The international and local cryptocurrency communities have had varied reactions after the U.S. Securities and Exchange Commission (U.S. SEC) issued a Wells Notice to Uniswap Labs, the developer behind the decentralized cryptocurrency exchange Uniswap and the UNI token.

A Wells Notice provides a final opportunity for an entity to respond to the U.S. SEC’s allegations before the start of formal legal proceedings.

Table of Contents

Local Reaction

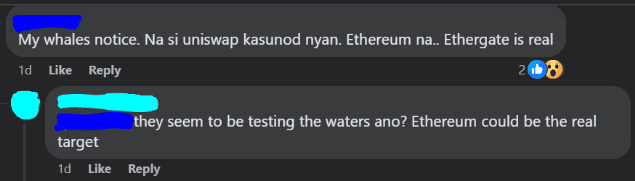

Recent Facebook posts by BitPinas show diverse reactions within the local crypto community to the latest news of the U.S. SEC vs. Uniswap Labs. Some expressed disappointment, while others viewed it as the regulator testing the regulatory environment.

One commenter criticized the U.S. SEC for its vague guidelines in the crypto sector, suggesting that its actions might deter developers and drive them out of the U.S.: “I can’t understand the U.S. SEC; instead of creating and/or proposing clear guidelines for the crypto space, it seems like they are aiming to discourage developers or push them out of the U.S. Note, web2 was dominated by U.S. startups and tech companies, while web3 is attracting attention from Asian companies. To capitalize on this technology, Japanese companies are even allocating significant funds to take the lead and secure this opportunity,” they explained.

Some speculate that the U.S. SEC is assessing the regulatory landscape, given its continued pursuit of major crypto entities.

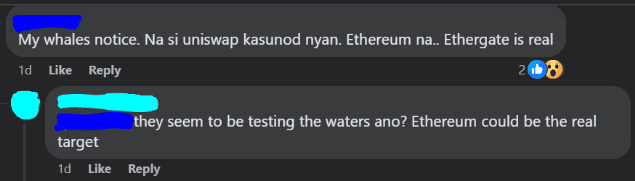

One community member raised the possibility of the Philippine SEC following the U.S. SEC’s actions against Uniswap Labs. While some argued that such actions would be unjustified due to Uniswap’s lack of personnel or promoters in the Philippines, others doubted and suggested that the local commission might follow suit.

It is noteworthy that in November, the Philippine SEC issued a warning against Binance after the exchange acknowledged violating the U.S. Bank Secrecy Act (BSA), resulting in a $4.3 billion penalty. Binance has maintained an active presence in the Philippines since 2019, with both staff and operational presence.

Global Reaction

Globally, the reaction to the U.S. SEC’s action against Uniswap Labs is perceived as a significant attack on the cryptocurrency industry, marking the potential start of a regulatory crackdown on decentralized finance (DeFi), with Uniswap as a key target.

A report from The Block highlighted the crypto community’s concerns about the U.S. SEC’s actions against Uniswap Labs, fearing it could hamper innovation and undermine decentralization. Some also called for clearer regulations to support crypto innovation in the U.S.

“This is the big one folks… Massive escalation by the U.S. SEC and the White House. Uniswap is a poster child for crypto decentralization—instead of celebrating Hayden Adams as a generational entrepreneur, they’re taking him to court. A war on crypto is a war on the internet,” Bankless co-founder Ryan Adams wrote on X.

Furthermore, The Rollup co-founder, Andy, views it as the onset of a “war on DeFi,” emphasizing the need for enhanced privacy on the blockchain and the development of censorship-resistant systems.

It should be noted that this is the U.S. SEC’s first major protocol targeting within the DeFi sector, despite prior engagements with decentralized organizations.

In addition, many in the crypto industry have shown solidarity with Uniswap. Chief Strategy Officer at Offchain Labs, A.J. Warner, emphasized the importance of defending DeFi, praising its sovereignty and transparency.

Some, like Jake Chervinsky from Variant Fund, expressed strong support for Uniswap Labs in any potential trial, while others, like Vishal Gupta, called for clear regulations to foster the growth of the U.S. crypto industry.

“Fair and transparent rules that allow technology to thrive are all we ask for,” Vishal Gupta, former Head of Exchange at Coinbase, posted.

On the other hand, crypto investor Muhammad Azhar, with 8.9k followers on X, emphasized the delicate balance between innovation and regulation, highlighting the importance of finding a middle ground where technology can flourish and accountability can be maintained for a sustainable future.

Uniswap Response

Uniswap and its founder Hayden Adams expressed their determination to fight any legal action from the US SEC, asserting confidence in the legality of their products.

In an X post, Adams criticizes the SEC for prioritizing “opaque systems” over consumer protection. He also noted that they anticipate a prolonged legal battle, potentially reaching the Supreme Court, emphasizing the importance of unity within the industry.

“This fight will take years, may go all the way to the Supreme Court, and the future of financial technology and our industry hangs in the balance. If we stand together we can win. I think freedom is worth fighting for. I think DeFi is worth fighting for,” Adams concluded.

Additionally, in a Uniswap Labs Blog, the firm also echoed its vows to continue operations. The blog also arguef against SEC jurisdiction, citing a lack of congressional authority and clear legal definitions. The firm also expressed disappointment in the SEC’s actions, asserting its commitment to innovation and economic freedom.

“We are confident that the products we offer are not just legal – they are transformative. They empower people across the world by enabling transparent, verifiable markets with fewer gatekeepers, which allows for cheap, accessible, global economic participation,” the statement read.

This article is published on BitPinas: Crypto Industry Reacts as SEC Signals Legal Action vs Uniswap

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitpinas.com/business/us-sec-uniswap-reaction/

- :has

- :is

- :not

- :where

- 10

- 2019

- 8

- 9

- a

- About

- accessible

- accountability

- across

- Act

- Action

- actions

- active

- addition

- advice

- After

- against

- Aiming

- All

- Allegations

- allow

- allows

- also

- an

- and

- andy

- anticipate

- any

- appropriate

- ARE

- argued

- article

- AS

- asian

- ask

- Asserting

- Assessing

- At

- attack

- attention

- attracting

- authority

- Balance

- Bank

- bank secrecy act

- Bankless

- Battle

- BE

- before

- behind

- between

- Big

- Billion

- binance

- BitPinas

- Block

- blockchain

- Blog

- both

- BSA

- by

- called

- CAN

- capitalize

- carry

- Celebrating

- censorship-resistant

- cheap

- chief

- child

- claim

- clear

- clearer

- Co-founder

- coinbase

- commission

- commitment

- Communities

- community

- Companies

- Concerns

- concluded

- confidence

- confident

- Congressional

- constitute

- consumer

- Consumer Protection

- content

- continue

- continued

- could

- Court

- Crackdown

- Creating

- Criticizes

- crypto

- crypto community

- Crypto Industry

- crypto sector

- crypto space

- cryptocurrency

- Cryptocurrency Exchange

- Cryptocurrency Industry

- Decentralization

- decentralized

- Decentralized Finance

- decentralized finance (DeFi)

- decisions

- Defending

- DeFi

- definitions

- Despite

- determination

- Developer

- developers

- Development

- diligence

- disappointment

- diverse

- does

- dominated

- drive

- due

- echoed

- Economic

- emphasized

- emphasizing

- empower

- enabling

- engagements

- enhanced

- entities

- entity

- Entrepreneur

- Environment

- escalation

- essential

- ETH

- Even

- exchange

- explained

- expressed

- fewer

- fight

- fighting

- final

- finance

- financial

- financial technology

- finding

- Firm

- First

- flourish

- follow

- followers

- following

- For

- formal

- Former

- Foster

- founder

- Freedom

- from

- fund

- funds

- future

- Gains

- generational

- given

- Global

- Global Economic

- Go

- Ground

- Growth

- guidelines

- Gupta

- had

- hand

- Have

- Hayden Adams

- he

- head

- highlighting

- him

- House

- HTTPS

- i

- if

- importance

- in

- industry

- Informational

- Innovation

- instead

- International

- Internet

- investing

- investment

- investor

- IT

- ITS

- Jake Chervinsky

- Japanese

- jurisdiction

- just

- Key

- Labs

- Lack

- landscape

- latest

- Latest News

- lead

- Legal

- Legal Action

- legal proceedings

- legality

- like

- local

- losses

- maintained

- major

- Making

- many

- Markets

- marking

- massive

- max-width

- May..

- member

- Middle

- might

- muhammad

- Need

- news

- note

- noted

- noteworthy

- Notice..

- November

- of

- Offchain

- Offchain Labs

- offer

- Officer

- on

- ONE

- only

- onset

- operational

- Operations

- Opportunity

- or

- organizations

- Other

- Others

- our

- out

- over

- own

- participation

- penalty

- People

- perceived

- Personnel

- Philippine

- Philippines

- photo

- plato

- Plato Data Intelligence

- PlatoData

- position

- possibility

- posted

- Posts

- potential

- potentially

- presence

- Prior

- prioritizing

- privacy

- Proceedings

- Products

- professional

- promoters

- proposing

- protection

- protocol

- provides

- published

- purposes

- pursuit

- Push

- raised

- RE

- reaching

- reaction

- reactions

- Reacts

- Read

- Regulation

- regulations

- regulator

- regulatory

- regulatory landscape

- report

- Respond

- responsibility

- responsible

- resulting

- rollup

- rsa

- rules

- Ryan

- Ryan Adams

- s

- SEC

- sector

- secure

- Securities

- Securities and Exchange Commission

- Seek

- seems

- should

- show

- shown

- signals

- significant

- since

- solely

- some

- sovereignty

- Space

- specific

- Staff

- stand

- start

- Startups

- Statement

- Strategy

- strong

- such

- Suit

- support

- Supreme

- Supreme Court

- sustainable

- sustainable future

- Systems

- Take

- taking

- Target

- targeting

- tech

- tech companies

- Technology

- Testing

- that

- The

- The Block

- The Future

- The Philippines

- the world

- their

- Them

- they

- think

- this

- Thrive

- to

- together

- token

- transformative

- Transparency

- transparent

- trial

- true

- u.s.

- U.S. Bank

- U.S. SEC

- U.S. Securities

- U.S. Securities and Exchange Commission

- Undermine

- understand

- UNI

- Uniswap

- unity

- us

- US Sec

- Variant

- varied

- verifiable

- views

- Violating

- vishal

- vs

- war

- Warner

- warning

- was

- Way..

- we

- Web2

- Web3

- Website

- Wells

- which

- while

- white

- White House

- will

- win

- with

- within

- world

- worth

- would

- wrote

- X

- years

- You

- Your

- zephyrnet