Markets Rally After Data Shows US Economy Cooling

Ether is trading above $2,000 for the first time since August 2022, a day after its heavily anticipated Shapella upgrade was executed successfully, up nearly 5% on the day.

Bitcoin has been on a roll of its own, surpassing $30,000 for the first time since June on April 11. The world’s largest digital asset is up 8% in the past week.

ETH Price, Source: The Defiant Terminal

LDO and RPL, the governance tokens of major liquid staking providers Lido Finance and Rocket Pool, dropped significantly in the week leading up to Shapella — both are down over 5% on the week, but have bounced back in the past 24 hours.

XRD, the native token of Radix, a DeFi-focused blockchain which launched in 2021, is the top gainer among the top 100 digital assets by market capitalization, up 26% in the past 24 hours.

Solana’s SOL is outperforming among larger Layer 1 smart contract platforms — the digital asset is up over 17% on the week.

SOL Price, Source: The Defiant Terminal

Solana’s much-hyped mobile device is launching today, which may be driving SOL price action.

Other Layer 1 tokens, like NEAR and FTM, have also posted strong weeks, with each up 9% or more in that span.

Macro Factors

Markets caught a tailwind after a report from the U.S. Department of Labor showed that initial jobless claims are at the highest levels since January 2022.

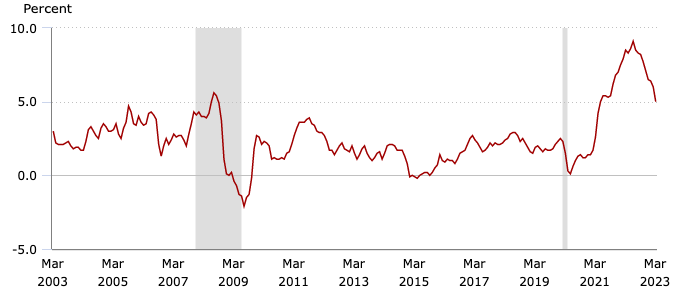

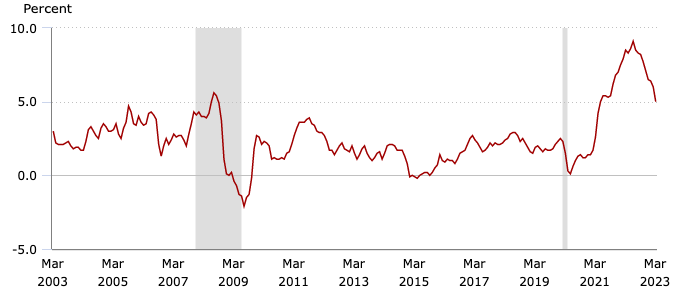

The Consumer Price Index report also came out yesterday from the U.S. Bureau of Labor Statistics — CPI clocked in at an annualized rate of 5%.

While the figure is down from its peak of 9.1% in June 2022, the United States has still seen annualized inflation of over 5% for the past 21 months.

The Fed also released the minutes from its March meeting on April 12. The statement included the prediction of a mild recession later this year.

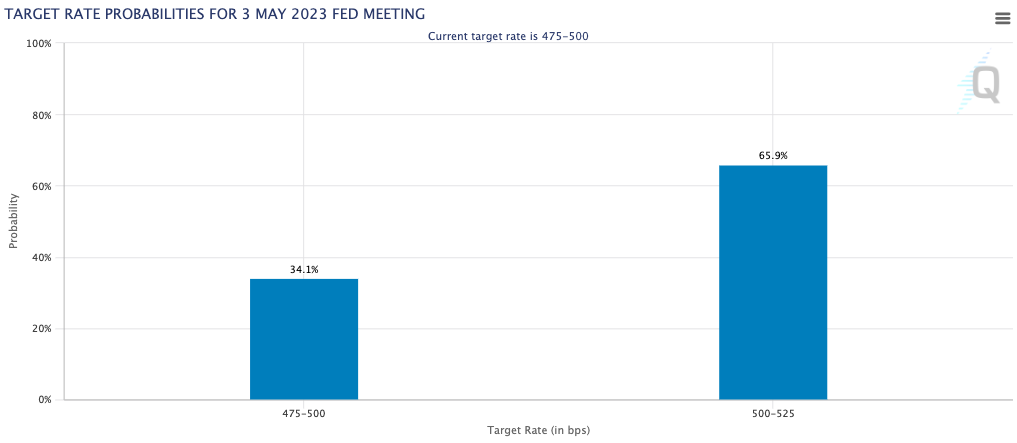

Investors are no doubt hoping that rising unemployment coupled with cooling inflation leads the US central bank to take a more accommodative stance. However, markets still predict another 25 basis point hike when the Fed next meets on May 3.

The anticipated hike represents a reversal from last week, when traders saw a cessation of hikes as being more likely.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://thedefiant.io/eth-hits-2k-after-shapella/

- :is

- $UP

- 000

- 1

- 100

- 11

- 2021

- 2022

- 26%

- 9

- a

- above

- Action

- After

- among

- amp

- and

- annualized

- Another

- Anticipated

- April

- ARE

- AS

- asset

- Assets

- At

- AUGUST

- back

- Bank

- basis

- basis point

- BE

- being

- blockchain

- Bureau

- bureau of labor statistics

- by

- capitalization

- caught

- central

- Central Bank

- claims

- CME

- consumer

- consumer price index

- contract

- contract platforms

- coupled

- CPI

- data

- day

- Department

- Department of Labor

- digital

- Digital Asset

- Digital Assets

- doubt

- down

- driving

- dropped

- each

- economy

- Ether

- Fed

- Figure

- finance

- First

- first time

- For

- from

- FTM

- governance

- Have

- heavily

- highest

- Hike

- Hikes

- hoping

- HOURS

- However

- HTTPS

- in

- included

- index

- inflation

- initial

- ITS

- January

- jobless claims

- labor

- larger

- largest

- Last

- launched

- launching

- layer

- layer 1

- leading

- Leads

- levels

- LIDO

- Lido Finance

- like

- likely

- Liquid

- major

- March

- Market

- Market Capitalization

- Markets

- May..

- meeting

- Meets

- months

- more

- native

- Native Token

- Near

- nearly

- next

- of

- on

- outperforming

- own

- past

- Peak

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Point

- pool

- posted

- predict

- prediction

- price

- PRICE ACTION

- providers

- rally

- Rate

- recession

- released

- represents

- Reversal

- rising

- Rocket

- Rocket Pool

- Roll

- s

- Shows

- significantly

- since

- smart

- smart contract

- Smart Contract Platforms

- SOL

- SOL Price

- Source

- span

- Statement

- States

- statistics

- Still

- strong

- successful

- Successfully

- Surges

- Tailwind

- Take

- that

- The

- the Fed

- this year

- time

- to

- today

- token

- Tokens

- top

- Traders

- Trading

- u.s.

- unemployment

- United

- United States

- upgrade

- us

- US Central Bank

- US economy

- week

- Weeks

- which

- with

- world’s

- year

- zephyrnet

![[SPONSORED] Lending protocols margin trading with DeFi Saver [SPONSORED] Lending protocols margin trading with DeFi Saver PlatoBlockchain Data Intelligence. Vertical Search. Ai.](http://platoblockchain.com/wp-content/uploads/2022/10/comp-1024x779-1-360x274.png)