- A crypto mixer is a decentralized platform where different digital currencies are blended to remove any trace of origin

- Crypto mixers collect, pool, and pseudo-randomly shuffle the digital currencies deposited by many users.

- FinCEN says illicit actors have sucked up almost $300 million of Bitcoin.

- In August 2021, Helix Mixer, a popular crypto mixer, suffered numerous investigations, finally succumbing to the pressure.

Blockchain and privacy have been a never-ending debate for most experts within the ecosystem. Many believe that blockchain is still looking for a balance regarding privacy. Generally, it completely ignores the privacy aspect or overly defines it to the point that crypto hackers exploit it. Developers believe blockchain should embrace decentralization so that tracing a crypto coin back to its uses is nearly impossible. This line of thought created one of the most controversial tools within the crypto ecosystem; Crypto mixers. Initially, many believed privacy coins would bring about a wave of crypto illegalities, but crypto mixers trump this expectation by a slide.

Unfortunately, many within the industry still advocate for crypto mixers. Their arguments mainly indicate that crypto mixers are among the few decentralized application that genuinely embraces the core element of Web3; Absolute Privacy.

Privacy is a driving element for blockchain.

Since the first iteration of the digital currency, Bitcoin, developers have devised numerous ways to replicate and improve its fundamental functionalities. This led to establishment of several consensus mechanisms, altcoins and multiple decentralized applications. Since then, the digital currency has gained numerous applications, leading to the establishment of various cooperations and industries seeking global implementations.

Unfortunately, over the years, many experts believe that in an attempt to implement its functionalities globally, they have ultimately diluted the core principles of digital currency. Initially, digital currency represented a new form of decentralization never seen before.

At the time, the concept of blockchain and privacy intertwined to ensure that control and information over a transaction solely resided with the user. However, this opened doors to numerous backlash from organizations within the Web2 ecosystem. This led to establishment of centralized and hybrid blockchain systems that did not sit well with various developers.

Bringing privacy to blockchain

Developers created privacy coins to counter the complete redefining of blockchain and privacy. These altcoins preserve anonymity by obscuring the flow of money across the network. They have the same functionality as any other Crypto coins but contain an added layer of privacy-preserving technology.

Also, Read The contradictory relationship between Blockchain technology and privacy.

One of the most significant privacy coins today are Zcash and Monero. Developers created privacy coins to retain the sense of anonymity that most organizations tried to take away from the ecosystem. Unfortunately, this presented several issues. The first is that privacy coins compete with other high-valued digital currencies.

Privacy is an innate concept for all blockchain-based systems but has recently been diluted by centralized entities.[Photo/Medium]

This presented a problem since only a few users would opt for a lower-value digital currency for a higher one. The second is that crypto hackers often find privacy coins convenient. According to law enforcers and crypto regulatory bodies, Monero has facilitated several illegal transactions.

Furthermore, it was severely limited to those who actively used privacy coins, leaving the rest unattended. Fortunately, this drive to harmonize blockchain and privacy led to the creation o crypto mixers, a platform that grants the pleasure of privacy to all crypto traders.

What are crypto mixers and their role in the ecosystem?

A crypto mixer is a decentralized platform where different digital currencies are blended to remove any trace of origin or owner of the funds. Innovators created the concept of crypto mixers as a platform that allows users to acquire complete anonymity when using digital currency.

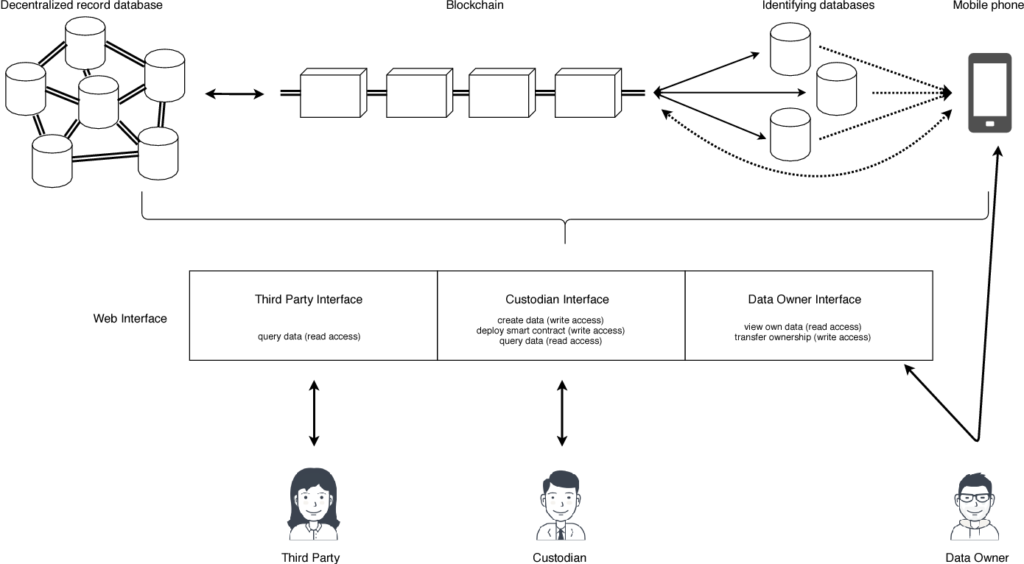

Crypto mixers work on the basic principle of deploying several privacy-enhanced technologies within their blockchain system. At its core, crypto mixers collect, pool, and pseudo-randomly shuffle the digital currencies deposited by many users. After the process, the funds receive a new address, and each user gets the same amount of deposited funds with a small deduction for service fees.

The dynamic mainly bolsters the concept of blockchain and privacy, and many often think that its functioning stems from a scaled application of privacy coins.

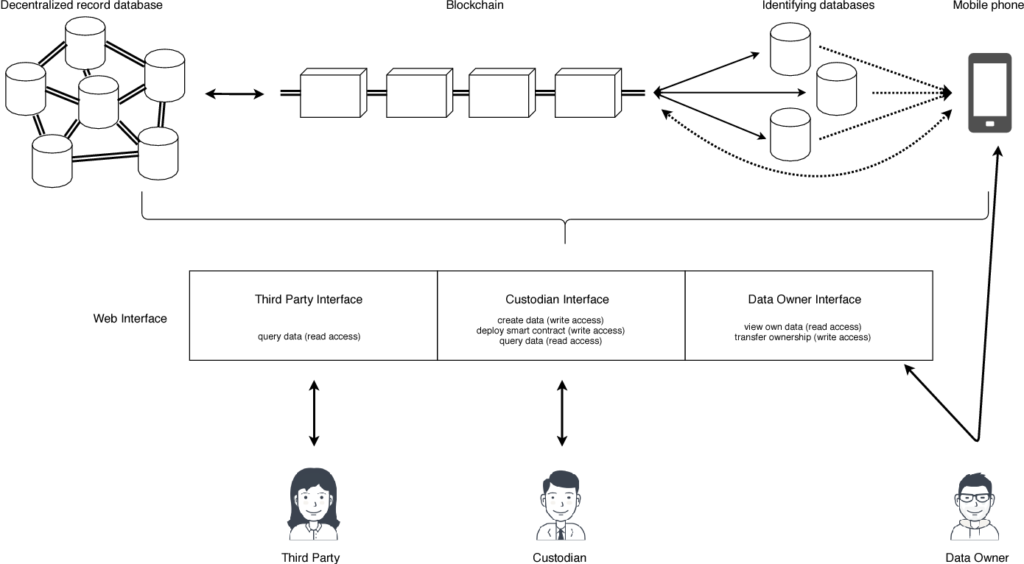

The concept of crypto mixing falls under two categories: Custodial and non-custodial.

Custodial mixing is when the user deposits “tainted” or “marked” digital currencies to a third party’s trust. After the process, they receive “clean” coins with new addresses after a certain period. Unfortunately, this process proved ineffective since it presented numerous issues.

Once the user deposited their funds, there was a high possibility the third party would steal the deposited funds. Fortunately, its inefficiency led to the establishment of non-custodial crypto mixing. With this process, no third party would take control of your “tainted” coins. Their services were neutral and used smart contracts to automate most of the transactions at the bedding and the end f the mining process.

Types of Crypto Mixers

Three types of crypto mixers shift between the two mixing processes mentioned above.

They include;

Centralized crypto mixers

Centralized crypto mixers are platforms that offer custodial mixing processes. This was the first iteration of attaining harmony between blockchain and privacy dating back to 2011. Third-party organizations would temporarily control the user’s private coins or the entire crypto wallet.

The main functionality of centralized crypto mixers.[Photo/VerLoop.io]

Also, Read Privacy Regulations in the Metaverse: A paradoxical problem.

Unfortunately, this method presented plenty of controversial talk among users and developers. The user faced additional privacy risks since the process required abdicating control over her crypto wallet. This method lured many crypto hackers and scammers who posed as legitimate centralized crypto mixers. Furthermore, centralized crypto mixers are a target for law enforcement who pin their activities on numerous crypt illegalities.

Decentralized crypto mixers

Decentralized crypto mixers are a more adept version of the process. These type use protocols such as CoinJoin to ensure transactions using a completely coordinated or P2P approach. Developers took this approach to counter the flaws of centralized crypto mixers.

The protocols allow a group of users to pool a certain amount of digital currency and redistribute it so that everyone receives completely new coins of the same value. Decentralized crypto mixers work hand-in-hand with most privacy coins and wallets. Its underlying smart contract recreates this process severally, allowing consistent anonymity within the network.

Smart Contract crypto mixers

Smart contract crypto mixers also utilized the than-custodial mixing process. However, unlike their counterpart decentralized mixers, they do not pool users’ funds into one transaction. Instead, developers often for more efficient approaches to ensuring an in-sync relationship between blockchain and privacy.

Here users send their digital currencies to the crypto mixer and receive a cryptographic note to establish provenance. If a user desires to withdraw eir funds, they send the note to the Crypto mixer and obtain a fresh new batch of “clean” digital currencies.

Until the user sends the note, the cryptocurrencies within the network will gradually continue blending in several different ways. Smart contract mixers often work with service providers called relayers. They provide the crypto coin necessary t pay gas fees on the mixer’s withdrawal transaction.

Controversial topic on crypto mixers.

The entire crypto ecosystem has clashed since the practical application of private coins and crypto mixers. Many crypto traders initially opt to use Crytpo mixers and privacy coins to control their funds truly. It lives up to the main agenda the entire web3 community s striving for.

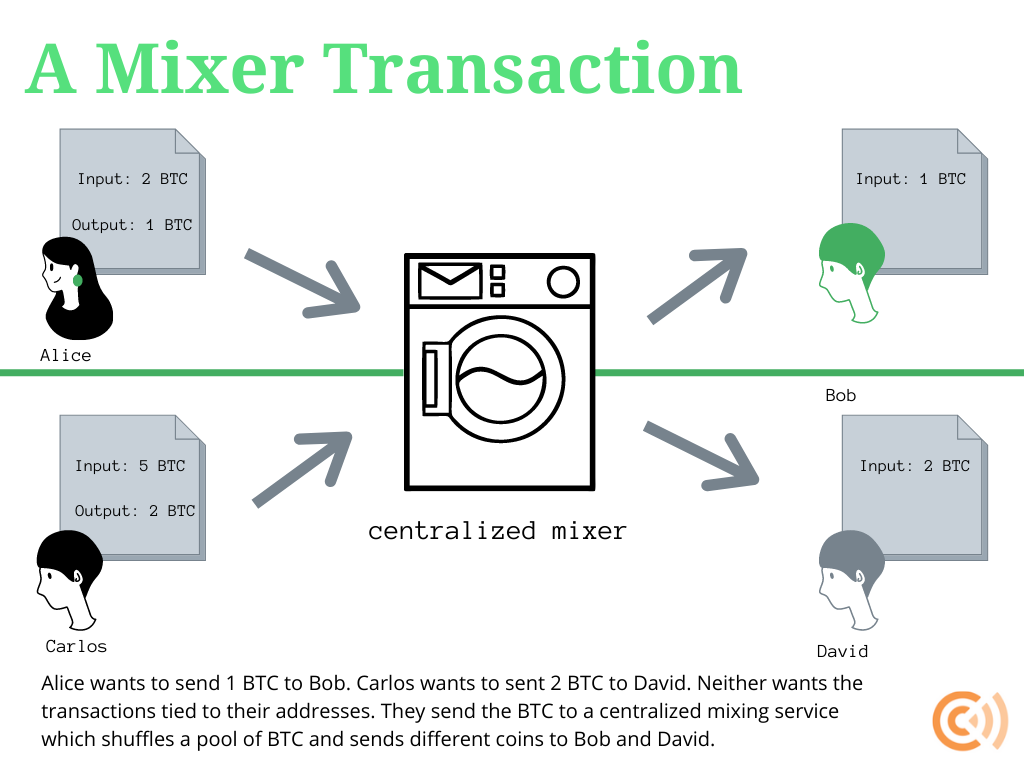

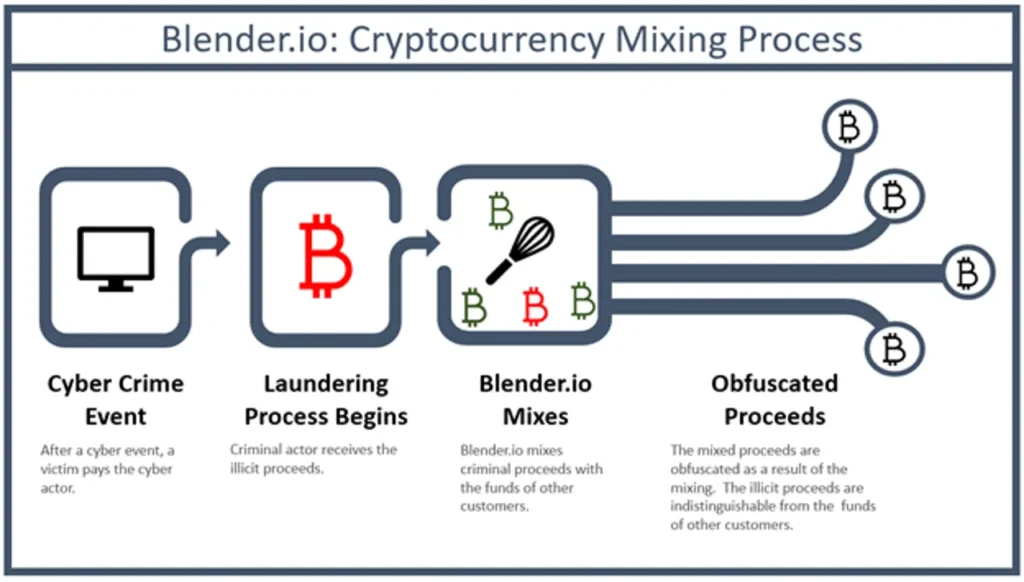

Unfortunately, their ability to tolerate blockage and privacy is too good. Once a user mixes their crypto, it is virtually untraceable. This provides an adept breeding ground for crypto illegalities. According to former US Assistant Attorney General Brian Benczkowski, crypto mixes are a front for crypto hackers to clean their money.

Blener.io is another crypto mixer that advocates for privacy in the blockchain.[Photo/Blender]

In truth, many attribute crypto mixers to money laundering. According to the Finacial Crimes Enforcement Network, crypto mixers are classified as money transmitters. Many centralized organizations and regulators via for their ability to erase traceable elements as “dangerous tools” for anyone. FinCEN says illicit actors have used almost $300 million of Bitcoin.

Over the year, crypto mixers have been subject to relentless legal lawsuits due to their operations. In August 2021, Helix Mixer, a popular crypto mixer, suffered numerous investigations, finally succumbing to the pressure; Larry Dean, CEO of Helix, pleaded guilty to charges of money laundering and several crypto illegalities that surrounded their operations.

Also, Read about Bankrupt crypto exchange platforms that intensified the 2022 crypto winter.

The same occurred for privacy coins as wallets, as many viewed their sheer applicability of blockchain and privacy to be too sophisticated. Wasabi wallet, a privacy wallet that utilizes non-custodial mixing processes, features sevral high-profile cases of crime. For any crypto mixer to operate, they must follow strict sanctions on any jurisdiction.

Regulators have gone to the extreme of advocating for the eradication of crypto mixers to prevent crypto hackers from clearing the tract. However valid this point may seem initially, there might be better options.

The positive take on crypto mixers

Crypto mixers uphold one of the digital currencies’ core principles: complete control of one’s funds. Its practicability is indeed exploitable by crypto hackers, but it still does not diminish its primary goal set.

Users can transact with their funding without any fear or worry that a central entity might seize control of their funds. Furthermore, cryp[to mixers play a significant role in protecting against crypto hackers. The consistent blending of crypto coins makes it difficult to lock on a specific target or set.

Centralized organizations have tried to take control of the fundamental functioning of several blockchain-based systems for some time. Many developers believe that by trying to coexist with web2, Web3 is essentially diluting its core principle to “Fit in”.

In truth, this serves as a better deployment method than direct turnover, but it has led to privacy issues. In a previous article, we highlighted why digital currencies could pose real potential damage if implemented poorly. By consistently trying to merge Web3 applications on the Web2 platform, we risk losing the very values it upholds.

Also, Read Potential risks posed by Web3 innovations.

Crypto mixers stand for the main component of web3 without compromise. Fortunately, serial crypto mixers, such as Tornado, have gained sanctions from regulators throughout the years, but they still have a long way to go.

Conclusion.

Crypto hackers still heavily rely on crypto mixers to erase their tracks. This issue is still a sore spot for many regulatory bodies, but they have survived.

Privacy coins and crypto mixers advocate for blockchain and privacy and, if properly implemented, can save grounds for ensuring true decentralization. Crypto inequalities are still an issue, but given time and enough understanding, we might usher in a new digital currency privacy age.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://web3africa.news/2023/06/09/featured/crypto-mixers-advocates-for-privacy/

- :has

- :is

- :not

- :where

- $UP

- 2011

- 2021

- 2022

- a

- ability

- About

- above

- Absolute

- According

- acquire

- across

- actively

- activities

- actors

- added

- Additional

- address

- addresses

- advocate

- advocates

- advocating

- After

- against

- age

- agenda

- All

- allow

- Allowing

- allows

- also

- Altcoins

- among

- amount

- an

- and

- Anonymity

- Another

- any

- anyone

- Application

- applications

- approach

- approaches

- ARE

- arguments

- article

- AS

- aspect

- Assistant

- At

- attorney

- Attorney General

- AUGUST

- automate

- away

- back

- Balance

- basic

- BE

- been

- before

- believe

- believed

- Better

- between

- Bitcoin

- blending

- blockchain

- blockchain system

- blockchain technology

- blockchain-based

- bodies

- Brian

- bring

- but

- by

- called

- CAN

- cases

- Catalyst

- categories

- central

- central entity

- centralized

- ceo

- certain

- charges

- classified

- Clearing

- Coin

- Coins

- collect

- community

- compete

- complete

- completely

- component

- compromise

- concept

- Consensus

- Consensus Mechanisms

- consistent

- contain

- continue

- contract

- contracts

- control

- controversial

- Convenient

- coordinated

- Core

- could

- Counter

- Counterpart

- created

- creation

- Crime

- Crimes

- crypt

- crypto

- Crypto Coin

- Crypto Coins

- Crypto ecosystem

- crypto exchange

- crypto exchange platforms

- crypto mixer

- crypto traders

- Crypto wallet

- cryptocurrencies

- cryptographic

- currencies

- Currency

- custodial

- Dating

- debate

- Decentralization

- decentralized

- Decentralized Applications

- decentralized platform

- Defines

- deploying

- deployment

- deposited

- deposits

- developers

- DID

- different

- difficult

- digital

- digital currencies

- digital currency

- direct

- do

- does

- doors

- drive

- driving

- due

- dynamic

- each

- ecosystem

- efficient

- element

- elements

- embrace

- Embraces

- end

- enforcement

- enough

- ensure

- ensuring

- Entire

- entities

- entity

- essentially

- establish

- establishment

- everyone

- exchange

- expectation

- experts

- experts believe

- Exploit

- extreme

- faced

- facilitated

- Falls

- fear

- Features

- Fees

- few

- Finally

- FinCen

- Find

- First

- flaws

- flow

- follow

- For

- form

- Former

- Fortunately

- fresh

- from

- front

- functionalities

- functionality

- functioning

- fundamental

- funding

- funds

- Furthermore

- gained

- GAS

- gas fees

- General

- generally

- given

- Global

- Globally

- Go

- goal

- gone

- good

- gradually

- grants

- Ground

- grounds

- Group

- guilty

- hackers

- Harmony

- Have

- heavily

- her

- High

- high-profile

- higher

- Highlighted

- However

- HTTPS

- Hybrid

- if

- Illegal

- illicit

- implement

- implemented

- impossible

- improve

- in

- include

- indicate

- industries

- industry

- inequalities

- information

- initially

- innate

- innovators

- instead

- into

- Investigations

- issue

- issues

- IT

- iteration

- ITS

- jurisdiction

- Laundering

- Law

- law enforcement

- Lawsuits

- layer

- leading

- leaving

- Led

- Legal

- legitimate

- Limited

- Line

- Lives

- Long

- looking

- losing

- Main

- mainly

- MAKES

- many

- max-width

- May..

- mechanisms

- mentioned

- Merge

- Metaverse

- method

- might

- million

- Mining

- mixer

- MIXERS

- Mixing

- Monero

- money

- Money Laundering

- more

- more efficient

- most

- multiple

- must

- nearly

- necessary

- network

- Neutral

- never

- New

- new coins

- no

- non-custodial

- numerous

- obtain

- occurred

- of

- offer

- often

- on

- once

- ONE

- only

- opened

- operate

- Operations

- Options

- or

- organizations

- origin

- Other

- over

- owner

- p2p

- party

- Pay

- period

- PHP

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Play

- pleasure

- Plenty

- Point

- pool

- Popular

- positive

- possibility

- potential

- Practical

- presented

- pressure

- prevent

- previous

- primary

- principle

- principles

- privacy

- Privacy coins

- private

- Problem

- process

- processes

- properly

- protecting

- protocols

- proved

- provenance

- provide

- providers

- provides

- Read

- real

- receive

- receives

- recently

- Redefining

- regarding

- regulations

- Regulators

- regulatory

- relationship

- relentless

- rely

- remove

- represented

- required

- REST

- retain

- Risk

- risks

- Role

- s

- same

- Sanctions

- Save

- says

- Scammers

- Second

- seeking

- seem

- seen

- Seize

- send

- sends

- sense

- serial

- serves

- service

- service providers

- Services

- set

- several

- severely

- shift

- should

- shuffle

- significant

- since

- sit

- Slide

- small

- smart

- smart contract

- Smart Contracts

- So

- solely

- some

- sophisticated

- specific

- Spot

- stand

- stems

- Still

- Strict

- subject

- succumbing

- such

- surrounded

- Survived

- system

- Systems

- Take

- Talk

- Target

- Technologies

- Technology

- than

- that

- The

- the metaverse

- their

- then

- There.

- These

- they

- think

- Third

- third-party

- this

- those

- thought

- throughout

- time

- to

- today

- too

- took

- tools

- topic

- tornado

- Trace

- traceable

- Tracing

- Traders

- transact

- transaction

- Transactions

- transmitters

- tried

- true

- truly

- trump

- Trust

- truth

- turnover

- two

- type

- types

- Ultimately

- under

- underlying

- understanding

- unfortunately

- unlike

- until

- untraceable

- Uphold

- us

- use

- used

- User

- users

- uses

- using

- utilized

- utilizes

- value

- Values

- various

- version

- very

- via

- virtually

- Wallet

- Wallets

- was

- Wave

- Way..

- ways

- we

- Web2

- Web3

- web3 applications

- Web3 community

- webp

- WELL

- were

- when

- WHO

- why

- will

- with

- withdraw

- withdrawal

- within

- without

- Work

- worry

- would

- WSJ

- year

- years

- Your

- zephyrnet