Build your portfolio using historical trend analysis

As crypto markets cooled in May 2021 some investors used that opportunity to stock up on the tokens they had not been able to purchase in the bull market cycle for fear of buying them at all-time highs. Whilst others clung for dear life to the tokens they had already purchased in the hope of a market resurge.

A dip in pricing is both an opportunity and a threat. In the short term, it will no doubt decrease the strength of an investor’s overall portfolio value. In turn, this can reduce the investors buying power as their available investment money is now tied up in tokens already purchased, that may be worth significantly less than originally invested. On the flip side, the ability to act and make purchases in these circumstances can arguably provide great rewards to those with patience and belief in the market cycles. Moreover, there are opportunities for those with disposable income when the prices are low.

We are now evolved enough in the crypto space to track moving averages and resistance lines for the majority of leading tokes. This gives an ability to look into the future based on historical data trends. For example, a quick glance at the all-time BTC chart will show us that whilst volatility has certainly been high, the overall trend is one of increasing value. In a simpler way, it’s also clear to see a repeating cycle in the shape of the chart. The 2021 cycle can be likened to the one seen in 2017/18 except the resistance lines for the token price have moved upward. Using that extremely basic view it could be argued that post the price increase we are in now BTC may return to a sideways price movement for the foreseeable future.

It is possible to look at all tokens in this way, but more precisely those with a long tail. Obviously looking at a token that launched last week for historical data would be flawed.

Top DeFi Tokens

This article will look at the token price of several top DeFi protocols over a 1-year time frame to date. The purpose is that we can look at historical price movements before and during the bull run and then try to predict its future price. Based on assumptions the platform will continue to hold its audience and that nothing completely wild happens between now and then which could massively alter price. Like a world pandemic for example. As mentioned, this is a theoretical look at prices and trends and in no way should be used to guide investment decisions other than for informational purposes.

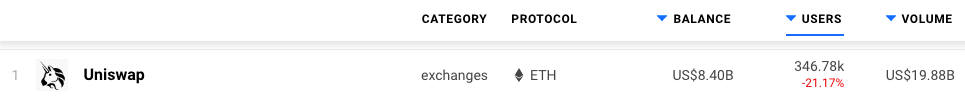

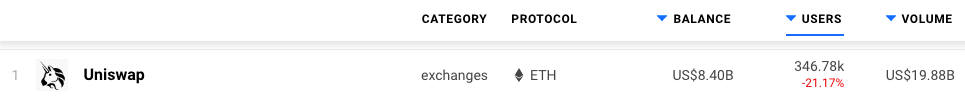

Uniswap

Uniswaps UNI token was introduced in mid-September 2020 so we will look at it from that point to today. For those that are not aware Uniswap is the leading decentralized exchange on the Ethereum network and has long been considered the champion of DeFi. The token premiered at a modest $3.44 and did not see a significant price rise until the bull market cycle really kicked off in January. Reaching over $42 at its peak. Using May 24th as an indicator of the end of the bull run we can see that the price fell to as low as $14.64.

Bearing in mind all the above information and that as a leading protocol we don’t envisage Uniswap simply being replaced or disappearing this could represent an investment opportunity. Additionally, the Uniswap platform has seen almost 350,000 unique active wallets interact with its smart contracts in the last 30-days. A strong indicator of audience loyalty.

Example (not inc fees): Buying 10 UNI tokens for around $150 at a post-dip low. Waiting for an amount of time and then selling UNI at a price closer to $40 per token could net you a $250 profit. Now, whilst you may be now thinking – yes, Ian, obviously. But without first understanding the token price trend it would not be possible to come to this loose conclusion. Moreover, this formula can be applied to any token with at least 1 year of activity.

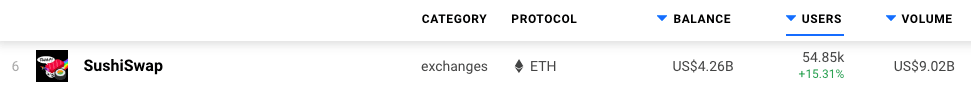

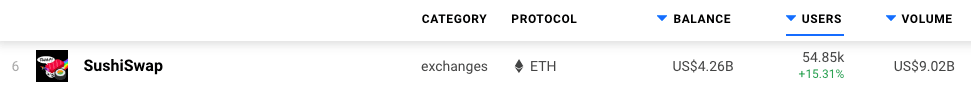

SushiSwap

SushiSwap is a fork of the Uniswap platform. It is fundamentally the same platform with enhancements that allowed users more access to yield farming and staking opportunities as it launched with its own native token from the get-go. The SUSHI token dropped at the end of August 2020 and is almost exactly 1 year old at the time of writing. The token premiered at a modest $2.59 and saw a significant price rise and fall in the immediate days after launch. Where it remained at around $1 until the bull market cycle really kicked off in January. Reaching over $23.05 at its peak. Using May 24th as an indicator of the end of the bull run we can see that the price fell to as low as $6.35.

Once again, taking into account the stature of the SushiSwap platform we don’t envisage SushiSwap simply being replaced or disappearing so this could represent an investment opportunity. Additionally, the SushiSwap platform has seen over 50,000 unique active wallets interact with its smart contracts in the last 30-days. A strong indicator of audience loyalty.

Example (not inc fees): Buying 10 SUSHI tokens for around $70 at a post-dip low. Waiting for an amount of time and then selling SUSHI at a price closer to $23 per token could net you a $160 profit.

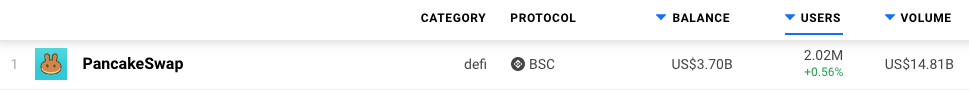

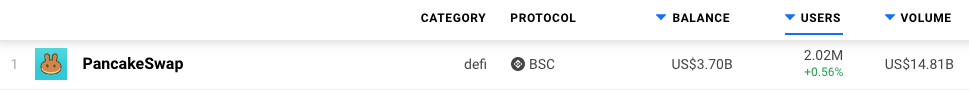

PancakeSwap

PancakeSwap is basically SushiSwap on Binance Smart Chain. Where it offers users the same services as leading DeFi applications such as staking, token swaps, and yield farming but importantly, at a fraction of the cost due to the fact actions do not incur Ethereum gas fees. The platform’s native CAKE DeFi token dropped around the end of September 2020 so once again provides a good case study. The token premiered at a modest $0.43 and did not see a significant price rise until the bull market cycle really kicked off in late January. Reaching $42.46 at its peak. Using May 24th as an indicator of the end of the bull run we can see that the price fell to as low as $11.31.

Once again, taking into account the stature of the PancakeSwap and the overall success of Binance Smart Chain in attracting DeFi users to its platform we don’t envisage PancakeSwap simply being replaced or disappearing. Additionally, the PancakeSwap platform has seen over 2 million unique active wallets interact with its smart contracts in the last 30-days. A massive indicator of audience loyalty.

Example (not inc fees): Buying 10 CAKE tokens for around $110 at a post-dip low. Waiting for an amount of time and then selling SUSHI at a price closer to $42 per token could net you a $310 profit.

In Summary

Performing all three of these trades and then realizing the profits calculated here at a later date could be a nice earner. Or course the tokens could never achieve their all-time highs again. Although, trend research would suggest otherwise. From a $330 investment, the margin of profit could be $720. Of course, add more zeros to the initial investment figures used in the examples and the margins shoot up.

As mentioned, this theory can be true for any token as long as it has a significant enough shelf life to analyze. Of course, this is very rudimental research. What really matters is the investor’s understanding and belief in a project. Importantly, belief can only be formed through research, interaction, and analyzing trend data. Moreover, I am saying nothing more complicated than for example: If Amazon stock plummeted tomorrow buying it would probably be a shrewd move. Based on historical information we can have some faith in a bounce back.

👇 Use DappRadar Token Swap to swap tokens with zero fees!👇

The above does not constitute investment advice. The information given here is purely for informational purposes only. Please exercise due diligence and do your research. The writer holds positions in ETH, BTC, ADA, NIOX, AGIX, MANA, SAFEMOON, SDAO, CAKE, HEX, LINK, GRT, CRO, SHIBA INU, AND OCEAN.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet