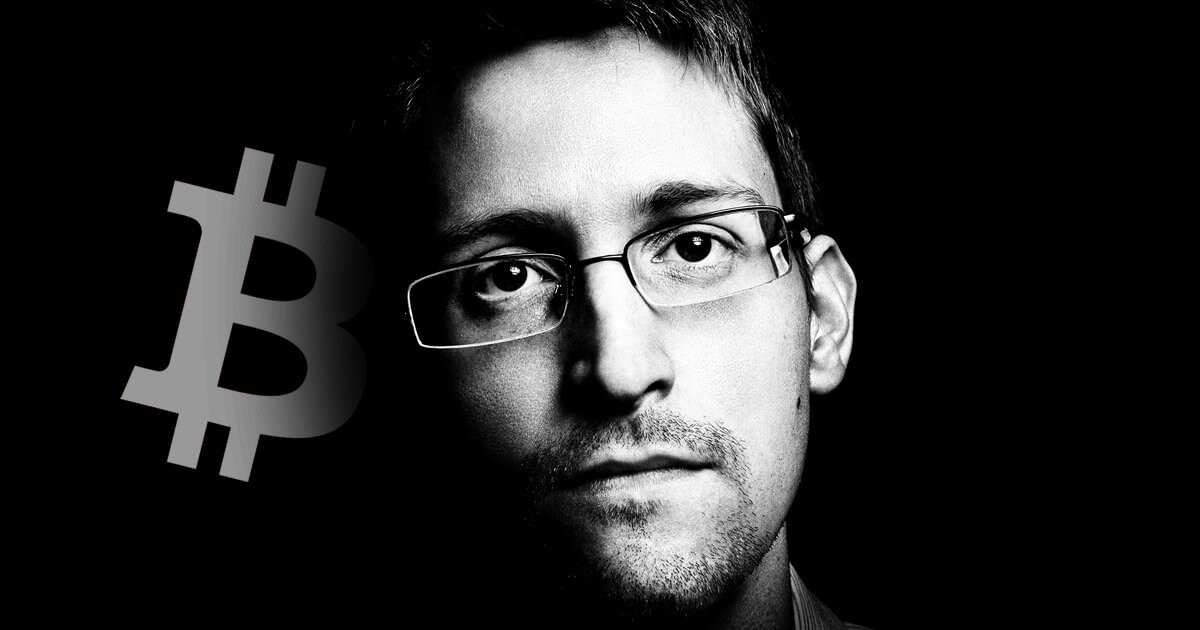

Edward Snowden, who catapulted to fame in 2013 as the whistleblower by uncovering the National Security Agency’s (NSA) massive surveillance program, has had a bittersweet relationship with Blockchain. Snowden was employed as a computer intelligence analyst in the global communications division at the CIA (Central Intelligence Agency)headquarters in Langley, Virginia. Since his explosive exposes, he has been granted political asylum in Russia.

Snowden enjoys a massive following and participates in public debates by appearing in the news, and through his social media handles, he makes it a point to put across his thoughts on various diverse issues.

His recent comment on the Biden administration’s 6 trillion dollar stimulus plan in which he termed it as “good for bitcoin”, has garnered immense interest amongst the cryptocurrency enthusiasts. Of course, this is just one of the many instances where Snowden has spoken about bitcoin.

It would be best if you were an even bigger crook to con the faceless shark with everything helping his purpose.

Let’s analyse his statements on bitcoin and cryptocurrencies in general over the years:

Edward Snowden has always been a fierce critique of government surveillance. According to him, the government’s around the globe are employing highly sophisticated surveillance and monitoring systems to sort through the massive public ledgers.

Bitcoin’s public ledger is nothing less than a jackpot for such governments, and that is why they often leave no stone unturned and use state of the art monitoring techniques to keep an eye on it.

To counter such intrusion into privacy, the most logical next innovation would be the evolution of private blockchain cryptocurrencies like zcash, which offer privacy by default.

So basically, if such private blockchains aren’t the norm in a couple of years, it will not be so because of lack of innovation or inability of technology; rather, it will be due to the excessive regulation and stringent surveillance systems of government.

Snowden sees critical flaws in bitcoin’s design, such as its transparency, security, transaction rate, and speculative tendencies. But Bitcoin’s biggest structural weakness, as flagged by Snowden, is its public ledger, and if this is not addressed, it will lead to fading out of bitcoin in the long term. That is because Snowden gives primacy to privacy over everything else. A public ledger is a record of every transaction in Bitcoin that is readily available to everyone.

The existing mechanism of the bitcoin blockchain is marred with balancing the recording of every transaction and simultaneously scaling its capacity to process these transactions. This balancing mechanism is incompatible with the idea of having an enduring and sustainable ecosystem for trade because it is not feasible to have a lifelong history of everyone’s purchases, make these interactions available to everyone and have that work out well at scale too.

Bitcoin’s inherent design permits the mining of new coin in a predetermined and at natural accelerating speed. Further, there is a cap of 21 million coins. Over half have already been mined, which nudges us to ponder that bitcoin will soon become a fixed money supply with absolutely zero scopes for further growth or expansion. In an interview, Snowden points out that there is a minuscule difference between fiat money and cryptocurrencies apart from the fact that the fiat currencies derive their backing from the state.

By comparison, Bitcoin’s value is pegged to the finite supply of 21 million and its acceptance amongst people worldwide. Therefore it can be safely inferred that bitcoin has a minimal fundamental and intrinsic value but has a highly variable speculative value based on genuine scarcity.

Bitcoin’s throughput is severely constrained by factors such as the size of blocks and on-chain scaling. Snowden claims that bitcoin’s transaction channel can handle only around seven transactions per second. In contrast, payment gateways like Visa and MasterCard routinely process tens and thousands of transactions per second.

This, according to Snowden view, has been a significant drawback and limitation present within the bitcoin network. Hence, to be valid for everyday transactions and decrease the associated costs of bitcoin’s Blockchain, there is an urgent need to fix the glitches with bitcoin’s lightning network (LN) and increase its throughput to a much higher level.

For bitcoin to survive in the long run, there is an immediate need to address these critical issues and ensure that the users do not have to spend hours waiting for their transaction to go through and shelving out around 20USD as transaction fees every time the network gets congested.

Snowden’s complaint with Bitcoin revolves centrally around the fact that transactions done via Bitcoin are not private as the ledger is readily available to everyone. He vehemently argues that it should be private by design. He believes that an open ledger is very harmful and fundamental negates the idea and concept of private money that can be spent freely.

The Public ledger compulsorily makes the ledger of businesses open to all, including their competitors, which may ultimately lead to losing leverage.

Combined with the issue of digital surveillance and the rise of authoritarian regimes across the globe, Bitcoin seems to be failing comprehensively on the privacy angle as it is very vulnerable to correlation attacks that can dish out various personal details about a user. In extreme cases, it can reveal identities when user history is accessed through highly sophisticated surveillance systems.

Further, he calls out the CIA to develop a tool that renders coin mixing operations outmoded by running a host of analyses on the public ledger. This aggressively stresses to the fact that individual Bitcoins could have a “dirty” history attached to them, making them less fungible.

- To sum up, it boils down to when the cryptocurrencies like bitcoin will design competing systems and mechanisms to tackle the challenge of threat to privacy by powerful agencies, governments, and authoritarian regimes that boast powerful surveillance techniques.

- Sooner or later, the dictators, powerful entities, corrupt and resourceful persons will encroach on these emerging technologies and outlaw them.

- The only sustainable way out is to design competing systems that tackle all the shortcomings of the present systems and at the same time attract the global consumer base. Until then, the only form of money which trumps all when it comes to privacy is CASH.

- 9

- All

- analyst

- around

- Art

- BEST

- biden

- Biggest

- Bitcoin

- blockchain

- businesses

- buy

- buy bitcoin

- Capacity

- cases

- Cash

- claims

- Coin

- Coins

- Communications

- competitors

- consumer

- Costs

- Couple

- cryptocurrencies

- cryptocurrency

- currencies

- CZ

- Design

- develop

- digital

- Dollar

- ecosystem

- EU

- EV

- evolution

- expansion

- eye

- Fees

- Fiat

- Fiat Money

- Fix

- flaws

- form

- General

- Global

- Government

- Governments

- Growth

- history

- hr

- HTTPS

- ia

- idea

- Including

- Increase

- Innovation

- Intelligence

- interest

- Interview

- IP

- issues

- IT

- lead

- Ledger

- Level

- Leverage

- lightning

- Lightning Network

- Long

- Making

- mastercard

- Media

- medium

- million

- Mining

- money

- monitoring

- national security

- network

- news

- offer

- open

- Operations

- payment

- People

- present

- privacy

- private

- Program

- public

- purchases

- Regulation

- Run

- running

- Russia

- Scale

- scaling

- security

- sees

- Size

- So

- Social

- social media

- speed

- spend

- State

- stimulus

- supply

- surveillance

- sustainable

- Systems

- Technologies

- Technology

- time

- trade

- transaction

- Transactions

- Transparency

- us

- users

- value

- View

- virginia

- visa

- Vulnerable

- WHO

- within

- Work

- work out

- worldwide

- years

- Zcash

- zero

![[Quantum Economics] What Are the Reasons Behind China’s Quest to Launch the First Major Digital… [Quantum Economics] What Are the Reasons Behind China’s Quest to Launch the First Major Digital… PlatoBlockchain Data Intelligence. Vertical Search. Ai.](http://platoblockchain.com/wp-content/uploads/2021/09/quantum-economics-what-are-the-reasons-behind-chinas-quest-to-launch-the-first-major-digital.jpg)

![[Cointelegraph] Decentralization is the final frontier for CBDCS [Cointelegraph] Decentralization is the final frontier for CBDCS PlatoBlockchain Data Intelligence. Vertical Search. Ai.](http://platoblockchain.com/wp-content/uploads/2021/08/cointelegraph-decentralization-is-the-final-frontier-for-cbdcs.jpg)