The Canadian dollar has weakened on Tuesday. In the North American session, USD/CAD is trading at 1.3517, up 0.48%.

Inflation drops, retail sales mixed

Canada’s inflation rate dropped in January. Headline inflation dropped to 5.9%, compared to 6.3% in December and below the 6.1% estimate. The core rate, which is considered a more reliable indicator, fell to 5.0%, down from 5.4% in December and below the 5.5% estimate.

The Bank of Canada will no doubt be pleased with this data. The BoC raised the cash rate last month by 25 basis points to 4.5% and signalled that it would keep rates on hold as long as inflation slowed in accordance with its forecast. The blowout January employment report of 150,000 new jobs raised market expectations of another rate hike this year to 100%, but that has now dropped to 80% due to the favourable inflation report.

Inflation has been coming down faster in Canada than in the US and the BoC is optimistic that the downturn will continue. The BoC is projecting inflation to fall to 3% by mid-2023 and decline to the Bank’s 2% target by the end of 2023. If inflation continues to fall at a rapid clip, the Bank will be able to hold rates. This is in sharp contrast to the US, where the buzz-word has been ‘higher for lower’. Last week, Goldman Sachs and the Bank of America revised their rate forecasts upwards, saying they expect the Fed to hike rates three more times this year due to lingering inflation and a strong labour market.

Canada’s retail sales report for December was mixed. Headline retail sales rose 0.5% m/m, above the December release of zero and the forecast of 0.2%. The core rate slipped to -0.6%, following -0.5% in December and shy of the forecast of -0.1%.

.

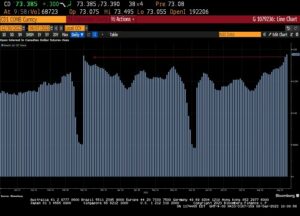

USD/CAD Technical

- There is resistance at 1.3320 and 1.3429

- 1.3583 and 1.3692 are the next resistance lines

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.marketpulse.com/20230221/canadian-dollar-dips-on-lower-inflation/

- 000

- 1

- 2%

- 2012

- 2023

- a

- Able

- above

- advice

- affiliates

- All

- Alpha

- america

- American

- analysis

- analyst

- and

- Another

- article

- author

- authors

- Bank

- Bank of America

- bank of canada

- based

- basis

- below

- BoC

- Box

- broad

- buy

- Canada

- Canadian

- Canadian Dollar

- Cash

- COM

- coming

- Commodities

- compared

- considered

- continue

- continues

- contrast

- contributor

- Core

- CORPORATION

- could

- Covers

- daily

- data

- December

- Decline

- deposited

- Directors

- Dollar

- doubt

- down

- DOWNTURN

- dropped

- Drops

- employment

- Equities

- estimate

- expect

- expectations

- experienced

- Fall

- faster

- Fed

- financial

- Financial Market

- Focus

- following

- Forecast

- forex

- from

- fundamental

- funds

- General

- goldman

- Goldman Sachs

- headline

- High

- highly

- Hike

- hold

- HTTPS

- in

- Including

- Indicator

- inflation

- inflation rate

- information

- investing

- investment

- Israel

- IT

- January

- Jobs

- Keep

- Labour

- Last

- Long

- lose

- major

- Market

- MarketPulse

- Markets

- max-width

- mixed

- Month

- more

- necessarily

- New

- next

- North

- officers

- online

- Opinions

- Optimistic

- plato

- Plato Data Intelligence

- PlatoData

- pleased

- points

- Posts

- publications

- published

- purposes

- raised

- range

- rapid

- Rate

- Rate Hike

- Rates

- release

- reliable

- report

- Resistance

- retail

- Retail Sales

- Risk

- ROSE

- Sachs

- sales

- Securities

- seeking

- Seeking Alpha

- sell

- session

- several

- sharing

- sharp

- since

- solution

- strong

- suitable

- Target

- The

- the Fed

- their

- this year

- three

- times

- to

- Trading

- Tuesday

- upwards

- us

- USD/CAD

- week

- which

- will

- Work

- would

- year

- You

- Your

- zephyrnet

- zero