While investors have been carefully observing the recent comeback of Ethereum (ETH), it isn’t prudent to miss out on the rally in the DeFi space. Over the last week, the DeFi market has resumed its northward trajectory once again.

As we can see from the below chart, the DeFi market has added more than $15 billion in the last seven. The overall DeFi market cap has surged closer to $80 billion.

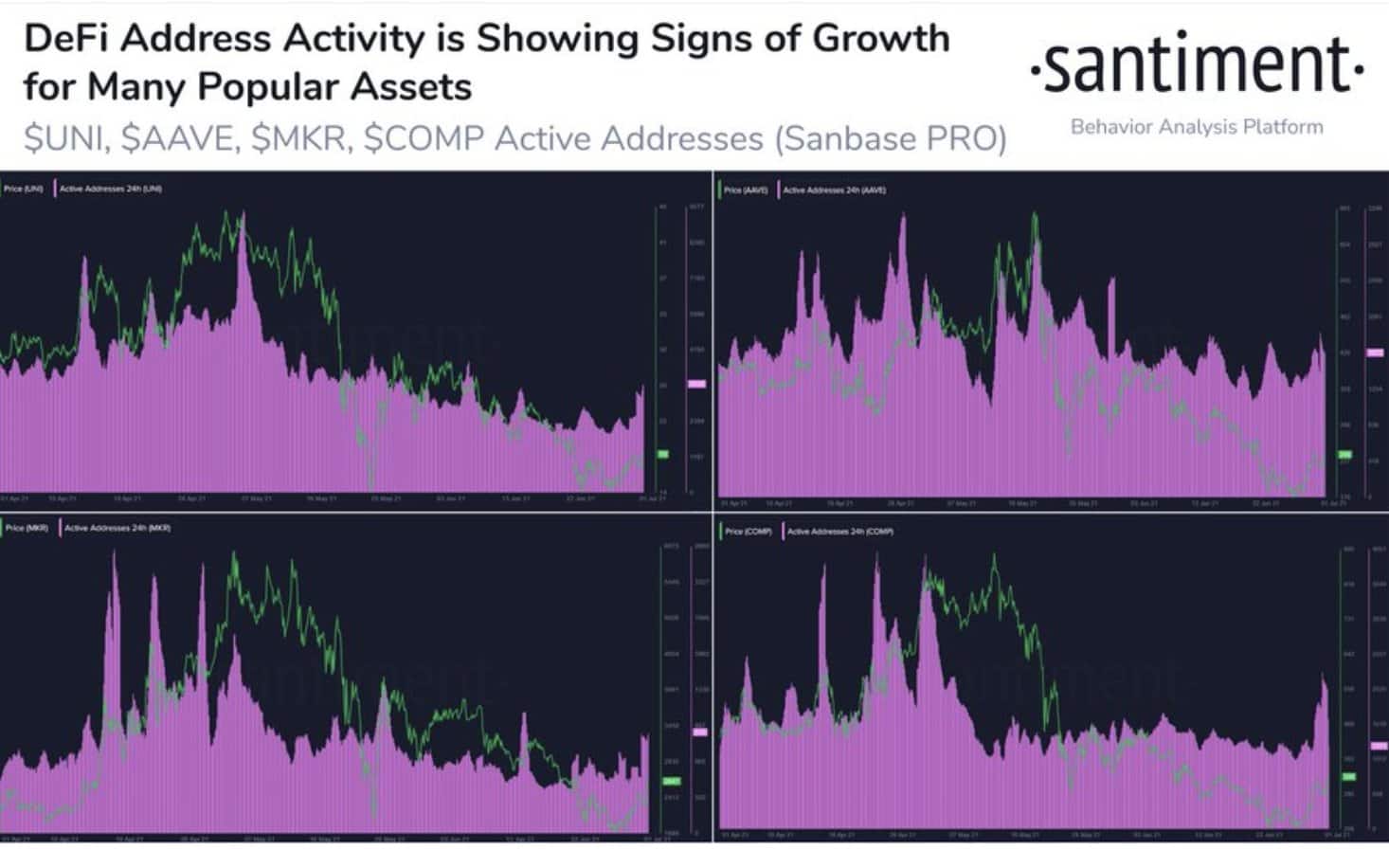

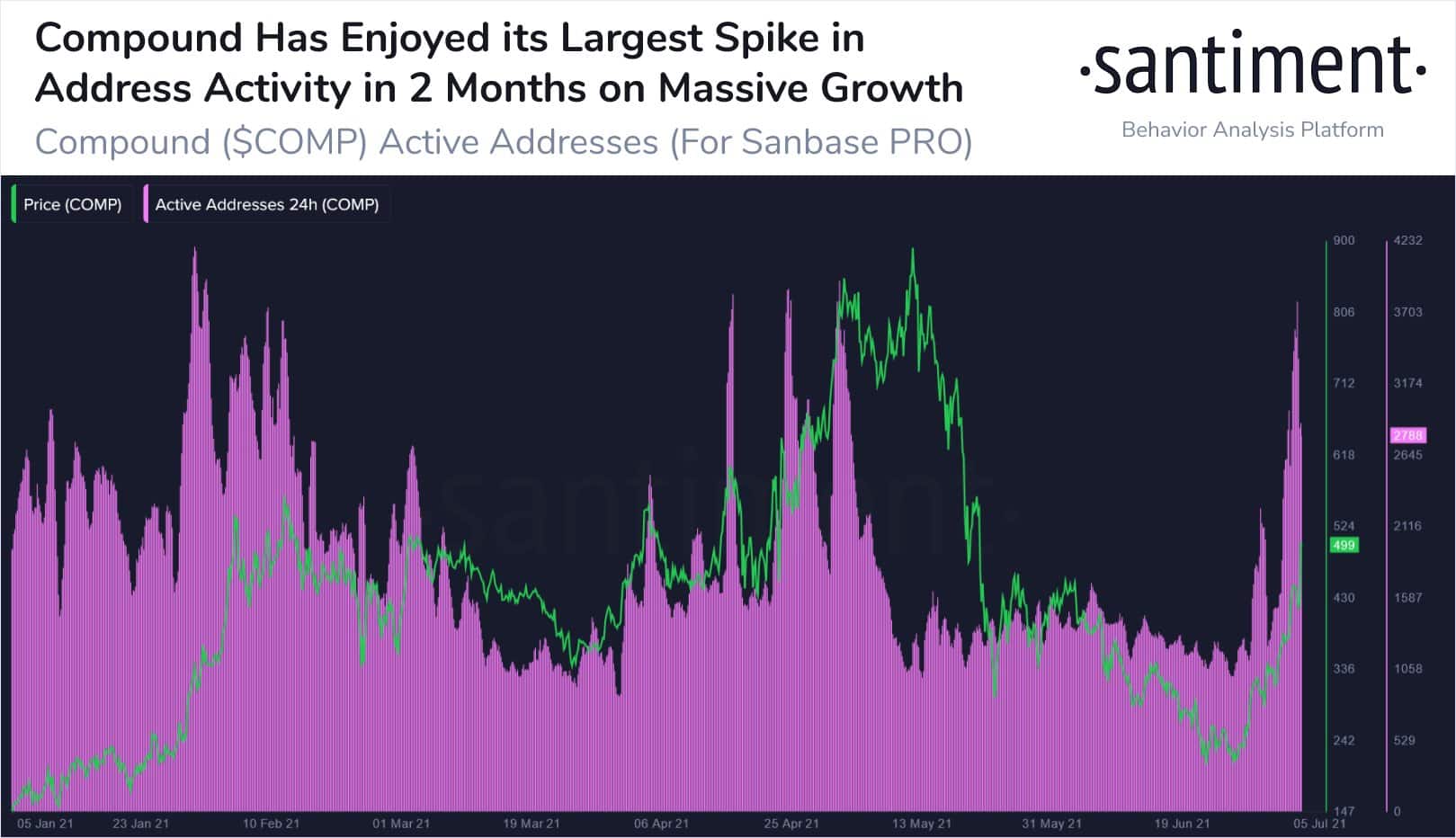

Some of the top-performing DeFi coins contributing to this comeback are Aave (AAVE), Compound (COMP), Uniswap (UNI), Synthetix (SNX), etc. Big market players like Aave and Compound have initiated some major steps to bring institutional players to the DeFi space. As per on-chain data provider Santiment, a majority of the DeFi coins are showing a strong uptick in the address activity.

Compund Unveils ‘Treasury’, Aave Introduces Aave Pro

As said, Defi firms are now taking efforts to bring institutional players to the DeFi space. Last week, Compound Labs announced its new ‘Treasury’ division in partnership with Fireblocks and USDC-stablecoin issuer Circle. This service allows neobanks and FinTech firms to convert the U.S. Dollars to stablecoin USDC and earn a fixed interest of 4% a year.

This service directly targets the businesses of traditional banks discouraging investors to put money in saving accounts or other low-fixed-rate investment vehicles. The result was that COMP price has shot more than 50% over the last week witnessing its biggest address activity spike in 2 months.

On the other hand, Aave protocol makes a similar attempt. The DeFi lending protocol has introduced a new permissionless platform “Aave Pro” in partnership with Fireblocks. The Aave Pro platform will initially support four assets – Bitcoin (BTC), Ethereum (ETH), Aave (AAVE) and USD Coin (USDC).

The platform aims to serve “institutions, FinTechs, and corporates” wherein Fireblocks will serve as the crypto custodian. The price of AAVE has surged more than 25% over the last week. At press time, AAVE is trading at a price of $316 with a market cap of $4.07 billion.

Subscribe to our newsletter for free

Source: https://coingape.com/defi-market-sees-strong-bounce-back-comp-aave-woo-institutions/

- Ads

- announced

- Assets

- avatar

- Banks

- Biggest

- Billion

- Bitcoin

- blockchain

- blockchain technology

- border

- BTC

- businesses

- Circle

- closer

- Coin

- Coins

- Compound

- content

- crypto

- cryptocurrencies

- cryptocurrency

- data

- DeFi

- dollars

- Economics

- ETH

- ethereum

- ethereum (ETH)

- finance

- financial

- fintech

- Free

- good

- hold

- HTTPS

- Institutional

- institutions

- interest

- investing

- investment

- Investors

- IT

- knowledge

- Labs

- learning

- lending

- major

- Majority

- Market

- Market Cap

- market research

- Markets

- money

- months

- Newsletter

- Opinion

- Other

- Partnership

- platform

- press

- price

- Pro

- rally

- research

- saving

- sees

- Share

- skills

- Space

- stablecoin

- support

- Technology

- time

- Trading

- u.s.

- Uniswap

- USD

- USD Coin

- USDC

- Vehicles

- week

- year