The European Central Bank is pushing ahead with plans to launch a digital euro, aiming to provide a pan-European digital payment solution that complements cash, according to Piero Cipollone, Member of the Executive Board of the ECB. Speaking at the Convegno Innovative Payments conference, Cipollone outlined the fundamental design choices and rationale behind the digital euro project, according to notes released on March 13.

As evolving payment trends reflect people’s increasing preference for digital payments, the ECB seeks to make lives more accessible by offering a public digital means of payment that can be used free of charge for any digital transaction in the euro area. Cipollone emphasized that the digital euro would bring cash-like features to the digital world, being available offline, free for basic use, and respectful of privacy while having a pan-European reach.

However, some critics have raised concerns about the privacy implications of the digital euro. In a recent post, WalkerAmerica, the host of Bitcoin Bitcoin-focused Titcoin Podcast, expressed skepticism about the ECB’s claims of privacy:

“ECB plans to roll out digital Euro CBDC starting in 2025 They claim it’ll be ‘private,’ but it will not be, given Lagarde already wants to throw you in jail for a 1000+ euro anonymous cash payment. Study #Bitcoin & opt out of this totalitarian surveillance token.”

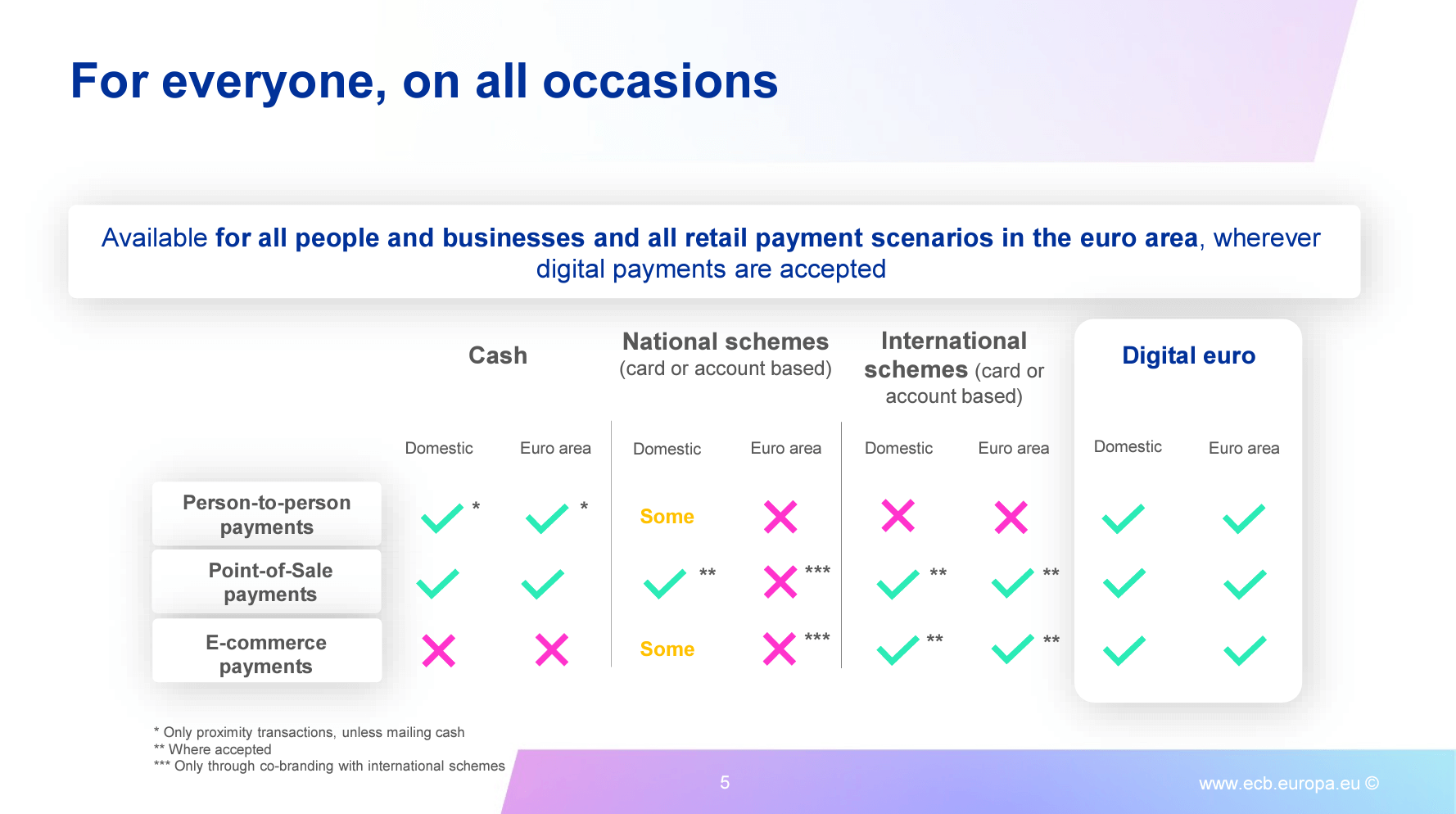

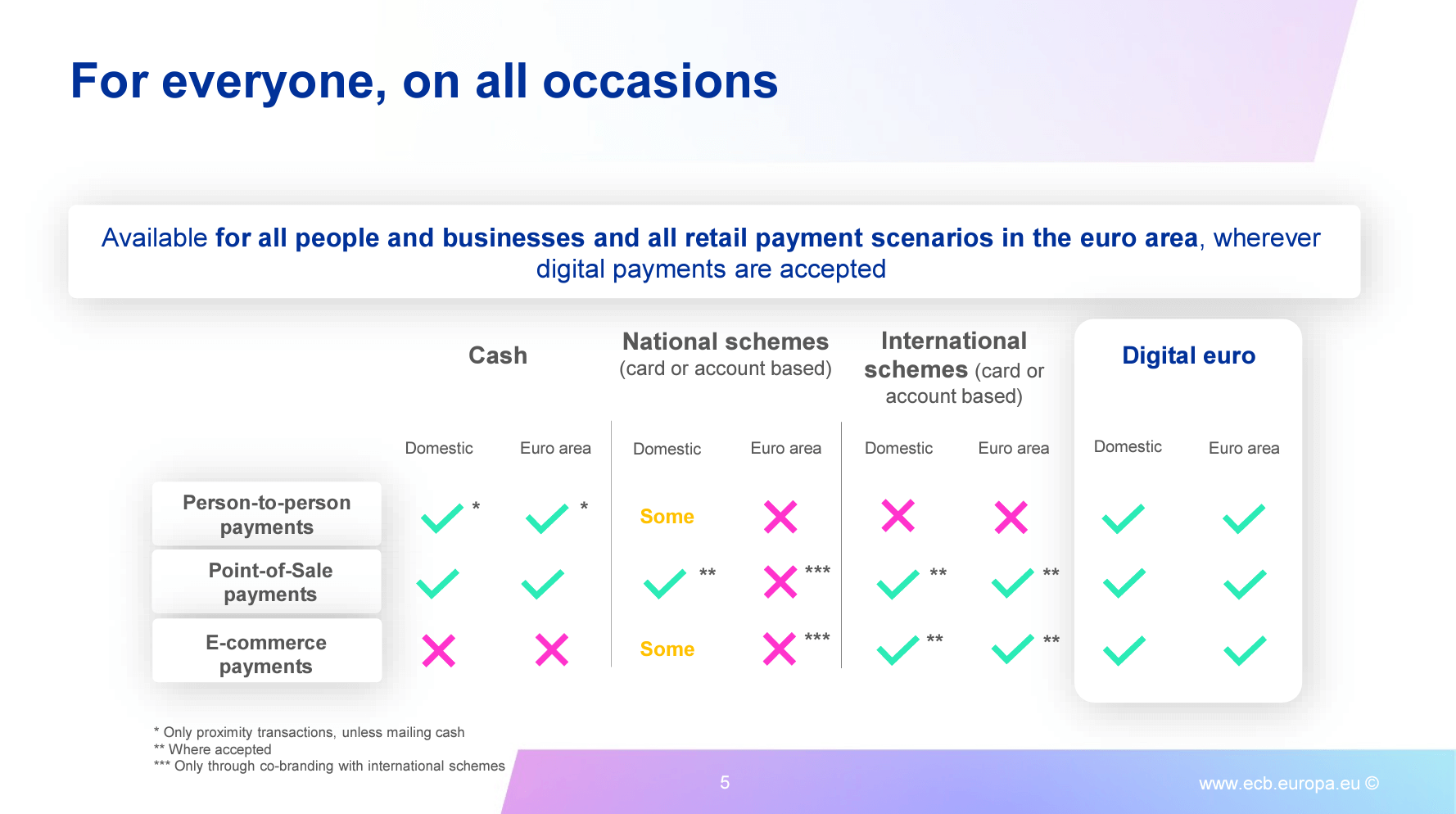

The released slides suggest the digital euro is designed to be accessible to everyone, including individuals and businesses, covering all retail payment scenarios in the euro area wherever digital payments are accepted. Cipollone highlighted the lack of a current European digital means of payment covering all euro area countries, with 13 out of 20 countries relying on international schemes for digital payments, settling 69% of all digital transactions in the EU. The digital euro aims to fill this gap by providing a standardized digital payment platform for the entire euro area.

Addressing inclusivity concerns, Cipollone noted that digital euro payments could also be made using a physical card, with cash being used for funding and defunding. Users would have access to face-to-face technical support and the option to switch intermediaries easily. Selected public entities would also serve as intermediaries for users without bank accounts.

Data protection and privacy are said to be key priorities for the digital euro project. The Eurosystem would implement safeguards to ensure high data protection standards, including internal data segregation and auditing. Innovative privacy-enhancing techniques would be adopted when ready and tested for large payment systems, fostering higher privacy standards for digital euro users.

However, the crypto industry has also been less optimistic about this, with people such as Bitcoin author Quinten Francois commenting that “Cash is anonymous and not censorable. Digital euro isn’t.” Further, in February, Cipollone spoke in front of the European Parliament’s Committee on Economic and Monetary Affairs to allay concerns about the security of the digital euro.

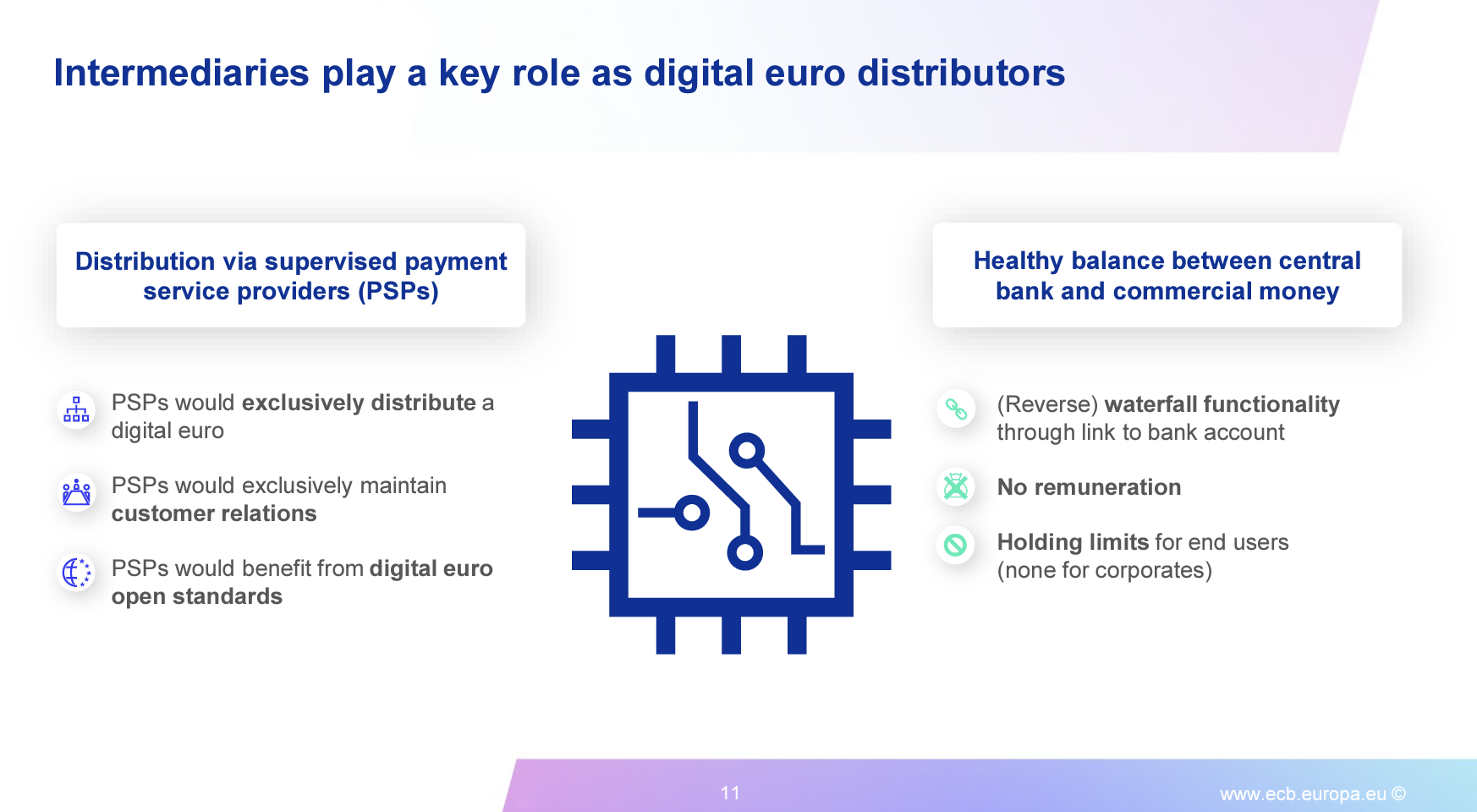

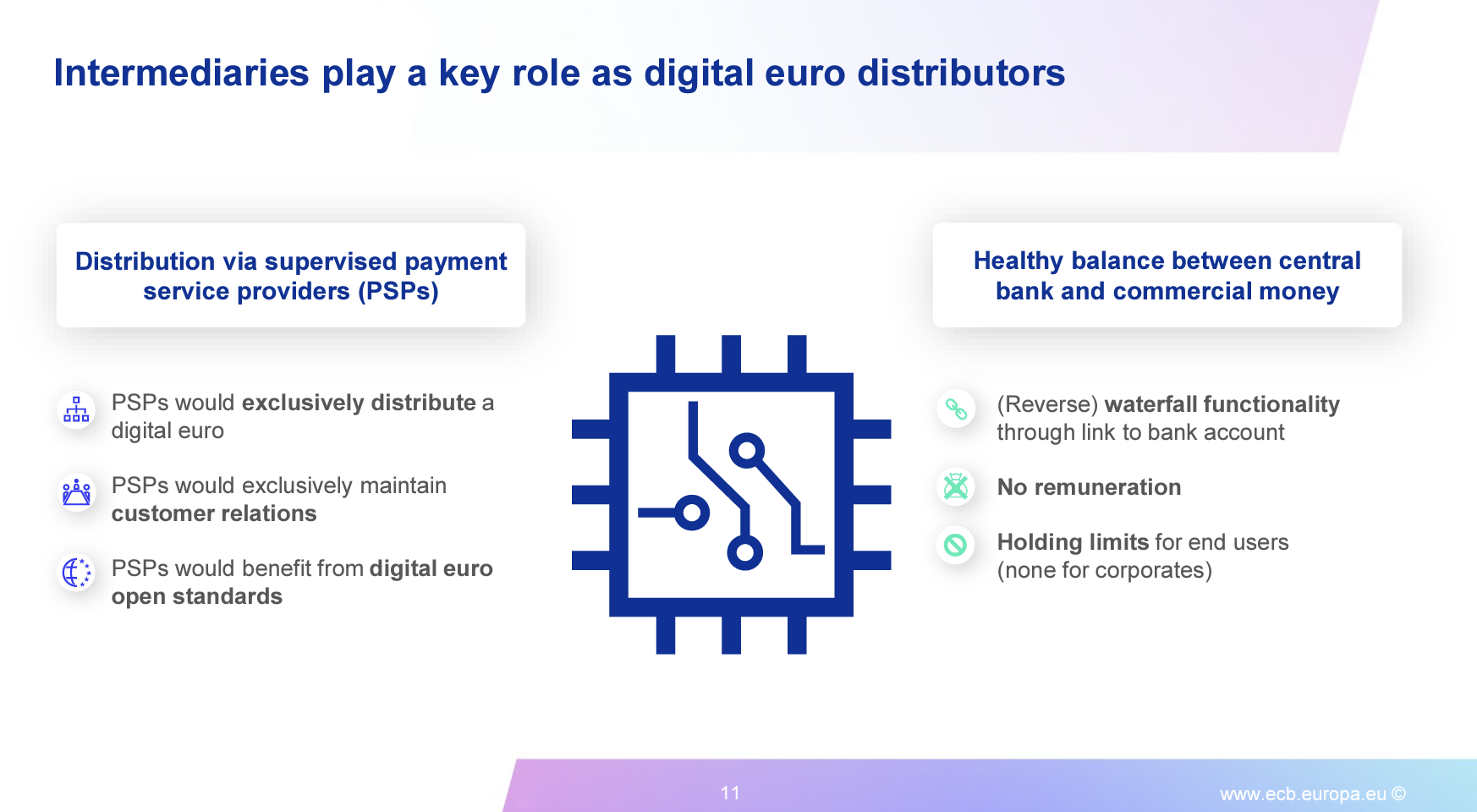

The presentation also asserts that the digital euro would be distributed via supervised payment service providers, maintaining a healthy balance between central bank and commercial money. PSPs would exclusively distribute the digital euro, strengthen customer relations, and benefit from open standards. A digital euro rulebook, drafted with the involvement of market participants, would establish common standards to ensure pan-European reach and a harmonized payment experience while giving the market freedom to develop innovative solutions.

Notably, the above slide showcases how there will be “holding limits” for end users. Still, there are none for “corporates,” suggesting that retail users will have a limit on how much of the digital euro they will be able to custody, but companies will have no limit. Such features aim to create a “healthy balance between central bank and commercial money,” according to the presentation.

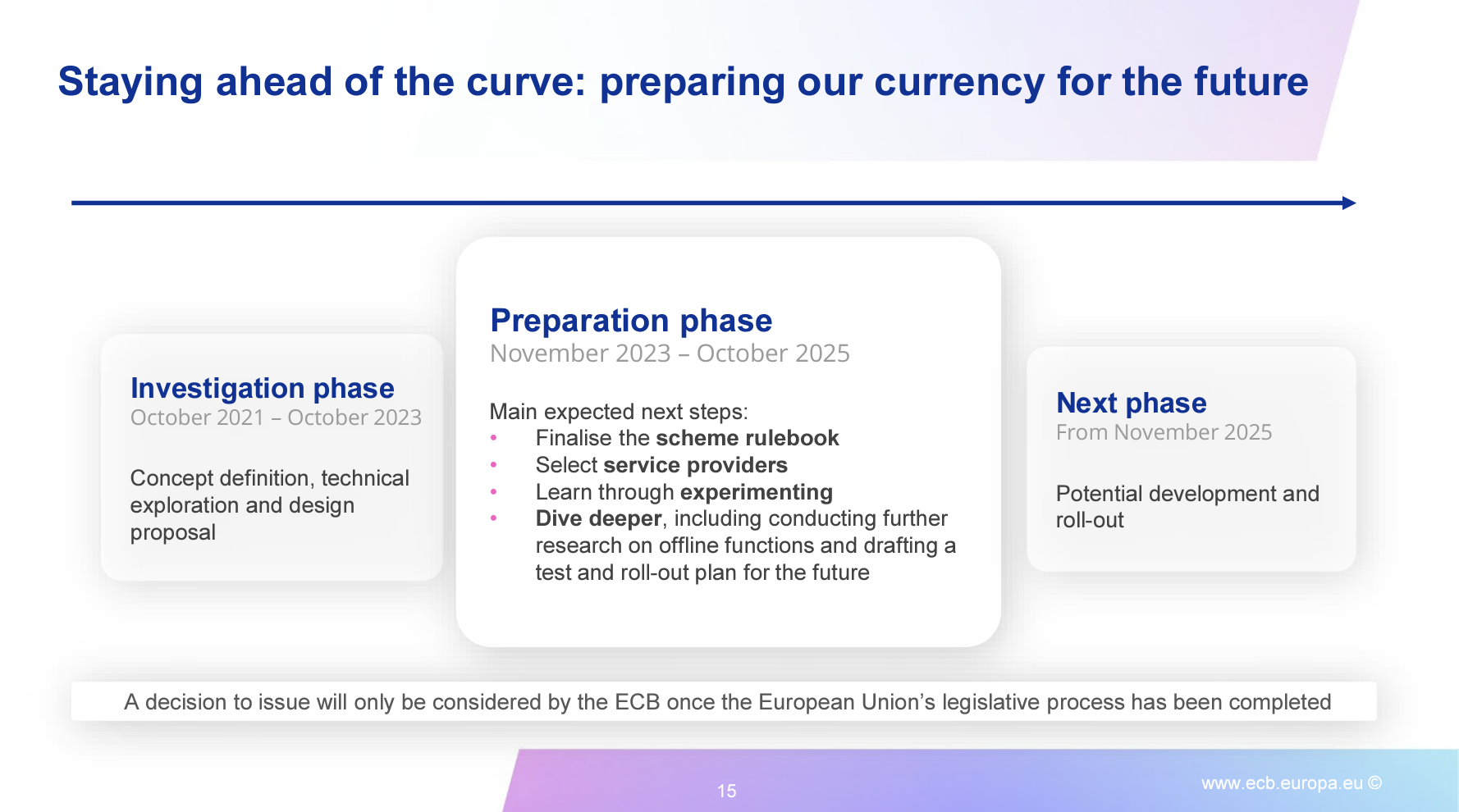

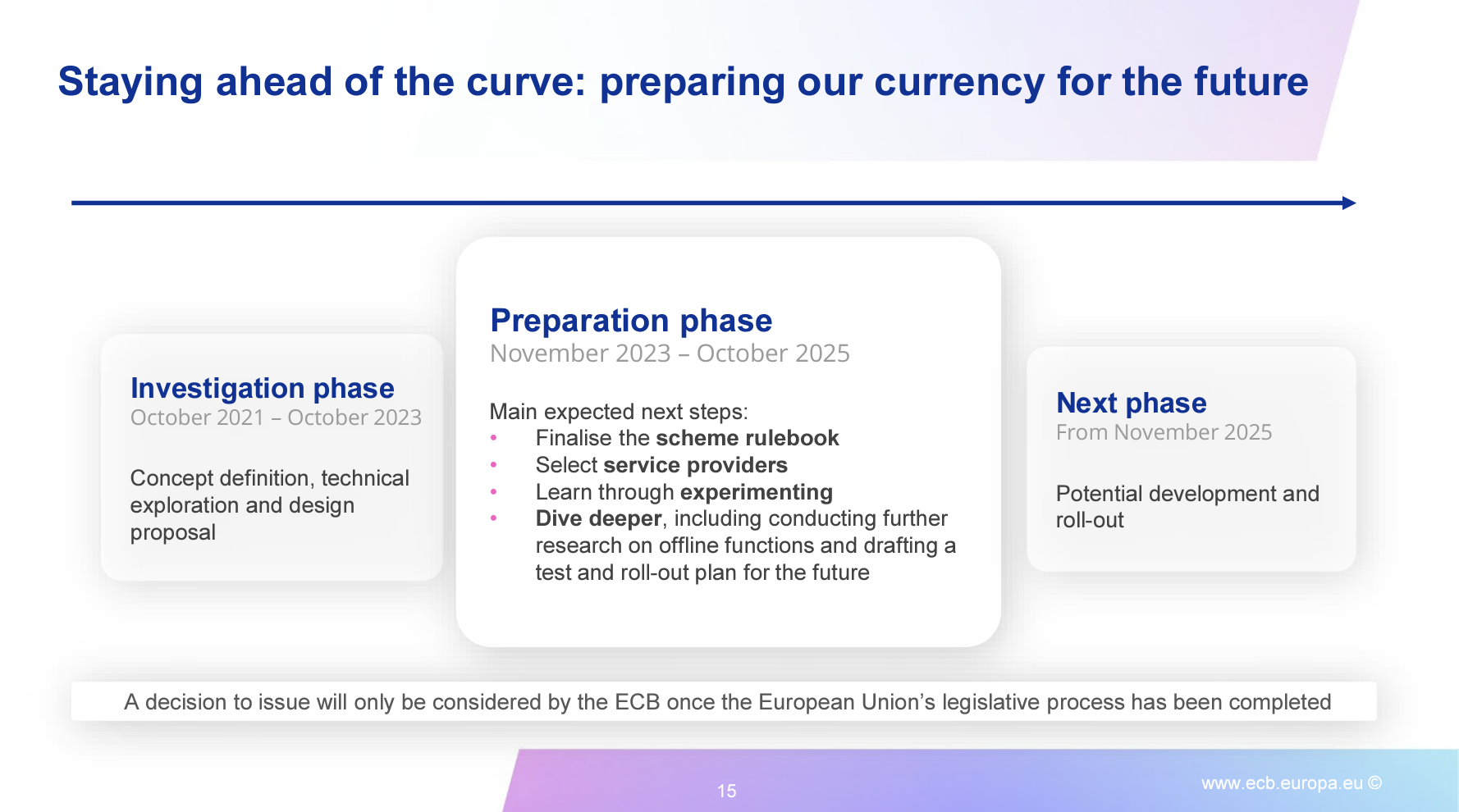

The digital euro project has passed its initial investigation phase (October 2021 – October 2023), focusing on concept definition, technical exploration, and design proposals. The current preparation phase (November 2023 – October 2025) involves finalizing the scheme rulebook, selecting service providers, learning through experimentation, and conducting further research on offline functions and test and rollout plans. A decision to issue the digital euro will only be considered by the ECB once the European Union’s legislative process has been completed. However, the document pens a potential rollout for November 2025.

As the ECB moves forward with its digital euro plans, the debate surrounding privacy and the potential for surveillance continues. Critics like WalkerAmerica urge individuals to study Bitcoin and opt out of what they perceive as a “totalitarian surveillance token.” The ECB will need to address these concerns and provide explicit assurances regarding data protection and user privacy to gain widespread acceptance of the digital euro.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://cryptoslate.com/ecb-executive-pens-november-2025-rollout-for-digital-euro-cbdc/

- :has

- :is

- :not

- 13

- 14

- 19

- 20

- 2021

- 2023

- 2025

- 32

- 36

- 7

- 9

- 990

- a

- Able

- About

- above

- acceptance

- accepted

- access

- accessible

- According

- Accounts

- address

- adopted

- Affairs

- ahead

- aim

- Aiming

- aims

- All

- already

- also

- and

- Anonymous

- any

- ARE

- AREA

- AS

- At

- auditing

- author

- available

- Balance

- Bank

- bank accounts

- basic

- BE

- been

- behind

- being

- benefit

- between

- Bitcoin

- board

- bring

- businesses

- but

- by

- CAN

- card

- Cash

- CBDC

- central

- Central Bank

- charge

- choices

- claim

- claims

- Commenting

- commercial

- committee

- Common

- Companies

- Completed

- concept

- Concerns

- conducting

- Conference

- considered

- continues

- could

- countries

- covering

- create

- Critics

- crypto

- Crypto Industry

- Current

- Custody

- customer

- data

- data protection

- debate

- decision

- definition

- Design

- designed

- develop

- digital

- Digital Payment

- Digital Payments

- digital transactions

- digital world

- distribute

- distributed

- document

- drafted

- easily

- ECB

- Economic

- emphasized

- end

- ensure

- Entire

- entities

- establish

- EU

- Euro

- euro payments

- Europa

- European

- European Central Bank

- everyone

- evolving

- exclusively

- executive

- experience

- exploration

- expressed

- featured

- Features

- February

- fill

- focusing

- For

- fostering

- Free

- Freedom

- from

- front

- functions

- fundamental

- funding

- further

- Gain

- gap

- given

- Giving

- Have

- having

- healthy

- High

- higher

- Highlighted

- host

- How

- However

- HTTPS

- implement

- implications

- in

- Including

- Inclusivity

- increasing

- individuals

- industry

- initial

- innovative

- intermediaries

- internal

- International

- investigation

- involvement

- involves

- issue

- IT

- ITS

- jail

- Key

- Lack

- Lagarde

- large

- launch

- learning

- Legislative

- like

- LIMIT

- Lives

- made

- Maintaining

- make

- March

- Market

- max-width

- means

- member

- Monetary

- money

- more

- moves

- much

- Need

- no

- None

- noted

- Notes

- November

- october

- of

- offering

- offline

- on

- once

- only

- open

- Option

- out

- outlined

- participants

- passed

- payment

- payment solution

- Payment Systems

- payments

- People

- people’s

- phase

- physical

- plans

- platform

- plato

- Plato Data Intelligence

- PlatoData

- podcast

- Post

- potential

- preparation

- presentation

- press

- privacy

- process

- project

- Proposals

- protection

- provide

- providers

- providing

- PSPs

- public

- Pushing

- raised

- rationale

- reach

- ready

- reflect

- regarding

- relations

- released

- relying

- research

- retail

- Roll

- rollout

- safeguards

- Said

- scenarios

- scheme

- schemes

- security

- Seeks

- selected

- selecting

- serve

- service

- service providers

- settling

- Skepticism

- Slide

- Slides

- solution

- Solutions

- some

- Source

- speaking

- standards

- Starting

- Still

- Strengthen

- Study

- such

- suggest

- support

- Surrounding

- surveillance

- Switch

- Systems

- Technical

- techniques

- test

- tested

- that

- The

- There.

- These

- they

- this

- Through

- throw

- timeline

- to

- token

- transaction

- Transactions

- Trends

- use

- used

- User

- user privacy

- users

- uses

- using

- via

- wants

- What

- when

- wherever

- while

- widespread

- will

- with

- without

- world

- would

- You

- zephyrnet