- Lido, a popular POS platform, has recently overhauled its staking activities by adding more node operators.

- Although Peercoin first implemented the POS mechanism, Ethereum would later test its capabilities in minor projects.

- According to blockchain security firm Certik, centralized entities within the network have caused most hacks, scams, and security breaches from 1737 cases.

The crypto industry is known for its sturdy nature and ability to survive even the worst of crises. Since 2009, its lucrative nature has attracted unwanted attention from hackers, scammers, and even governments trying to control it. Fortunately, Nakamoto gave us the blueprint of digital currency to create financial systems. His main aim is to empower the user directly. As a result, the entire crypto industry is split between those who believe in their dreams and those who seek to control it.

The question of centralization is a heated debate among developers, innovators, and investors. A decentralized network coinciding with a centralized system is a feat many consider hypocritical. Unfortunately, with Ethereum 2.0 ushering in the Proof-of-Stake(POS) mechanism, the era of Proof-of-Work(POW) is steadily fading. With its recent feature, many are wondering if this new upgrade is steadily borderlining to a more centralized control. This new story has caused quite an uproar within the crypto industry.

Ethereum 2.0 shifting into centralization

The POS mechanism is one of the vital steps of the crypto industry. Its accessibility, low power consumption, and faster transaction speed have gained much recognition from traders and exchanges. Unfortunately, as a side effect of increased staking activity, a common issue has arisen, threatening its foundation, centralization. For instance, Lido, a popular POS platform, has recently overhauled its staking activities by adding more node operators. According to the franchise, this move would ensure no single entity controlled a significant portion of staked Ether.

At its basic level, the more a validator stakes their crypto coins, the more power and influence the user has over the decentralized network. With time and enough crypto coins, a single or a group of validators could have significant control over and enter a decentralized system, bringing about a single point of failure.

Also, Read Is crypto mining experiencing an irreversible downfall?

According to JPMorgan, since Ethereum 2.0 first debuted, its popularity has been slow-paced, but still growing. As more users continue to stake, a growing concern has risen and a fear that would change the foundation of the crypto industry. Furthermore, JPMorgan stated that hypothecation is an added risk from the rise of liquid staking.

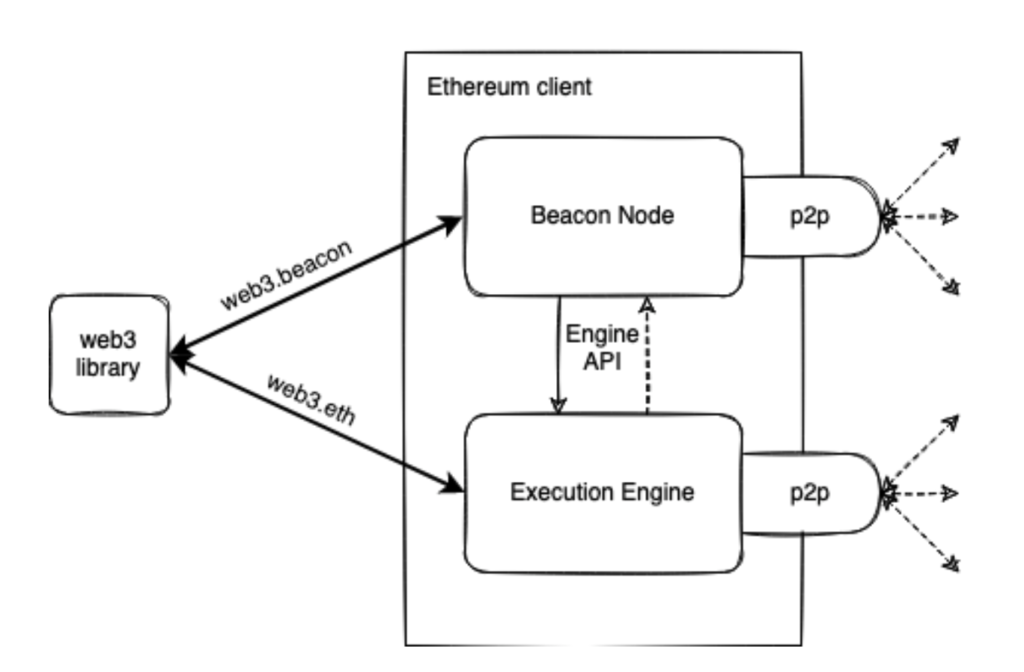

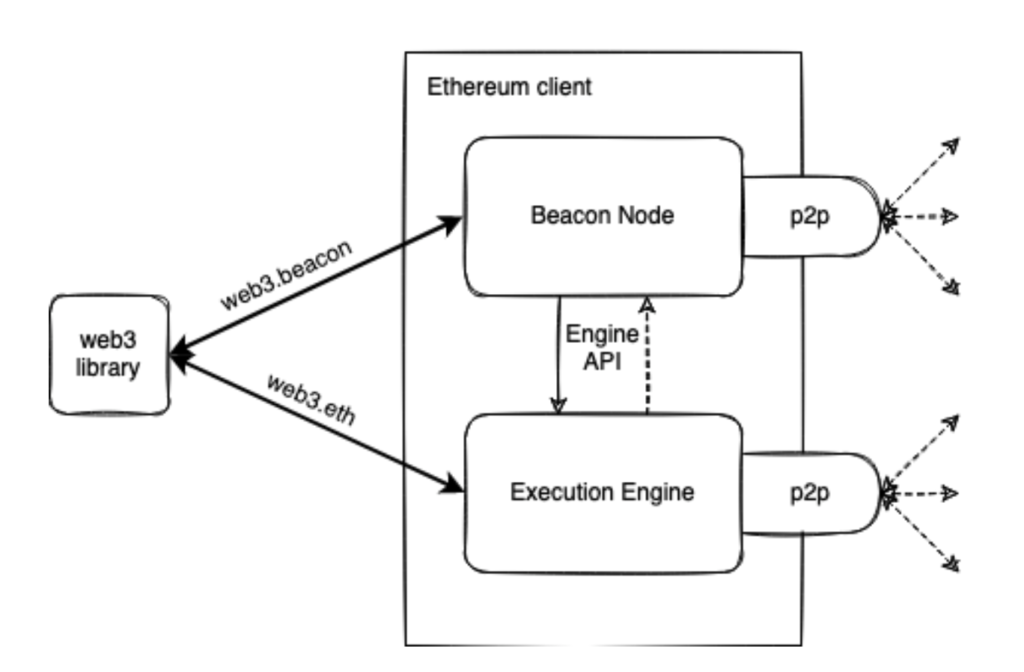

The basic functionality of the Ethereum 2.0 POS mechanism.[Photo/Consensys]

Generally, this is when liquid tokens are reused as collateral across numerous DeFi protocols simultaneously. They said, “Rehypothecation could result in a cascade of liquidations if a staked asset drops sharply in value or is hacked or slashed due to malicious attack or a protocol error. The increase in staking has also reduced the appeal of Ether from a yield perspective, especially given the backdrop of rising yields in traditional financial assets.“

Today, the total staking yields have dropped from 7.3% before the Shanghai upgrade to about 5.5%.

Ethereum 2.0 the age of the POS mechanism

Amid the vast empire of the crypto industry, only one crypto coin has claimed second place since its founding, Ethereum. In fact, since its founding, many believed that its founder, Vitalik Buterin, created it to rival and one day overthrow the original cryptocurrency. Although, Vitalik never had such a thought when he developed Ether. Instead, right from the start, Buterin only desired to improve upon the founding mechanism of Bitcoin to create an ecosystem dependent on a decentralized network.

As a result, Vitalik created the Ethereum Blockchain network, an ecosystem that thrives upon the creativity of others. Its vast functionalities and tools are a haven for developers and innovators who seek to put their skills to the test. According to their report, Ethereum’s decentralized network houses over 200 DeFi projects. Its multiphased upgrades like Beacon Chain, the Merge, and Shard Chains are why Ethereum is a crypto titan. Its determination to improve upon Bitcoin is why many believe it will one day surpass its predecessor.

Ethereum, like many crypto-base industries, initially utilized the first consensus mechanism, Proof of Work. Unfortunately, its vase decentralized network soon brought significant issues and lawsuits to Buterin’s doorsteps. The POW consensus mechanism had one major flaw, its power consumption. The complex cryptographic solutions require significant processing power, which results in the consumption of high volumes of electricity.

Also, Read Kraken crypto exchange fined US$30 million for violating crypto regulations.

Unfortunately, this generally worsened as Ethereum’s decentralized nature grew, causing the franchise’s power consumption to rival that of entire countries. Aware of these limitations, Buterin sought to develop a new consensus mechanism that did not heavily rely on the computing power of its network. This led to the development of Proof-of-Stake(POS) consensus mechanisms.

Although Peercoin first implemented this mechanism, Ethereum would later test its capabilities in minor projects. Its low energy consumption and faster transaction rate soon proved useful, and Ethereum made one of its biggest transformations since its founding, the Merge. Completely shifting to a POS consensus mechanism ushered in a new era for the entire crypto industry.

Ethereum 2.0 soon became the talk of the industry and would later become a beacon of inspiration for its peers. Ethereum 2.0 offered better tools, and the introduction of validators soon caught the eye of many investors. Essentially, the POS mechanism requires validators to stake, or lock in, the amount of crypto into the decentralized network.

Validators are responsible for validating or checking transactions made on the network they participate in. Once they validate a transaction, they forward it to the network and receive a reward as compensation. Unfortunately, a rising issue has occurred amid its simplistic nature and centralization.

The dangers of centralization

Unfortunately, the web3 franchise has moved to a more centralized approach, going against the desire of Nakamoto. Typically, when a decentralized network attains a centralized entity, its innate security measures and design ultimately fail. According to blockchain security firm Certik, centralized entities within the network have caused most hacks, scams, and security breaches from 1737 cases.

Originally, DeFi-based organizations have sought to alleviate the limitations of traditional financial systems through decentralized networks. The main selling point of a decentralized network is the power distribution throughout the network. Adding an entity with a slightly higher power range shifts the entire decision-making scheme of smart contracts. It means a system’s decisions shift more to the user with more power.

Ronghui Gu, co-founder of Certik, said, “It does sound ironic that decentralized finance’s main problem is centralization. But the fact that we’re even talking about this is a sign of the importance that decentralization as an ideology commands in the crypto industry.”

Also, Read The Explainer: the Ethereum Merge and what it means for crypto investors.

Furthermore, centralization also brings about the issue of censorship. Generally, a vital flaw in today’s tech, finance, and media industries is the issue of the flow of information. If a group or a single entity governs an entire platform, most decisions pivot in their favor. For instance, if a giant financial institution suffers from a security breach, it would more likely alter or censor such information.

In addition, the exclusion of transactions from a network is a common vice in today’s financial world. In addition, when implemented, a poorly decentralized network can damage an industry significantly. If a centralized system is introduced and managed too heavily to see the decision-making mechanisms of smart contracts, it would generally cripple the entire crypto industry.

Thus, if Ethereum 2.0 takes a turn for centralization, it could spell significant danger to the entire community. For example, they could avoid processing funds sent to and from Tornado cash wallet addresses sanctioned by OFAC. The POS mechanism gives significant authority to validators, thus further increasing their ability to sway the entire ecosystem. Ethereum 2.0 may be revolutionary, but if only a few validators govern its decentralized network, it could cause irreversible damage. The FTX crash is among the dangers of centralization. Now imagine the scale of damage that issue caused and double it, given Ethereum’s vast reach.

Wrapping Up

Ethereum 2.0 has forever changed the crypto industry. Its POS mechanism has caused a massive shift as many have abandoned the POW mechanism. Unfortunately, if we continue to ignore the centralization issue, another crypto crash is all but assured.

Furthermore, many have claimed that the industry should abandon the need for centralization. Generally, developers have stated it aids in the transition from web2 to web3, but infringing on its most basic principle ultimately undermines their efforts. Will the crypto industry shift to its core principle, or will it seek an easier approach and give in to the control of centralization?

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://web3africa.news/2023/10/11/news/ethereum-2-0-turns-to-centralization-endangering-the-industry/

- :has

- :is

- :not

- 200

- 32

- 7

- a

- ability

- About

- accessibility

- According

- across

- activities

- activity

- added

- adding

- addition

- addresses

- against

- age

- aids

- aim

- All

- alleviate

- also

- Although

- Amid

- among

- amount

- an

- and

- Another

- appeal

- approach

- ARE

- AS

- asset

- Assets

- assured

- attack

- attention

- attracted

- authority

- avoid

- aware

- backdrop

- basic

- BE

- beacon

- became

- become

- been

- before

- believe

- believed

- Better

- between

- Biggest

- Bitcoin

- blockchain

- Blockchain network

- Blockchain security

- Bloomberg

- blueprint

- breach

- breaches

- Bringing

- Brings

- brought

- but

- Buterin

- by

- CAN

- capabilities

- cascade

- cases

- Cash

- caught

- Cause

- caused

- causing

- Censorship

- Centralization

- centralized

- CertiK

- chain

- change

- changed

- checking

- claimed

- Co-founder

- Coin

- Coins

- Collateral

- Common

- community

- Compensation

- completely

- complex

- computing

- computing power

- Concern

- Consensus

- consensus mechanism

- Consensus Mechanisms

- Consider

- consumption

- continue

- contracts

- control

- controlled

- Core

- could

- countries

- Crash

- create

- created

- creativity

- crises

- crypto

- Crypto Coin

- Crypto Coins

- crypto crash

- crypto exchange

- Crypto Industry

- crypto mining

- cryptocurrency

- cryptographic

- Currency

- DANGER

- dangers

- day

- debate

- debuted

- Decentralization

- decentralized

- decentralized network

- decentralized networks

- Decision Making

- decisions

- DeFi

- defi projects

- DeFi protocols

- dependent

- Design

- desire

- desired

- determination

- develop

- developed

- developers

- Development

- DID

- digital

- digital currency

- directly

- distribution

- does

- double

- downfall

- dreams

- dropped

- Drops

- due

- easier

- ecosystem

- effect

- efforts

- electricity

- Empire

- empower

- energy

- Energy Consumption

- enough

- ensure

- Enter

- Entire

- entities

- entity

- Era

- error

- especially

- essentially

- Ether

- ethereum

- Ethereum 2.0

- Ethereum blockchain

- ethereum merge

- Ethereum's

- Even

- example

- exchange

- Exchanges

- experiencing

- eye

- fact

- FAIL

- Failure

- faster

- favor

- fear

- feat

- Feature

- few

- finance

- financial

- financial institution

- financial systems

- fined

- Firm

- First

- flaw

- flow

- For

- forever

- Fortunately

- Forward

- Foundation

- founder

- founding

- franchise

- from

- FTX

- ftx crash

- functionalities

- functionality

- funds

- further

- Furthermore

- gained

- gave

- generally

- giant

- Give

- given

- gives

- going

- Governments

- governs

- grew

- Group

- Growing

- hacked

- hackers

- hacks

- had

- Have

- he

- heavily

- High

- higher

- his

- houses

- HTTPS

- ideology

- if

- ignore

- imagine

- implemented

- importance

- improve

- in

- Increase

- increased

- increasing

- industries

- industry

- influence

- information

- initially

- innate

- innovators

- Inspiration

- instance

- instead

- Institution

- into

- introduced

- Introduction

- Investopedia

- Investors

- issue

- issues

- IT

- ITS

- JPMorgan

- known

- later

- Lawsuits

- Led

- Level

- LIDO

- like

- likely

- limitations

- Liquid

- liquid staking

- liquidations

- Low

- lucrative

- made

- Main

- major

- managed

- many

- massive

- max-width

- May..

- means

- measures

- mechanism

- mechanisms

- Media

- Merge

- million

- Mining

- minor

- more

- most

- move

- moved

- much

- nakamoto

- Nature

- Need

- network

- networks

- never

- New

- no

- node

- Node Operators

- now

- numerous

- occurred

- of

- offered

- on

- once

- ONE

- only

- operators

- or

- organizations

- original

- Others

- over

- participate

- peers

- perspective

- Pivot

- Place

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Point

- Popular

- popularity

- portion

- PoS

- PoW

- power

- predecessor

- principle

- Problem

- processing

- Processing Power

- projects

- proof

- protocol

- protocols

- proved

- put

- question

- quite

- range

- Rate

- reach

- Read

- receive

- recent

- recently

- recognition

- Reduced

- rely

- report

- require

- requires

- responsible

- result

- Results

- revolutionary

- Reward

- right

- Rise

- Risen

- rising

- Risk

- Rival

- Said

- Sanctioned

- Scale

- Scammers

- scams

- scheme

- Second

- security

- security breaches

- Security Measures

- see

- Seek

- Selling

- selling point

- sent

- shanghai

- shift

- SHIFTING

- Shifts

- should

- Shows

- side

- sign

- significant

- significantly

- Signs

- simultaneously

- since

- single

- skills

- smart

- Smart Contracts

- Solutions

- soon

- sought

- Sound

- speed

- SPELL

- split

- stake

- Staked

- Staking

- start

- stated

- steadily

- Steps

- Still

- Story

- sturdy

- such

- Suffers

- surpass

- survive

- Sway

- system

- Systems

- takes

- Talk

- talking

- tech

- test

- that

- The

- The Merge

- their

- These

- they

- this

- those

- thought

- thrives

- Through

- throughout

- Thus

- time

- titan

- to

- today’s

- Tokens

- too

- tools

- tornado

- Tornado Cash

- Total

- Traders

- traditional

- transaction

- transaction speed

- Transactions

- transformations

- transition

- treasury

- true

- trying

- TURN

- typically

- Ultimately

- unfortunately

- unwanted

- upgrade

- upgrades

- upon

- us

- User

- users

- ushering

- utilized

- VALIDATE

- validating

- Validator

- validators

- value

- Vast

- vice

- Violating

- vital

- vitalik

- volumes

- Wallet

- we

- Web2

- Web3

- What

- when

- which

- WHO

- why

- will

- with

- within

- wondering

- Work

- world

- Worst

- would

- Yield

- yields

- zephyrnet