The Monetary Authority of Singapore (MAS) has officially rolled out the COSMIC platform, a digital initiative aimed at bolstering the defense against money laundering, terrorism financing, and the proliferation of weapons of mass destruction.

The system, which became operational today (1 April 2024), alongside the enforcement of the Financial Services and Markets (Amendment) Act 2023, enables the seamless exchange of customer information among financial institutions (FIs) on a global scale.

The introduction of COSMIC—short for Collaborative Sharing of Money Laundering/TF Information & Cases—follows the amendment of the Financial Services and Markets Act in May 2023.

This amendment established a legal and regulatory framework facilitating FIs to share critical customer data, but only under strict conditions. Such data sharing is contingent on the detection of specific, objectively-defined indicators of suspicious behavior or “red flags”.

With the primary objective of maintaining customer confidentiality while enabling FIs to alert each other about potential threats, the new system imposes stringent policies and operational safeguards.

This balance ensures the protection of legitimate customers’ interests while empowering FIs to effectively assess and mitigate risks associated with financial crimes.

COSMIC’s development was a collaborative effort between MAS and six of Singapore’s largest commercial banks, including DBS, OCBC, UOB, Citibank, HSBC, and Standard Chartered Bank.

These institutions will participate in the initial phase of the platform, which currently focuses on addressing three main risks: the misuse of legal entities, trade finance exploitation for illicit purposes, and proliferation financing.

Loo Siew Yee

Loo Siew Yee, Assistant Managing Director (Policy, Payments & Financial Crime), MAS, said,

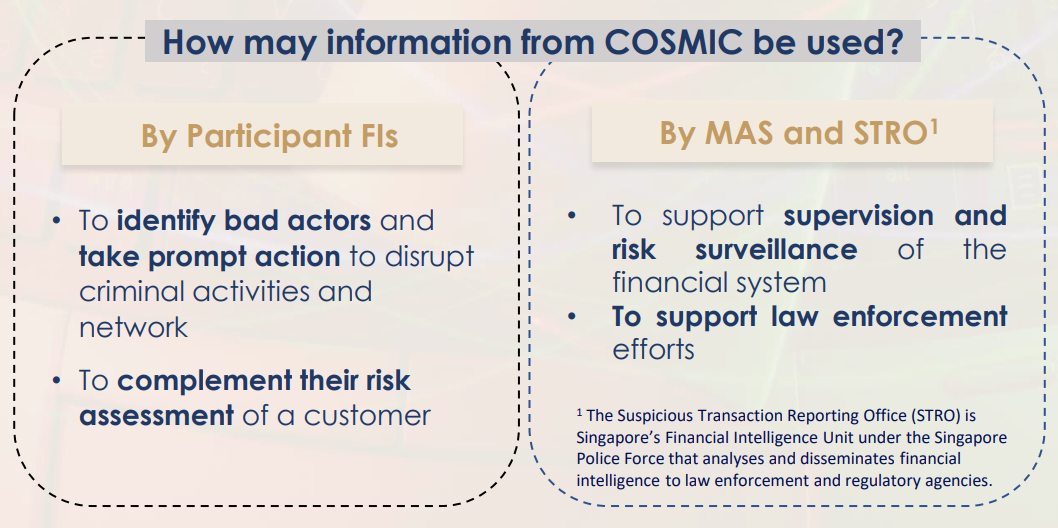

“COSMIC will enable FIs to warn each other of suspicious activities and make more informed risk assessments on a timely basis.

It complements the industry’s existing close collaboration with MAS and law enforcement authorities to combat financial crime. This will strengthen Singapore’s capabilities to uphold our reputation as a well-regulated and trusted financial centre.”

Lam Chee Kin

Lam Chee Kin, Group Head of Legal & Compliance, DBS said,

“With criminals getting more sophisticated, COSMIC is a game changer by providing banks, regulators, and law enforcement agencies the platform needed to share information in a very controlled and targeted manner and hence weed out bad actors more effectively.

COSMIC also complements our own financial surveillance capabilities, enabling us to triangulate risk signals faster, unravel networks and take swift actions. At the same time, we are mindful that legitimate customers should not be denied access to financial services and have worked closely with fellow participant banks and MAS on a set of guiding principles to ensure appropriate use of information derived from COSMIC.”

DBS added that it also sees potential for COSMIC to expand its coverage to include more types of financial crimes and involve a wider range of financial industry stakeholders.

This article was updated at 2.40pm to include DBS’ quote.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/93934/security/cosmic-platform-goes-live-in-singapore-to-combat-financial-crime/

- :has

- :is

- :not

- 1

- 10

- 150

- 2023

- 2024

- 250

- 300

- 7

- a

- About

- access

- Act

- actions

- activities

- actors

- added

- addressing

- against

- agencies

- aimed

- Alert

- alongside

- also

- amendment

- among

- and

- appropriate

- April

- April 2024

- ARE

- article

- AS

- assess

- assessments

- Assistant

- associated

- At

- author

- Authorities

- authority

- Bad

- Balance

- Bank

- Banks

- basis

- BE

- became

- begin

- behavior

- between

- bolstering

- but

- by

- capabilities

- caps

- centre

- Changer

- Chartered

- Citibank

- Close

- closely

- collaboration

- collaborative

- combat

- commercial

- compliance

- conditions

- confidentiality

- content

- controlled

- coverage

- Crime

- Crimes

- Criminals

- critical

- Currently

- customer

- customer data

- Customers

- data

- data sharing

- DBS

- Defense

- denied

- Derived

- Detection

- Development

- digital

- Director

- each

- effectively

- effort

- empowering

- enable

- enables

- enabling

- end

- enforcement

- ensure

- ensures

- entities

- established

- exchange

- existing

- Expand

- exploitation

- facilitating

- faster

- fellow

- finance

- financial

- financial crimes

- Financial institutions

- financial services

- financial-crime

- financing

- fintech

- Fintech News

- FIS

- focuses

- For

- form

- Framework

- from

- game

- game-changer

- getting

- Global

- global scale

- Goes

- Group

- guiding

- Have

- head

- hence

- High

- hottest

- HSBC

- HTTPS

- illicit

- in

- include

- Including

- Indicators

- industry

- industry’s

- information

- informed

- initial

- Initiative

- institutions

- interests

- Introduction

- involve

- IT

- ITS

- jpg

- Kin

- Lam

- largest

- Laundering

- Law

- law enforcement

- Legal

- legitimate

- live

- mailchimp

- Main

- Maintaining

- make

- managing

- Managing Director

- manner

- Markets

- MAS

- Mass

- max-width

- May..

- misuse

- Mitigate

- money

- Money Laundering

- Month

- more

- MS

- needed

- networks

- New

- news

- objective

- ocbc

- of

- Officially

- on

- once

- only

- operational

- or

- Other

- our

- out

- own

- participant

- participate

- payments

- phase

- platform

- plato

- Plato Data Intelligence

- PlatoData

- policies

- policy

- Posts

- potential

- primary

- principles

- protection

- providing

- purposes

- quote

- range

- Regulators

- regulatory

- reputation

- Risk

- risks

- Rolled

- safeguards

- Said

- same

- Scale

- seamless

- sees

- Services

- set

- Share

- share information

- sharing

- should

- signals

- Singapore

- Singapore’s

- SIX

- sophisticated

- specific

- stakeholders

- standard

- Standard Chartered

- Standard Chartered Bank

- Strengthen

- Strict

- stringent

- such

- surveillance

- suspicious

- SWIFT

- system

- Take

- targeted

- Terrorism

- terrorism financing

- that

- The

- this

- threats

- three

- time

- timely

- to

- today

- trade

- Trade Finance

- trusted

- types

- under

- unravel

- UOB

- updated

- Uphold

- us

- use

- very

- was

- we

- Weapons

- weed

- well-regulated

- which

- while

- wider

- will

- with

- worked

- Your

- zephyrnet