Cryptocurrency markets drop ahead of the upcoming FED meeting and we can see it turning red as the investors prepare for the new meeting which is expected to see a 75-basis point rate hike as we can see more today in our latest cryptocurrency news today.

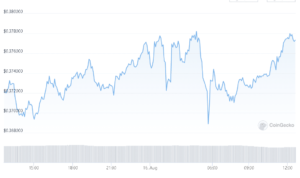

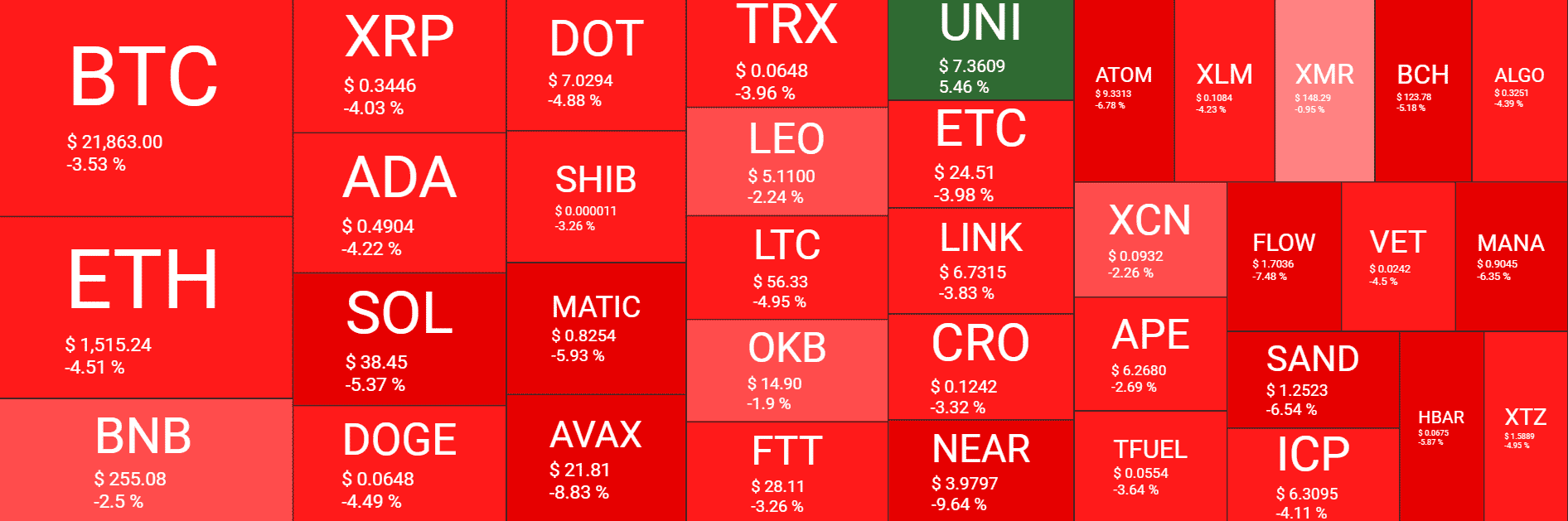

The price of BTC, ETH, and other major cryptocurrencies crashed on Monday as the FED is expected to increase the benchmark rates of interest by 0.75% which is the biggest hike in the past three decades. Bitcoin dropped to a weekly low of $21,935 which is down by 2.8% over the past day with Ethereum shedding up to 5% for the day to the current value of $1528. among the ten biggest crypto assets, Cardano is the heaviest hit with a drop of 7% in the past day followed by Solana which dropped by 4.35%, and DOGE dropped by 4.4% too.

The combined market cap of all crypto assets dropped from $1.08 trillion to $1 trillion by press time as per the data from CoinMarketCap. The Cryptocurrency markets drop ahead of the new FED meeting and the latest price action came ahead of the two-day-long FED meeting kicking off which is expected to get wrapped up with the US Central bank raising interest rates by 75 basis points.

The officials already increased the benchmark short-term borrowing rates by 1.5% this year like the 75 basis point increase in June which is the biggest increase in three decades. The move which the FED considers its main weapon to curb growing inflation will see the interest rates increase to a target range of 2.25% to 2.50% which means the pandemic era support for the US economy is coming to an end. When the federal fudns rates increased, the entire economy like student debt, credit cards, home equity lines of credit, and another loan sare became more expensive.

ADVERTISEMENT

The idea is that less accessible borrowing will dampen consumer demand which will bring inflation down. The US inflation has actually accelerated since the FED started increasing the rates in March with surging prices for goods, gas, and rent catapulting the figures to a new high of 9.1%. the Interest rate hike scan play out in stocks, crypto, and other investments while bringing risks of a decrease in the capital inflows and then a decline in economic growth. The expected increase of the interest rates in the US also came after a move by the ECB when the interest rate in the Eurozone was increased by 0.5%.

ADVERTISEMENT

- Altcoin News

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto market drops

- Crypto Markets

- crypto mining

- cryptocurrency

- cryptocurrency markets

- DC Forecasts

- decentralized

- DeFi

- Digital Assets

- ethereum

- fed meeting

- machine learning

- markets drop

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- upcoming fed meeting

- W3

- zephyrnet