This report provides a comprehensive analysis of Dogecoin (DOGE)’s price dynamics on Binance, covering technical indicators, moving averages, and pivot points.

Price and Volume

As of 08:20:05, the current price of Dogecoin (DOGE) is $0.061100, a decrease of $0.000900 (-1.45%) from the previous close. The volume over the last 24 hours is 530,429,616 DOGE. The bid/ask spread is $0.061100/$0.061110. The day’s range is $0.059750 – $0.062560.

Technical Indicators

Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract used by traders who follow technical analysis.

- RSI(14): The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. The RSI for DOGE is 49.215, indicating a neutral position.

- STOCH(9,6): The Stochastic Oscillator compares a security’s closing price to its price range over a specific period of time. The STOCH(9,6) for DOGE is 65.494, indicating a buy position.

- STOCHRSI(14): The Stochastic Relative Strength Index (StochRSI) is a momentum oscillator used to identify overbought or oversold conditions in a market. The StochRSI for DOGE is 95.027, indicating an overbought condition.

- MACD(12,26): The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD(12,26) for DOGE is 0.000, indicating a neutral position.

- ADX(14): The Average Directional Index (ADX) is used to measure the strength or weakness of a trend, not the actual direction. The ADX for DOGE is 20.081, indicating a buy position.

- Williams %R: The Williams %R is a momentum indicator that measures overbought and oversold levels. The Williams %R for DOGE is -22.293, indicating a buy position.

- CCI(14): The Commodity Channel Index (CCI) is a momentum-based oscillator used to help determine when an investment vehicle is reaching a condition of being overbought or oversold. The CCI(14) for DOGE is 52.0142, indicating a buy position.

- ATR(14): The Average True Range (ATR) is a market volatility indicator. The ATR(14) for DOGE is 0.0005, indicating less volatility.

- Highs/Lows(14): The Highs/Lows(14) for DOGE is 0.0000, indicating a buy position.

- Ultimate Oscillator: The Ultimate Oscillator is a technical indicator that is used to generate buy and sell signals, incorporating the price action of an asset for three different time periods. The Ultimate Oscillator for DOGE is 50.022, indicating a neutral position.

- ROC: The Rate of Change (ROC) is a momentum oscillator, which measures the percentage change between the current price and the n period past price. The ROC for DOGE is -0.309, indicating a sell position.

- Bull/Bear Power(13): The Bull Power indicator measures the buying pressure in the market. The Bull Power for DOGE is 0.0006, indicating a buy position.

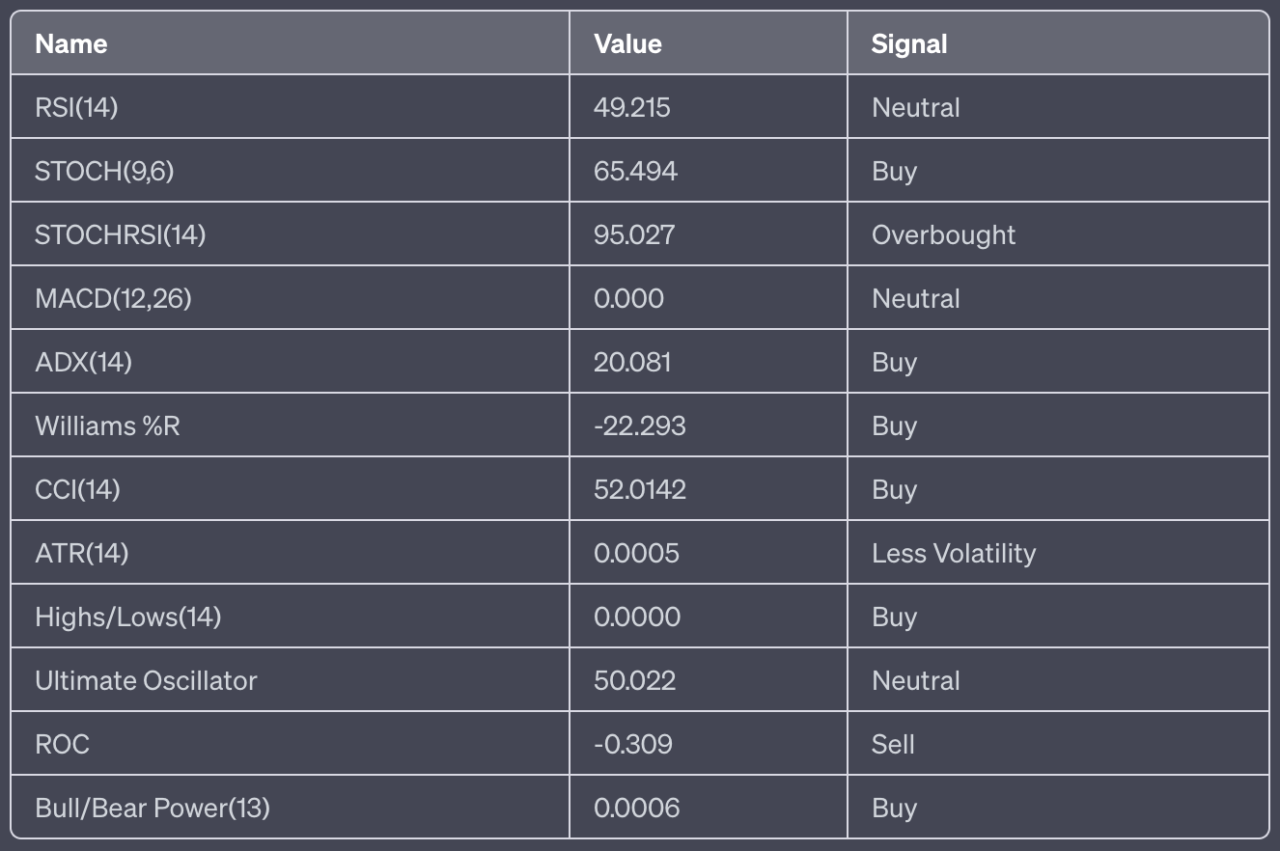

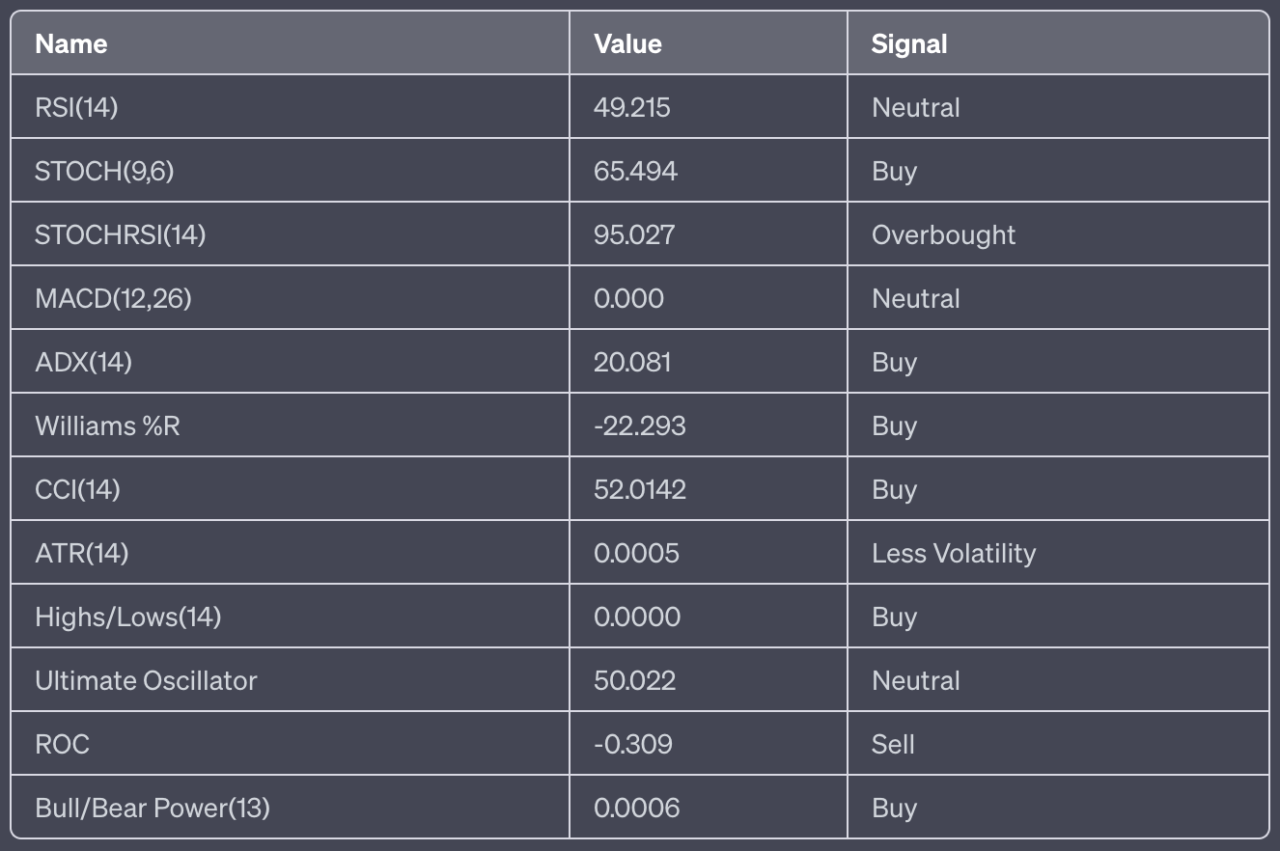

Here is a summary of the technical indicators in table form:

In summary, the technical indicators suggest a strong buy sentiment for DOGE since there are six buy signals, one sell signal, and three neutral signals.

Moving Averages

Moving averages are a type of data smoothing technique that analysts use in technical analysis to identify trends in a set of data, such as stock prices. They help to reduce the noise and fluctuation in price data to present a smoother line, making it easier to see the overall direction or trend.

There are several types of moving averages, but two of the most common ones are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

- Simple Moving Average (SMA): The SMA is calculated by adding together the prices for a certain number of periods and then dividing by that number of periods. For example, a 5-day SMA would add together the closing prices for the last 5 days and then divide by 5. The SMA gives equal weight to all the data points in its calculation.

- Exponential Moving Average (EMA): The EMA is similar to the SMA, but it gives more weight to recent data. This means it responds more quickly to recent price changes than the SMA. The calculation of the EMA is a bit more complex than the SMA, involving an exponential smoothing factor to give more weight to recent prices.

The significance of different period moving averages (like 5-day, 10-day, 20-day, 50-day, 100-day, and 200-day) lies in the timeframe that traders are interested in:

- 5-day, 10-day, and 20-day moving averages are often used for short-term trends. They respond quickly to price changes and are useful for traders looking to take advantage of short-term price movements.

- 50-day and 100-day moving averages are more medium-term. They are less sensitive to daily price fluctuations and provide a clearer picture of the medium-term trend.

- 200-day moving average is a long-term trend indicator. It’s less sensitive to daily price fluctuations and provides a clearer picture of the long-term trend. Many traders consider a market to be in a long-term uptrend when the price is above the 200-day moving average and in a long-term downtrend when it’s below.

It’s important to note that moving averages are lagging indicators, meaning they are based on past prices. They can help identify a trend but won’t predict future price movements.

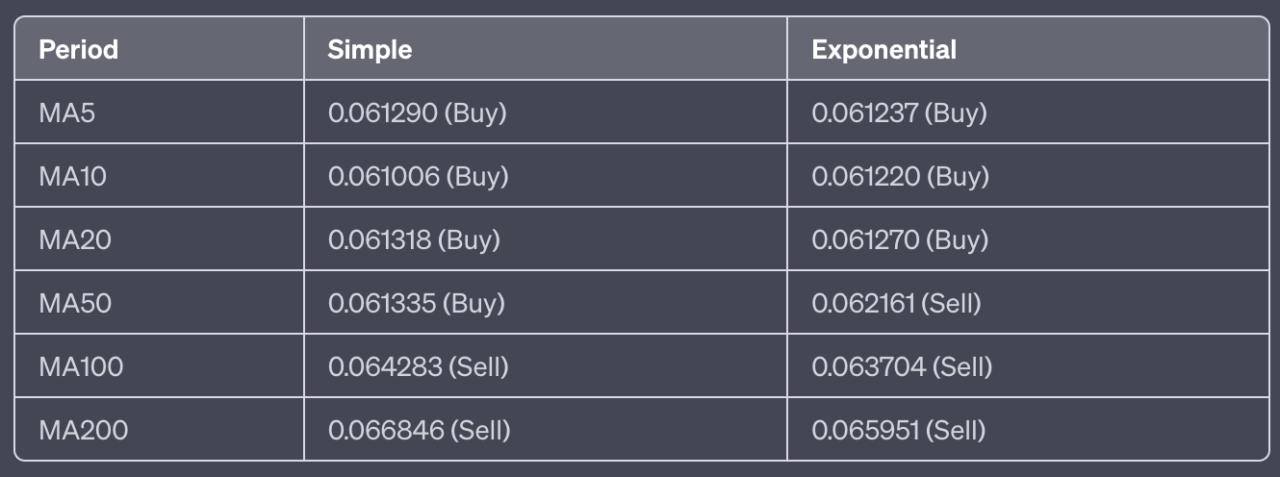

Here’s a detailed breakdown of the moving averages for Dogecoin (DOGE):

- MA5: The 5-day moving average is $0.061290, indicating a buy position. The 5-day exponential moving average is $0.061237, indicating a buy position.

- MA10: The 10-day moving average is $0.061006, indicating a buy position. The 10-day exponential moving average is $0.061220, indicating a buy position.

- MA20: The 20-day moving average is $0.061318, indicating a buy position. The 20-day exponential moving average is $0.061270, indicating a buy position.

- MA50: The 50-day moving average is $0.061335, indicating a buy position. The 50-day exponential moving average is $0.062161, indicating a sell position.

- MA100: The 100-day moving average is $0.064283, indicating a sell position. The 100-day exponential moving average is $0.063704, indicating a sell position.

- MA200: The 200-day moving average is $0.066846, indicating a sell position. The 200-day exponential moving average is $0.065951, indicating a sell position.

<!–

–> <!–

–>

Here is a summary of the moving averages:

The moving averages suggest a buy sentiment for DOGE since there are seven buy signals and five sell signals.

In the short term, the 5-day, 10-day, and 20-day moving averages and their exponential counterparts all indicate a buy position, suggesting that the price of DOGE has been increasing recently. This could be a sign of positive momentum in the market for DOGE. However, as indicated by the 50-day moving average, the medium-term trend is mixed. The simple moving average suggests a buy position, but the exponential moving average suggests a sell position. This could indicate some uncertainty or volatility in the market. In the long term, both the 100-day and 200-day moving averages and their exponential counterparts indicate a sell position. This suggests that the price of DOGE has been decreasing over the longer term.

In summary, while the short-term trend for DOGE appears to be positive, the medium and long-term trends suggest some caution may be warranted.

Pivot Points

Pivot points are technical analysis indicators used to determine the overall trend of the market over different time frames. They are calculated using the high, low, and closing prices of a previous trading period. If the trading price for the next period is above the pivot point, it is considered a bullish sentiment, and if it is below the pivot point, it is considered bearish.

There are several methods to calculate pivot points, each with its own way of calculating support and resistance levels. Here are the methods used in this report:

- Classic: This is the most common method of calculating pivot points. The pivot point is calculated as the average of the high, low, and closing prices from the previous trading period. Support and resistance levels are then calculated off of this pivot point.

- Fibonacci: This method applies the mathematical concept of Fibonacci sequences to the price data to calculate the pivot point and associated support and resistance levels.

- Camarilla: This method uses a unique equation to calculate the pivot point and support and resistance levels, which often results in much closer levels than other methods.

- Woodie’s: This method gives more weight to the closing and opening prices when calculating the pivot point.

- DeMark’s: This method was developed by Tom DeMark and uses the relationship between the opening, closing, and high and low prices of the previous trading period to calculate the pivot point.

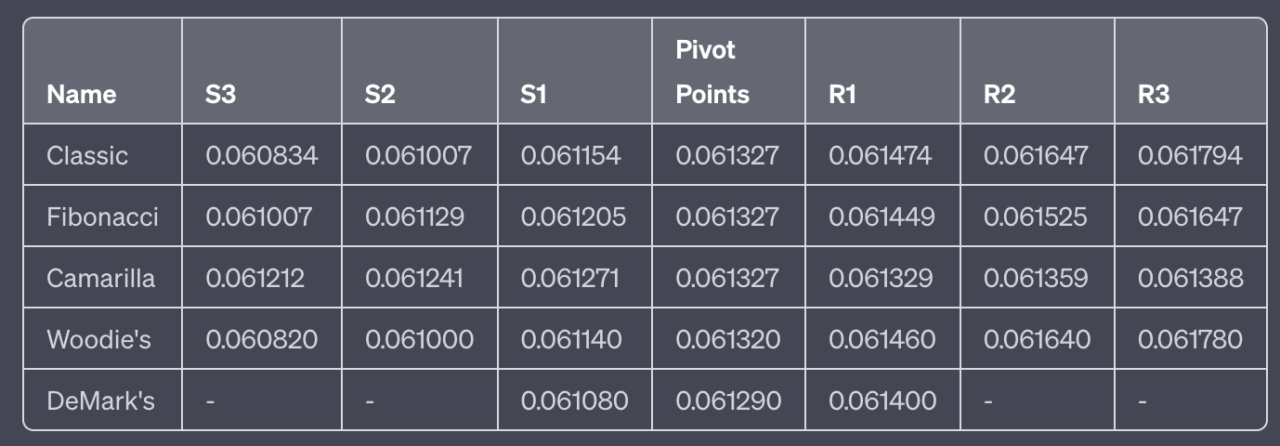

Here’s a detailed breakdown of the pivot points for Dogecoin (DOGE):

- Classic: The Classic pivot points are as follows: S3: 0.060834, S2: 0.061007, S1: 0.061154, Pivot Point: 0.061327, R1: 0.061474, R2: 0.061647, R3: 0.061794.

- Fibonacci: The Fibonacci pivot points are as follows: S3: 0.061007, S2: 0.061129, S1: 0.061205, Pivot Point: 0.061327, R1: 0.061449, R2: 0.061525, R3: 0.061647.

- Camarilla: The Camarilla pivot points are as follows: S3: 0.061212, S2: 0.061241, S1: 0.061271, Pivot Point: 0.061327, R1: 0.061329, R2: 0.061359, R3: 0.061388.

- Woodie’s: The Woodie’s pivot points are as follows: S3: 0.060820, S2: 0.061000, S1: 0.061140, Pivot Point: 0.061320, R1: 0.061460, R2: 0.061640, R3: 0.061780.

- DeMark’s: The DeMark’s pivot points are as follows: S1: 0.061080, Pivot Point: 0.061290, R1: 0.061400.

Here is a summary of the pivot points in table form:

The pivot point in the Classic method is at $0.061327. The support levels are at $0.061154 (S1), $0.061007 (S2), and $0.060834 (S3). If the price drops to these levels, we could expect the price to bounce back up as these levels often act as a floor that the price has difficulty moving below. On the other hand, the resistance levels are at $0.061474 (R1), $0.061647 (R2), and $0.061794 (R3). If the price rises to these levels, we could expect some selling pressure, which could push the price back down as these levels often act as a ceiling that the price has difficulty moving above.

Featured Image Credit: Photo / illustration by “Dylan Calluy” via Unsplash

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.cryptoglobe.com/latest/2023/06/dogecoin-doge-usd-price-analysis-for-12-june-2023-technical-indicators-suggest-strong-buy/

- :has

- :is

- :not

- $UP

- 000

- 12

- 13

- 14

- 15%

- 20

- 2023

- 24

- 26%

- 49

- 50

- 9

- a

- above

- Act

- Action

- actual

- add

- adding

- Ads

- ADvantage

- adx

- All

- an

- analysis

- Analysts

- and

- appears

- ARE

- AS

- asset

- associated

- At

- average

- average directional index

- back

- based

- BE

- bearish

- been

- being

- below

- between

- binance

- Bit

- both

- Bounce

- Breakdown

- bull

- Bullish

- but

- buy

- Buying

- by

- calculate

- calculated

- calculating

- calculations

- CAN

- caution

- ceiling

- certain

- change

- Changes

- Channel

- classic

- clearer

- Close

- closer

- closing

- commodity

- Common

- complex

- comprehensive

- concept

- condition

- conditions

- Consider

- considered

- contract

- Convergence

- could

- covering

- credit

- Current

- daily

- data

- data points

- Days

- decrease

- detailed

- Determine

- developed

- different

- Difficulty

- direction

- Divergence

- Doge

- DOGE/USD

- Dogecoin

- Dogecoin (DOGE)

- down

- downtrend

- Drops

- dynamics

- each

- easier

- EMA

- equal

- example

- expect

- exponential

- exponential moving average

- factor

- Fibonacci

- Floor

- fluctuation

- fluctuations

- follow

- follows

- For

- form

- from

- future

- Future Price

- generate

- Give

- gives

- hand

- help

- here

- High

- HOURS

- However

- HTTPS

- identify

- if

- image

- important

- in

- incorporating

- increasing

- index

- indicate

- indicated

- Indicator

- Indicators

- interest

- interested

- investment

- Investment vehicle

- involving

- IT

- ITS

- june

- lagging

- Last

- less

- levels

- lies

- like

- Line

- Long

- long-term

- longer

- looking

- Low

- low prices

- MACD

- Making

- many

- Market

- market volatility

- mathematical

- max-width

- May..

- meaning

- means

- measure

- measures

- medium

- method

- methods

- mixed

- Momentum

- more

- most

- movements

- moving

- moving average

- moving averages

- much

- Neutral

- next

- Noise

- number

- of

- off

- often

- on

- ONE

- ones

- open

- open interest

- opening

- or

- Other

- over

- overall

- own

- past

- percentage

- period

- periods

- picture

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- Point

- points

- position

- positive

- power

- predict

- present

- pressure

- previous

- price

- PRICE ACTION

- Price Analysis

- Price Fluctuations

- Prices

- provide

- provides

- Push

- quickly

- R3

- range

- Rate

- reaching

- recent

- recently

- reduce

- relationship

- relative

- relative strength index

- report

- Resistance

- Respond

- Results

- Rises

- rsi

- Screen

- screens

- security

- see

- sell

- Selling

- sensitive

- sentiment

- set

- seven

- several

- Short

- short-term

- Shows

- sign

- Signal

- signals

- significance

- similar

- Simple

- since

- SIX

- sizes

- SMA

- smoother

- some

- specific

- speed

- spread

- stock

- strength

- strong

- such

- suggest

- Suggests

- SUMMARY

- support

- support levels

- table

- Take

- Technical

- Technical Analysis

- term

- than

- that

- The

- their

- then

- There.

- These

- they

- this

- three

- time

- timeframe

- to

- together

- Traders

- Trading

- Trend

- Trends

- true

- two

- type

- types

- ultimate

- Uncertainty

- unique

- uptrend

- use

- used

- uses

- using

- vehicle

- Volatility

- volume

- was

- Way..

- we

- weakness

- weight

- when

- which

- while

- WHO

- Williams

- with

- would

- zephyrnet