Crypto in Southeast Asia is increasingly popular among investors. The region is home to a complex financial landscape that’s characterized by a significant portion of the population being underbanked or unbanked, alongside a digitally-savvy youth demographic with high mobile Internet connectivity.

These dynamics set the stage for the burgeoning adoption of crypto-assets and decentralized finance (DeFi), hailed for their potential to enhance financial inclusion.

But despite the prospects, digital assets pose significant risks relating to volatility, liquidity and regulatory uncertainty, requiring regulators to establish proper rules and frameworks to mitigate those risks, all the while fostering innovation in the financial sector, a new report by the Organisation for Economic Co-operation and Development (OECD), says.

The report, titled “The Limits of DeFi for Financial Inclusion: Lessons from ASEAN”, examines the limitations of DeFi and crypto-asset activity for the promotion of financial inclusion, providing examples from economies part of the Association of Southeast Asian Nations (ASEAN), and offering policy recommendations to foster digital innovation in finance but also mitigate associated risks.

Thailand, Philippines, and Vietnam among top global adopters of crypto assets

Recent data from blockchain intelligence startup Chainalysis reveals robust DeFi market activities in ASEAN, with Thailand, the Philippines, and Vietnam emerging as global leaders in crypto-asset adoption.

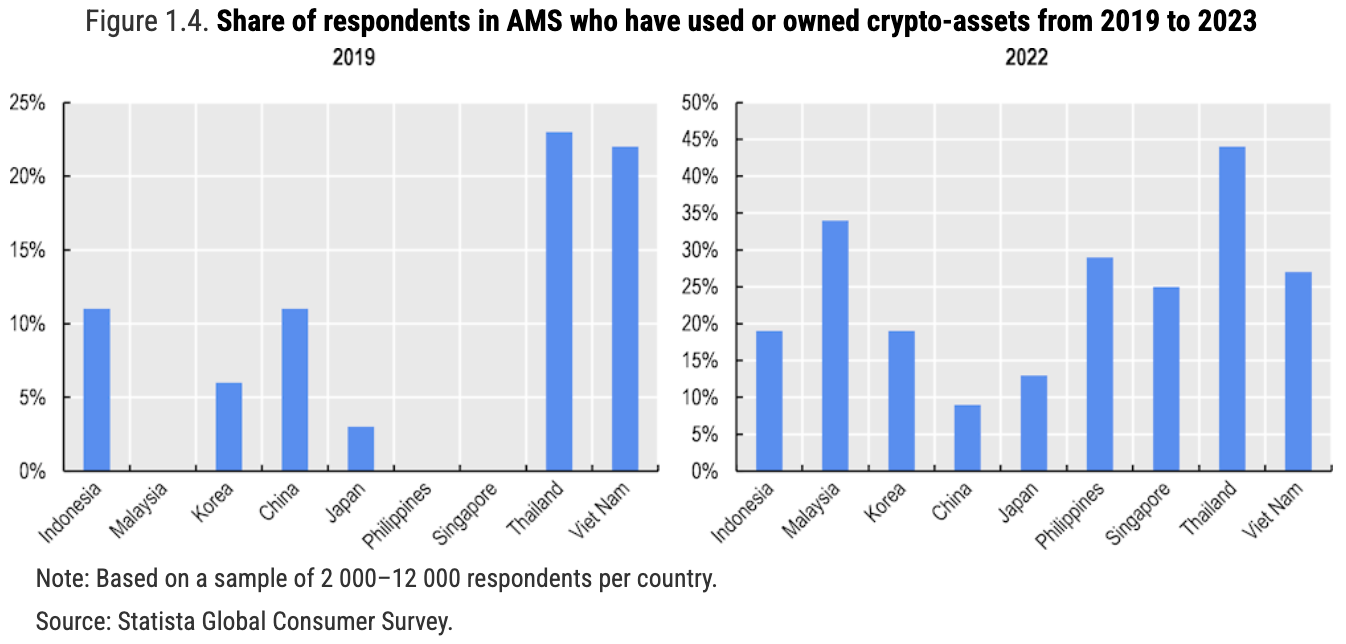

Surveys conducted by Statista further underscore the significant ownership and usage of crypto-assets among populations in Malaysia, Vietnam, and Thailand.

Share of respondents in ASEAN member states who have used or owned crypto-assets from 2019 to 2023, Source: The Limits of DeFi for Financial Inclusion: Lessons from ASEAN, OECD, Mar 2024

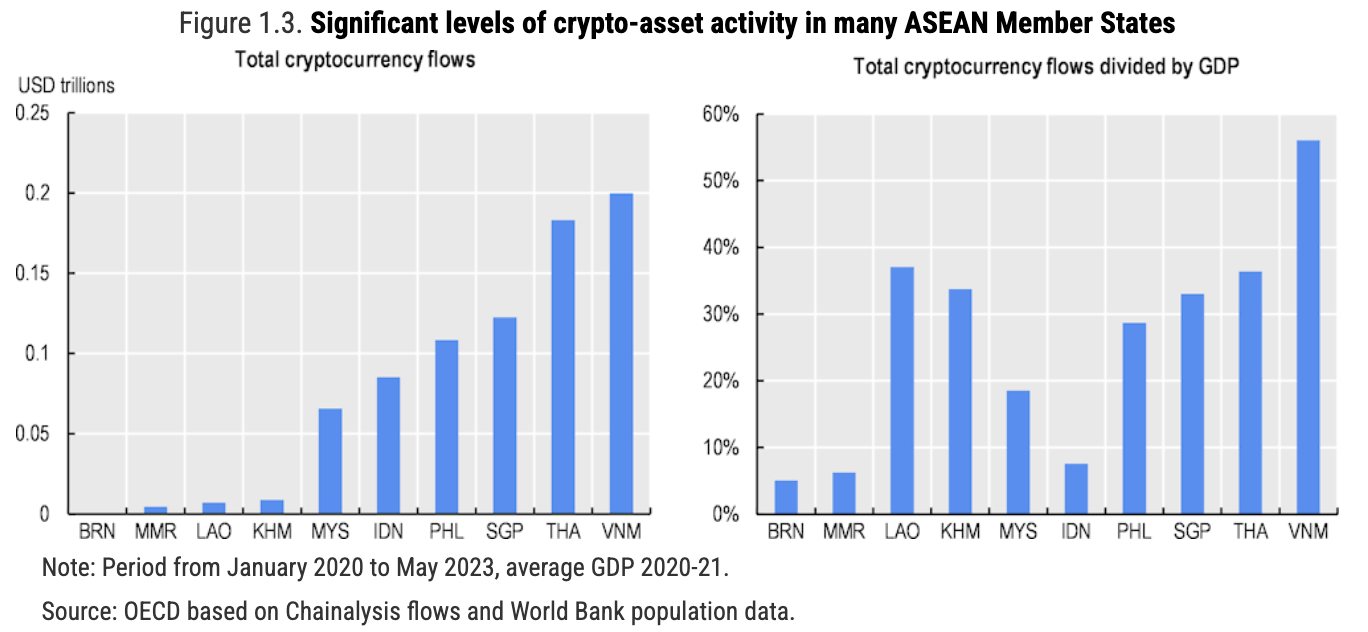

Sizable crypto-asset flows per capita have also been recorded in almost all ASEAN member states, but Vietnam received the largest amount of inflows for the 2020-2022 period with a total of US$190 billion in crypto-inflows.

Vietnam is followed by Thailand with US$180 billion, Singapore (US$120 billion), the Philippines (US$110 billion), and Indonesia (US$90 billion).

At the other end of the spectrum, Brunei, Myanmar, Cambodia and Lao recorded negligent crypto-asset flows during the period.

Crypto in Southeast Asia, Source: The Limits of DeFi for Financial Inclusion: Lessons from ASEAN, OECD, Mar 2024

Malaysia Leads ASEAN in Crypto Mining Activities

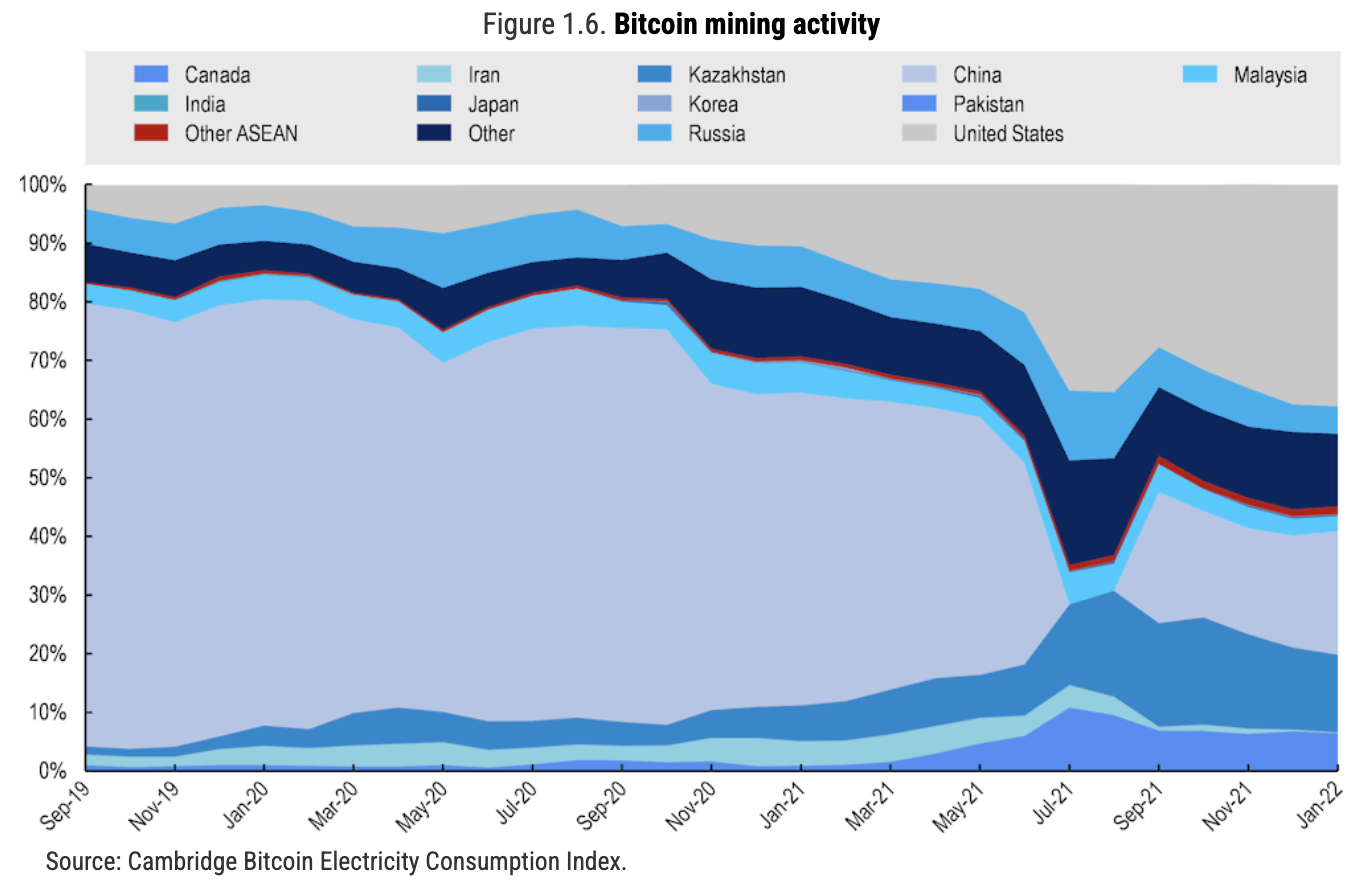

Data of crypto-asset mining activity has also been captured in 7 ASEAN member states, with the largest part of that activity taking place in Malaysia and some activity also taking place in Thailand.

Data from the Cambridge Bitcoin Electricity Consumption Index show that Malaysia accounted for 2.51% of global Bitcoin mining in January 2022, while Thailand accounted for 0.96%.

Bitcoin mining activity, Source: The Limits of DeFi for Financial Inclusion: Lessons from ASEAN, OECD, Mar 2024

Speculative behavior and professional investors dominates crypto-asset activity

The report also argues that although crypto-assets promise improved financial inclusion in Southeast Asia, these innovations have fallen short of their democratization goals, and have instead exposed retail investors to significant risks.

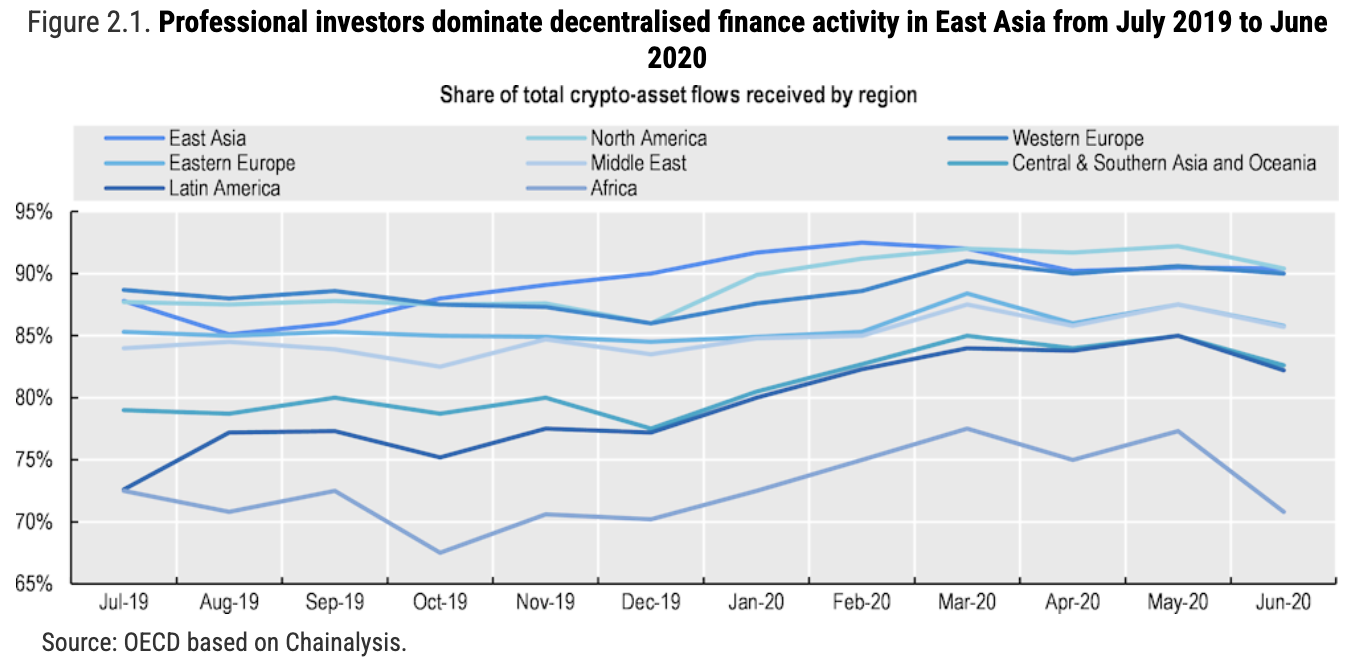

Currently, professional investors, including large holders of crypto-assets and institutional players, dominate DeFi activity globally, and retail participation remains marginal. Using transaction sizes as a proxy, the OECD report estimates that more than two-thirds of global crypto-asset activity is performed by professional and/or institutional investors in every main region.

Share of total crypto-asset flows received by region, Source: The Limits of DeFi for Financial Inclusion: Lessons from ASEAN, OECD, Mar 2024

Additionally, the report notes that the complexity of DeFi protocols and their non-custodial nature make these technologies practically difficult to use for retail participants, therefore unfit for financial inclusion purposes.

Moreover, crypto-asset activity is primarily driven by speculation, with investors attracted by the potential for outsized returns. The volatility and difficulty in valuing crypto-assets make them unsuitable for payments purposes, the report says.

Crypto-asset activity in ASEAN peaked in H2 2021, coinciding with high crypto-asset valuations and in line with global trends. Activity started subsiding in early 2022 at the onset of the so-called “crypto winter”, indicating that speculative forces are driving the market to a large extent.

Crypto-asset activity in ASEAN, Source: The Limits of DeFi for Financial Inclusion: Lessons from ASEAN, OECD, Mar 2024

Meanwhile, stablecoins, which are often praised for their potential in payments and international remittances, are primarily used in DeFi protocols as collateral rather than for their intended purposes. Furthermore, the stablecoin market is highly concentrated, with a few dominant players controlling a significant portion of the market.

Legal Status of Crypto in Southeast Asian Markets

Across ASEAN, policymakers have embraced digital innovation as a critical lever to accelerate economic development and gain a competitive edge. At the same time, policy efforts are underway in the region to address challenges stemming from particularly challenging and risky areas of digital finance, including crypto-assets and DeFi.

The report explores policy considerations regarding the rapidly evolving landscape of digital finance, highlighting the need to establish policy frameworks that carefully balance risks and opportunities. Innovation facilitators and regulatory sandboxes are possible ways for supervisors to stimulate innovation in finance in a controlled manner, it says.

The report also advises ASEAN policymakers to build institutional capacity and coordinate domestically and internationally to implement global policy frameworks effectively and for the supervision of crypto-asset and DeFi activity. International cooperation is crucial to prevent regulatory arbitrage and ensure consistency in regulatory outcomes.

Finally, the report notes that the harmonization of policy approaches to fintech in the ASEAN region could encourage cross-border activity and support innovation at the regional level. Particularly given the diverse level of institutional capacity in the region, more regional and international dialogue could help Southeast Asian countries tap into broader and deeper expertise and to develop policies and instruments that can best support domestic priorities.

Featured image credit: Edited from freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/93881/crypto/crypto-adoption-in-southeast-asia-is-on-the-rise/

- :has

- :is

- 1

- 2019

- 2021

- 2022

- 2023

- 2024

- 36

- 7

- 750

- 9

- 900

- a

- accelerate

- accounted

- activities

- activity

- address

- adopters

- Adoption

- All

- almost

- alongside

- also

- Although

- among

- amount

- and

- approaches

- arbitrage

- ARE

- areas

- Argues

- AS

- Asean

- asia

- asian

- Assets

- associated

- Association

- At

- attracted

- author

- Balance

- been

- begin

- behavior

- being

- BEST

- Billion

- Bitcoin

- Bitcoin mining

- blockchain

- Breakdown

- broader

- build

- burgeoning

- but

- by

- Cambodia

- cambridge

- CAN

- Capacity

- Capita

- caps

- captured

- carefully

- chainalysis

- challenges

- challenging

- characterized

- Chart

- Collateral

- competitive

- complex

- complexity

- Concentrated

- conducted

- Connectivity

- considerations

- consumption

- content

- controlled

- controlling

- cooperation

- coordinate

- could

- countries

- credit

- critical

- cross-border

- crucial

- crypto

- Crypto adoption

- crypto mining

- crypto-assets

- decentralized

- Decentralized Finance

- decentralized finance (DeFi)

- deeper

- DeFi

- DeFi Market

- DeFi protocols

- democratization

- demographic

- Despite

- develop

- Development

- dialogue

- difficult

- Difficulty

- digital

- Digital Assets

- Digital Finance

- digital innovation

- diverse

- Domestic

- domestically

- dominant

- Dominate

- dominates

- driven

- driving

- during

- dynamics

- Early

- Economic

- Economic Development

- economies

- Edge

- effectively

- efforts

- electricity

- embraced

- emerging

- encourage

- end

- enhance

- ensure

- establish

- estimates

- Every

- evolving

- Examines

- examples

- existing

- expertise

- explores

- exposed

- extent

- Fallen

- few

- finance

- financial

- financial inclusion

- Financial sector

- fintech

- Fintech News

- Flows

- followed

- For

- Forces

- form

- Foster

- fostering

- frameworks

- from

- further

- Furthermore

- Gain

- given

- Global

- Globally

- Goals

- Have

- help

- High

- highlighting

- highly

- holders

- Home

- hottest

- HTML

- HTTPS

- image

- implement

- improved

- in

- Including

- inclusion

- increasingly

- index

- indicating

- Indonesia

- inflows

- infographic

- Innovation

- innovations

- instead

- Institutional

- institutional investors

- institutional players

- instruments

- Intelligence

- intended

- International

- internationally

- Internet

- into

- Investors

- IT

- January

- jpg

- landscape

- large

- largest

- leaders

- Leads

- Lessons

- Level

- lever

- limitations

- limits

- Line

- Liquidity

- mailchimp

- Main

- make

- Malaysia

- manner

- mar

- Market

- max-width

- member

- Mining

- Mitigate

- Mobile

- Month

- more

- Myanmar

- Nations

- Nature

- Need

- New

- news

- non-custodial

- Notes

- OECD

- of

- offering

- often

- on

- once

- onset

- opportunities

- or

- organisation

- Other

- outcomes

- owned

- ownership

- part

- participants

- participation

- particularly

- payments

- per

- performed

- period

- Philippines

- Place

- plato

- Plato Data Intelligence

- PlatoData

- players

- policies

- policy

- policymakers

- Popular

- population

- populations

- portion

- pose

- possible

- Posts

- potential

- practically

- Praised

- prevent

- primarily

- professional

- promise

- promotion

- proper

- prospects

- protocols

- providing

- proxy

- purposes

- rapidly

- rather

- received

- recommendations

- recorded

- regarding

- region

- regional

- Regulation

- Regulators

- regulatory

- remains

- Remittances

- report

- respondents

- retail

- Retail Investors

- returns

- Reveals

- Rise

- risks

- Risky

- robust

- rules

- same

- sandboxes

- says

- sector

- set

- Share

- Short

- significant

- Singapore

- sizes

- some

- Source

- southeast

- Southeast Asia

- Spectrum

- speculation

- speculative

- stablecoin

- Stablecoins

- Stage

- started

- startup

- States

- Status

- stimulate

- supervision

- support

- taking

- Tap

- Technologies

- Thailand

- than

- that

- The

- The Philippines

- their

- Them

- therefore

- These

- those

- time

- to

- top

- Total

- transaction

- Trends

- two-thirds

- unbanked

- Uncertainty

- underbanked

- underscore

- Underway

- Usage

- use

- used

- using

- Valuations

- valuing

- Vietnam

- Volatility

- ways

- which

- while

- WHO

- with

- Your

- youth

- zephyrnet