It is taken for granted in some circles that FTX sold bitcoin and eth as soon as they were deposited to prop up FTX backed tokens, like FTT or Solana.

“FTX and Alameda sold down the crypto markets with our assets to fund their unprofitable gambling. Markets would otherwise be much higher,” Andrew Kang of Mechanism Capital said back in November.

As much has been confirmed in court for Celsius, the now defunct defi platform, as the bankruptcy examiner Shoba Pillay stated they sold bitcoin and eth deposited by customers to buy Cel, its own token.

For FTX however there has not quite been such confirmation, but they gave a $10 billion loan to Alameda, some of which was invested in startup equity, for which presumably they sold some crypto.

In addition, the address we’ve highlighted in the featured image looks interesting, if not very much so:

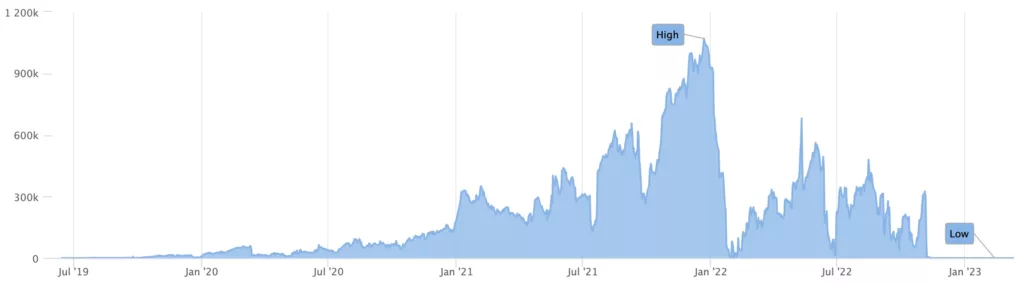

This shows they held as much as one million eth at the very peak on Christmas day 2021. Then just weeks after, all of it disappears with the balance going down to 8,000 eth on the 28th of January 2022.

One million eth is currently worth $2 billion. In or around January 2022, it would have been about five billion. Though where this address is concerned, it became zero billion.

We see that yoyo-ing prior to Christmas too. In September for example it went from 600,000 eth to 300,000.

Likewise after Christmas, it recovers from that 8,000 bottom in January to hit half a million in June and then about 15,000 at the end of that June while Luna was collapsing.

According to court documents regarding Celsius, rather than an insta selling of bitcoin or eth, it happened in waves to cover shortfalls in stablecoins or btc/eth.

If the same happened at FTX, then the chart above would make some sense but unfortunately we can’t analyze it fully because transactions on Etherscan go only back to October.

So we can’t quite see where that one million eth went to in weeks, which means it is becoming necessary now to start our own node for Trustnodes, soon-ish, not least because you can’t necessarily trust the blockchain explorers anymore to the same extent as when almost everyone was running a node.

That’s particularly in regards to their bitcoin holdings. The explorer says they have received 160,000 BTC in total, yet going through the transactions we can’t quite figure out when such sums were received or transferred out, if indeed they were, save for 20,000 BTC.

Bitcoin explorers in particular are known to sometime be bugy, though Etherscan has been fine in general except it is limiting.

The only statement we can make with some certainty therefore is that the one million eth address does belong to FTX because it stops moving on November the 8th when the 325,000 eth balance becomes zero as the exchange goes bankrupt.

Otherwise it is more a maybe they did sell billions worth of eth, over about two years, during the bull and in particular during the bear, with that January especially worthy of zoom in.

Because if it turns out the sum went out of FTX, it obviously wasn’t depositors that did so in weeks, and if it was converted then that would have been huge pressure on price.

This is used by some to explain the tamer bull in 2021 in as far as bitcoin did not have a blow off top.

If that is correct, now that FTX has gone, then there would be some sort of re-pricing to untame the bull, by about one million eth.

For eth bulls as well this would be a nice theory as it would partially explain why there wasn’t a re-pricing of the ratio following the Merge to full Proof of Stake, which turned the asset into deflationary.

The merge happened in the middle of September, but its repricing began in July when eth doubled from $1,000 to $2,000 by mid-August.

FTX’s eth balance went from circa 20,000 at the end of June to again nearly half a million by mid-August, and then down to 55,000 eth by mid-October.

So this all fits nicely, but without concrete evidence at present. That leads to the question of whether this is the bulls’ equivalent of Tether pumping it all, in this case FTX dumping it all.

Time will tell, but there is concrete evidence that some of the now bankrupt entities did sell bitcoin and eth, and therefore some of the artificial sell pressure has been lifted.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://www.trustnodes.com/2023/04/12/did-ftx-sell-one-million-eth

- :is

- $UP

- 000

- 2021

- 2022

- 8

- a

- About

- above

- addition

- address

- After

- Alameda

- All

- analyze

- and

- Andrew

- April

- ARE

- around

- artificial

- AS

- asset

- Assets

- At

- back

- backed

- Balance

- bankrupt

- Bankruptcy

- BE

- Bear

- because

- becomes

- becoming

- began

- Billion

- billions

- Bitcoin

- blockchain

- blow

- Bottom

- BTC

- bull

- Bulls

- buy

- by

- CAN

- capital

- case

- CEL

- Celsius

- certainty

- Chart

- Christmas

- circles

- cold wallet

- concerned

- confirmation

- converted

- Court

- cover

- crypto

- Crypto Markets

- Currently

- Customers

- day

- DeFi

- DeFi platform

- deflationary

- defunct

- deposited

- depositors

- DID

- documents

- doubled

- down

- during

- entities

- equity

- Equivalent

- especially

- ETH

- eth bulls

- etherscan

- everyone

- evidence

- examiner

- example

- Except

- exchange

- Explain

- explorer

- Explorers

- featured

- Figure

- fine

- following

- For

- from

- FTT

- FTX

- full

- fully

- fund

- Gambling

- General

- Go

- Goes

- going

- granted

- Half

- happened

- Have

- Held

- High

- higher

- Highlighted

- Hit

- Holdings

- However

- HTTPS

- huge

- image

- in

- insta

- interesting

- invested

- IT

- ITS

- January

- July

- known

- Leads

- Lifted

- like

- loan

- LOOKS

- Luna

- make

- Markets

- max-width

- means

- mechanism

- Mechanism Capital

- Merge

- Middle

- million

- more

- moving

- nearly

- necessarily

- necessary

- node

- November

- october

- of

- on

- ONE

- otherwise

- own

- particular

- particularly

- Peak

- platform

- plato

- Plato Data Intelligence

- PlatoData

- present

- pressure

- price

- Prior

- proof

- Proof-of-Stake

- pumping

- question

- rather

- ratio

- received

- Recovers

- regarding

- regards

- running

- same

- Save

- sell

- sell bitcoin

- Selling

- sense

- September

- Shoba Pillay

- Shows

- So

- Solana

- sold

- some

- Stablecoins

- stake

- start

- startup

- stated

- Statement

- Stops

- such

- Tether

- that

- The

- their

- therefore

- Through

- to

- token

- Tokens

- too

- top

- Total

- Transactions

- transferred

- Trust

- Trustnodes

- Turned

- Wallet

- waves

- webp

- Weeks

- WELL

- whether

- which

- while

- will

- with

- without

- worth

- would

- years

- You

- zephyrnet

- zero

- zoom