- The press release of the recently concluded China’s Politburo meeting consisted of a more expansionary tone such as the implementation of “counter-cyclical” measures.

- A dovish tilt is now being priced in by interest rates futures after yesterday’s FOMC meeting. Based on the CME FedWatch tool, the odds have increased to bring forward the expected first Fed Funds rate cut to March 2024 from May/June 2024.

- This latest set of dovish expectations on the future path of the Fed’s monetary policy has negated the prior steep depreciation of the yuan against the US dollar.

- Short-term positive animal spirits have been revived in China equities, and its proxies (the Hang Seng Indices) ex-post Politburo & FOMC.

The market’s reaction so far has been positive in terms of risk-on behaviour toward China equities and their proxies (Hang Seng Index, Hang Seng TECH Index & Hang Seng China Enterprises Index) ex-post press release on the outcome of the July’s Politburo meeting that concluded on Monday, 24 July after the close of the Asian session as well as yesterday’s ex-post US central bank, Federal Reserve’s FOMC meeting on its interest rate policy.

The Politburo is a top decision-making body led by President Xi that set key economic policy agenda for China, and Monday’s meeting set the agenda for the coming months to implement expansionary policies to address the current weak internal demand environment. It vowed to implement a counter-cyclical policy to boost consumption, more support for the property market, and ease local government debt.

The share prices of China ADR listed in the US stock exchanges have a remarkable intraday performance on Monday, 24 July US session. China’s Big Tech such as Alibaba (BABA), and Baidu (BIDU) ended the US session with gains of around 5%. A basket of China stocks listed as exchange-traded funds in the US soared as well, the KranShares CSI China Internet ETF (KWEB), and Invesco Golden Dragon China ETF (PGJ) rallied by +4.5% and +4% respectively, notched their best single day return since May 2023.

Even though the press release lacks the details of the implementation of upcoming fiscal stimulus measures (again), and refrains from enacting major stimulus measures that increase the risk of debt overhang in the property sector, it is the choice of words, and tonality used that sparked the risk-on behaviour. Firstly, President Xi’s key phrase on China’s housing market, houses are for living, not for speculation” has been omitted for the first since mid-2019” which suggests that more leeway to negate the ongoing weakness in houses prices such as easing home buying restrictions in major cities such as Shanghai and Beijing.

Secondly, the term “counter-cyclical” measures are being emphasized which suggests that boosting domestic demand takes priority over infrastructure spending. Given the heightened risk of a deflationary spiral taking shape in China and a “liquidity trap” situation where more accommodative monetary policy may lead to lesser marginal economic growth, the key solution to break the adverse deflationary spiral and its liquidity trap aftereffects is to shore up consumer confidence via expanding domestic demand actively.

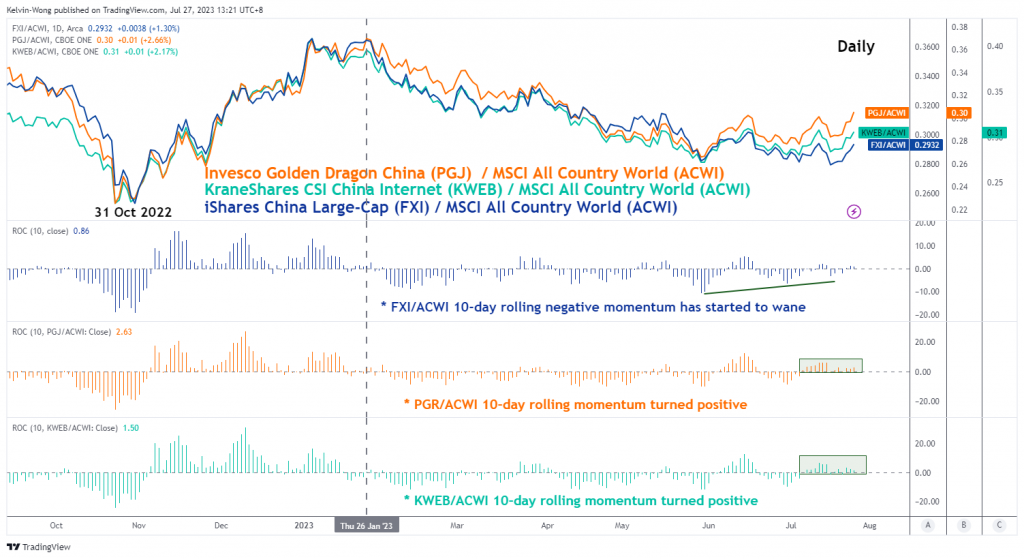

Outperformance of China ADR exchange-traded funds supported by a stronger yuan

Fig 1: Relative momentum of China ADRs ETFs vs. MSCI All Country World ETF of 26 Jul 2023 (Source: TradingView, click to enlarge chart)

Overall, short-term sentiment seems to have turned bullish for China equities where China ADR ETFs have outperformed major US benchmark US stock indices on a month-to-date horizon as of yesterday, 26 July 2023; the KranShares CSI China Internet ETF (KWEB), and Invesco Golden Dragon China ETF (PGJ) gained by +12% and +13.14% respectively over S&P 500 (+2.61%), and MSCI All Country World Index ETF (+2.97%).

Also, yesterday’s Fed Chair Powell ex-post FOMC press conference indicated that the Fed will be data-dependent in deciding whether to pause or hike the Fed Funds rate at its next FOMC meeting on 20 September. This implies that the Fed is likely not in a mode of raising interest rates at every other meeting after yesterday’s expected 25 basis points hike to bring the Fed Funds rate to a 22-year high at 5.25% to 5.50%.

Markets seem to be pricing in a more dovish tilt on the expected start of the first Fed Funds rate cut. Based on the CME FedWatch tool derived from the 30-day Fed Funds futures pricing data, the odds have increased for the first expected cut to occur on the 20 March 2024 FOMC meeting with a combined probability of 56.07%. Previously, before yesterday’s FOMC, higher odds for the expected first-rate cut were clustered between the 1 May and 19 June 2024 FOMC meetings.

The current dovish tilt on the expected future trajectory of the Fed Funds rate has negated further upside yield premium of the US’s 2-year Treasury note over China’s 2-year sovereign bond. Since Monday, 24 Jul, the yield premium has narrowed by 11 bps to 2.75% from 2.86% as of today at this time of the writing which in turn supported the yuan from a further deprecation against the US dollar.

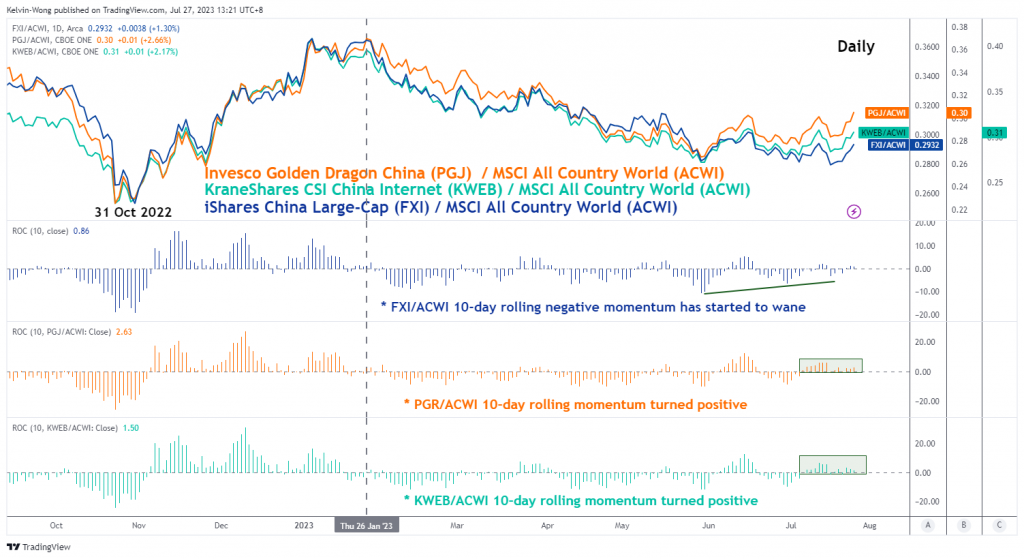

USD/CNH (offshore yuan) remained below its 20-day moving average

Fig 2: USD/CNH medium-term trend as of 27 Jul 2023 (Source: TradingView, click to enlarge chart)

The yuan has started to strengthen against the US dollar in the short-term horizon since last Thursday, 20 July which in turn created a positive feedback loop back that reinforces the bullish sentiment towards China equities. The USD/CNH (offshore yuan) has failed to break above its 20-day moving average, acting as a key intermediate resistance at 7.2160 with a bearish momentum reading seen on its daily RSI oscillator.

Hence, further potential weakness in the USD/CNH is likely to be able to kickstart short-term uptrend phases for China equities and its proxies.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.marketpulse.com/indices/china-equities-maintain-short-term-bullish-momentum-ex-post-politburo-fomc/kwong

- :has

- :is

- :not

- :where

- ][p

- $UP

- 1

- 11

- 15 years

- 15%

- 19

- 20

- 2023

- 2024

- 24

- 25

- 26%

- 27

- 500

- 7

- 700

- a

- Able

- About

- above

- access

- acting

- actively

- addition

- address

- ADRs

- adverse

- advice

- affiliates

- After

- again

- against

- agenda

- Alibaba

- All

- an

- Analyses

- analysis

- and

- animal

- any

- ARE

- around

- AS

- asian

- At

- author

- authors

- avatar

- average

- award

- back

- Baidu

- Bank

- based

- basis

- basket

- BE

- bearish

- Bearish Momentum

- been

- before

- Beijing

- being

- below

- Benchmark

- BEST

- between

- Big

- big tech

- body

- bond

- boost

- boosting

- Box

- Break

- bring

- Bullish

- business

- buy

- Buying

- by

- central

- Central Bank

- Chair

- Chart

- China

- Chinas

- choice

- Cities

- click

- Close

- CME

- COM

- combination

- combined

- coming

- Commodities

- concluded

- conducted

- Conference

- confidence

- Connecting

- consumer

- consumption

- contact

- content

- country

- courses

- created

- CSI

- Current

- Cut

- daily

- data

- day

- Debt

- Deciding

- Decision Making

- deflationary

- Demand

- Derived

- details

- Directors

- Dollar

- Domestic

- Dovish

- Dragon

- ease

- easing

- Economic

- Economic growth

- Economic policy

- Elliott

- emphasized

- enlarge

- enterprises

- Environment

- Equities

- ETF

- ETFs

- Every

- exchange

- exchange-traded

- exchange-traded funds

- Exchanges

- expanding

- expectations

- expected

- experience

- expert

- Failed

- far

- Fed

- Fed Chair

- Fed Chair Powell

- fed funds rate

- Federal

- Federal Reserve’s

- feedback

- financial

- Find

- First

- first-rate

- Fiscal

- flow

- FOMC

- For

- foreign

- foreign exchange

- forex

- Forward

- found

- from

- fund

- fundamental

- funds

- further

- future

- Futures

- gained

- Gains

- General

- given

- Global

- global markets

- Golden

- Government

- Growth

- Hang

- Hang Seng

- Have

- heightened

- High

- higher

- Hike

- Home

- horizon

- houses

- housing

- housing market

- HTTPS

- if

- implement

- implementation

- in

- Inc.

- Increase

- increased

- index

- indicated

- Indices

- information

- Infrastructure

- interest

- INTEREST RATE

- Interest Rates

- internal

- Internet

- Invesco

- investment

- IT

- ITS

- July

- june

- Kelvin

- Key

- Last

- latest

- lead

- Led

- lesser

- levels

- like

- likely

- Liquidity

- Listed

- living

- local

- Local Government

- Macro

- maintain

- major

- March

- March 2024

- Market

- market outlook

- market research

- MarketPulse

- Markets

- max-width

- May..

- measures

- meeting

- meetings

- Mode

- Momentum

- Monday

- Monetary

- Monetary Policy

- months

- more

- moving

- moving average

- MSCI

- necessarily

- news

- next

- now

- numerous

- Odds

- of

- officers

- on

- ongoing

- only

- Opinions

- or

- Other

- out

- Outcome

- Outlook

- over

- passionate

- path

- pause

- performance

- perspectives

- photo

- plato

- Plato Data Intelligence

- PlatoData

- please

- points

- policies

- policy

- positioning

- positive

- Posts

- potential

- Powell

- Premium

- president

- press

- Press Release

- previously

- Prices

- pricing

- Prior

- priority

- Produced

- property

- providing

- purposes

- raising

- Rate

- Rates

- reaction

- Reading

- recently

- reinforces

- relative

- release

- remained

- remarkable

- research

- Resistance

- respectively

- restrictions

- retail

- return

- Reversal

- Risk

- rsi

- rss

- S&P

- S&P 500

- sector

- Securities

- seem

- seems

- seen

- sell

- senior

- sentiment

- September

- service

- Services

- session

- set

- shanghai

- Shape

- Share

- share prices

- sharing

- short-term

- since

- Singapore

- single

- site

- situation

- So

- so Far

- soared

- solution

- Source

- sovereign

- sparked

- specializing

- Spending

- start

- started

- stimulus

- stock

- stock exchanges

- Stock markets

- Stocks

- Strategist

- Strengthen

- stronger

- such

- Suggests

- support

- Supported

- takes

- taking

- tech

- Technical

- Technical Analysis

- ten

- term

- terms

- that

- The

- the Fed

- The Future

- their

- this

- though?

- thousands

- thursday

- time

- to

- today

- TONE

- tool

- top

- toward

- towards

- Traders

- Trading

- TradingView

- Training

- trajectory

- treasury

- Trend

- TURN

- Turned

- unique

- upcoming

- Upside

- uptrend

- us

- US Central Bank

- US Dollar

- used

- using

- v1

- via

- Visit

- vs

- Wave

- weakness

- WELL

- were

- whether

- which

- will

- winning

- with

- wong

- words

- world

- would

- writing

- xi

- years

- yesterday

- Yield

- You

- Yuan

- zephyrnet