Dash was launched in 2014, which is roughly five years from the launch of Bitcoin. It was developed with a maximum supply limitation of 18.9 billion and follows the same proof algorithm as Bitcoin, called the proof of work. Furthermore, one needs to mine dash using commutation power to generate the cryptocurrency.

But these are just the similarities, Dash is way faster and offers a more secure and private transaction medium as compared to the digital gold, Bitcoin. Dash uses something called the master node to speed up the transaction process using a feature called instant send. Master nodes also store the blockchain data, governance of the blockchain network, and distribution of Dash development funds for different purposes.

One can become a master node by holding over 1000 Dash cryptocurrencies. Other than instant send, Dash also makes use of something called a private send for incognito transactions that cannot be traced to the original sender. Since it focuses on the ease of using a blockchain for completing transactions, it is being increasingly used for regular payments and to beat hyperinflation in countries like Venezuela along with the BTC.

DASH Cryptocurrency Price Analysis

Compared to the recent price action and returns, the 2018 rally was like mount Everest. In 2017, Dash went from around $11 on January 01, 2017, to a high of $1275 on December 23, 2017, which was over 100 times the returns making people millionaires on small investments. The current trend in 2021 hasn’t been so great, but it is still a considerable gain. In 2021, Dash went from close to $100 to the highs of $400 in April and managed to jump back from close to the $110 levels back to the $200 levels.

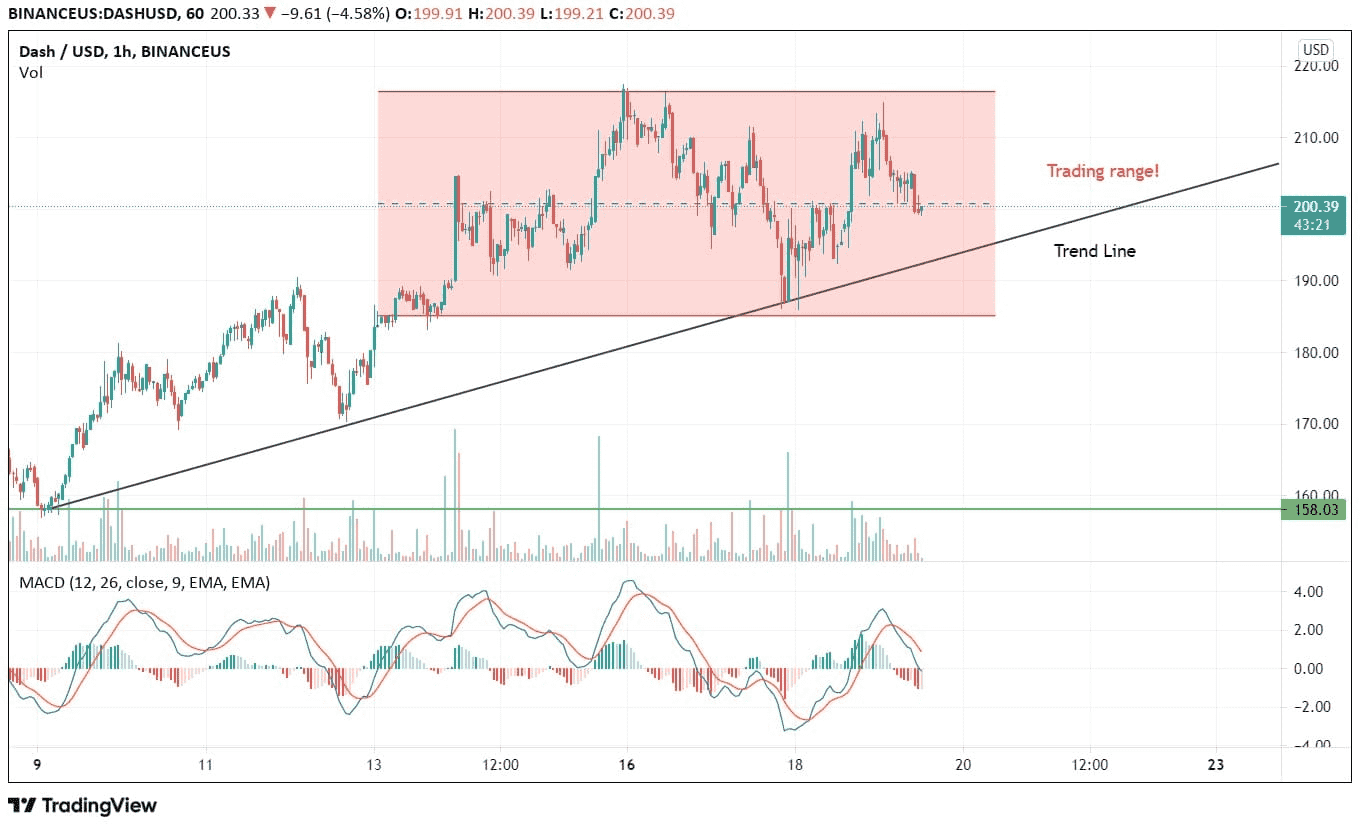

Dash cryptocurrency is facing difficulty in breaching its long-term moving average of 200 days and seems to be getting consistent rejections even after three attempts to breach the 200 DMA within a week. It will become positive only after breaching the 200 DMA resistance, which comes to around $213.3 levels as of August 19, 2021. Consolidating at current levels without breaking the trend line and initiating a good upside movement. On the downside, Dash has support at $180, followed by $145 levels.

Unlike other cryptocurrencies, which are witnessing a drawdown of more than 15 to 25%, dash has held its ground against any profit booking or sell-off. It’s rather waiting for a trigger event to give a decent upside move. The outlook is positive in both the short and long term, but one must wait for some time before making a fresh entry. There is a good chance of dash reclaiming $300 in the next few months.

RSI on daily charts is trading close to the overbought zones and is still indicating a sign of bearish crossover, but there is a good probability that it will be a false breakdown.

On hourly charts, Dash is showing its true sentiment, which is nothing short of bullish. Based on our Dash predictions, we can expect Dash to break out of its trading zone and breach the resistance levels on both hourly and daily charts. Ideally, the price action indicates that Dash should take support from the trendline and bounce back, but one must wait for two or three hours for the probability to ascertain a sense of guaranteed success. MACD is indicating the end of the negative swing and there is a good chance of bounce back in play.

Source: https://www.cryptonewsz.com/dash-faces-a-tug-of-war-at-the-long-term-resistance-of-215-usd/

- 100

- 9

- Action

- algorithm

- analysis

- April

- around

- AUGUST

- bearish

- Billion

- Bitcoin

- blockchain

- breach

- BTC

- Bullish

- Charts

- countries

- cryptocurrencies

- cryptocurrency

- Current

- Dash

- data

- Development

- digital

- digital gold

- Event

- faces

- facing

- Feature

- fresh

- funds

- Gold

- good

- governance

- great

- High

- HTTPS

- hyperinflation

- Investments

- IT

- jump

- launch

- Line

- Long

- Making

- medium

- millionaires

- months

- move

- network

- nodes

- Offers

- Other

- Outlook

- payments

- People

- power

- prediction

- price

- Price Analysis

- Price Prediction

- private

- Profit

- proof

- rally

- returns

- sense

- sentiment

- Short

- small

- So

- speed

- store

- success

- supply

- support

- time

- Trading

- transaction

- Transactions

- Venezuela

- wait

- war

- week

- within

- Work

- years