- million

- Momentum

- network

- numbers

- Other

- pandemic

- Paper

- Patents

- Platforms

- policies

- prediction

- price

- Profit

- profitable

- protect

- Race

- rally

- ray dalio

- Reading

- Satoshi

- Satoshi Nakamoto

- sense

- setting

- Shares

- Stage

- started

- street

- supply

- surge

- Tesla

- the world

- time

- top

- trades

- Transactions

- trillions

- value

- VC

- VC funding

- Wave

- white paper

- Whitepaper

- world

- writing

- year

- years