The gore in the crypto market has gone on today, prompting almost $300 million in liquidations in the fates sector.

Crypto Futures Market Observes Almost $300M In Liquidations

In case anybody is uninformed what a “liquidation” is, it’s ideal to get a short gander at the operations of subsidiaries trading.

When a financial backer opens a crypto prospects contract, they need to initially advance some underlying security, called the margin.

Against this edge, the holder can decide to settle on “leverage,” which is a credit frequently commonly the underlying position.

The benefit of influence is that if the cost of the crypto (which the agreement is for) moves toward the path the financial backer bet on, then the benefits are hoards something other than the underlying position’s benefit alone.

However, the opposite likewise turns out as expected, on the off chance that the value ends up moving the other way, misfortunes are likewise amplified by a similar sum as the leverage.

Related Reading | Bitcoin Miners Continue To Sell As Outflows Spike Again

When a particular piece of the underlying edge is eaten up by these misfortunes, the trade powerfully shuts the position. This is the thing a liquidation is.

Now, here is the information connected with the prospects liquidations in the crypto market over the past day:

Appears as though a huge sum was exchanged in the market during the most recent 24 hours | Source: CoinGlass

As you can find in the above table, around $287 million in the crypto fates market was flushed over the beyond 24 hours.

Out of this, about $241 million worth of liquidations happened as of now alone. The beyond four hours likewise saw sizeable liquidations at nearly $64 million.

Related Reading | Crypto Scammers Pose “Significant Threat” On LinkedIn, FBI Agent Warns

The influence flush over the course of the past day included almost 80k prospects positions, with 71% of them having a place with long traders.

This truth checks out as a greater part of the liquidations were set off by the crypto market noticing further massacre today.

Such huge liquidations are entirely expected on the lookout. There are two or three purposes for this; the first is that the greater part of the coins are profoundly volatile.

The other explanation is that numerous subsidiaries trades offer choices for very enormous amounts of influence, once in a while even 100x the underlying position.

The high influence joined with the unstable idea of crypto can make the fates market an unsafe zone for clueless traders.

BTC Price

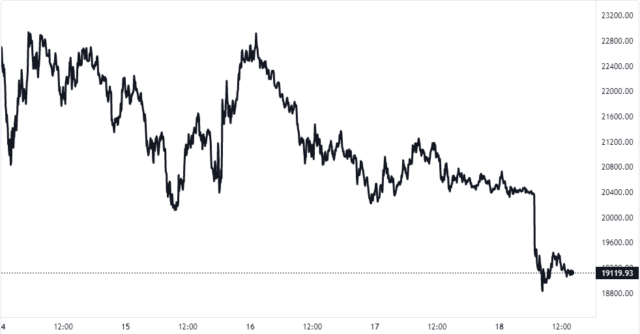

At the hour of composing, Bitcoin’s cost floats around $19.1k, down 33% over the most recent seven days. Over the course of the last month, the crypto has lost 37% in value.

The underneath diagram shows the pattern in the cost of the coin over the last five days.

BTC appears to have crashed down beneath $20k today | Source: BTCUSD on TradingView

Included picture from Quantitatives on Unsplash.com, outline from TradingView.com

#Crypto #Liquidations #Hit #300M #Carnage #Continues #Bitcoinist.com

- 000

- a

- About

- advance

- Agreement

- amounts

- around

- benefit

- benefits

- Beyond

- Bitcoin

- Bitcoin News

- Bitcoinist

- case

- Checks

- choices

- Coin

- Coins

- connected

- continue

- continues

- contract

- credit

- crypto

- Crypto Market

- day

- down

- during

- Edge

- ends

- enormous

- expected

- expects

- fbi

- financial

- First

- from

- further

- Futures

- greater

- happened

- having

- here

- High

- holder

- HTTPS

- huge

- idea

- ideal

- included

- influence

- information

- joined

- Leverage

- LINK

- Liquidation

- liquidations

- Long

- make

- Market

- million

- Miners

- Month

- most

- moving

- news

- numerous

- offer

- opens

- Operations

- Other

- part

- particular

- Pattern

- picture

- piece

- position

- price

- prospects

- purposes

- Reading

- recent

- Scammers

- sector

- security

- sell

- set

- Short

- similar

- some

- something

- The

- thing

- three

- today

- trade

- Traders

- trades

- Trading

- Unsplash

- value

- What

- while

- worth