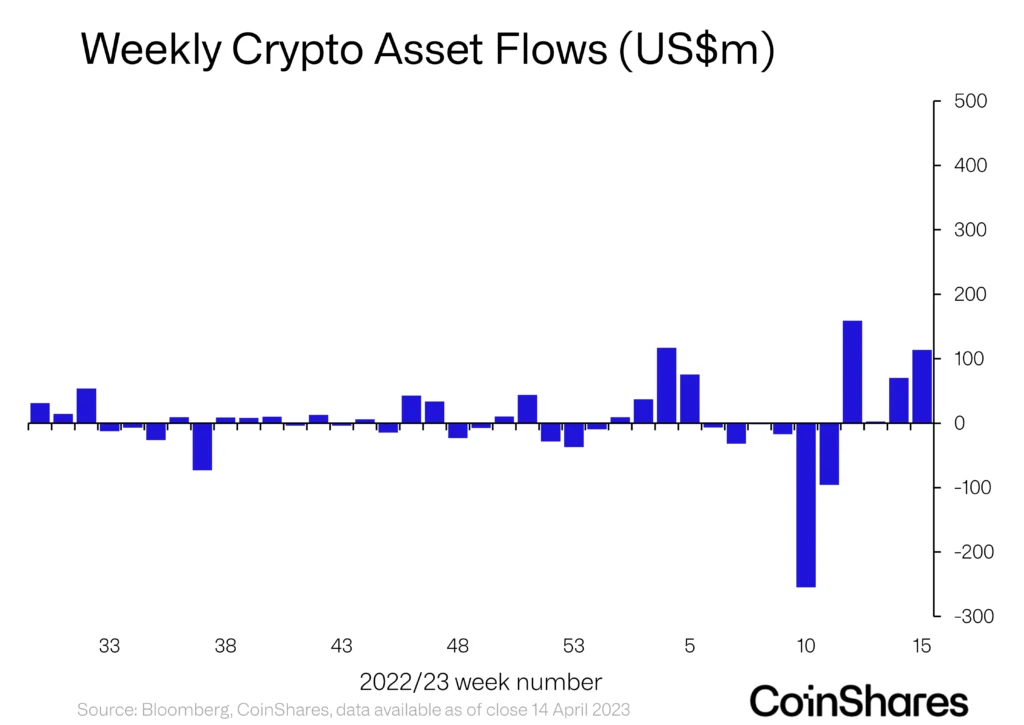

- Over the past four weeks, net inflows into digital asset mutual funds have totaled an impressive $345 million.

- Meanwhile, investments in “Short Bitcoin” funds, which bet on Bitcoin’s decline, saw an influx of $14.6 million last week.

- The USA and Germany lead the charge in digital asset fund investments, with Grayscale dominating the $35.7 billion digital mutual fund market, holding $25.8 billion.

While the recent price appreciation of the largest cryptocurrency may have sparked additional interest from speculators, the steady and continual inflow hints at the gradually maturing sentiment among long-term investors.

In the past week, digital asset mutual funds have seen a net inflow of a whopping $114 million, taking the net inflow over the last 4 weeks to an impressive $345 million! Bitcoin funds are the star of the show, accounting for a massive $103.8 million of that investment.

While Ethereum’s Shapella upgrade was successful, investments in the world computer’s funds were lacking at a paltry $300,000.

2023 Is A Dream For Bitcoin So Far

2023 is turning out splendid for Bitcoin with $78 million net inflows, unlike Ethereum still struggling at $23 million outflows.

But here’s an interesting twist: despite the rise in crypto, especially Bitcoin, investments in “Short Bitcoin” funds haven’t slowed down. Last week alone saw an influx of $14.6 million into these funds betting on Bitcoin’s decline.

Funds for Litecoin, XRP, and Cardano also saw investments of $200K, $100K, and $100K respectively.

USA and Grayscale Leads in Funding

When it comes to countries leading the charge in digital asset fund investments, the USA and Germany take the cake, with $58.5 million and $35.4 million invested, respectively. Canada came third at $17.2 million.

The leader in enabling access for traditional investors remains Grayscale. It’s worth mentioning that Grayscale continues to dominate the $35.7 billion digital mutual fund market, holding a staggering $25.8 billion.

While volatility remains, interest in crypto funds grows more robust by the week. Though uncertainties remain, cryptocurrencies appear poised to claim a more prominent role in investment portfolios.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://cryptocoin.news/news/crypto-funds-see-impressive-114-million-inflows-in-the-past-week-91018/?utm_source=rss&utm_medium=rss&utm_campaign=crypto-funds-see-impressive-114-million-inflows-in-the-past-week

- :is

- 000

- 1

- 7

- 8

- a

- access

- Accounting

- Additional

- alone

- among

- and

- appear

- appreciation

- ARE

- asset

- At

- Bet

- Betting

- Billion

- Bitcoin

- Bitcoin Funds

- by

- CAKE

- Canada

- Cardano

- charge

- claim

- continues

- countries

- crypto

- Crypto funds

- cryptocurrencies

- cryptocurrency

- Decline

- Despite

- digital

- Digital Asset

- Dominate

- down

- dream

- enabling

- especially

- ethereum

- Ethereum's

- For

- from

- fund

- funds

- Germany

- gradually

- Grayscale

- Grows

- Have

- hints

- holding

- HTTPS

- impressive

- in

- inflows

- influx

- interest

- interesting

- invested

- investment

- Investments

- Investors

- IT

- jpg

- largest

- Last

- lead

- leader

- leading

- Leads

- Litecoin

- long-term

- Market

- massive

- max-width

- May..

- million

- more

- mutual

- mutual fund

- mutual funds

- net

- of

- on

- outflows

- past

- plato

- Plato Data Intelligence

- PlatoData

- portfolios

- price

- prominent

- recent

- remain

- remains

- Rise

- robust

- Role

- sentiment

- show

- So

- Star

- steady

- Still

- Struggling

- successful

- Take

- taking

- that

- The

- the world

- These

- Third

- to

- traditional

- Turning

- twist

- uncertainties

- upgrade

- USA

- Volatility

- webp

- week

- Weeks

- which

- with

- world

- worth

- xrp

- zephyrnet