- CZ has agreed to step down after pleading guilty to breaking US AML laws as part of a $4.3 billion settlement.

- According to CoinMarketCap, Binance has a daily trading volume of $14 billion with over 90 million customers worldwide.

- CZ will personally pay $50 million, one of US history’s most significant corporate penalties.

The entirety of the crypto market has showcased its resilience in the past few months. The FTX crash almost brought the entire industry to its knees. Still, the market has positively turned with several crypto titans’ intervention and crypto traders’ resilience.

Unfortunately, despite Bitcoin regaining its lost value and blockchain technology becoming more mainstream, the aftermath still affects the industry. Several regulatory bodies like the US SEC have rained down numerous crypto lawsuits. Their efforts to safeguard their ecosystems have adversely affected its crypto environment.

The US SEC targeted Ripple, Kraken Coinbase, and even Binance. Unfortunately, today, many crypto-based organizations have fled the US crypto market, stating that the efforts of the US SEC have shifted from protecting against crypto scams and hacks to controlling the very concept of cryptocurrency.

In recent developments, Changpeng Zhao has pleaded guilty to Violating US Anti-Money Laundering requirements and has repeatedly stepped down as the CEO of Binance. Unfortunately, this news has rattled the entire crypto ecosystem, and many are questioning the credibility of custodial exchanges. However, the bigger question is: what will happen to Binance? How will this revelation affect the upcoming Bull run and the crypto market?

Changpeng Zhao pleads guilty and resigns from Binance.

After the FTX crash, it became clear that custodial or centralized exchange poses a more significant threat than we initially thought. It highlighted how introducing a centralized entity onto the crypto market can potentially be a leeway for illegal activity. Thus, to prevent a similar scenario, regulatory bodies from different regions tightened their grip on AML laws and regulatory frameworks surrounding crypto-based organizations.

However, the US SEC has hogged the spotlight as it overturned its region’s crypto ecosystems. Since the beginning of the year, the US SEC has filed numerous crypto lawsuits against exchanges exhibiting slight misconduct. Unfortunately, the vague crypto laws within the nation worsened its state, forcing many crypto-changes to succumb to the pressure and adhere to their will or shut down their US-based operations. The regulatory body did not discriminate on size or influence and ensured all would adhere to their laws, even crypto titans like Kraken, Coinbase, Ripple, and Binance.

For some time, Binance engaged in a fierce legal battle with the US SEC, which claimed that the crypto titan had engaged in several money-laundering activities. This news hogged the spotlight for some time as Binance soon became the beacon of hope representing the entire industry as it battled centralized governmental control. Unfortunately, things took a drastic turn of events on November 22 as Changpend Zhao, the CEO and Founders of the top crypto exchange, pleaded guilty to the charge.

Also, Read Binance reports $652 million Bitcoin withdrawal: Details.

According to the report, CZ has agreed to step down after pleading guilty to breaking US AML laws as part of a $4.3 billion settlement. This agreement has officially closed the year-long probe on the world’s largest crypto exchange, proving how centralized exchanges pose much danger to the ecosystems.

According to the Justice Department, Binance did not have the protocols to report the transactions for money laundering risks. Regarding the heightened anonymity cryptocurrency embraces, this was sure to attract plenty of criminals to the platform. Fortunately, the Department of Justice struck a deal with Changpeng Zhao to ensure the continued operation of Binance. According to the deal, CZ will personally pay $50 million, one of US history’s most significant corporate penalties. In addition, he will pay a $200 million fine and may face a maximum sentence of 10 years in prison.

According to the court’s decision, the US Department of Justice charged Binance with money laundering sanctions violations and conspiracy to conduct an unlicensed money-trading business. As part of CZ’s confession, he added that Binance had failed to prevent and report any suspicious transaction made by terrorist organizations like Hamas’ al-Qassam Brigades, the Islamic State, and al Qaeda.

In addition, the investigations revealed that Binance allowed transactions with more than $890 million involving customers in Iran, a country the US imposed strict financial sanctions on. It also revealed that Binance sanctioned transactions between US users and counterparts in other sanctioned jurisdictions like Cuba, Syria, and illegally occupied regions of Ukraine.

US Treasury Secretary Janet Yellen said, “Binance turned a blind eye to its legal obligations in pursuing profit. Its willful failures allowed money to flow to terrorists, cybercriminals, and child abusers through its platform. Today’s historic penalties and monitorship to ensure compliance with US law and regulations mark a milestone for the virtual currency industry.”

What does Changpeng Zhao’s resignation mean for the industry?

In his defense, CZ claimed he prioritized Binance’s growth and profits over compliance with stern US laws. He attested that the company operated in a grey zone but did not regret his actions. According to the court proceeding, asking for forgiveness rather than permission was better.

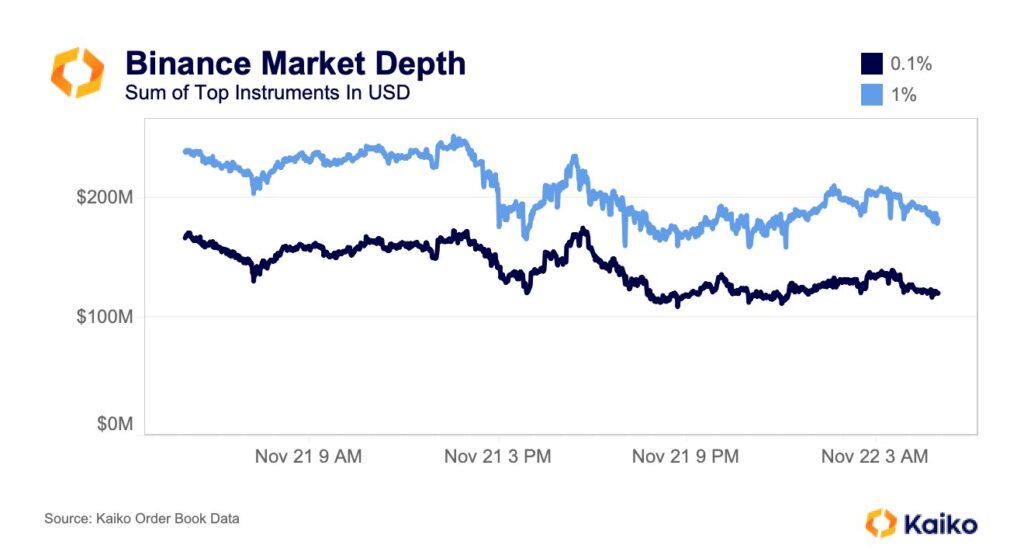

Binance Liquidity Tanks After U.S. Settlement, Creating Challenging Trading Conditions.[Photo/CoinDesk]

Despite his good-natured effort to secure Binance’s future, it may have grave effects on the crypto markets. For instance, Binance was the rival to the infamous FTX, and during its collapse, it was through their intervention that the market eventually survived. Unfortunately, this big reveal further proves the claims of the US SEC.

Also, Read Binance cryptocurrency exchange faces payment processing issues and limits withdrawals in Europe.

Custodial exchanges rose to bridge the gap between traditional and decentralized systems. It’s through the effects of these exchanges that web3 increased over the years. Today, organizations like Coinbase significantly propelled the adoption rate of crypto payment gateways. In addition, their efforts and technology have led to the widespread adoption of blockchain-based systems.

Unfortunately, CZ pleading guilty has shifted the perspective on centralized exchanges. Binance currently holds the largest supply of Bitcoin. If the industry were to disappear suddenly, it would be the end of the crypto industry literally. According to CoinMarketCap, Binance has a daily trading volume of $14 billion with over 90 million customers worldwide.

Its closest competitor is Coinbase, with a total trading volume of only $2 billion. In a nutshell, it would take the combined efforts of Coinbase, Kraken, Bybit, OKX, KuCoin, Bitget, and Gate.io to generate a trading volume that rivals Binance’s.

Hence, if Binance were to shut down its operation or follow in FTX’s footsteps, it would end the market overnight.

Furthermore, since CZ has proven the US SEC’s suspicions, Amy will question the integrity of centralized exchanges. The market may experience a similar mass withdrawal rate if nothing is done.

Binance says, “We are sorry.”

Changpeng Zhao has made it clear that he did what he did to secure the future of Binance, but it’s time to let it go. In a recent post, he said, “Binance is no longer a baby. It is time for me to let it walk and run. I know Binance will continue to grow and excel with its deep bench.“

In response to the fiasco, Binance has publicly apologized and stated it will face the consequences of its previous actions. The company released a statement claiming, “While Binance is not perfect, it has strived to protect users since its early days as a small startup and has made tremendous efforts to invest in security and compliance. Binance grew extremely fast globally and made misguided decisions along the way. Today, Binance takes responsibility for this last chapter.“

Binance has agreed to follow any verdict the US Department of Justice takes and will try to improve its system to prevent a similar occurrence.

Also, Read Binance Labs invested in Xterio to develop AI-integrated web3 games.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://web3africa.news/2023/11/22/news/changpeng-zhao-pleads-guilty/

- :has

- :is

- :not

- 10

- 22

- a

- According

- actions

- activities

- activity

- added

- addition

- adhere

- Adoption

- adversely

- affect

- affected

- After

- aftermath

- against

- agreed

- Agreement

- AL

- All

- allowed

- almost

- along

- also

- AML

- amy

- an

- and

- Anonymity

- anti-money laundering

- any

- ARE

- AS

- asking

- attract

- Baby

- Battle

- BE

- beacon

- became

- becoming

- Beginning

- Better

- between

- Big

- bigger

- Billion

- binance

- Bitcoin

- Bitget

- blockchain

- blockchain technology

- blockchain-based

- bodies

- body

- Breaking

- BRIDGE

- brought

- bull

- Bull Run

- business

- but

- by

- Bybit

- CAN

- centralized

- centralized exchange

- Centralized Exchanges

- ceo

- challenging

- Changpeng

- Changpeng Zhao

- Chapter

- charge

- charged

- child

- claimed

- claiming

- claims

- clear

- closed

- coinbase

- CoinMarketCap

- Collapse

- combined

- company

- competitor

- compliance

- concept

- conditions

- Conduct

- Consequences

- Conspiracy

- continue

- continued

- control

- controlling

- Corporate

- counterparts

- country

- Court

- Crash

- Creating

- Credibility

- Criminals

- crypto

- Crypto ecosystem

- Crypto Ecosystems

- crypto exchange

- Crypto Industry

- crypto laws

- Crypto Lawsuits

- Crypto Market

- Crypto Markets

- crypto payment

- crypto scams

- crypto-based

- cryptocurrency

- Cryptocurrency Exchange

- Currency

- Currently

- custodial

- custodial exchanges

- Customers

- cybercriminals

- CZ

- CZ’s

- daily

- daily trading

- DANGER

- Days

- deal

- decentralized

- decision

- decisions

- deep

- Defense

- Department

- department of justice

- Despite

- develop

- developments

- DID

- different

- disappear

- does

- done

- down

- during

- Early

- ecosystem

- Ecosystems

- effects

- effort

- efforts

- Embraces

- end

- engaged

- ensure

- ensured

- Entire

- entirety

- entity

- Environment

- Europe

- Even

- events

- eventually

- Excel

- exchange

- Exchanges

- Exhibiting

- experience

- extremely

- eye

- Face

- faces

- Failed

- failures

- FAST

- few

- fierce

- filed

- financial

- Financial Sanctions

- fine

- flow

- follow

- For

- forcing

- Forgiveness

- Fortunately

- founders

- frameworks

- from

- FTX

- ftx crash

- further

- future

- gap

- gate

- gate.io

- gateways

- generate

- Globally

- Go

- governmental

- grew

- Grow

- Growth

- guilty

- hacks

- had

- happen

- Have

- he

- heightened

- Highlighted

- his

- historic

- holds

- hope

- How

- However

- HTTPS

- i

- if

- Illegal

- illegally

- imposed

- improve

- in

- In other

- increased

- industry

- infamous

- influence

- initially

- instance

- integrity

- intervention

- introducing

- Invest

- invested

- Investigations

- involving

- Iran

- Islamic

- Islamic State

- issues

- IT

- ITS

- jurisdictions

- Justice

- Justice Department

- Know

- Kraken

- Kucoin

- Labs

- largest

- Largest Crypto

- Last

- Laundering

- Law

- Laws

- Lawsuits

- Led

- Legal

- let

- like

- limits

- Liquidity

- longer

- lost

- made

- Mainstream

- many

- mark

- Market

- Markets

- Mass

- max-width

- maximum

- May..

- me

- mean

- milestone

- million

- misguided

- money

- Money Laundering

- months

- more

- most

- much

- nation

- news

- no

- nothing

- November

- numerous

- Nutshell

- obligations

- occurrence

- of

- Officially

- OKX

- on

- ONE

- only

- onto

- operated

- operation

- Operations

- or

- organizations

- Other

- over

- overnight

- part

- past

- Pay

- payment

- payment processing

- perfect

- permission

- Personally

- perspective

- platform

- plato

- Plato Data Intelligence

- PlatoData

- pleads

- Pleads Guilty

- Plenty

- pose

- poses

- positively

- Post

- potentially

- pressure

- prevent

- previous

- prioritized

- prison

- probe

- processing

- Profit

- profits

- propelled

- protect

- protecting

- protocols

- proven

- proves

- proving

- publicly

- question

- Rate

- rather

- Read

- recent

- regarding

- regions

- regret

- regulations

- regulatory

- released

- REPEATEDLY

- report

- Reports

- representing

- Requirements

- Resignation

- resilience

- response

- responsibility

- reveal

- Revealed

- revelation

- Ripple

- risks

- Rival

- rivals

- ROSE

- Run

- s

- Said

- Sanctioned

- Sanctions

- says

- scams

- scenario

- SEC

- secretary

- secure

- security

- sentence

- settlement

- several

- shifted

- showcased

- shut

- Shut down

- significant

- significantly

- similar

- since

- Size

- small

- some

- soon

- Spotlight

- startup

- State

- stated

- Statement

- stating

- Step

- Still

- Strict

- supply

- sure

- Surrounding

- Survived

- suspicious

- Syria

- system

- Systems

- Take

- takes

- Tanks

- targeted

- Technology

- terrorist

- terrorists

- than

- that

- The

- The Future

- their

- These

- things

- this

- thought

- threat

- Through

- Thus

- time

- titan

- titans

- to

- today

- today’s

- took

- top

- Total

- Trading

- trading volume

- traditional

- transaction

- Transactions

- treasury

- tremendous

- true

- try

- TURN

- Turned

- u.s.

- Ukraine

- unfortunately

- upcoming

- us

- US Department of Justice

- US Sec

- users

- value

- Verdict

- very

- Violating

- Violations

- Virtual

- virtual currency

- volume

- walk

- was

- Way..

- we

- Web3

- were

- What

- which

- widespread

- will

- with

- withdrawal

- Withdrawals

- within

- world’s

- worldwide

- would

- Xterio

- year

- years

- zephyrnet

- Zhao